Enterprise workflow software maker ServiceNow (NYSE:NOW) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 24.2% year on year to $2.60 billion. It made a non-GAAP profit of $3.41 per share, improving from its profit of $2.37 per share in the same quarter last year.

ServiceNow (NOW) Q1 CY2024 Highlights:

- Revenue: $2.60 billion vs analyst estimates of $2.59 billion (small beat)

- RPO (remaining performance obligations): $17.8 billion vs. analyst estimates of $17.2 billion (3.5% beat)

- EPS (non-GAAP): $3.41 vs analyst estimates of $3.13 (8.9% beat)

- Subscription Revenue Guidance for Q2 CY2024 is $2.53 billion at the midpoint, below analyst estimates of $2.61 billion

- The company maintained subscription revenue guidance for the full year of $10.57 billion at the midpoint (in line with expectations of $10.58 billion)

- Full year margin guidance maintained

- Gross Margin (GAAP): 80%, up from 79.1% in the same quarter last year

- Free Cash Flow of $1.21 billion, down 10.3% from the previous quarter (beat vs. expectations of $969 million)

- Customers: 1,933 customers paying more than $1m annually

- Market Capitalization: $152.2 billion

Founded by Fred Luddy, who wrote the code for the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR, and customer service.

A simple example would be a new employee on-boarding, which is typically a multi-departmental experience, and involves getting a badge from security, desk from facilities, laptop from IT, dealing with finance, compliance and HR. With ServiceNow, employees are able to do all that through a self-help portal, saving significant amounts of time. The key to the success of the Now platform is allowing the companies to design and build these workflows in a no-code environment, without needing any software developers.

ServiceNow's clients can sell their custom workflow applications to other users in the ServiceNow App Store and as a result, ServiceNow is generally most useful for larger customers, who have many complex workflows that may (for example) require a multitude of approvals as well as being time sensitive. In turn, large customers are more valuable to ServiceNow, as they are likely to need more users and thus generate more revenue and a greater number of custom workflows for sale in the App Store.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Other providers of software for creating digital workflows include BMC, Oracle (NYSE:ORCL), Salesforce (NYSE:CRM), and SAP (NYSE:SAP).

