Enterprise workflow software maker ServiceNow (NYSE:NOW) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 25% year on year to $2.29 billion. Turning to EPS, ServiceNow made a non-GAAP profit of $2.92 per share, improving from its profit of $1.96 per share in the same quarter last year.

Is now the time to buy ServiceNow? Find out by accessing our full research report, it's free.

ServiceNow (NOW) Q3 FY2023 Highlights:

- Revenue: $2.29 billion vs analyst estimates of $2.27 billion (small beat)

- RPO (remaining performance obligations) and cRPO (current remaining performance obligations) both beat and these are leading indicators of revenue

- EPS (non-GAAP): $2.92 vs analyst estimates of $2.55 (14.6% beat)

- Subscription Revenue Guidance for Q4 2023 is $2.32 billion at the midpoint, below analyst estimates of $2.39 billion

- Free Cash Flow of $175 million, down 60.9% from the previous quarter

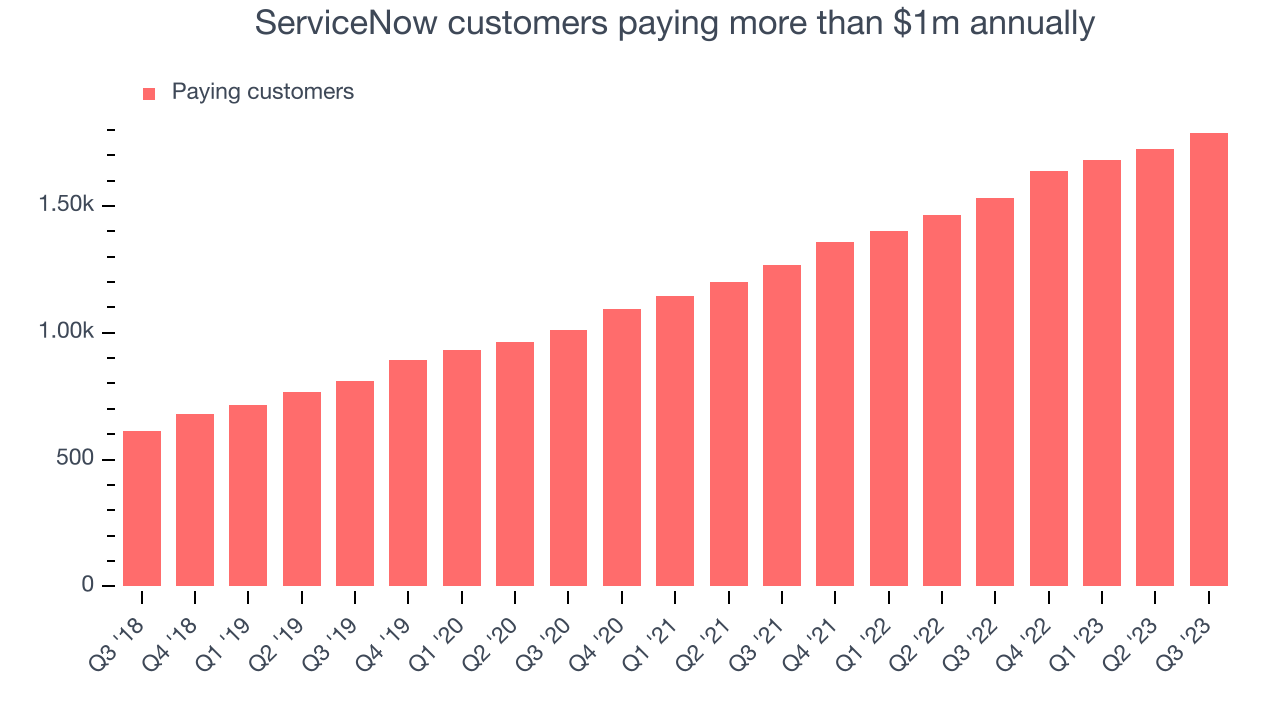

- Customers: 1,789 customers paying more than $1m annually

- Gross Margin (GAAP): 78.3%, in line with the same quarter last year

“Q3 marks another quarter of exceptional execution as we significantly surpassed the high end of our guidance metrics,” said ServiceNow CFO Gina Mastantuono. “Our robust results show that the world's best‑run enterprises are choosing ServiceNow to drive their digital transformation roadmaps. With the capabilities unlocked by generative AI, the window of opportunity is even more expansive, positioning us well to continue delivering a strong balance of growth and profitability.”

