The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the vertical software stocks have fared in Q4, starting with Olo (NYSE:OLO).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 12 vertical software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 4.86%, while on average next quarter revenue guidance was 2.18% above consensus. Tech stocks have had a rocky start in 2022, but vertical software stocks held their ground better than others, with share price down 9.71% since earnings, on average.

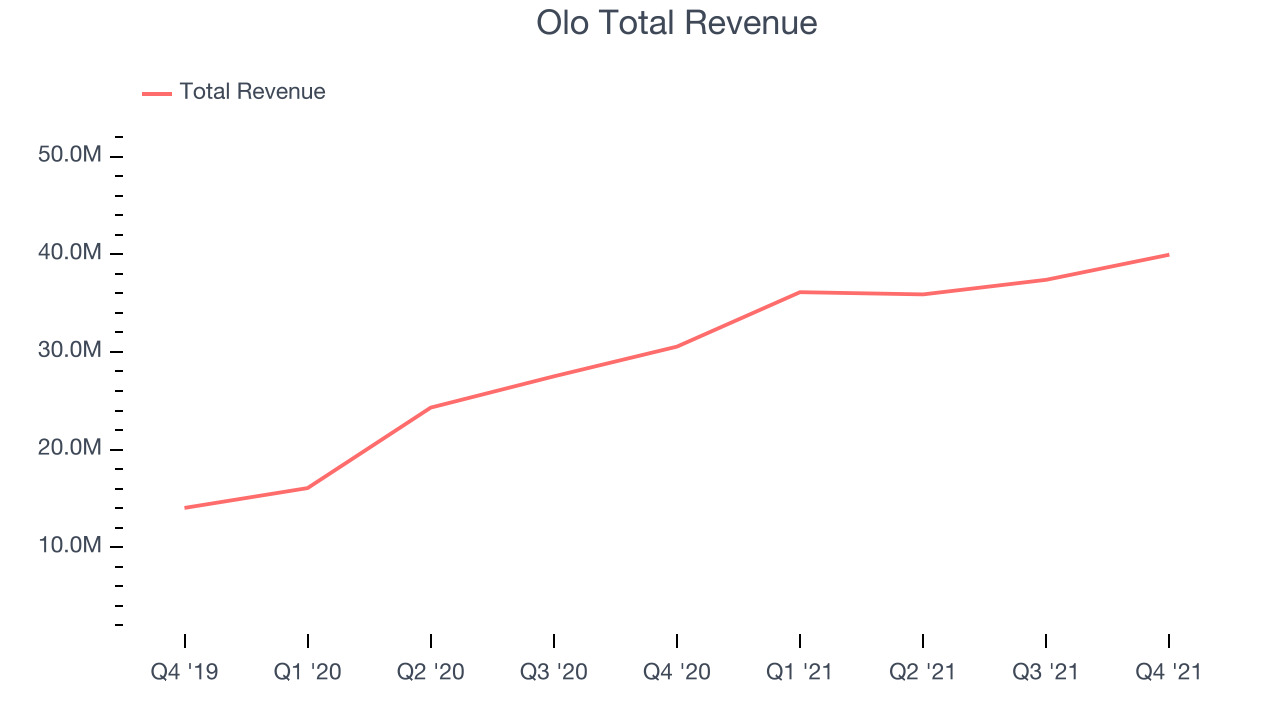

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $39.9 million, up 30.8% year on year, beating analyst expectations by 2.2%. It was a slower quarter for the company, with a decline in gross margin compared to the previous year and underwhelming revenue guidance for the next quarter.

“2021 was a great year for Olo. We grew annual revenues by more than 50%, expanded ARPU by 16% to more than $2,000 per year, surpassed more than $20 billion in Gross Merchandise Value for the year, successfully completed our IPO, and closed our first strategic acquisition. We ended the year with our platform connecting approximately 79,000 active restaurant locations across more than 500 restaurant brands to more than 200 technology partners and more than 85 million consumers who have ordered over the platform this past year.” said Noah Glass, Olo’s Founder and CEO.

The stock is up 2.64% since the results and currently trades at $13.95.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it's free.

