Internet security and content delivery network Cloudflare (NYSE:NET) reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 32% year on year to $362.5 million. The company expects next quarter's revenue to be around $373 million, in line with analysts' estimates. It made a non-GAAP profit of $0.15 per share, improving from its profit of $0.06 per share in the same quarter last year.

Cloudflare (NET) Q4 FY2023 Highlights:

- Revenue: $362.5 million vs analyst estimates of $353 million (2.7% beat)

- EPS (non-GAAP): $0.15 vs analyst estimates of $0.12 (26.3% beat)

- Revenue Guidance for Q1 2024 is $373 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $1.65 billion at the midpoint, in line with analyst expectations and implying 27.2% growth (vs 33.1% in FY2023)

- Free Cash Flow of $50.72 million, up 45.4% from the previous quarter

- Gross Margin (GAAP): 77%, up from 75.3% in the same quarter last year

- Market Capitalization: $27.99 billion

"We had an exceptionally strong fourth quarter. We grew revenue by 32% percent year-over-year, to $362.5, blew away our previous records for new ACV—delivering the highest quarterly growth since 2021—and signed both our largest new customer win and largest customer renewal ever. Our pipeline close rates, sales force productivity, average deal size, and linearity all improved markedly quarter-over-quarter. To close out the year, strength in our business was driven by robust momentum with large customers, significant progress in the public sector, and growth in Cloudflare One," said Matthew Prince, co-founder & CEO of Cloudflare.

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare runs a large network of data centres around the world that serve as storage for their customers' content, shielding it from malicious attacks and delivering it in the fastest way possible.

The power of the product is in its size, used by tens of millions of internet properties, it is so big that it can protect customers even against state-sponsored attacks. And the massive volume of data flowing through the network allows their machine learning algorithms to improve every day.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Cloudflare competes in the market for network and content delivery services with companies like AKAMAI (NASDAQ:AKAM) or Fastly (NYSE:FSLY) and partly with cloud cybersecurity and vendors like Zscaler (NASDAQ:ZS).

