Enterprise workflow software maker ServiceNow (NYSE:NOW) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 24.2% year on year to $2.60 billion. It made a non-GAAP profit of $3.41 per share, improving from its profit of $2.37 per share in the same quarter last year.

Is now the time to buy ServiceNow? Find out by accessing our full research report, it's free.

ServiceNow (NOW) Q1 CY2024 Highlights:

- Revenue: $2.60 billion vs analyst estimates of $2.59 billion (small beat)

- RPO (remaining performance obligations): $17.8 billion vs. analyst estimates of $17.2 billion (3.5% beat)

- EPS (non-GAAP): $3.41 vs analyst estimates of $3.13 (8.9% beat)

- Subscription Revenue Guidance for Q2 CY2024 is $2.53 billion at the midpoint, below analyst estimates of $2.61 billion

- The company provided subscription revenue guidance for the full year of $10.57 billion at the midpoint

- Full year margin guidance maintained

- Gross Margin (GAAP): 80%, up from 79.1% in the same quarter last year

- Free Cash Flow of $1.21 billion, down 10.3% from the previous quarter (beat vs. expectations of $969 million)

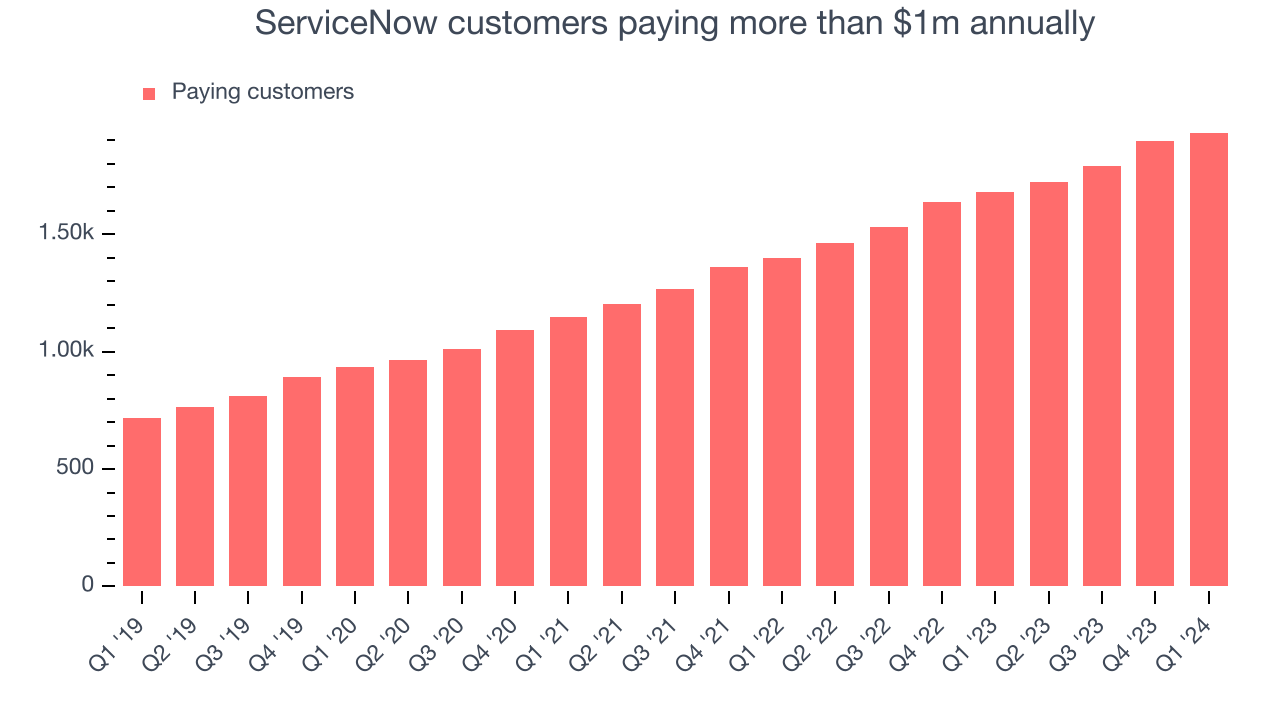

- Customers: 1,933 customers paying more than $1m annually

- Market Capitalization: $152.2 billion

Founded by Fred Luddy, who wrote the code for the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR, and customer service.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

