Wine company The Duckhorn Portfolio (NYSE:NAPA) fell short of analysts' expectations in Q2 FY2024, with revenue flat year on year at $103 million. The company's full-year revenue guidance of $403 million at the midpoint also came in 4.5% below analysts' estimates. It made a non-GAAP profit of $0.18 per share, down from its profit of $0.18 per share in the same quarter last year.

Duckhorn (NAPA) Q2 FY2024 Highlights:

- Revenue: $103 million vs analyst estimates of $105.1 million (2% miss)

- EPS (non-GAAP): $0.18 vs analyst expectations of $0.18 (1.4% miss)

- The company dropped its revenue guidance for the full year from $423.5 million to $403 million at the midpoint, a 4.8% decrease

- Free Cash Flow was -$50.66 million, down from $7.67 million in the previous quarter

- Gross Margin (GAAP): 56.6%, up from 53.4% in the same quarter last year

- Sales Volumes were down 2.7% year on year

- Market Capitalization: $1.07 billion

With many of their grapes sourced from the famous Napa Valley region of California, The Duckhorn Portfolio (NYSE:NAPA) is a producer of premium wines and known for its Merlot and other Bordeaux varietals.

The company goes to market with brands such as Duckhorn Vineyards, Paraduxx, Goldeneye, Migration, and Canvasback. In addition to the Merlots and Bordeauxs for which they’re known, Duckhorn Portfolio also offers Cabernet Sauvignon, Sauvignon Blanc, and Pinot Noir wines.

The core customer is the discerning wine connoisseur who appreciates wines boasting superior taste and complexity. This core customer also appreciates and is loyal to brands that exude elegance. Duckhorn products are therefore premium priced, with most bottles in the high-double-digit to low-triple-digit dollar range at retail.

Duckhorn's products can be purchased from specialty or more upscale grocery stores, wine shops, and upscale restaurants. The company's wines are also featured at its own wineries and tasting rooms. Furthermore, Duckhorn Portfolio has an e-commerce platform where consumers can not only purchase directly from the company but can access detailed information about each wine, food pairing suggestions, and the ability to join wine clubs for exclusive access to limited releases and other special offerings.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors include Constellation Brands (NYSE:STZ), Treasury Wine Estates (ASX:TWE) and private companies Silver Oak Cellars and Opus One Winery.Sales Growth

