Cloudflare (NYSE:NET) Posts Better-Than-Expected Sales In Q1 But Stock Drops 14.3%

Adam Hejl 2024/05/02 4:15 pm EDT

Internet security and content delivery network Cloudflare (NYSE:NET) announced better-than-expected results in Q1 CY2024, with revenue up 30.5% year on year to $378.6 million. The company expects next quarter's revenue to be around $394 million, in line with analysts' estimates. It made a non-GAAP profit of $0.16 per share, improving from its profit of $0.08 per share in the same quarter last year.

Cloudflare (NET) Q1 CY2024 Highlights:

- Revenue: $378.6 million vs analyst estimates of $373.4 million (1.4% beat)

- EPS (non-GAAP): $0.16 vs analyst estimates of $0.13 (22.6% beat)

- Revenue Guidance for Q2 CY2024 is $394 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $1.65 billion at the midpoint

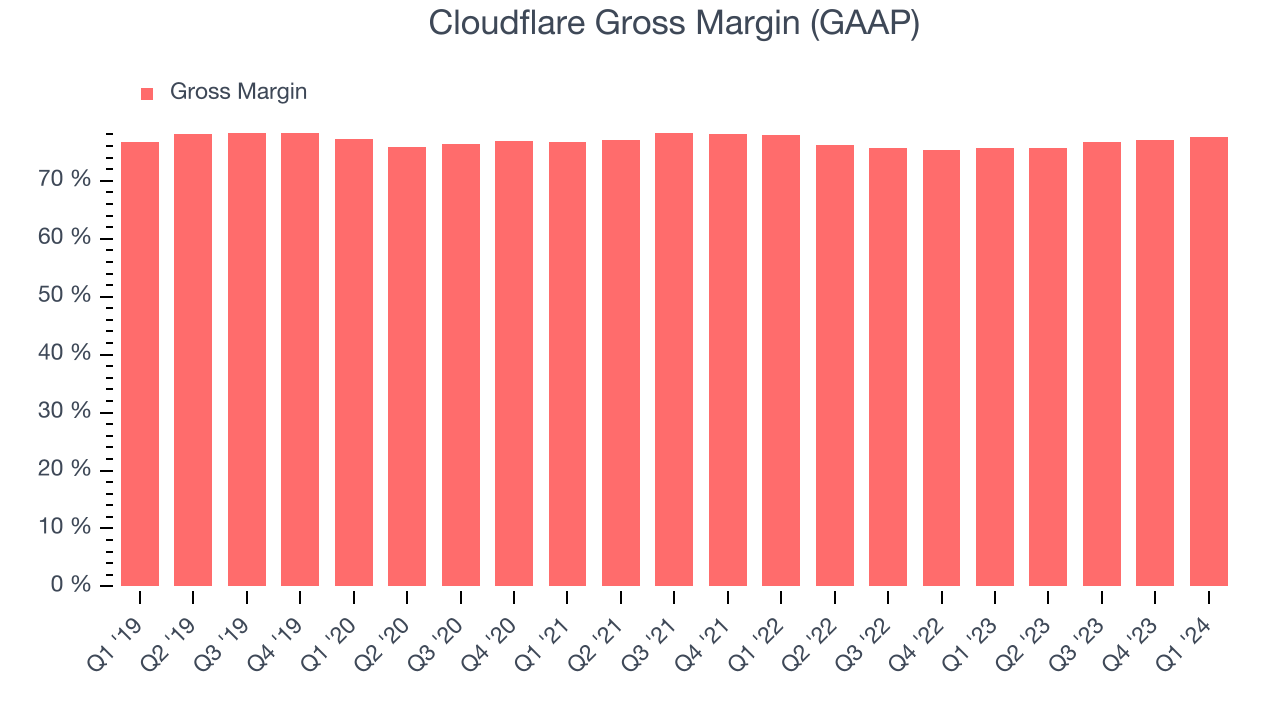

- Gross Margin (GAAP): 77.5%, up from 75.7% in the same quarter last year

- Free Cash Flow of $35.61 million, down 29.8% from the previous quarter

- Market Capitalization: $29.91 billion

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare runs a large network of data centres around the world that serve as storage for their customers' content, shielding it from malicious attacks and delivering it in the fastest way possible.

