Application performance management software company New Relic (NYSE:NEWR) announced better-than-expected results in the Q4 FY2021 quarter, with revenue up 8.14% year on year to $172.6 million. New Relic made a GAAP loss of $58.8 million, down on its loss of $28.5 million, in the same quarter last year.

Is now the time to buy New Relic? Get early access to our full analysis of the earnings results here

New Relic (NYSE:NEWR) Q4 FY2021 Highlights:

- Revenue: $172.6 million vs analyst estimates of $167 million (3.38% beat)

- EPS (non-GAAP): -$0.27 vs analyst estimates of -$0.46

- Revenue guidance for Q1 2022 is $173 million at the midpoint, above analyst estimates of $169.1 million

- Management's revenue guidance for upcoming financial year 2022 is $710 million at the midpoint, predicting 6.34% growth (vs 20.1% in FY2021)

- Free cash flow of $21.7 million, up from negative free cash flow of -$12.73 million in previous quarter

- Net Revenue Retention Rate: 99%, down from 108% previous quarter

- Gross Margin (GAAP): 66.9%, down from 72.3% previous quarter

- Bill Staples to replace Lew Cirne as CEO

“FY21 was a transformational year for New Relic, and we are a fundamentally better company entering FY22. The investments we’ve made in our product and platform, and our move to a consumption model, are resonating with the market as we’ve aligned our entire company around our customers and their success,” said Lew Cirne, founder and CEO, New Relic. "The time is ideal for me to hand over the reins to Bill to execute on our vision and strategy. It has been an honor and joy to serve as New Relic’s CEO for nearly fourteen years, and I look forward to continuing to serve as Executive Chairman. I couldn’t be more excited for our future under Bill’s leadership."

Infrastructure Monitoring

New Relic, founded in 2008, is an anagram for the name of its founder, CEO Lew Cirne, a software developer who had previously built another company in the same space called Wily Technology, and sold it in 2006. New Relic gained early traction with its focus on the Ruby on Rails developer community, winning many high profile evangelists.

New Relic (NYSE:NEWR) is essentially a monitoring system that collects, scores and analyses performance data about a client's IT stack. The software provides companies with a shared real-time dashboard where the information about their software stacks is visualised, including software applications and the infrastructure they run on. It can be integrated with other services like Pager Duty (NYSE:PD) and Slack (NYSE:WORK) to alert employees if the performance score drops and needs attention. On top of that, New Relic allows clients to solve problems faster by providing automatic insights into the root cause of every problem.

New Relic has been transitioning its pricing to a usage based model, which means its revenue should grow with the increasing complexity of its customers' technology. That's important, since it faces a number of competitors in the performance monitoring space, such as Datadog (NASDAQ:DDOG) and Dynatrace (NYSE:DT). On top of that, demand for application performance monitoring software should increase as businesses undergo digital transformation, so we'd expect revenue to grow over time if the company remains competitive.

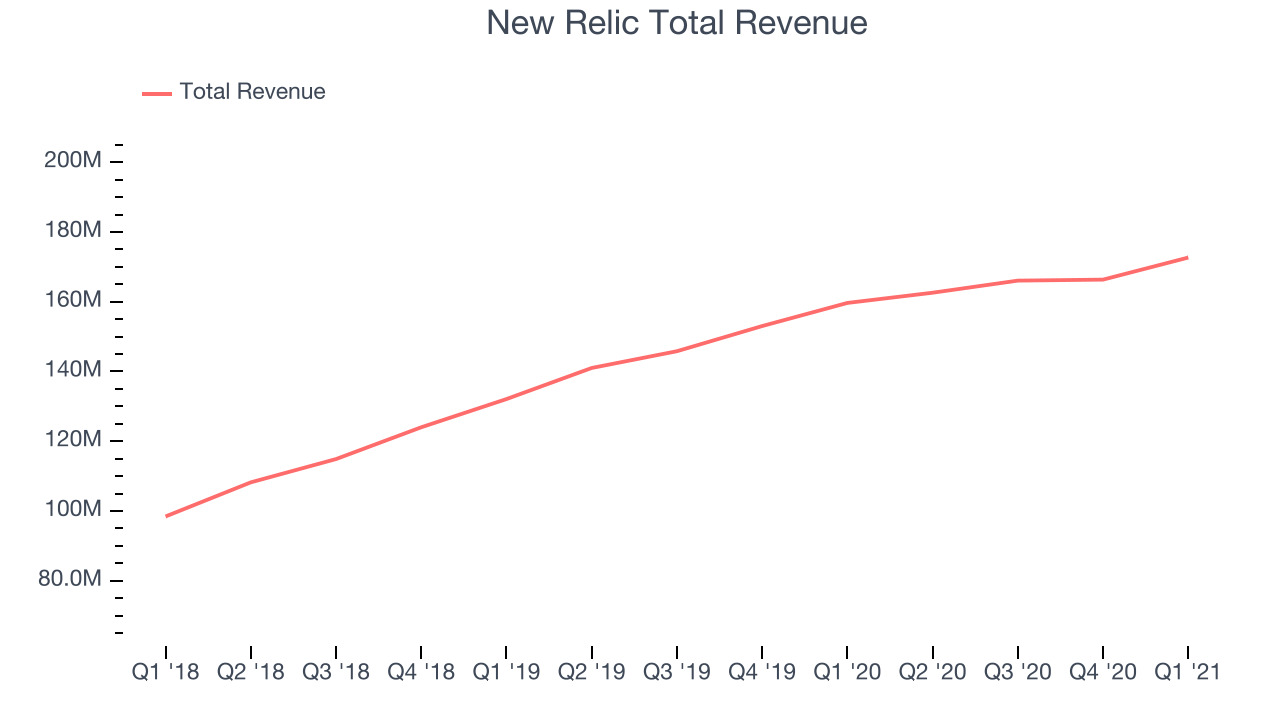

As you can see below, New Relic's revenue growth has been strong over the last twelve months, growing from $159.6 million to $172.6 million.

