Duckhorn’s 37.4% return over the past six months has outpaced the S&P 500 by 25.8%, and its stock price has climbed to $11.03 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Duckhorn, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.The recent price increase implies the market likes this company, we don't have much confidence in NAPA. Here are three reasons why you should be careful with NAPA and one stock we like more.

Why Is Duckhorn Not Exciting?

With many of its grapes sourced from the famous Napa Valley region of California, Duckhorn (NYSE:NAPA) is a producer of premium wines and is known for its Merlot and other Bordeaux varietals.

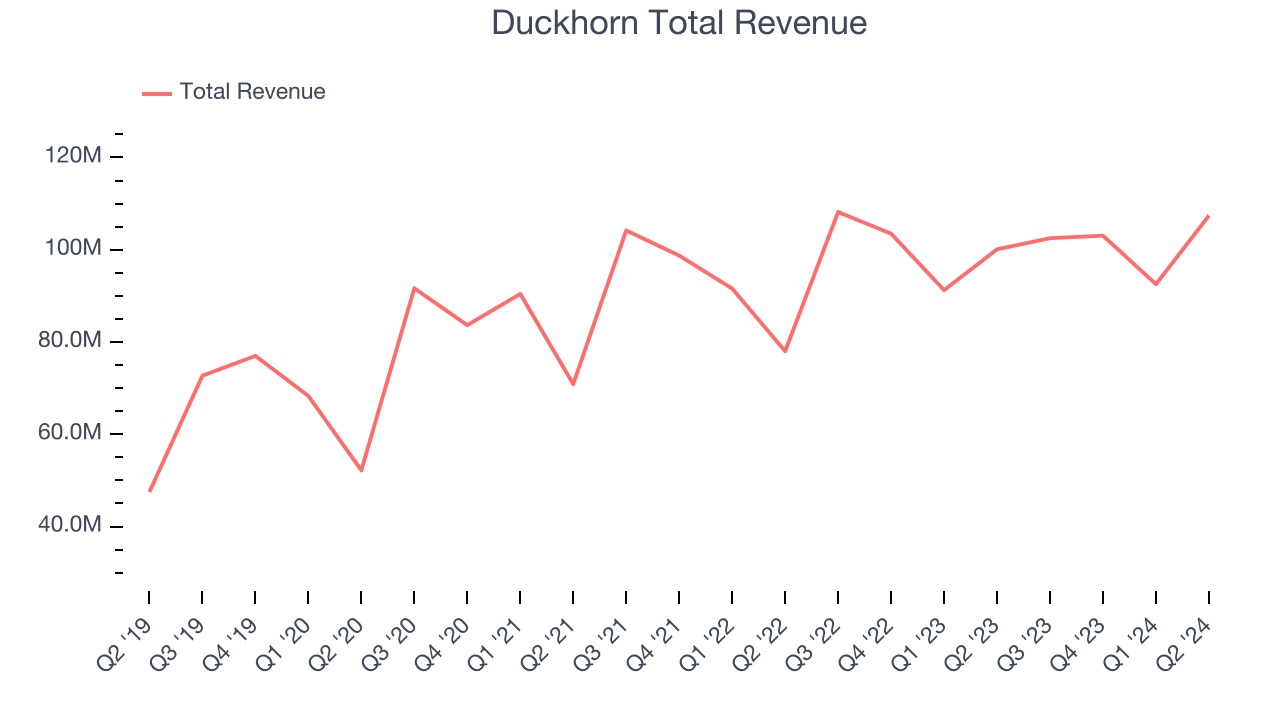

1. Small Revenue Base: Less Negotiating Leverage with Suppliers

Duckhorn is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

2. Long-Term Revenue Growth Disappoints

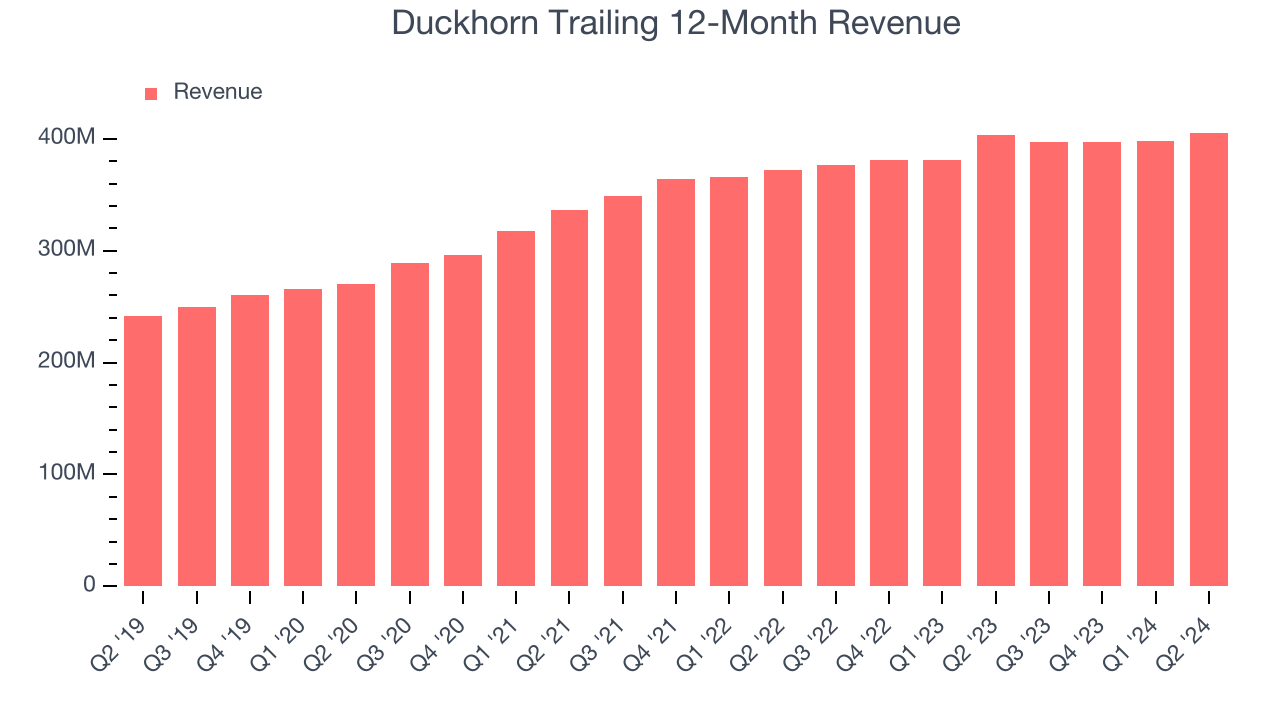

