Restaurant software company (NYSE:OLO) reported results ahead of analyst expectations in the Q3 FY2022 quarter, with revenue up 26.4% year on year to $47.2 million. The company expects that next quarter's revenue would be around $48.4 million, which is the midpoint of the guidance range. That was in roughly line with analyst expectations. Olo made a GAAP loss of $14.5 million, down on its loss of $11.3 million, in the same quarter last year.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it's free.

Olo (OLO) Q3 FY2022 Highlights:

- Revenue: $47.2 million vs analyst estimates of $46.6 million (1.32% beat)

- EPS (non-GAAP): $0.02 vs analyst estimates of $0.01 (46.3% beat)

- Revenue guidance for Q4 2022 is $48.4 million at the midpoint, above analyst estimates of $48.1 million

- Free cash flow of $1.35 million, up from negative free cash flow of $2.97 million in previous quarter

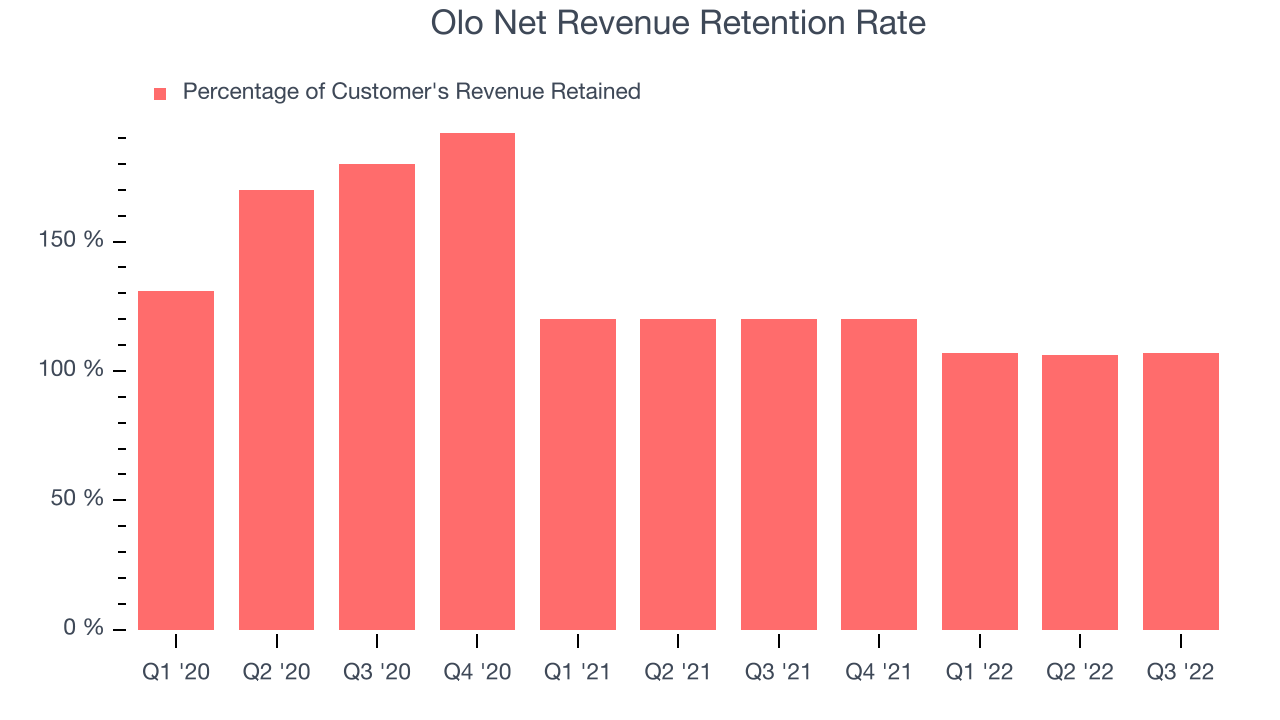

- Net Revenue Retention Rate: 107%, in line with previous quarter

- Gross Margin (GAAP): 67.7%, down from 78.1% same quarter last year

“We’re proud of our third quarter results. We generated $47.3 million in total revenue, a 26% increase year over year, as our platform supported increased module adoption within our existing customer base, increased transaction volume, and continued growth in new locations,” said Noah Glass, Olo’s Founder and CEO.

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management.