The power of the product is in its size, used by tens of millions of internet properties, it is so big that it can protect customers even against state-sponsored attacks. And the massive volume of data flowing through the network allows their machine learning algorithms to improve every day.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Cloudflare competes in the market for network and content delivery services with companies like AKAMAI (NASDAQ:AKAM) or Fastly (NYSE:FSLY) and partly with cloud cybersecurity and vendors like Zscaler (NASDAQ:ZS).

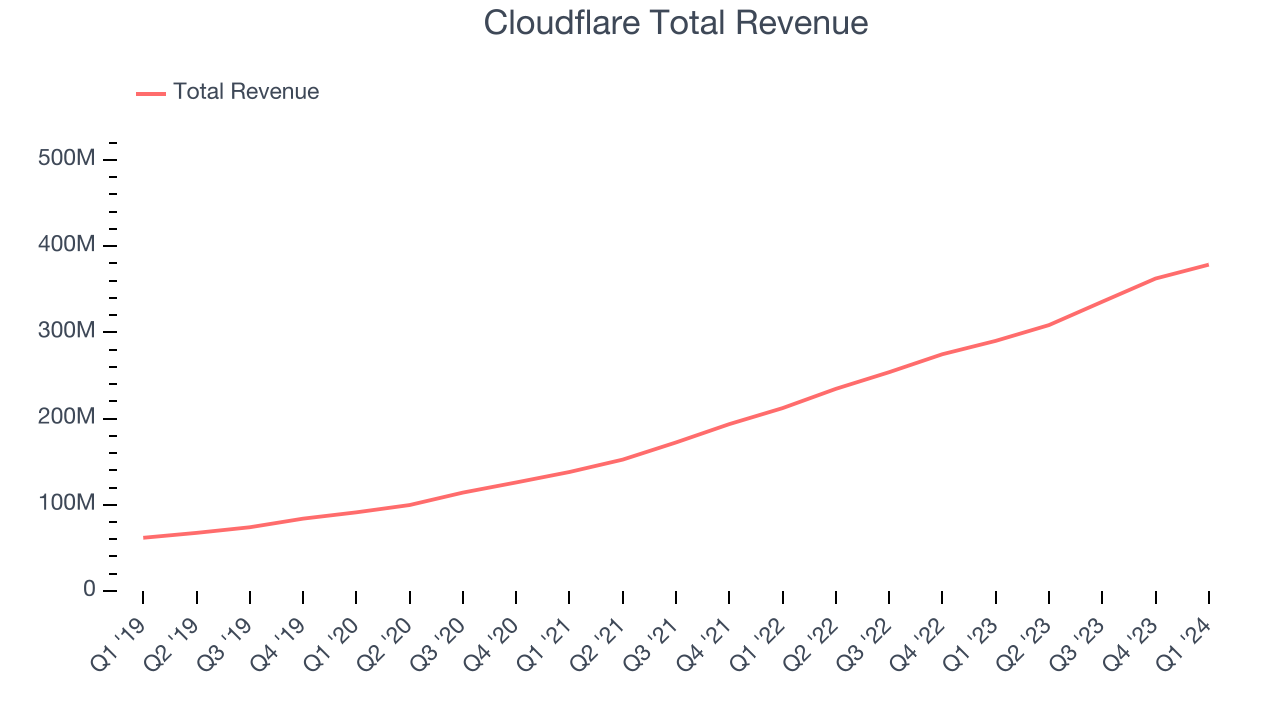

Sales Growth

As you can see below, Cloudflare's revenue growth has been impressive over the last three years, growing from $138.1 million in Q1 2021 to $378.6 million this quarter.

Unsurprisingly, this was another great quarter for Cloudflare with revenue up 30.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $16.13 million in Q1 compared to $26.87 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Cloudflare is expecting revenue to grow 27.7% year on year to $394 million, slowing down from the 31.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 26.7% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Cloudflare's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 77.5% in Q1.

That means that for every $1 in revenue the company had $0.78 left to spend on developing new products, sales and marketing, and general administrative overhead. Cloudflare's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Cloudflare is controlling its costs and not under pressure from its competitors to lower prices.