New Relic's quarterly revenue was only up 8.14% year on year, which would likely disappoint many shareholders. We can see that the company increased revenue by $6.32 million quarter on quarter accelerating on $286 thousand in Q3 2021. In investing, the past matters mostly as an indicator of the future. It is useful to know what are the analysts projecting for New Relic and whether they are likely to upgrade their price targets after these results. You can easily find that out on our platform. Click here to get early access.

A Freemium Growth Model

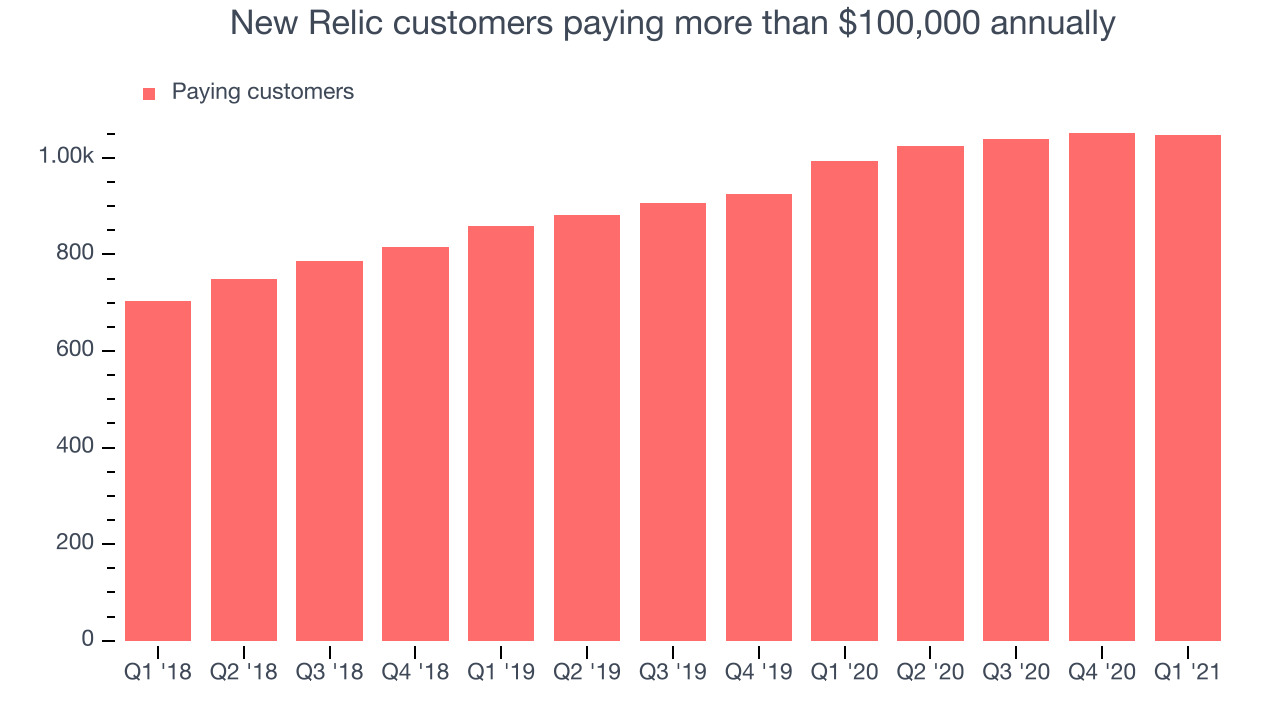

Like many software companies, New Relic has a product led sales process that allows any developer to use their product for free (with limitations), and offers free trials for larger customers. However, most of their revenue comes from larger, enterprise customers, so its important that the company succeeds with larger accounts. On top of that, big businesses have greater needs, and more potential for upsell, so we definitely like to see the number of larger accounts grow over time.

You can see below that at the end of the quarter New Relic reported 1,048 enterprise customers paying more than $100,000 annually, loss of 3 on last quarter, suggesting that the sales momentum with large customers is slowing down.

Key Takeaways from New Relic's Q4 Results

With market capitalisation of $3.58 billion New Relic is among smaller companies, but its more than $816 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

New Relic' revenue guidance for the next quarter looks quite a bit better than what the analysts were expecting. And we were also excited to see it that it outperformed Wall St’s revenue expectations this quarter. On the other hand, it was disappointing to see the slowdown in new contract wins and the revenue guidance for next year indicates quite a significant slowdown in growth. Overall, this quarter's results were definitely not the best we've seen from New Relic. New Relic wasn't the most inspiring growth stock going into these results, and we don't think this quarter has helped its growth credentials.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.