Sales Growth

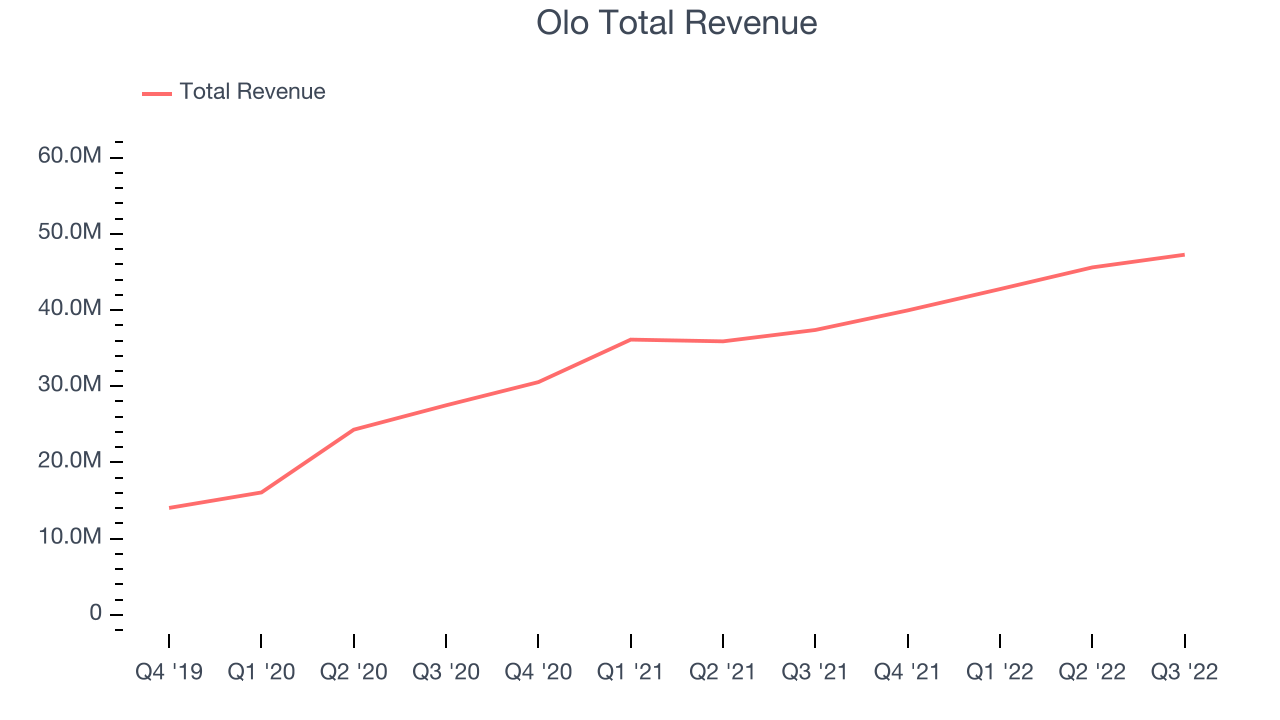

As you can see below, Olo's revenue growth has been impressive over the last two years, growing from quarterly revenue of $27.5 million in Q3 FY2020, to $47.2 million.

This quarter, Olo's quarterly revenue was once again up a very solid 26.4% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $1.66 million in Q3, compared to $2.84 million in Q2 2022. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates Olo is expecting revenue to grow 21.2% year on year to $48.4 million, slowing down from the 30.8% year-over-year increase in revenue the company had recorded in the same quarter last year. Ahead of the earnings results the analysts covering the company were estimating sales to grow 15.6% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

Olo's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 107% in Q3. That means even if they didn't win any new customers, Olo would have grown its revenue 7% year on year. Despite it going down over the last year this is still a decent retention rate and it shows us that not only Olo's customers stick around but at least some of them get increasing value from its software over time.

Key Takeaways from Olo's Q3 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Olo’s balance sheet, but we note that with a market capitalization of $1.31 billion and more than $468.3 million in cash, the company has the capacity to continue to prioritise growth over profitability.

Olo delivered solid revenue growth this quarter. And we were also happy to see it topped analysts’ revenue expectations, even if just narrowly. On the other hand, there was a deterioration in gross margin. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on target. The company is flat on the results and currently trades at $7.46 per share.

Should you invest in Olo right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.