Sales Growth

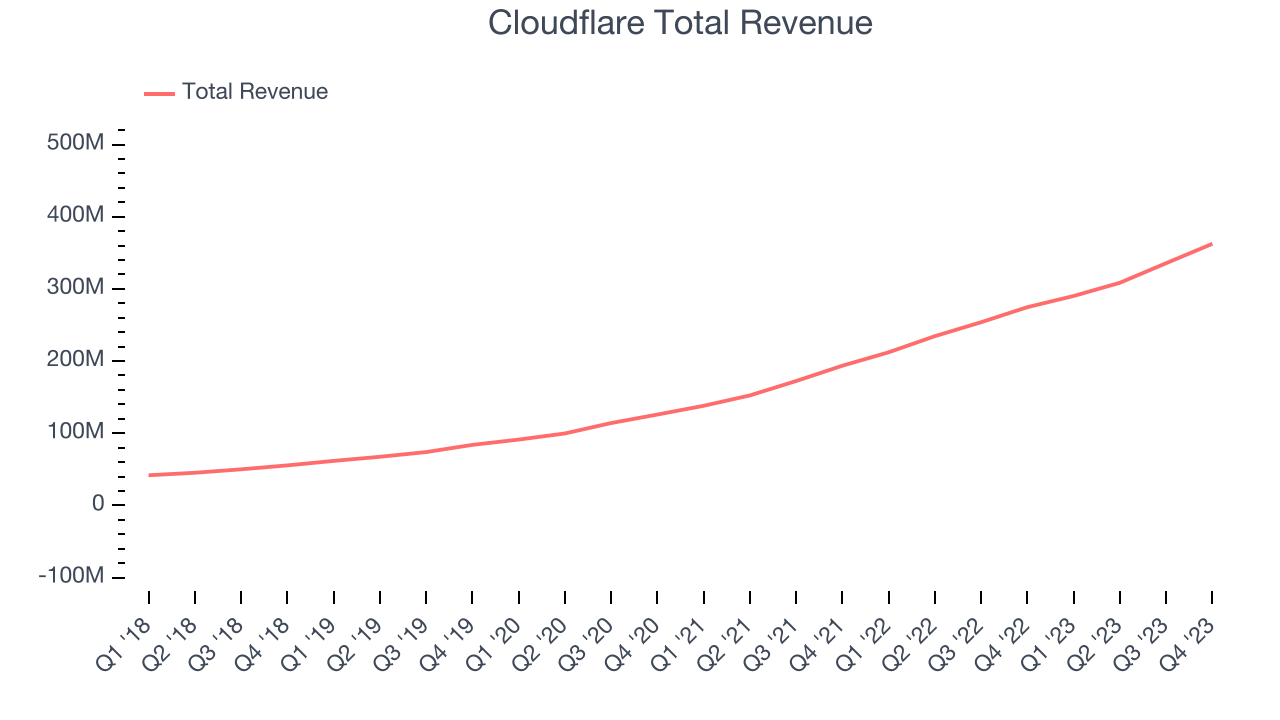

As you can see below, Cloudflare's revenue growth has been impressive over the last two years, growing from $193.6 million in Q4 FY2021 to $362.5 million this quarter.

Unsurprisingly, this was another great quarter for Cloudflare with revenue up 32% year on year. Quarter on quarter, its revenue increased by $26.87 million in Q4, which was roughly in line with the Q3 2023 increase. This steady growth shows that the company can maintain a strong growth trajectory.

Next quarter's guidance suggests that Cloudflare is expecting revenue to grow 28.5% year on year to $373 million, slowing down from the 36.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.65 billion at the midpoint, growing 27.2% year on year compared to the 33% increase in FY2023.

Profitability

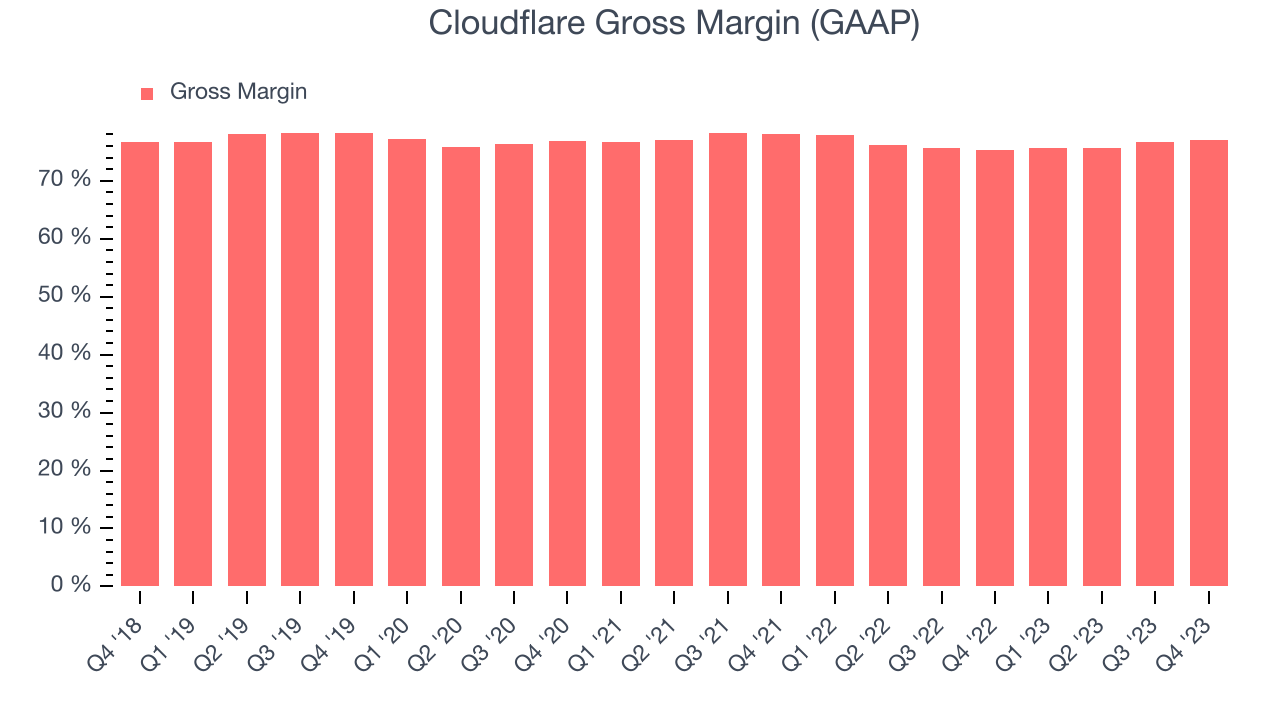

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Cloudflare's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 77% in Q4.

