Restaurant software company (NYSE:OLO) reported Q4 FY2021 results that beat analyst expectations, with revenue up 30.8% year on year to $39.9 million. Guidance for the full year also exceeded estimates, however the guidance for the next quarter was less impressive, coming in at $41.7 million, 5.15% below analyst estimates. Olo made a GAAP loss of $2.07 million, improving on its loss of $2.95 million, in the same quarter last year.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it's free.

Olo (OLO) Q4 FY2021 Highlights:

- Revenue: $39.9 million vs analyst estimates of $39 million (2.2% beat)

- EPS (non-GAAP): $0.02 vs analyst expectations of $0.02 (small miss)

- Revenue guidance for Q1 2022 is $41.7 million at the midpoint, below analyst estimates of $44 million

- Management's revenue guidance for upcoming financial year 2022 is $195 million at the midpoint, beating analyst estimates by 2.05% and predicting 30.5% growth (vs 59.8% in FY2021)

- Free cash flow was negative $10.6 million, down from positive free cash flow of $10.2 million in previous quarter

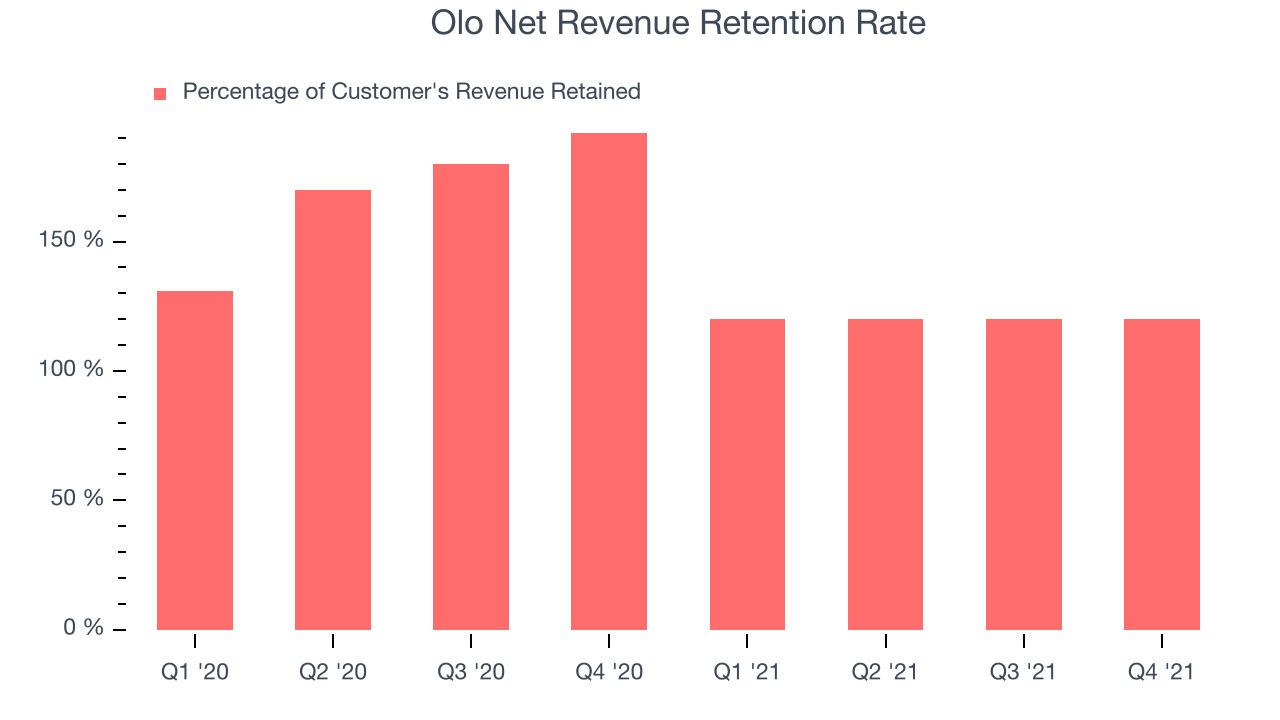

- Net Revenue Retention Rate: 120%, in line with previous quarter

- Gross Margin (GAAP): 78.8%, down from 82.6% same quarter last year

“2021 was a great year for Olo. We grew annual revenues by more than 50%, expanded ARPU by 16% to more than $2,000 per year, surpassed more than $20 billion in Gross Merchandise Value for the year, successfully completed our IPO, and closed our first strategic acquisition. We ended the year with our platform connecting approximately 79,000 active restaurant locations across more than 500 restaurant brands to more than 200 technology partners and more than 85 million consumers who have ordered over the platform this past year.” said Noah Glass, Olo’s Founder and CEO.