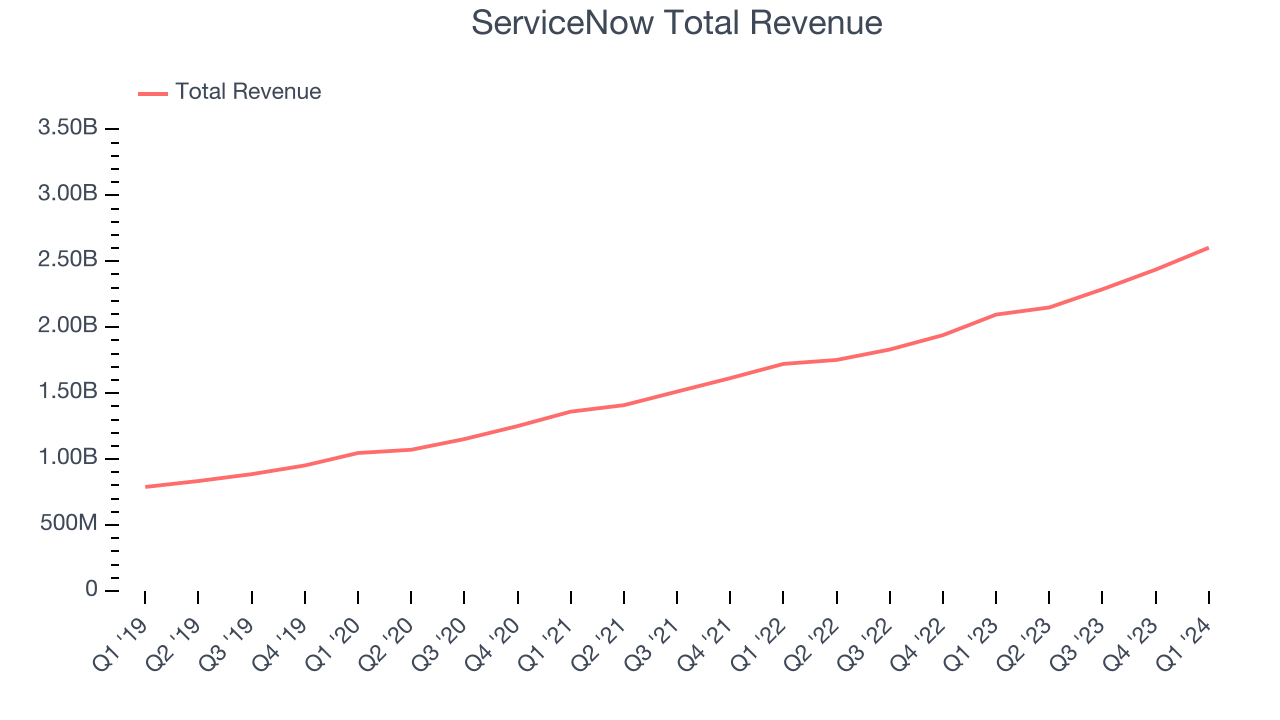

As you can see below, ServiceNow's revenue growth has been strong over the last three years, growing from $1.36 billion in Q1 2021 to $2.60 billion this quarter.

This quarter, ServiceNow's quarterly revenue was once again up a very solid 24.2% year on year. On top of that, its revenue increased $166 million quarter on quarter, a solid improvement from the $149 million increase in Q4 CY2023. Thankfully, that's a slight re-acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 20.5% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Large Customers Growth

This quarter, ServiceNow reported 1,933 enterprise customers paying more than $1m annually, an increase of 36 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from ServiceNow's Q1 Results

It was good to see ServiceNow beat on RPO (remaining performance obligations, a leading indicator), revenue, operating profit, and adjusted EPS. On the other hand, its new large contract wins slowed and subscription revenue guidance for the next quarter was below expectations. Overall, the results were mixed, with a solid quarter but unexciting guidance. The company is down 4.8% on the results and currently trades at $711 per share.

ServiceNow may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.