Internet security and content delivery network Cloudflare (NYSE:NET) reported Q1 FY2021 results topping analyst expectations, with revenue up 51.2% year on year to $138 million. Cloudflare made a GAAP loss of $39.9 million, down on it's loss of $32.7 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Cloudflare (NYSE:NET) Q1 FY2021 Highlights:

- Revenue: $138 million vs analyst estimates of $131 million (5.37% beat)

- EPS (non-GAAP): -$0.03 vs analyst estimates of -$0.03

- Revenue guidance for Q2 2021 is $146 million at the midpoint, above analyst estimates of $138.9 million

- The company lifted revenue guidance for the full year, from $591 million to $614 million at the midpoint, a 3.89% increase

- Free cash flow was negative -$2.22 million, compared to negative free cash flow of -$23.48 million in previous quarter

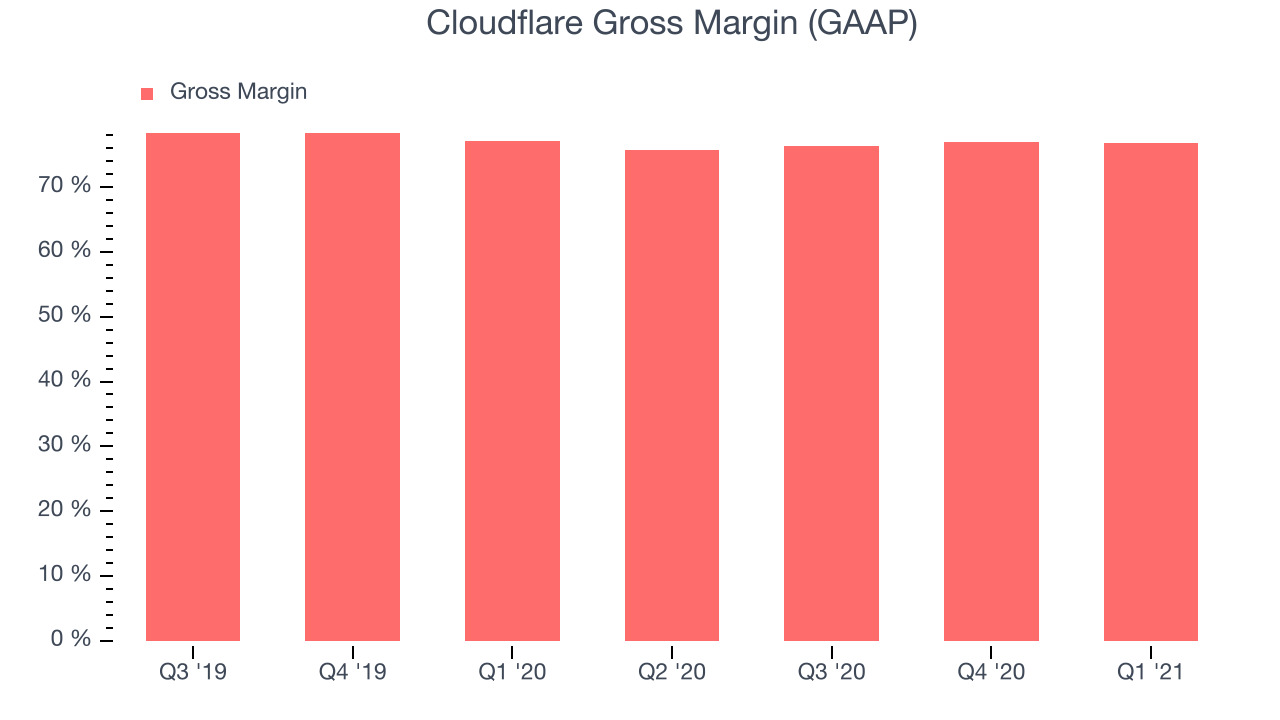

- Gross Margin (GAAP): 76.7%, in line with previous quarter

“We had a record-setting start to the year. Our Q1 revenue growth was up 51% year-over-year, and dollar net retention increased to 123%. We crossed 4 million total customers, and our large customer count was up 70% year-over-year, accounting for more than half of our total revenue,” said Matthew Prince, co-founder & CEO of Cloudflare.

Building A Better Internet

Founded in San Francisco in 2009, Cloudflare is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites. It runs a large network of data centres around the world that serve as storage for their customers content, shielding it from malicious attacks and delivering it in a fastest way possible. The power of Cloudflare is in its size, used by tens of millions of internet properties it is so big that it can protect customers even against state-sponsored attacks and the huge volume of data flowing through the network allows their machine learning algorithms to improve every day.