Duckhorn is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

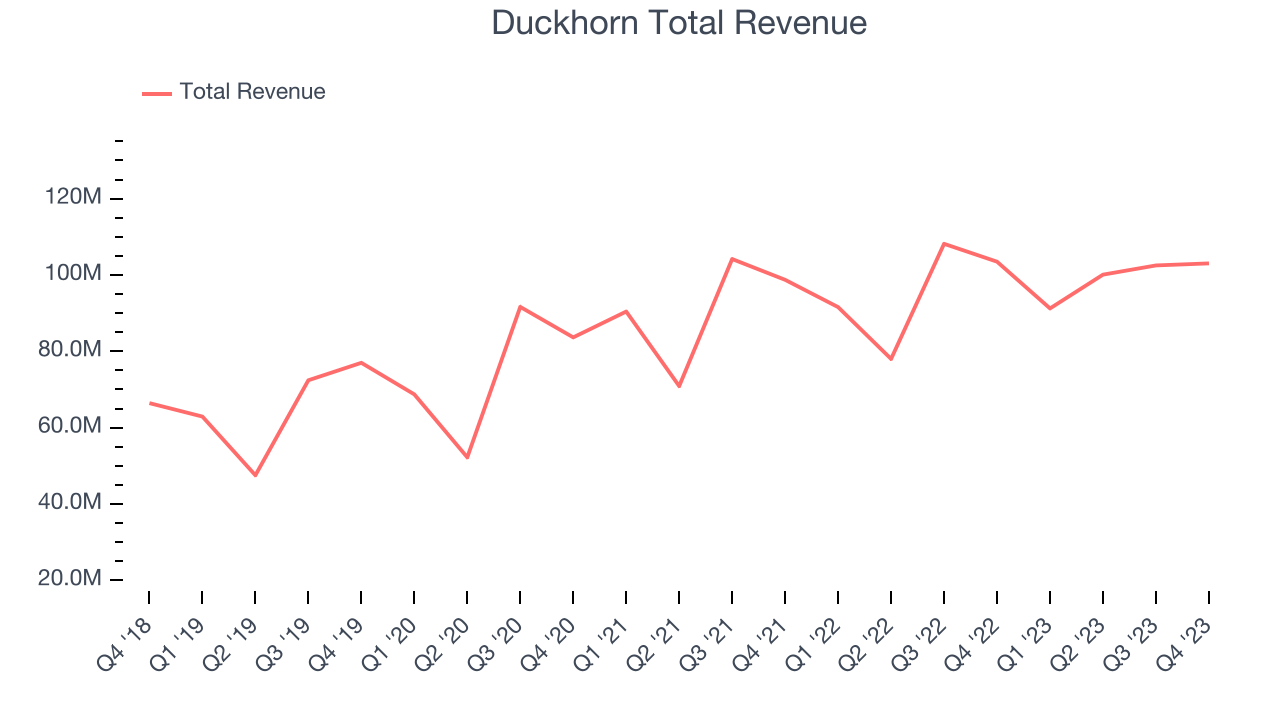

As you can see below, the company's annualized revenue growth rate of 10.2% over the last three years was decent for a consumer staples business.

This quarter, Duckhorn missed Wall Street's estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $103 million in revenue. Looking ahead, Wall Street expects sales to grow 10.2% over the next 12 months, an acceleration from this quarter.