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Duckhorn’s sales grew at a mediocre 6.4% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer staples sector.

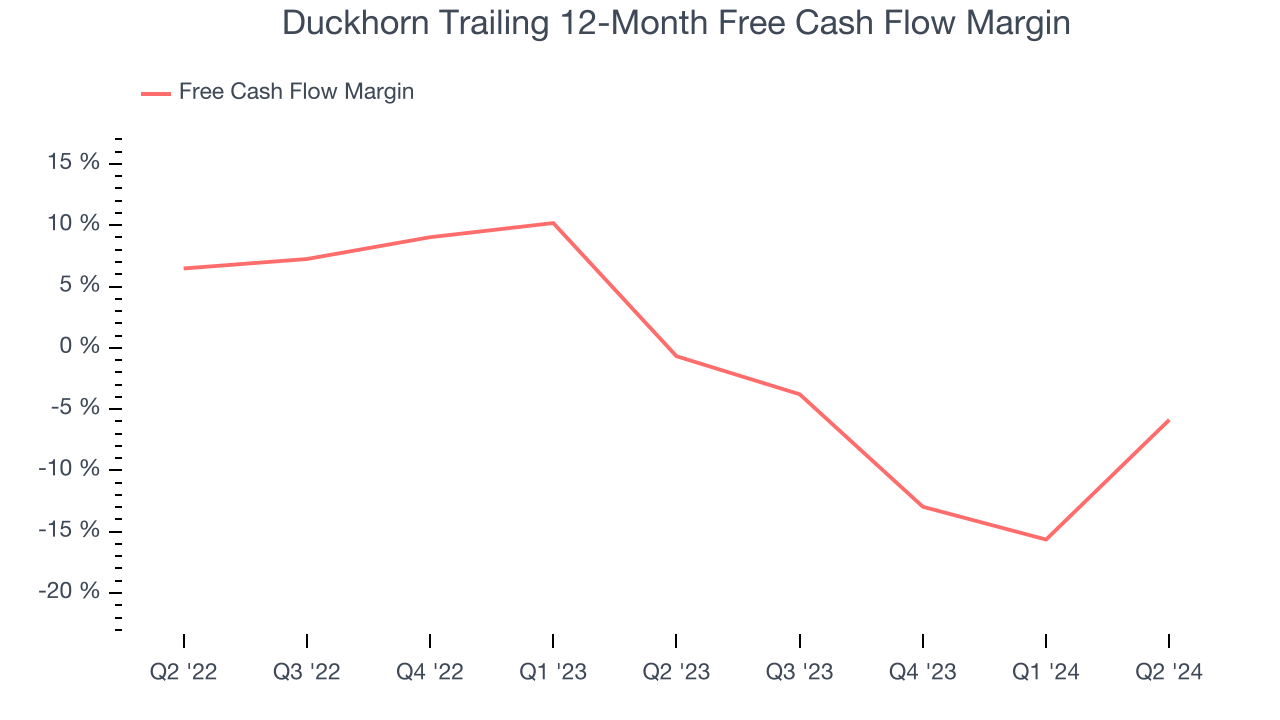

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Duckhorn’s demanding reinvestments have consumed many resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.3%, meaning it lit $3.28 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Final Judgment

Duckhorn’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 17.3x forward price-to-earnings (or $11.03 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d rather buy

Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.Stocks We Would Buy Instead of Duckhorn

With rates dropping, inflation stabilizing, and the elections in the rear-view mirror, all signals point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.