Since January 2020, the S&P 500 has delivered a total return of 80.4%. But one standout stock has nearly doubled the market - over the past five years, Enpro has surged 155% to $172.45 per share. Its momentum hasn’t stopped as it’s also gained 21.7% in the last six months, beating the S&P by 14.2%.

Is now the time to buy Enpro, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on Enpro for now. Here are three reasons why there are better opportunities than NPO and a stock we'd rather own.

Why Is Enpro Not Exciting?

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

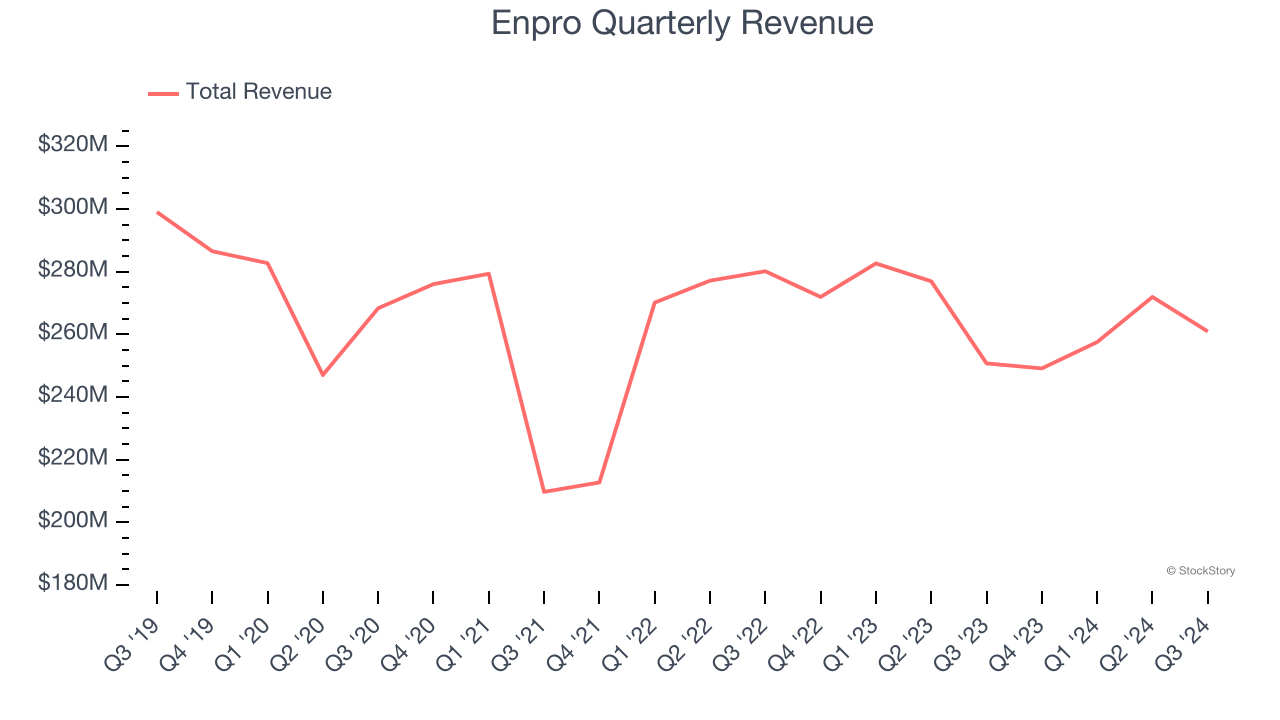

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Enpro’s demand was weak over the last five years as its sales fell at a 3% annual rate. This was below our standards and signals it’s a lower quality business.

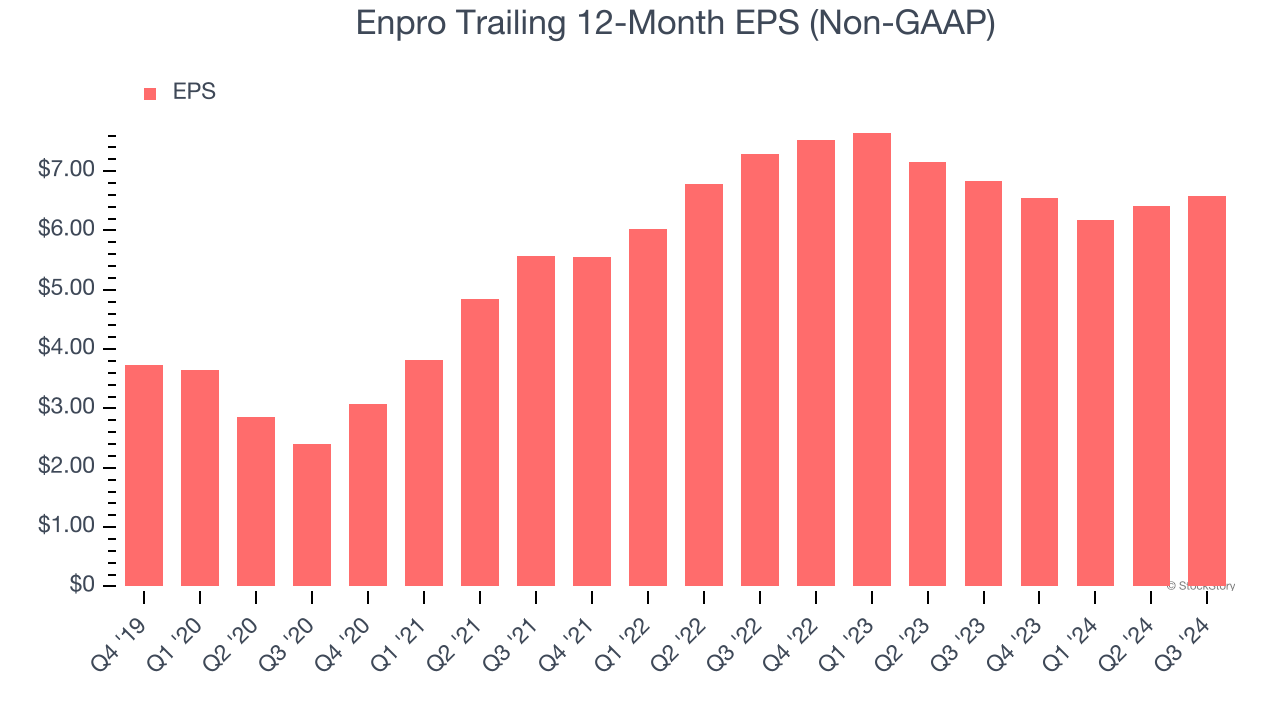

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Enpro, its EPS declined by 5% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Enpro historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Enpro isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 20.6× forward price-to-earnings (or $172.45 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Enpro

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.