Volume Growth

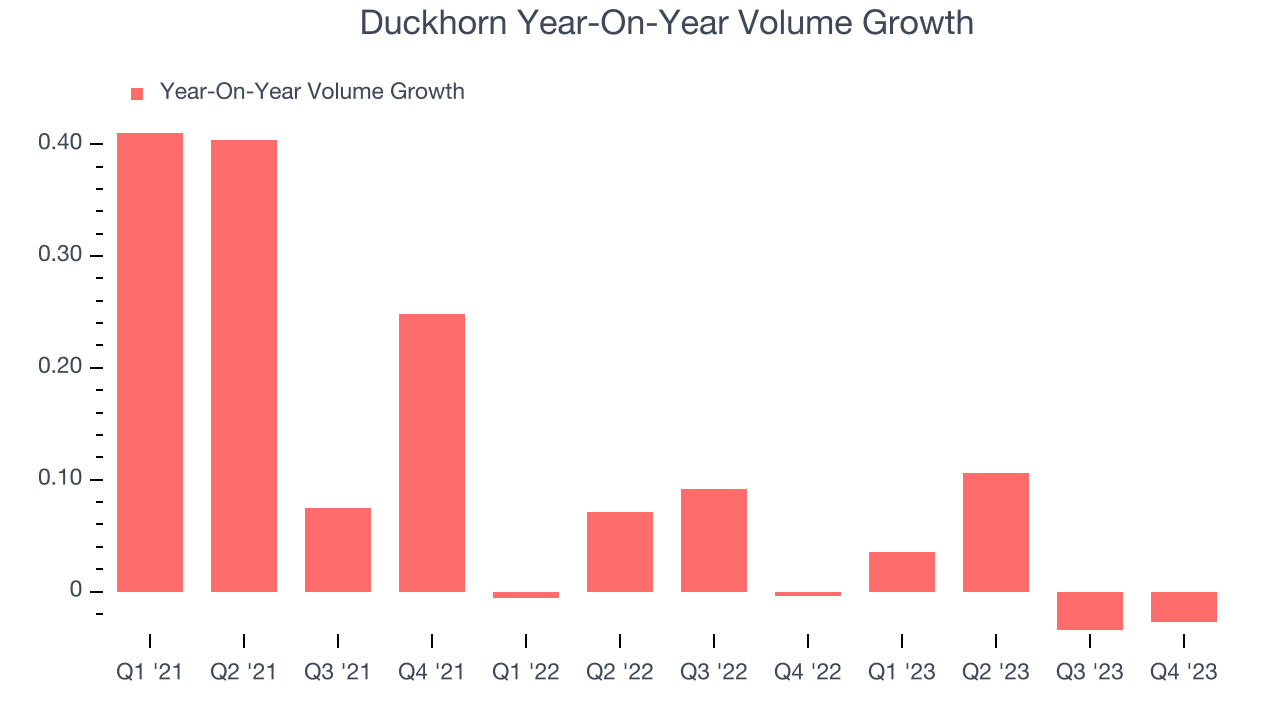

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Duckhorn's average quarterly volume growth was a healthy 2.9% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Duckhorn's Q2 2024, sales volumes dropped 2.7% year on year. This result was a further deceleration from the 0.4% year-on-year decline it posted 12 months ago, showing the business is struggling to push its products.

Gross Margin & Pricing Power

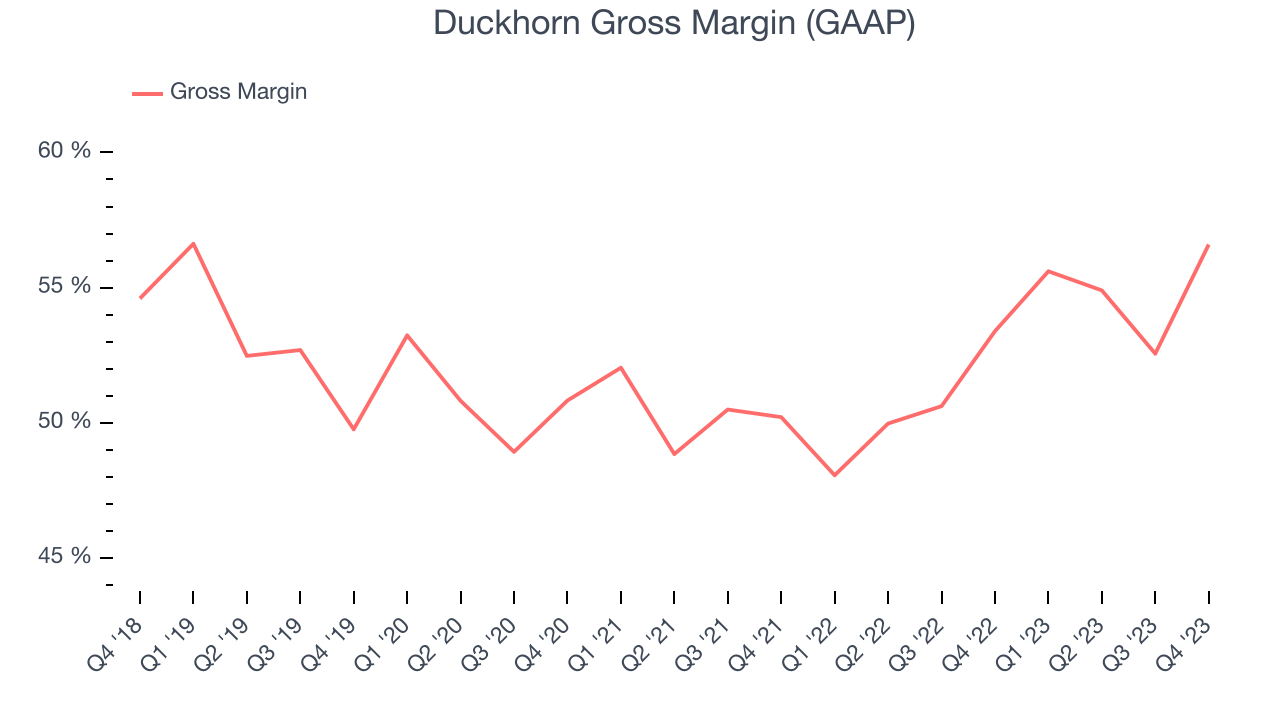

All else equal, we prefer higher gross margins. They usually indicate that a company sells more differentiated products and commands stronger pricing power.

