Personal care company Nu Skin (NYSE:NUS) missed analysts' expectations in Q1 CY2024, with revenue down 13.3% year on year to $417.3 million. Next quarter's revenue guidance of $437.5 million also underwhelmed, coming in 3.7% below analysts' estimates. It made a non-GAAP profit of $0.09 per share, down from its profit of $0.37 per share in the same quarter last year.

Is now the time to buy Nu Skin? Find out by accessing our full research report, it's free.

Nu Skin (NUS) Q1 CY2024 Highlights:

- Revenue: $417.3 million vs analyst estimates of $432.4 million (3.5% miss)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.05 ($0.04 beat)

- Revenue Guidance for Q2 CY2024 is $437.5 million at the midpoint, below analyst estimates of $454.4 million

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.15 at the midpoint, below analyst estimates of $0.35

- The company reconfirmed its revenue guidance for the full year of $1.8 billion at the midpoint

- Gross Margin (GAAP): 70.5%, down from 72.3% in the same quarter last year

- Market Capitalization: $608.4 million

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE:NUS) is a personal care and dietary supplements company that engages in direct selling.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Nu Skin carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Nu Skin can still achieve high growth rates because its revenue base is not yet monstrous.

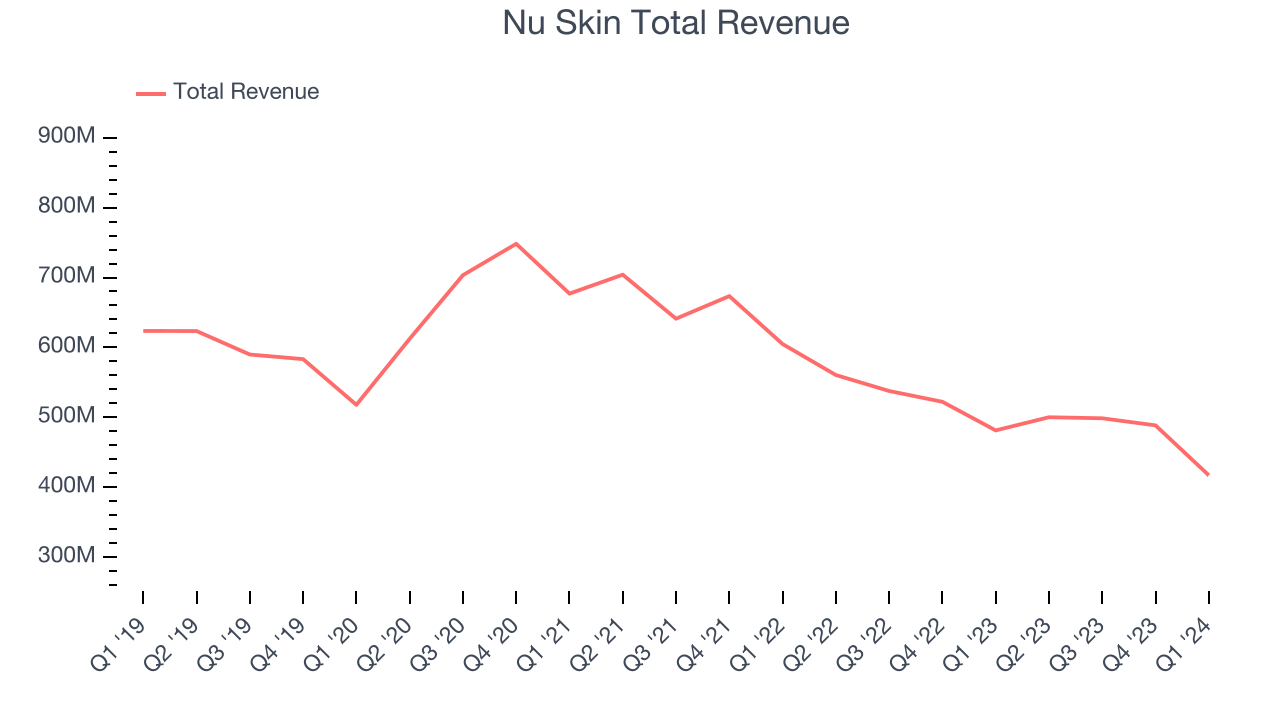

As you can see below, the company's revenue has declined over the last three years, dropping 11.4% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Nu Skin missed Wall Street's estimates and reported a rather uninspiring 13.3% year-on-year revenue decline, generating $417.3 million in revenue. The company is guiding for a 12.5% year-on-year revenue decline next quarter to $437.5 million, a further deceleration from the 10.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 4.1% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

