Newspaper and digital media company The New York Times (NYSE:NYT) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5.9% year on year to $594 million. It made a non-GAAP profit of $0.31 per share, improving from its profit of $0.19 per share in the same quarter last year.

The New York Times (NYT) Q1 CY2024 Highlights:

- Revenue: $594 million vs analyst estimates of $591.8 million (small beat)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.20 ($0.11 beat)

- Lowered full year guidance for subscription revenue growth to 7% year on year at the midpoint (8% previously)

- Gross Margin (GAAP): 46.7%, up from 45.3% in the same quarter last year

- Free Cash Flow of $46.66 million, down 64.2% from the previous quarter

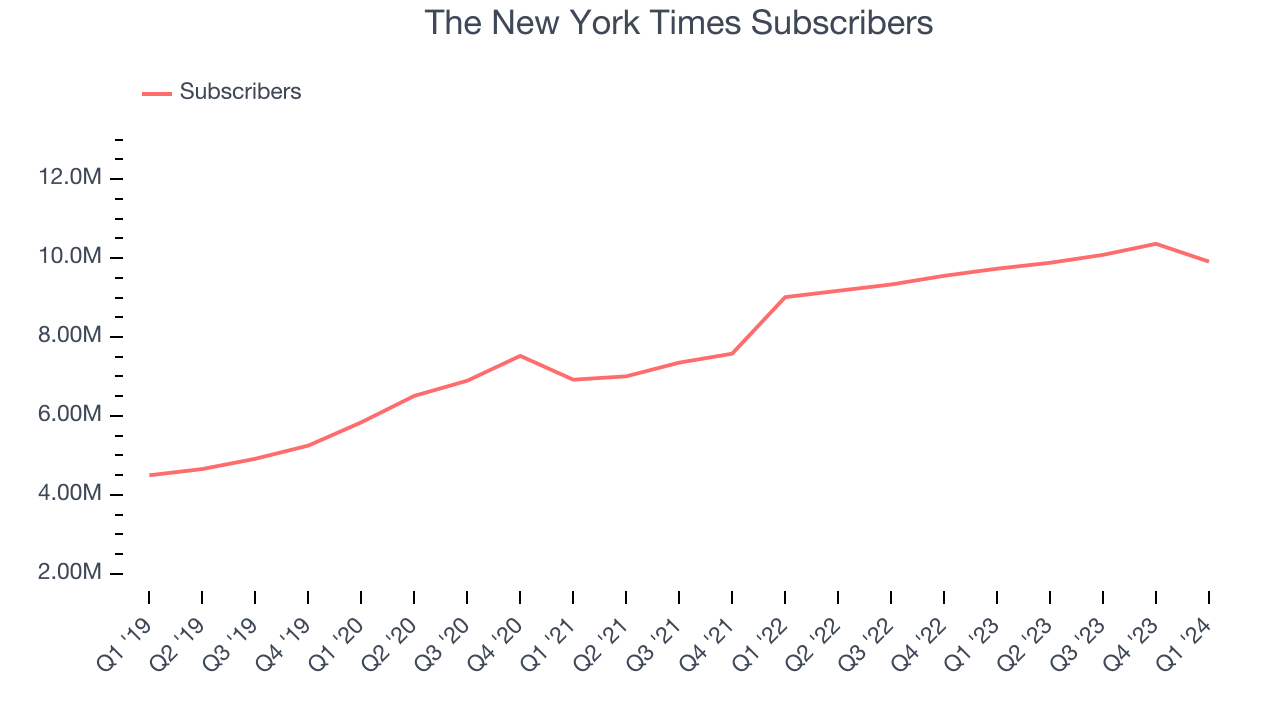

- Subscribers: 9.91 million

- Market Capitalization: $7.61 billion

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

Henry Jarvis Raymond and George Jones established The New York Times to provide factual, unbiased news reporting. This initiative was a response to the prevalent trend of opinionated journalism at the time. Over the years, The New York Times has garnered a reputation for in-depth reporting, earning numerous Pulitzer Prizes and establishing itself as a benchmark in quality news.

The organization offers a comprehensive range of content, including news articles, opinion pieces, features, and investigative journalism, available in both print and digital formats. The company's product portfolio also features Audm, a read-aloud audio service, and The Athletic, a digital-first sports media platform that was acquired in 2022.