Duckhorn's gross profit margin came in at 56.6% this quarter, up 3.2 percentage points year on year. That means for every $1 in revenue, $0.43 went towards paying for raw materials, production of goods, and distribution expenses.

Duckhorn has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 52.8% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 8.8% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

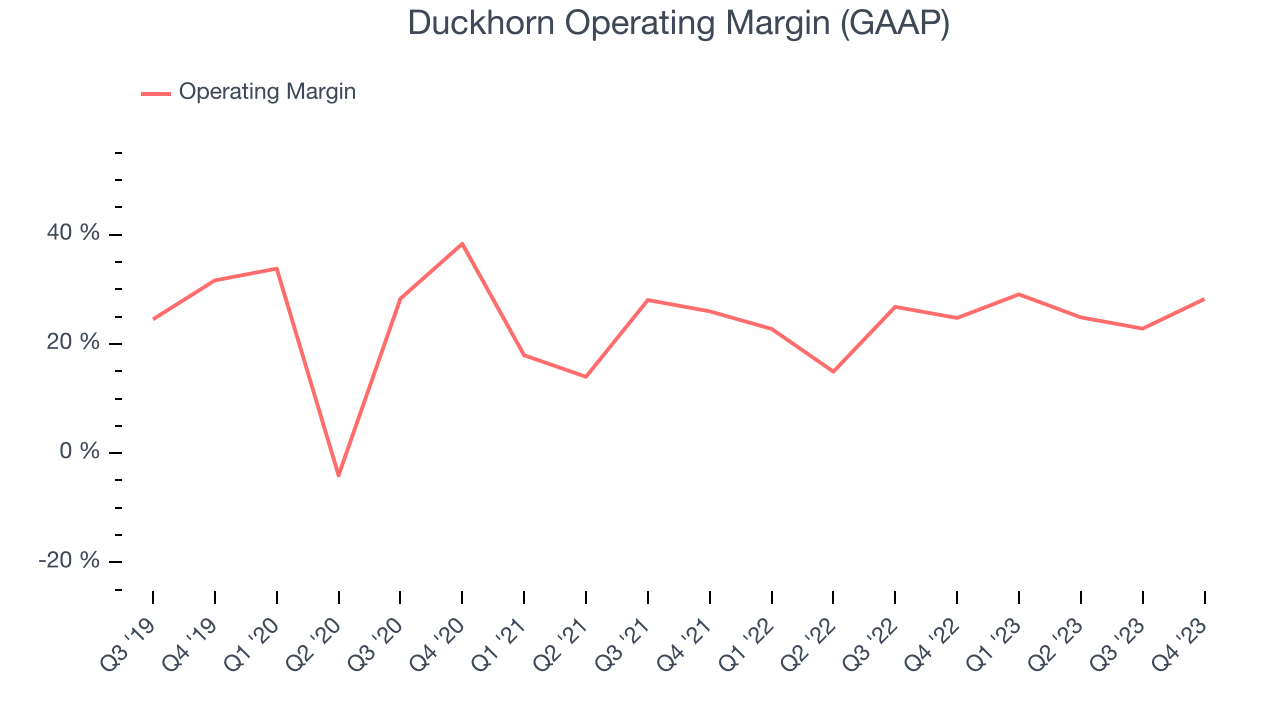

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q2, Duckhorn generated an operating profit margin of 28.2%, up 3.5 percentage points year on year. This increase was encouraging, and we can infer Duckhorn was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Duckhorn has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 24.5%. On top of that, its margin has improved by 3.3 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Duckhorn has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 24.5%. On top of that, its margin has improved by 3.3 percentage points on average over the last year, a great sign for shareholders. EPS