Sales Growth

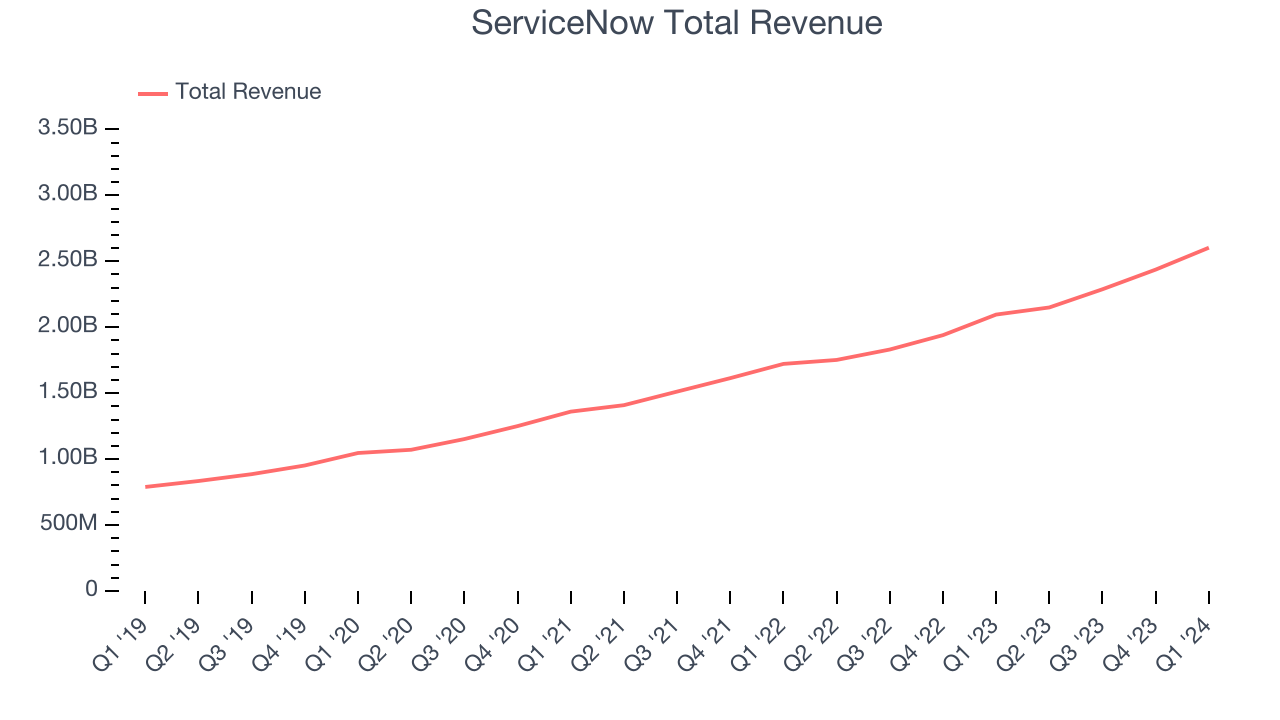

As you can see below, ServiceNow's revenue growth has been strong over the last three years, growing from $1.36 billion in Q1 2021 to $2.60 billion this quarter.

This quarter, ServiceNow's quarterly revenue was once again up a very solid 24.2% year on year. On top of that, its revenue increased $166 million quarter on quarter, a solid improvement from the $149 million increase in Q4 CY2023. Thankfully, that's a slight re-acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 20.5% over the next 12 months before the earnings results announcement.

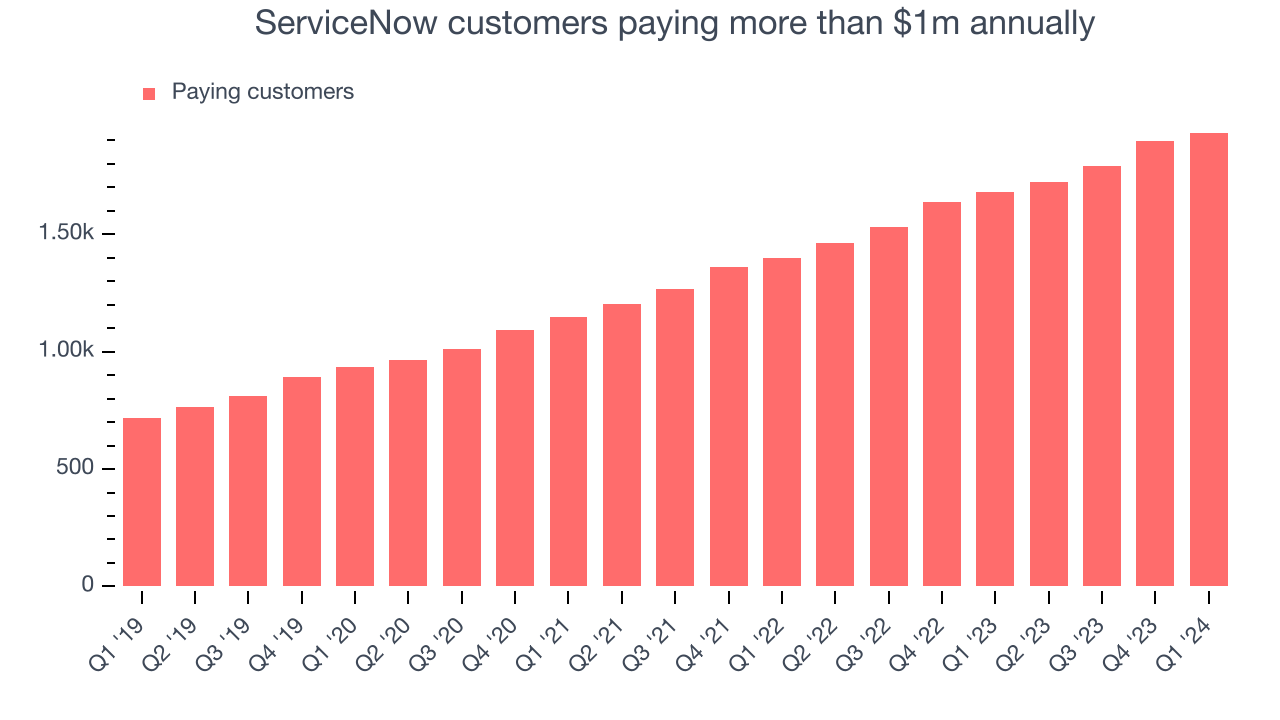

Large Customers Growth

This quarter, ServiceNow reported 1,933 enterprise customers paying more than $1m annually, an increase of 36 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Profitability