The New York Times generates revenue through subscriptions, advertising, and content licensing. It has strategically shifted its focus toward digital subscriptions, adapting to the changing media consumption habits of consumers in the digital age.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the news publishing and digital media sector include Gannett (NYSE:GCI), News (NASDAQ:NWSA), and E.W. Scripps (NASDAQ:SSP).Sales Growth

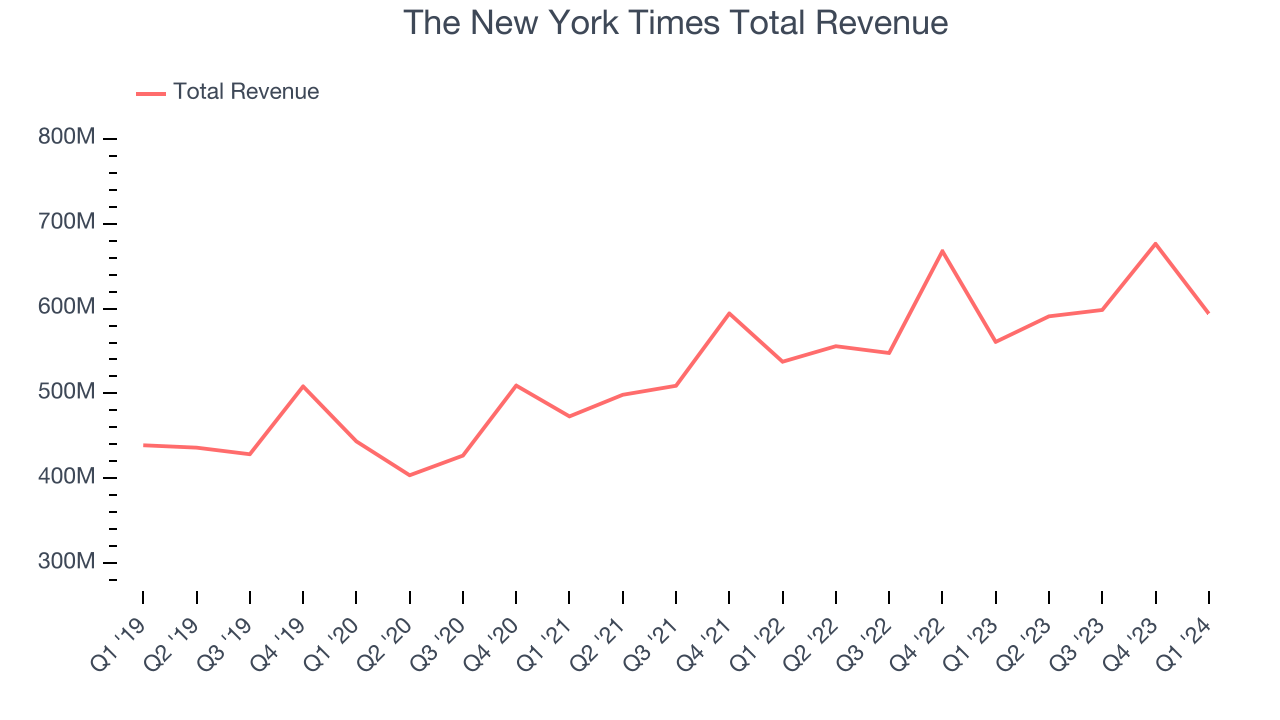

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. The New York Times's annualized revenue growth rate of 6.8% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. The New York Times's annualized revenue growth of 7.2% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. The New York Times's annualized revenue growth of 7.2% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

We can dig even further into the company's revenue dynamics by analyzing its number of subscribers, which reached 9.91 million in the latest quarter. Over the last two years, The New York Times's subscribers averaged 14.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, The New York Times grew its revenue by 5.9% year on year, and its $594 million of revenue was in line with Wall Street's estimates.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