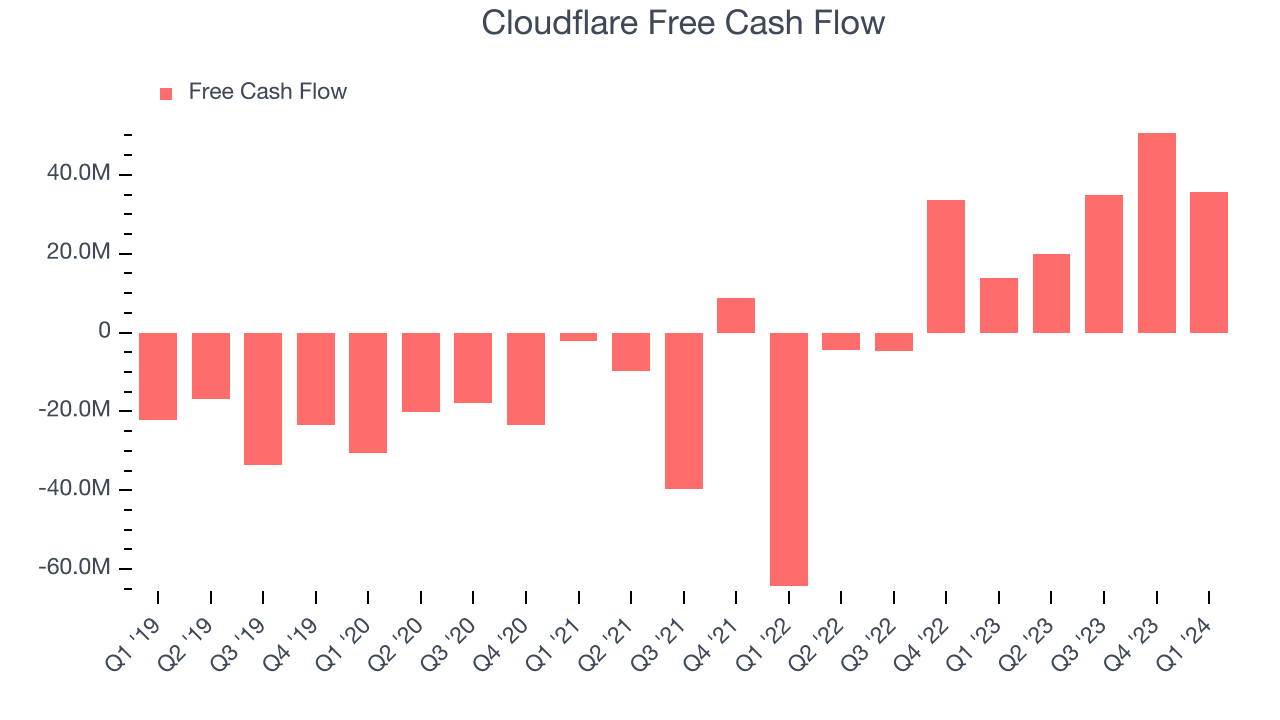

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Cloudflare's free cash flow came in at $35.61 million in Q1, up 156% year on year.

Cloudflare has generated $141.2 million in free cash flow over the last 12 months, or 10.2% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Cloudflare's Q1 Results

It was encouraging to see Cloudflare narrowly top analysts' revenue expectations this quarter. On the other hand, its billings unfortunately missed analysts' expectations and its full-year revenue guidance was on the lower side of Wall Street's estimates. Overall, this was a mixed quarter for Cloudflare. The company is down 14.3% on the results and currently trades at $76.23 per share.

Is Now The Time?

Cloudflare may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Cloudflare is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. Additionally, its efficient customer acquisition hints at the potential for strong profitability, and its customers are increasing their spending quite quickly, suggesting they love the product.

There's no doubt the market is optimistic about Cloudflare's growth prospects, as its 17.2x price-to-sales ratio based on the next 12 months would suggest. But looking at the tech landscape today, Cloudflare's qualities as one of the best businesses really stand out, and we think that the multiple is justified. We still like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $100.79 right before these results (compared to the current share price of $76.23), implying they see short-term upside potential in Cloudflare.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.