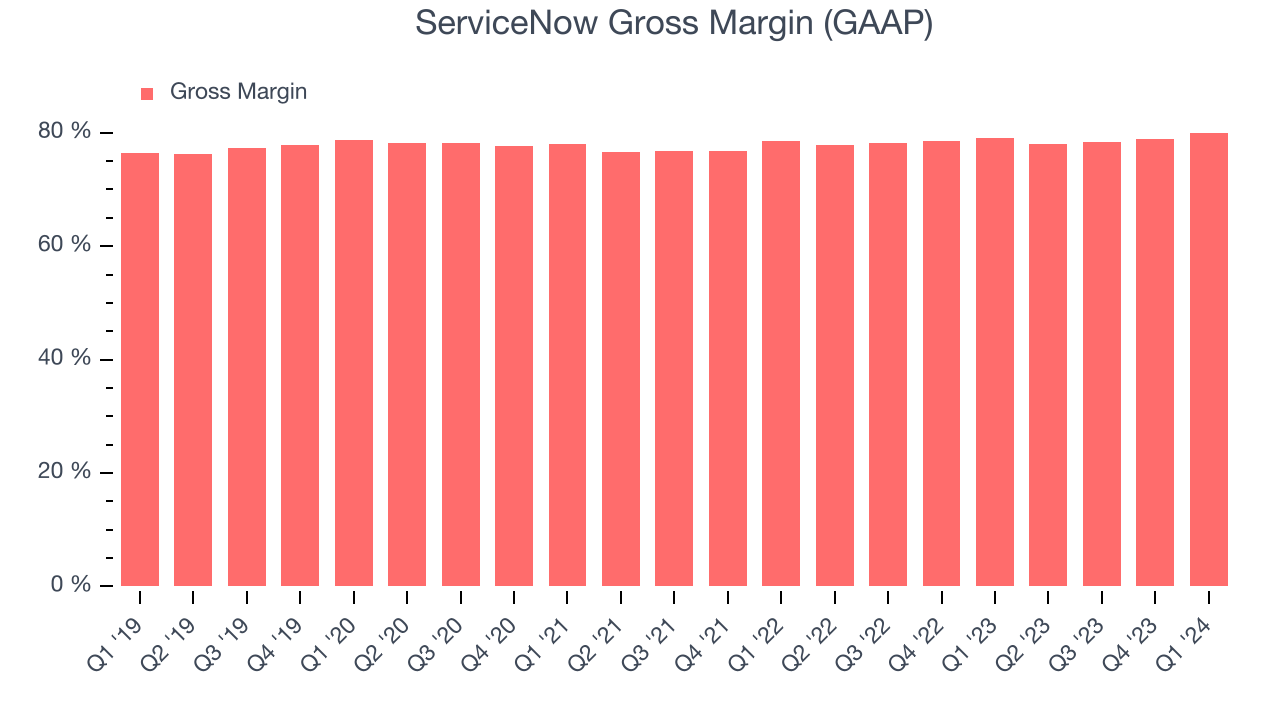

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. ServiceNow's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 80% in Q1.