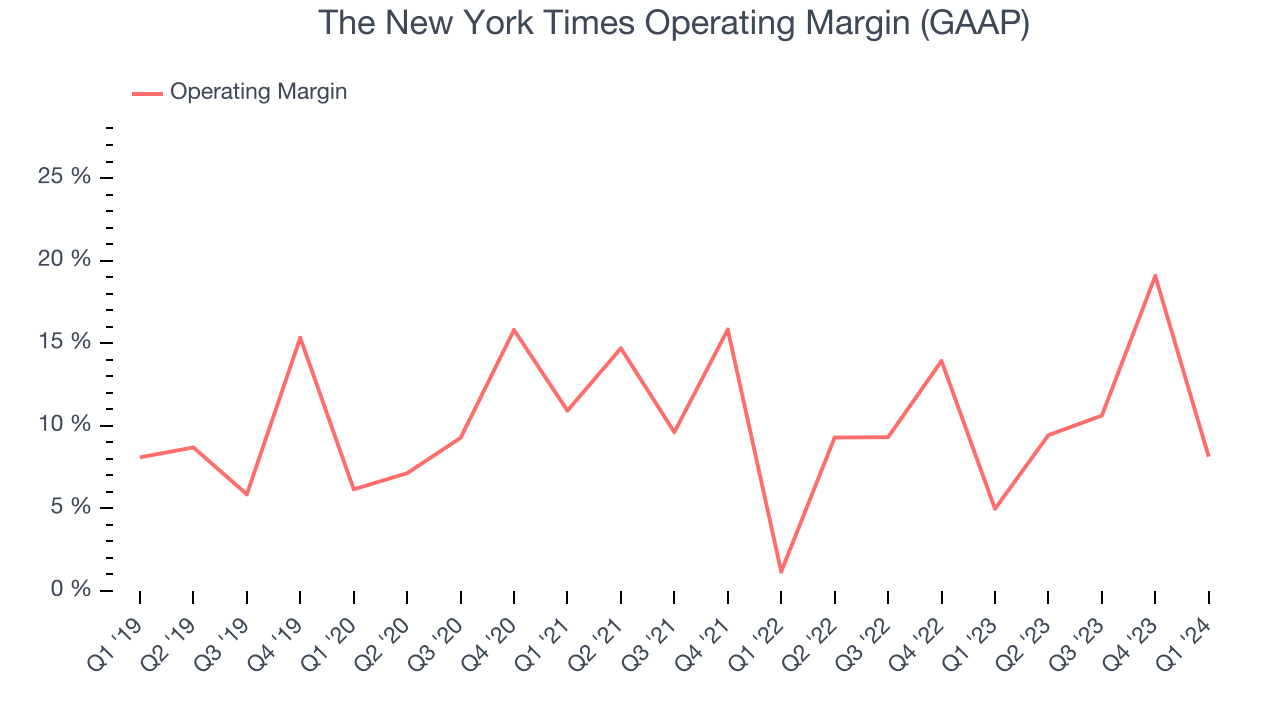

The New York Times has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.9%, higher than the broader consumer discretionary sector.

In Q1, The New York Times generated an operating profit margin of 8.1%, up 3.2 percentage points year on year.

