Enterprise workflow software maker ServiceNow (NYSE:NOW) reported strong growth in the Q1 FY2021 earnings announcement, with revenue up 29.9% year on year to $1.36 billion. ServiceNow made a GAAP profit of $82 million, improving on its profit of $48.2 million, in the same quarter last year.

ServiceNow (NYSE:NOW) Q1 FY2021 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.33 billion (1.71% beat)

- EPS (non-GAAP): $1.52 vs analyst estimates of $1.35 (12.7% beat)

- Subscription revenue guidance for Q2 2021 is $1.293 billion at the midpoint, representing 28% year on year growth (edit: the previous version of this article included incorrect Q2 guidance numbers)

- The company upgraded subscription revenue guidance for the full year to $5.456 billion billion at the midpoint

- Free cash flow of $627 million, up 10.9% from previous quarter

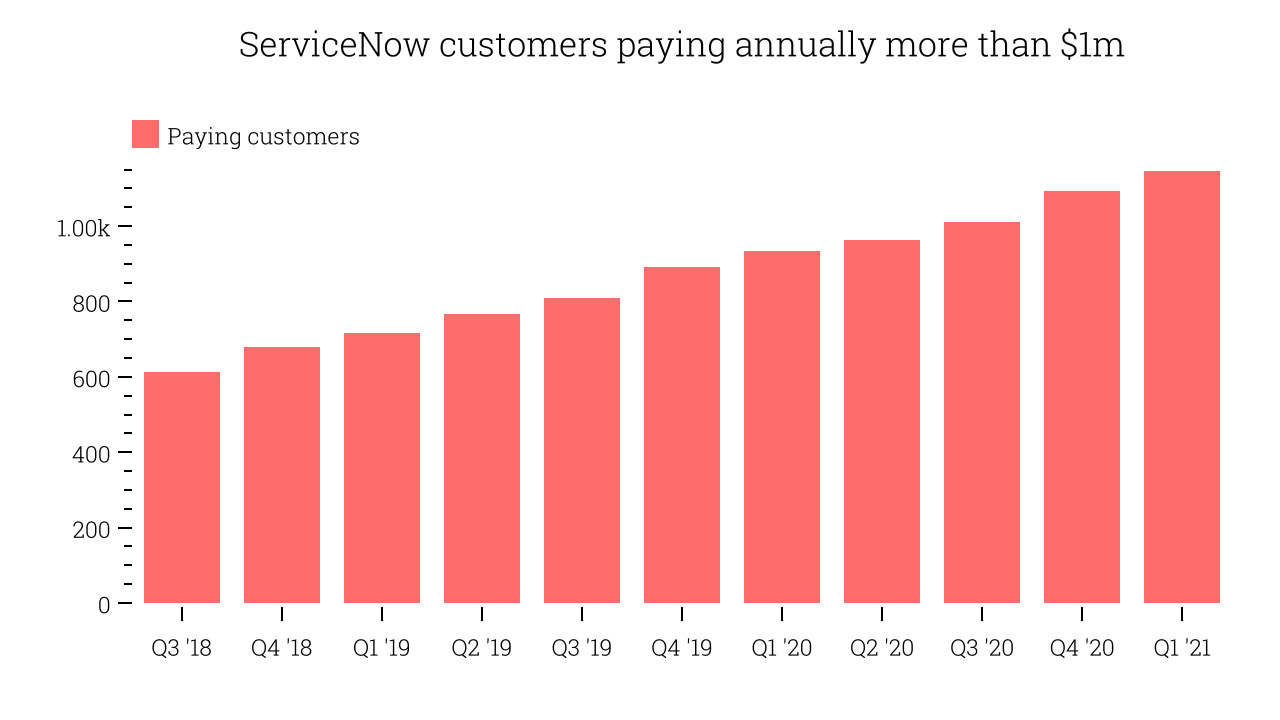

- Customers: 1,146 customers paying annually more than $1m

- Gross Margin (GAAP): 78%, in line with previous quarter

"Our outstanding start to 2021 is rooted in our relentless focus to make the world of work, work better for people,” said Bill McDermott, ServiceNow president and CEO. “As the leading platform for digital transformation, our empathy for customers inspires our continuous innovation. Over the past 18 months, we doubled the features and functionality in our releases to solve the world’s most pressing challenges. We are humbled to support turning millions of vaccines into vaccinations globally. There is no limit to the opportunities ahead as we strive to become the defining enterprise software company of the 21st century.”

Leader In Enterprise SaaS

The story of ServiceNow starts in 2004 when Fred Luddy, the founder, wrote the code for the initial working prototype of ServiceNow on a single flight from San Francisco to London, after being frustrated how bad the experience using software at work was compared to the software he was using at home.

ServiceNow offers software as a service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR and Customer Service. A simple example would be a new employee on-boarding, which is typically a multi-departmental experience, and involves getting a badge from security, desk from facilities, laptop from IT, dealing with finance, compliance and HR. With ServiceNow employees are able to do all that through a self-help portal, saving significant amounts of time. The key to the success of the Now platform is allowing the companies to design and build these workflows in a no-code environment, without needing any software developers.