That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, sales and marketing, and general administrative overhead. Cloudflare's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Cloudflare is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

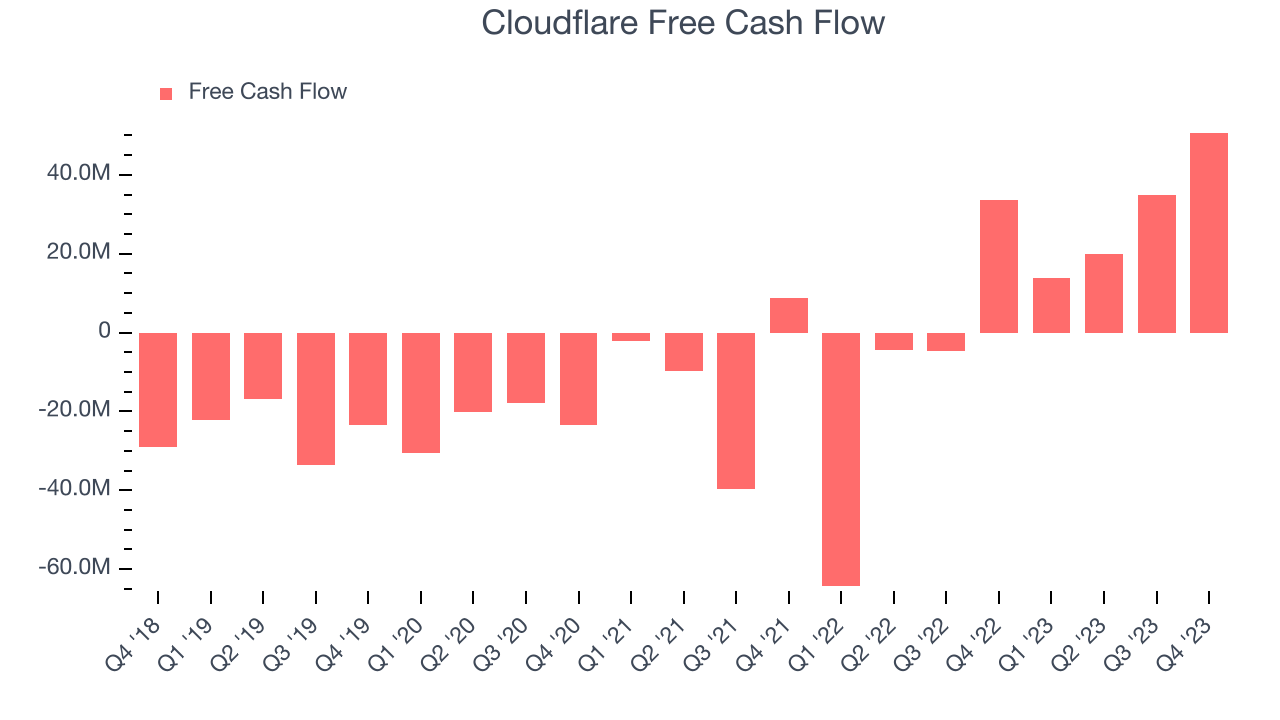

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Cloudflare's free cash flow came in at $50.72 million in Q4, up 50.7% year on year.

Key Takeaways from Cloudflare's Q4 Results

It was good to see Cloudflare beat analysts' revenue expectations this quarter. Its full-year guidance also showed the company can maintain a strong level of growth. And with free cash flow now in positive territory, we believe that growth is sustainable over the long term. Zooming out, we think this was a very solid quarter, showing that the company is staying on track. The stock is up 20.2% after reporting and currently trades at $115 per share.

Is Now The Time?

When considering an investment in Cloudflare, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Cloudflare is a good business. We'd expect growth rates to moderate from here, but its growth over the last two years has been phenomenal. On top of that, its very efficient customer acquisition hints at the potential for strong profitability and its customers are increasing their spending quite quickly, suggesting they love the product.

Cloudflare's price-to-sales ratio based on the next 12 months of 18.5x indicates that the market is certainly optimistic about its growth prospects. There's definitely a lot of things to like about Cloudflare and looking at the tech landscape right now, it seems that it doesn't trade at an unreasonable price point.

Wall Street analysts covering the company had a one-year price target of $76.45 per share right before these results (compared to the current share price of $115).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.