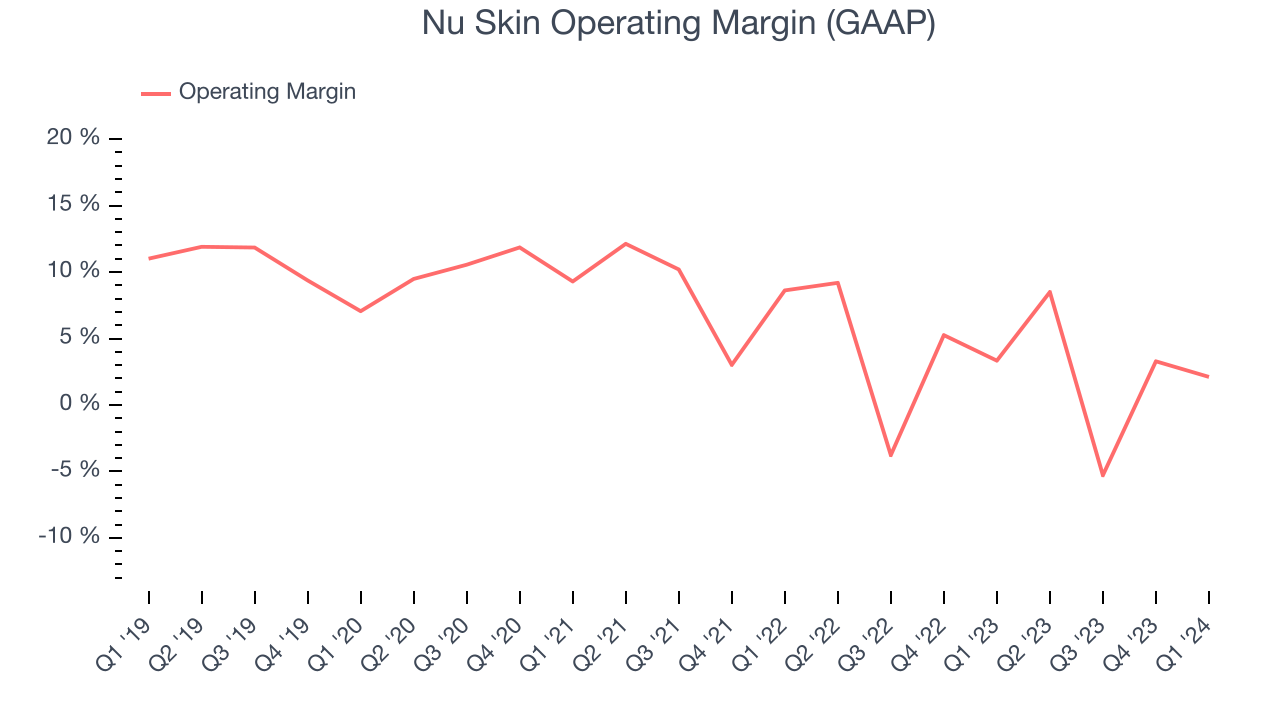

This quarter, Nu Skin generated an operating profit margin of 2.1%, down 1.2 percentage points year on year. Because Nu Skin's gross margin decreased more than its operating margin, we can infer the company had weaker pricing power and higher raw materials/transportation costs.

Zooming out, Nu Skin was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.9%. On top of that, Nu Skin's margin has slightly declined by 1.4 percentage points on average over the last year. This shows Nu Skin has faced some speed bumps along the way.

Zooming out, Nu Skin was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.9%. On top of that, Nu Skin's margin has slightly declined by 1.4 percentage points on average over the last year. This shows Nu Skin has faced some speed bumps along the way.Key Takeaways from Nu Skin's Q1 Results

We were impressed by how significantly Nu Skin blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter missed analysts' expectations. Overall, the results could have been better. The stock is flat after reporting and currently trades at $12.3 per share.

So should you invest in Nu Skin right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.