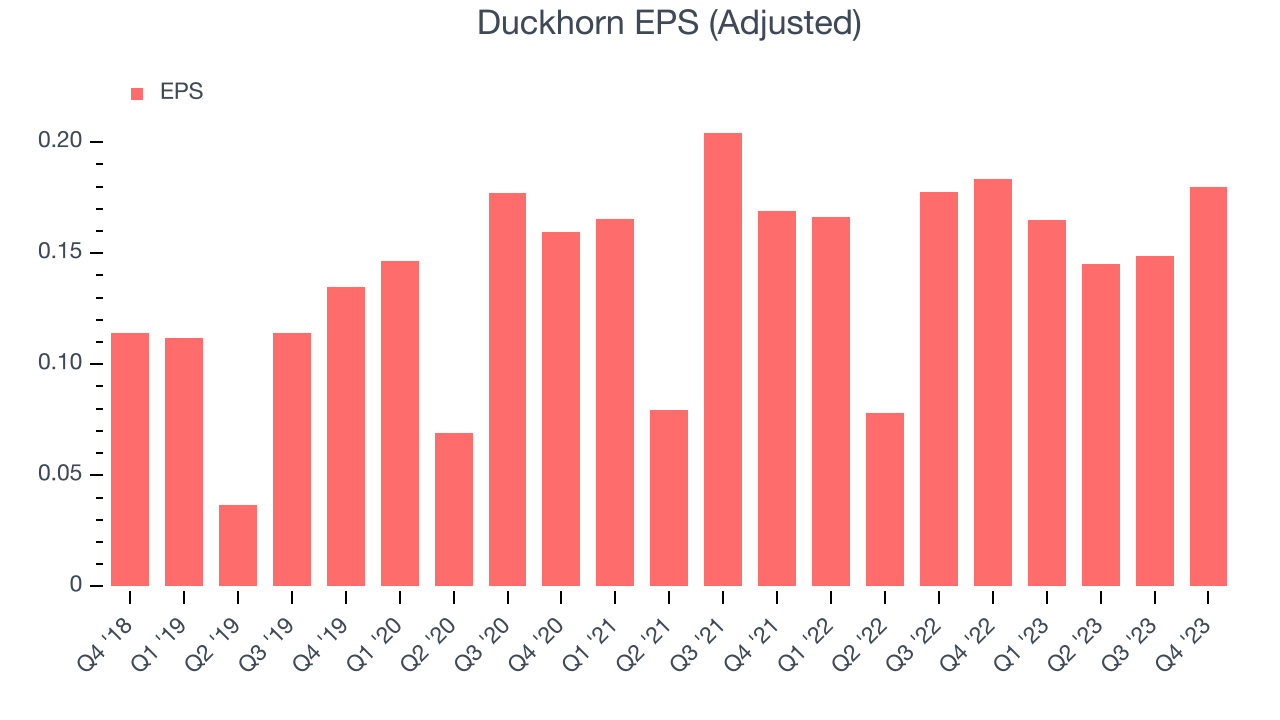

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q2, Duckhorn reported EPS at $0.18, down from $0.18 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Duckhorn's EPS grew 15.7%, translating into an unimpressive 5% compounded annual growth rate.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 8.9% year-on-year increase in EPS.