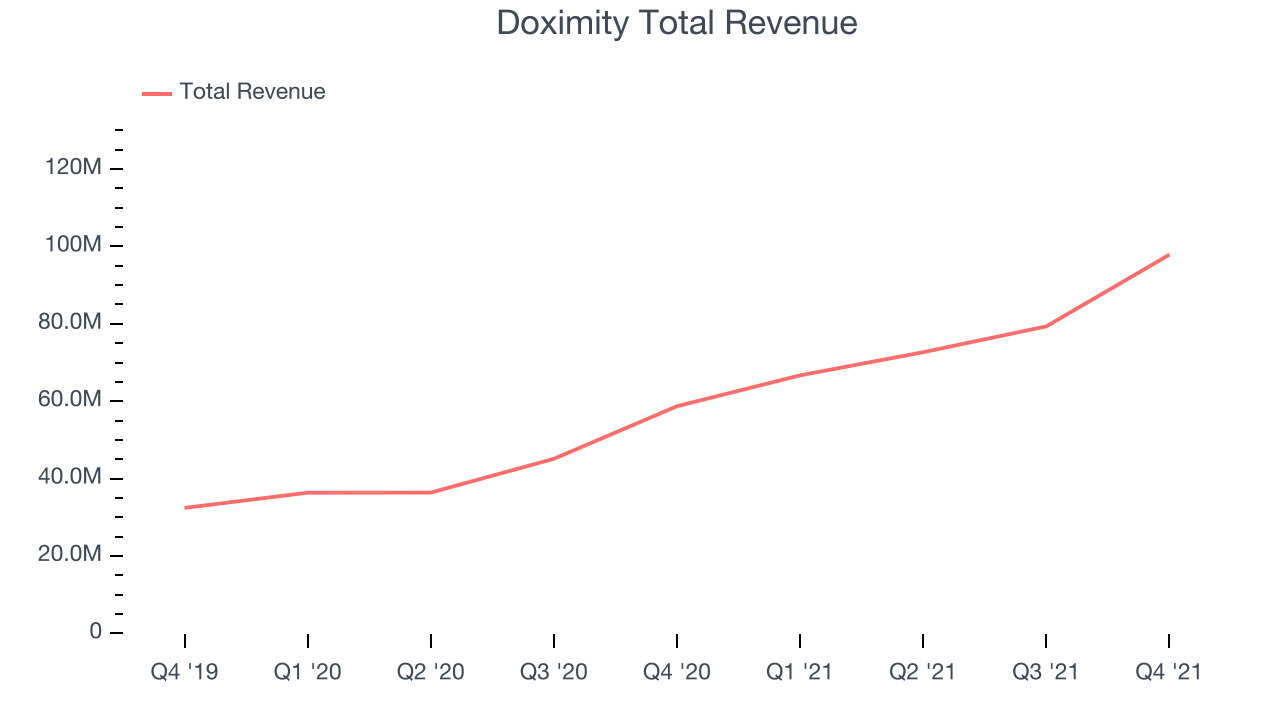

Best Q4: Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading professional network for U.S. medical professionals.

Doximity reported revenues of $97.8 million, up 66.7% year on year, beating analyst expectations by 13.4%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

The stock is up 10% since the results and currently trades at $54.82.

Is now the time to buy Doximity? Access our full analysis of the earnings results here, it's free.

Weakest Q4: 2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $243.6 million, up 13.1% year on year, in line with analyst expectations. It was a weak quarter for the company, with a full year guidance missing analysts'.

2U had the weakest full year guidance update in the group. The stock is down 27.5% since the results and currently trades at $13.01.

Read our full analysis of 2U's results here.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $4.26 billion, up 9.14% year on year, in line with analyst expectations. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

Adobe had the slowest revenue growth among the peers. The stock is down 2.95% since the results and currently trades at $453.01.

Read our full, actionable report on Adobe here, it's free.

Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $304.8 million, up 247% year on year, beating analyst expectations by 15.9%. It was a very strong quarter for the company, with an impressive beat of analyst estimates.

Upstart achieved the strongest analyst estimates beat and fastest revenue growth among the peers. The stock is down 6.49% since the results and currently trades at $101.91.

Read our full, actionable report on Upstart here, it's free.

The author has no position in any of the stocks mentioned