Founded by Fred Luddy, who wrote the code for the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR, and customer service.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

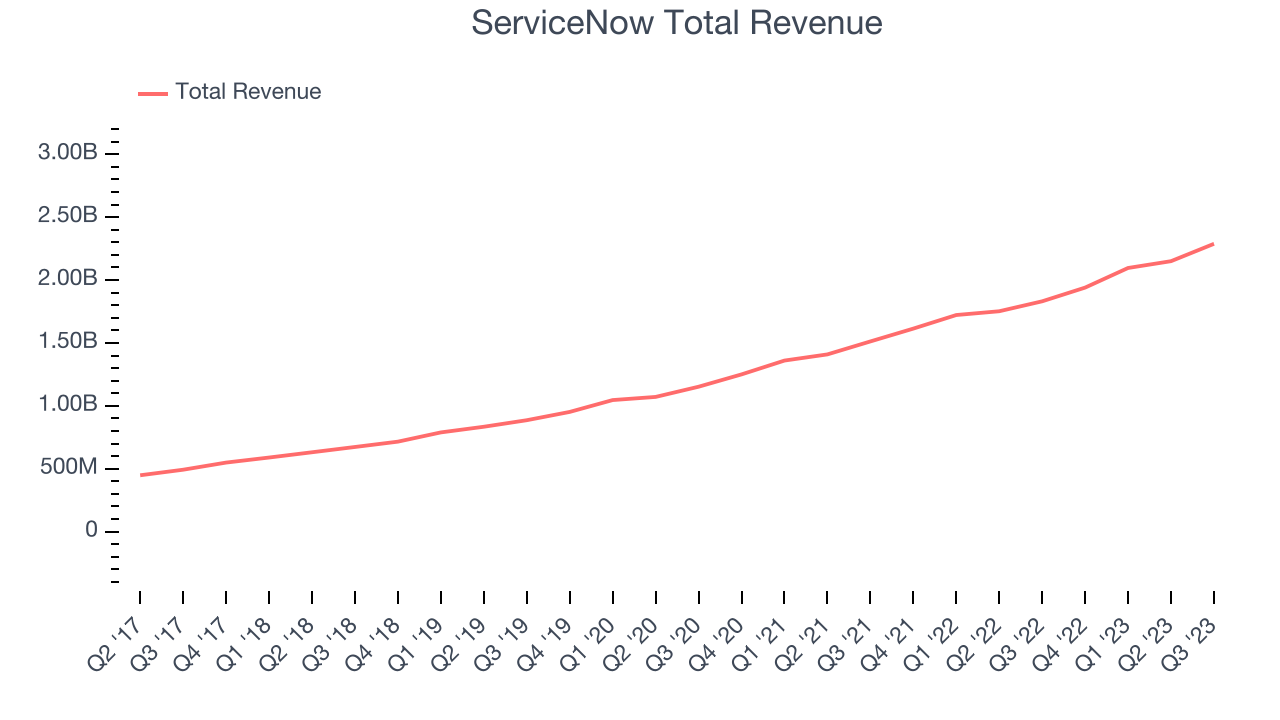

As you can see below, ServiceNow's revenue growth has been strong over the last two years, growing from $1.51 billion in Q3 FY2021 to $2.29 billion this quarter.

This quarter, ServiceNow's quarterly revenue was once again up a very solid 25% year on year. On top of that, its revenue increased $138 million quarter on quarter, a very strong improvement from the $54 million increase in Q2 2023. This is a sign of acceleration of growth and great to see.

Looking ahead, analysts covering the company were expecting sales to grow 21.7% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Large Customers Growth

This quarter, ServiceNow reported 1,789 enterprise customers paying more than $1m annually, an increase of 65 from the previous quarter. That's quite a bit more contract wins than last quarter and quite a bit above what we've typically observed in past quarters, demonstrating that the business has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from ServiceNow's Q3 Results

With a market capitalization of $113 billion, a $4.07 billion cash balance, and positive free cash flow over the last 12 months, we're confident that ServiceNow has the resources needed to pursue a high-growth business strategy.

Revenue beat slightly but two important leading indicators of revenue growth--RPO and cRPO (total and current remaining performance obligations) beat more handily. We were also impressed by ServiceNow's significant improvement in new large contract wins this quarter. On profitability, the company exceeded expectations for operating income. Finally, the company raised its full year outlook for subscription revenue and slightly raised its full year outlook for operating margins while reiterating gross and free cash flow margins. Overall, we think this was good quarter that should please many shareholders. The stock is up 5.92% after reporting and currently trades at $562.11 per share.

ServiceNow may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.