That means that for every $1 in revenue the company had $0.80 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, ServiceNow's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

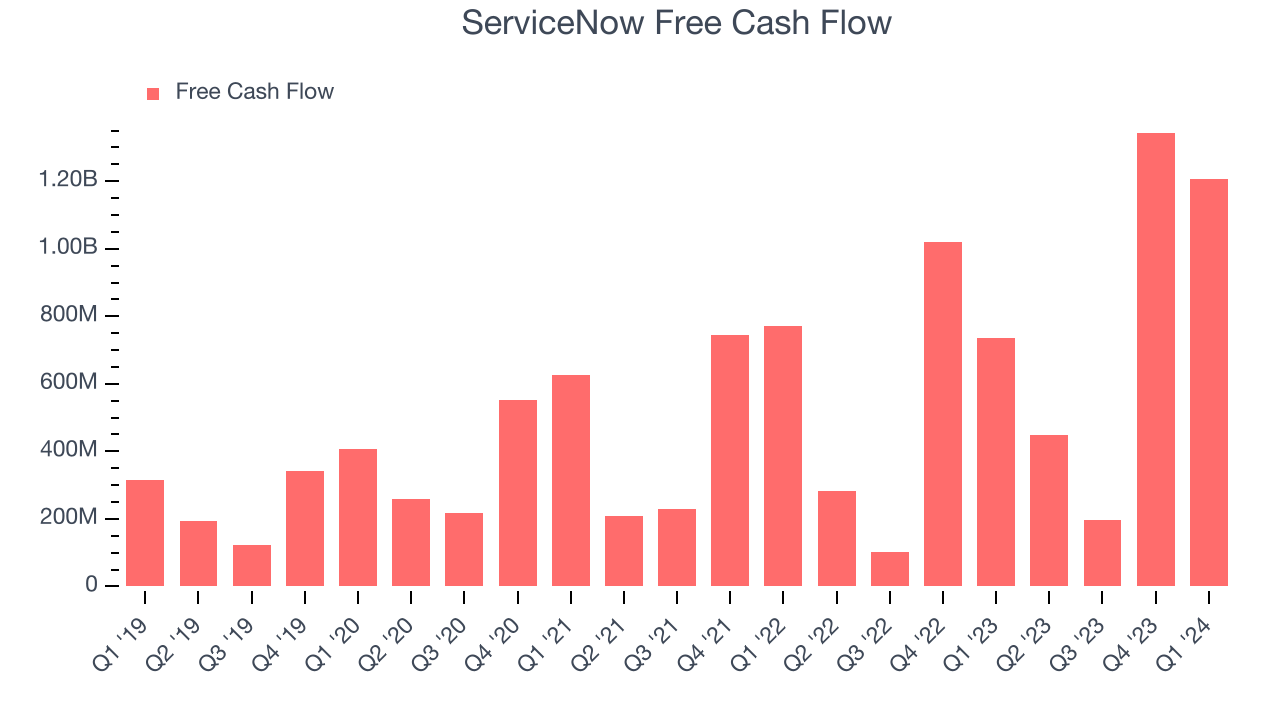

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. ServiceNow's free cash flow came in at $1.21 billion in Q1, up 63.6% year on year.

ServiceNow has generated $3.19 billion in free cash flow over the last 12 months, an eye-popping 33.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

ServiceNow is a well-capitalized company with $5.11 billion of cash and $2.27 billion of debt, meaning it could pay back all its debt tomorrow and still have $2.84 billion of cash on its balance sheet. This net cash position gives ServiceNow the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from ServiceNow's Q1 Results

It was good to see ServiceNow beat on RPO (remaining performance obligations, a leading indicator), revenue, operating profit, and adjusted EPS. On the other hand, its new large contract wins slowed and subscription revenue guidance for the next quarter was below expectations. Overall, the results were mixed, with a solid quarter but unexciting guidance. The company is down 4.8% on the results and currently trades at $711 per share.

Is Now The Time?

When considering an investment in ServiceNow, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think ServiceNow is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been solid over the last three years. Additionally, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its customers are increasing their spending quite quickly, suggesting they love the product.

There's no doubt the market is optimistic about ServiceNow's growth prospects, as its 13.6x price-to-sales ratio based on the next 12 months would suggest. Looking at the tech landscape today, ServiceNow's qualities as one of the best businesses really stand out and there's no doubt it's a bit of a market darling. We don't mind paying a premium for a premium business and would argue that it's often wise to hold on to quality businesses long term, even when expectations are high, but we do want to mention that there seems to be a lot optimism priced in at the moment.

Wall Street analysts covering the company had a one-year price target of $847.87 right before these results (compared to the current share price of $711).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.