The demand for Cloudflare is being driven by the massive technological shift from on-premise hardware to services in the cloud. Because almost any online business that is based in the cloud can benefit from Cloudflare’s services, the company is well positioned for the ongoing transformation. Cloudflare competes in the market for network services with legacy on-premise companies like Cisco (NASDAQ:CSCO) or F5 Networks (NASDAQ:FFIV) and partly with cloud cybersecurity and content delivery vendors like Zscaler (NASDAQ:ZS) and Fastly (NYSE:FSLY).

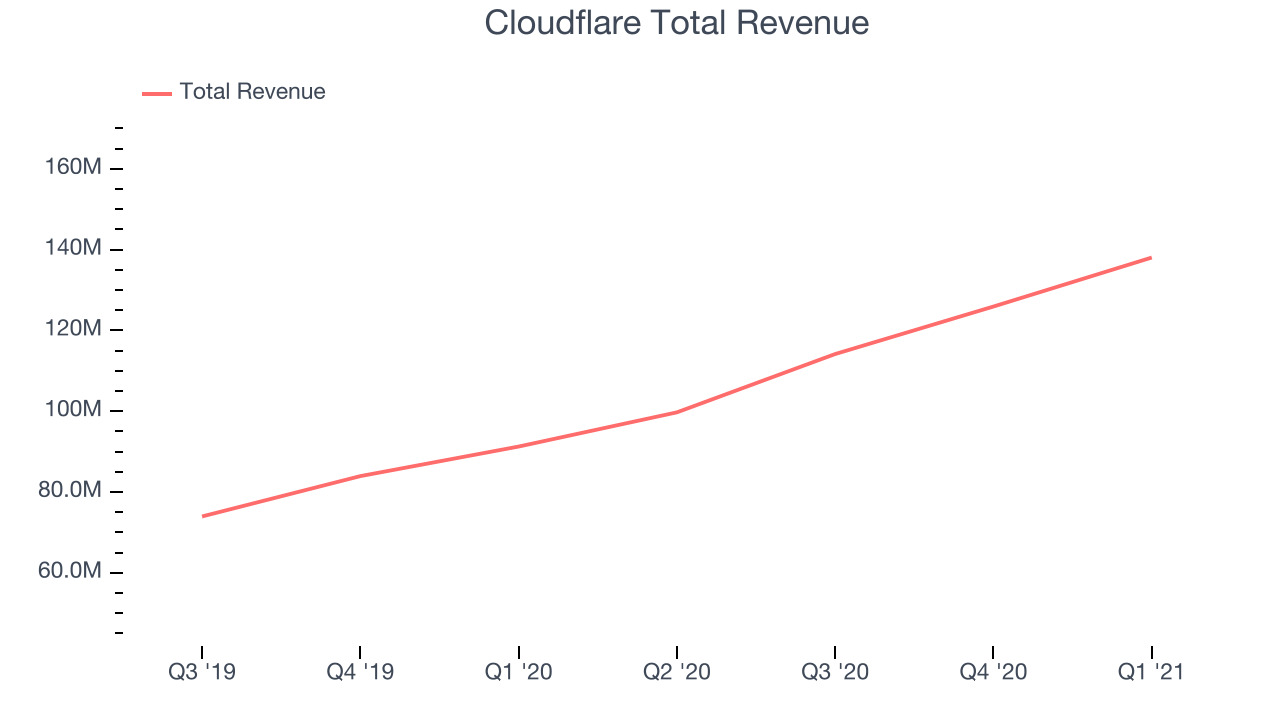

As you can see below, Cloudflare's revenue growth has been exceptional over the last twelve months, growing from $91.2 million to $138 million.

This was another standout quarter with the revenue up a splendid 51.2% year on year. Quarter on quarter the revenue increased by $12.1 million in Q1, which was roughly in line with the Q4 2020 increase. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory.

Cost Efficient Infrastructure

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Unlike other software a as service companies Cloudflare has to pay for physical infrastructure and network bandwidth to move data around the world but was successful in designing their architecture to be very efficient.

Cloudflare's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 76.7% in Q1. That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a good gross margin that will allow Cloudflare to fund large investments in product and sales during periods of rapid growth and be profitable when it reaches maturity. It is good to see that the gross margin is staying stable which indicates that Cloudflare is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Cloudflare's Q1 Results

With market capitalisation of $24.5 billion, more than $1.03 billion in cash and the fact it is operating close to free cash flow break-even, we're confident that Cloudflare has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth Cloudflare delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. Therefore, we think Cloudflare will continue to stand out as a compelling growth stock, arguably even more so than before.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.