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management.

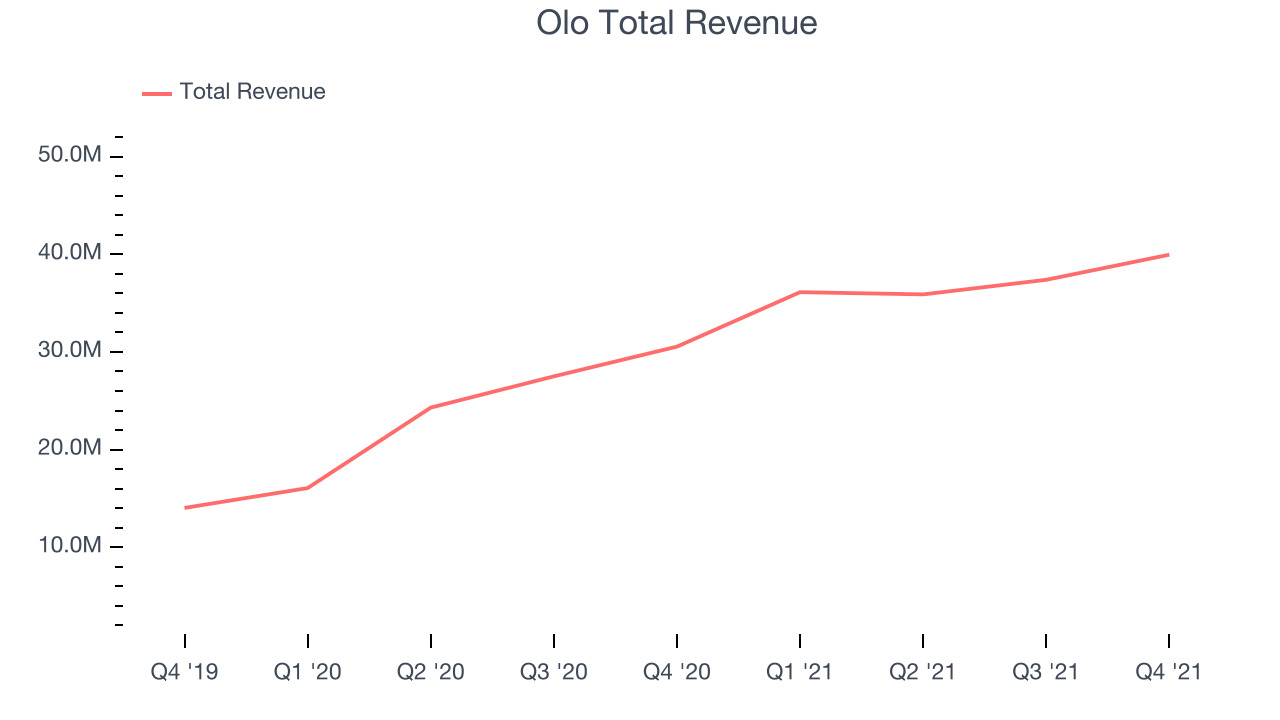

Sales Growth

As you can see below, Olo's revenue growth has been exceptional over the last year, growing from quarterly revenue of $30.5 million, to $39.9 million.

And unsurprisingly, this was another great quarter for Olo with revenue up 30.8% year on year. On top of that, revenue increased $2.56 million quarter on quarter, a very strong improvement on the $1.49 million increase in Q3 2021, and a sign of re-acceleration of growth.

Guidance for the next quarter indicates Olo is expecting revenue to grow 15.5% year on year to $41.7 million, slowing down from the 124% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $195 million at the midpoint, growing 30.5% compared to 59.8% increase in FY2021.

There are others doing even better than Olo. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

Olo's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 120% in Q4. That means even if they didn't win any new customers, Olo would have grown its revenue 20% year on year. Despite it going down over the last year this is still a good retention rate and a proof that Olo's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Olo's Q4 Results

With a market capitalization of $2.27 billion Olo is among smaller companies, but its more than $514.4 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

It was good to see Olo deliver strong revenue growth this quarter. And we were also glad that the revenue guidance for the rest of the year exceeded expectations. On the other hand, the revenue guidance for next year indicates a significant slowdown and the revenue guidance for the next quarter missed analysts' expectations. Overall, this quarter's results were mixed, not the best we've seen from Olo. The company is down 0.66% on the results and currently trades at $13.5 per share.

Olo may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.