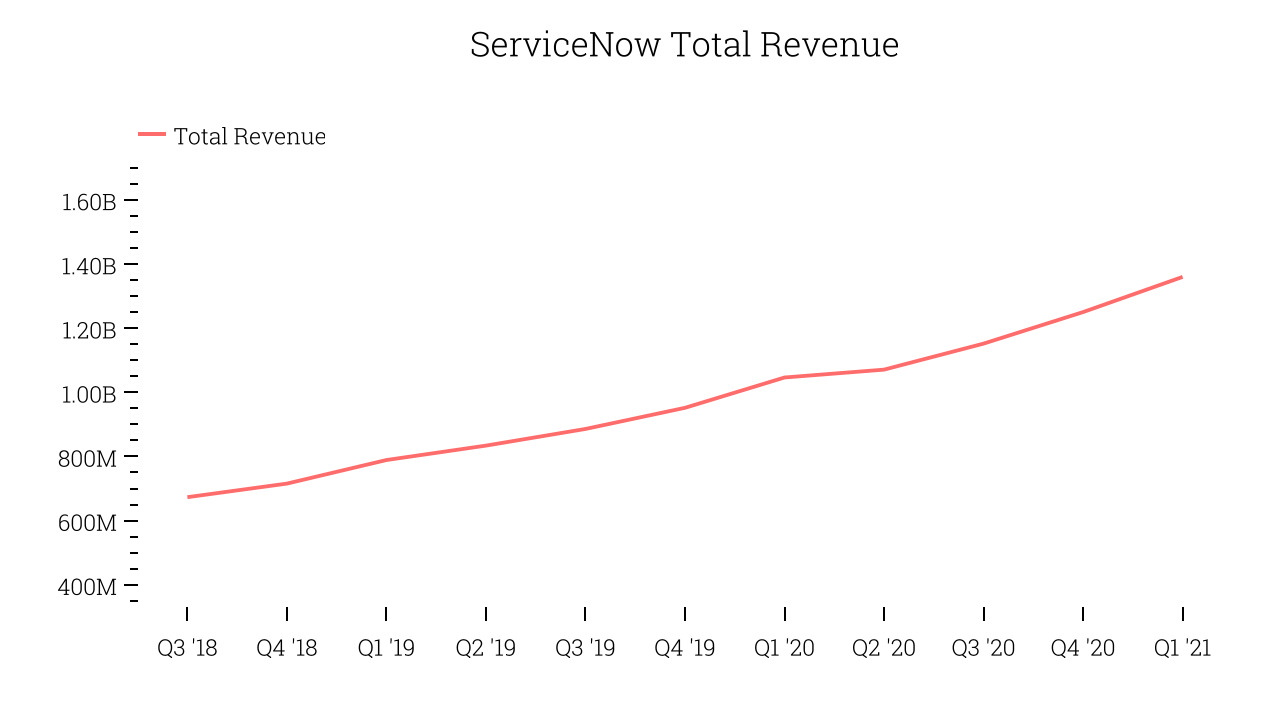

As you can see below, ServiceNow's revenue growth has been very strong over the last twelve months, growing from $1.04 billion to $1.36 billion.

This quarter, ServiceNow's quarterly revenue was once again up a very solid 29.9% year on year. On top of that, revenue increased $109 million quarter on quarter, a solid improvement on the $98.3 million increase in Q4 2020. Happily, that's a slight re-acceleration of growth.

Pure Enterprise Play

ServiceNow's clients can sell their custom workflow applications to other users in the ServiceNow App Store and as a result, ServiceNow is generally most useful for larger customers, who have many complex workflows that may (for example) require a multitude of approvals as well as being time sensitive. In turn, large customers are more valuable to Service Now, as they are likely to need more users and thus generate more revenue and a greater number of custom workflows for sale in the App Store.

You can see below that at the end of the quarter ServiceNow reported 1,146 enterprise customers paying annually more than $1m, an increase of 53 on last quarter. That is a bit less contract wins than last quarter but about the same as what we have typically seen over the last year, suggesting that the company still has decent sales momentum, even if this was a weaker quarter.

Key Takeaways from ServiceNow's Q1 Results

Sporting a market capitalisation of $111 billion, more than $3.45 billion in cash and operating free cash flow positive over the last twelve months, we're confident that ServiceNow has the resources it needs to pursue a high growth business strategy.

It was good to see ServiceNow deliver strong revenue growth this quarter. And we were also excited to see it that it upgraded full year guidance. On the other hand, it was disappointing to see the slowdown in new contract wins. Zooming out, we think this was still a decent, albeit mixed, quarter. While the market has high expectations of ServiceNow, it has a track record of one of the best SaaS businesses out there, and after these results it still deserves a spot on your watchlist if you like software as a service growth stories.

The author has no position in any of the stocks mentioned.

Note: The previous version of this article included incorrect Q2 revenue guidance, this has now been updated