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

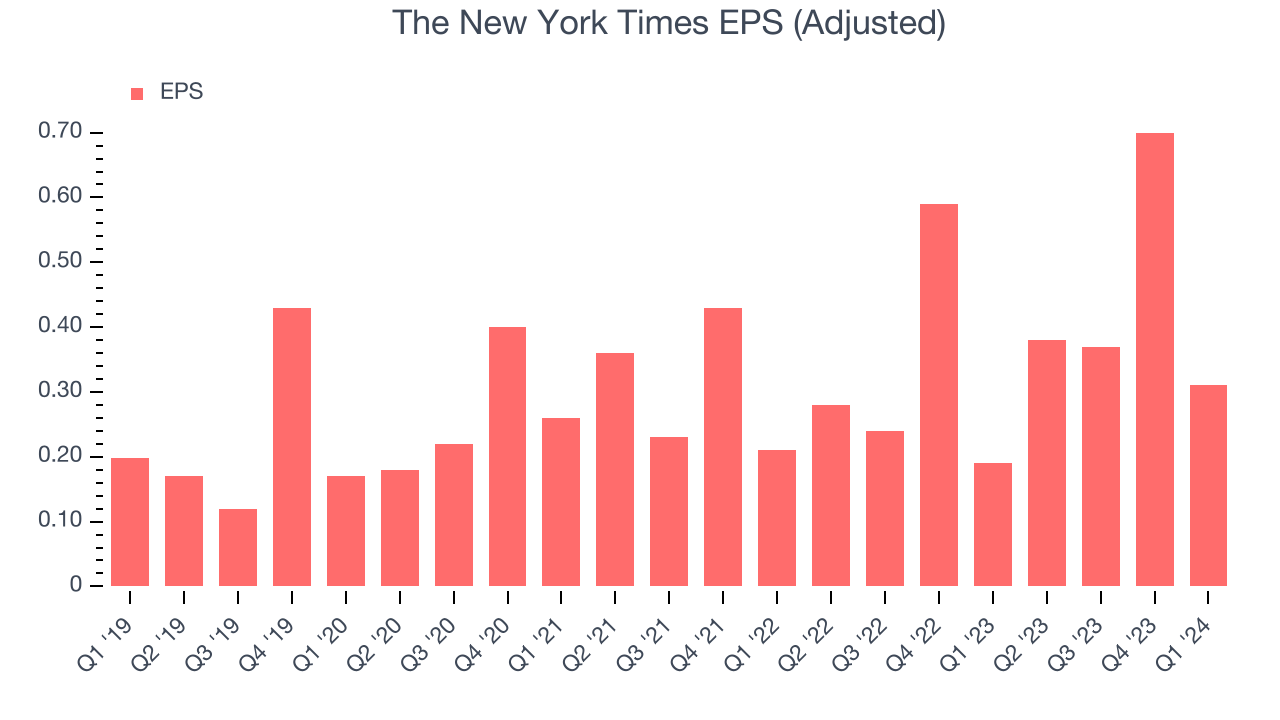

Over the last five years, The New York Times's EPS grew 109%, translating into a solid 15.9% compounded annual growth rate.

In Q1, The New York Times reported EPS at $0.31, up from $0.19 in the same quarter last year. This print beat analysts' estimates by 54.2%. Over the next 12 months, Wall Street expects The New York Times to perform poorly. Analysts are projecting its LTM EPS of $1.76 to shrink by 3% to $1.71.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

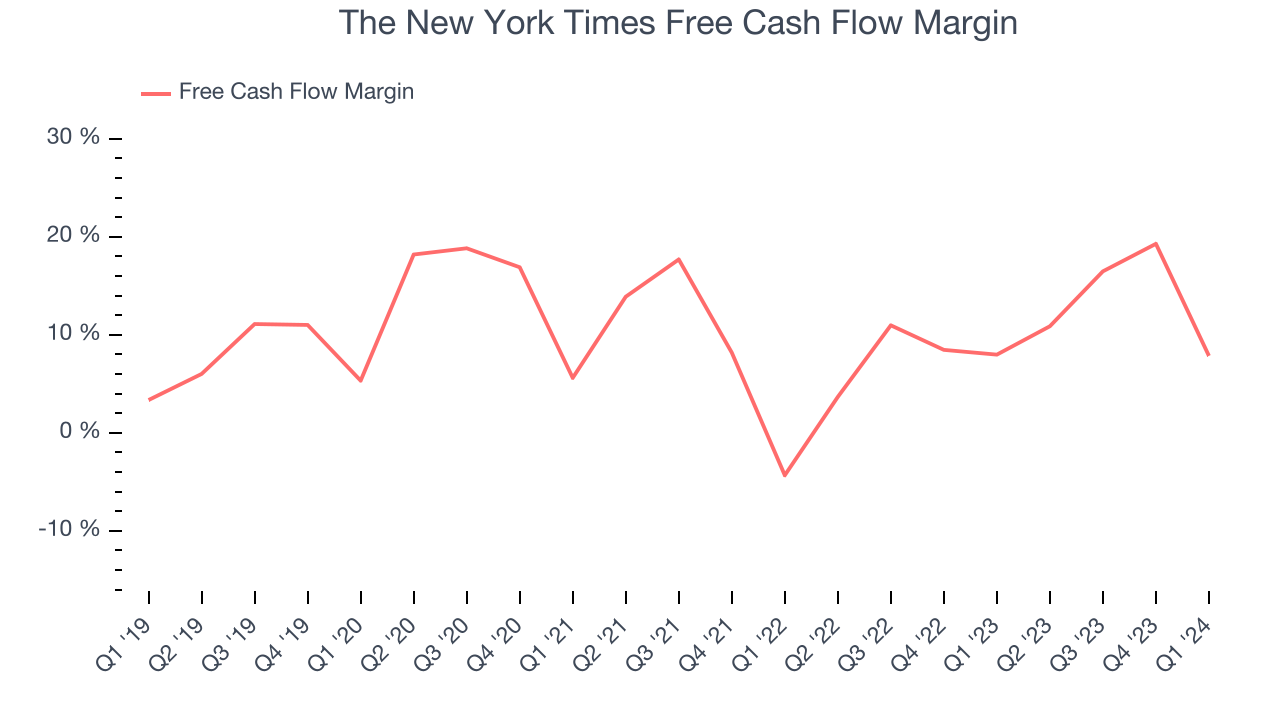

Over the last two years, The New York Times has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 10.9%, slightly better than the broader consumer discretionary sector.