Cash Is King

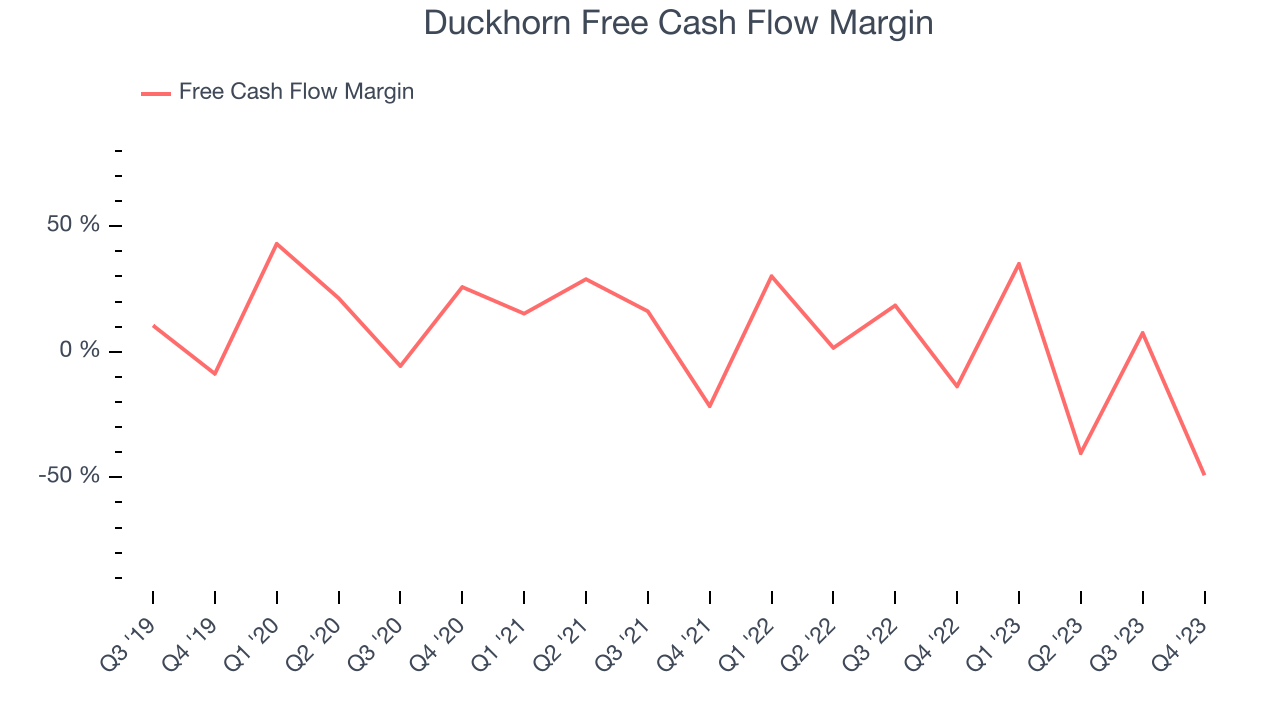

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Duckhorn burned through $50.66 million of cash in Q2, representing a negative 49.2% free cash flow margin. The company reduced its cash burn by 255% year on year.

Over the last eight quarters, Duckhorn's demanding reinvestment strategy has consumed many company resources. Its free cash flow margin has averaged negative 2.2%, poor for a consumer staples business. Furthermore, its margin has averaged year-on-year declines of 22 percentage points over the last 12 months. We'll keep an eye on this as almost any movement in the wrong direction is undesirable given it's already burning cash. The company will need to improve its free cash flow conversion if it wants to survive (and ultimately thrive).

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Duckhorn's five-year average ROIC was 6.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Duckhorn's ROIC has stayed the same over the last two years. If the company wants to become an investable business, it will need to increase its returns.

Key Takeaways from Duckhorn's Q2 Results

We enjoyed seeing Duckhorn exceed analysts' gross margin and adjusted EBITDA expectations this quarter. Sadly, that's where the good news ends. Its revenue missed Wall Street's projections as its sales volumes declined 2.7% year on year (analysts were expecting 1.4% growth). Management noted that despite its volume declines, it gained market share as the broader wine industry faced headwinds.

Given the choppy industry backdrop, management lowered its full-year guidance. Sales are now forecasted to be $403 million at the midpoint vs estimates of $422 million. Its adjusted EBITDA and EPS outlook weren't spared either.

Overall, this was a mixed quarter for Duckhorn. The company is down 3.6% on the results and currently trades at $9.11 per share.

Is Now The Time?

Duckhorn may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Duckhorn, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last three years and its growth over the next 12 months is expected to be higher, its brand caters to a niche market. And while its impressive operating margins show it has a highly efficient business model, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

Duckhorn's price-to-earnings ratio based on the next 12 months is 13.6x. While the price is reasonable and there are some things to like about Duckhorn, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $12.61 per share right before these results (compared to the current share price of $9.11).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.