The New York Times's free cash flow came in at $46.66 million in Q1, equivalent to a 7.9% margin and in line with the same quarter last year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

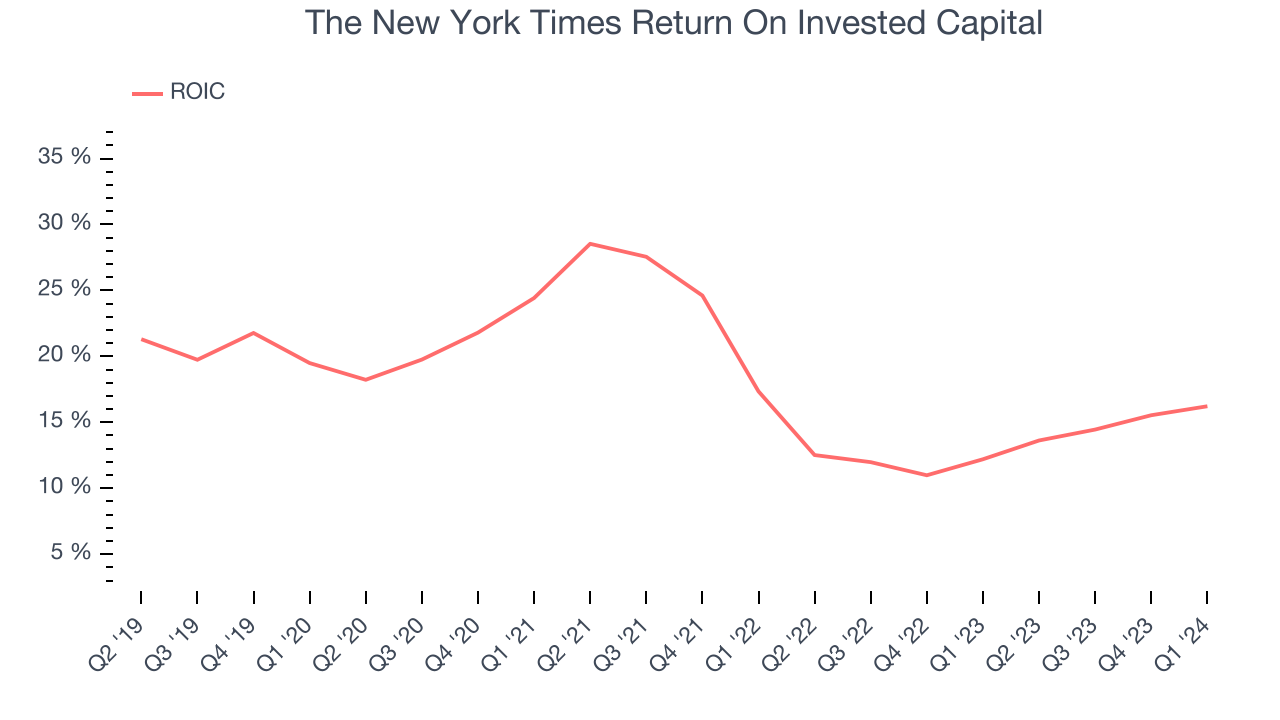

Although The New York Times hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 17.9%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, The New York Times's ROIC averaged 7.7 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

The New York Times is a profitable, well-capitalized company with $686.3 million of cash and $350 million of debt, meaning it could pay back all its debt tomorrow and still have $336.3 million of cash on its balance sheet. This net cash position gives The New York Times the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from The New York Times's Q1 Results

We were impressed by how significantly The New York Times blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. On the other hand, its number of subscribers unfortunately missed. Additionally, the company slightly lowered its full year outlook for subscription revenue growth. Overall, we think this was a mixed quarter. The stock is up 1.5% after reporting and currently trades at $46.95 per share.

Is Now The Time?

The New York Times may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of The New York Times, we'll be cheering from the sidelines. First off, its revenue growth has been uninspiring over the last five years. And while its EPS growth over the last five years has exceeded its peer group average, unfortunately, its projected EPS for the next year is lacking.

The New York Times's price-to-earnings ratio based on the next 12 months is 27.1x. While we've no doubt one can find things to like about The New York Times, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $48 per share right before these results (compared to the current share price of $46.95).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.