Restaurant software company (NYSE:OLO) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 26.6% year on year to $63 million. On top of that, next quarter's revenue guidance ($64.25 million at the midpoint) was surprisingly good and 5.9% above what analysts were expecting. It made a non-GAAP profit of $0.05 per share, improving from its profit of $0.03 per share in the same quarter last year.

Olo (OLO) Q4 FY2023 Highlights:

- Revenue: $63 million vs analyst estimates of $58.86 million (7% beat)

- EPS (non-GAAP): $0.05 vs analyst expectations of $0.05 (small miss)

- Revenue Guidance for Q1 2024 is $64.25 million at the midpoint, above analyst estimates of $60.68 million

- Management's revenue guidance for the upcoming financial year 2024 is $270.5 million at the midpoint, beating analyst estimates by 4.6% and implying 18.5% growth (vs 23% in FY2023)

- Free Cash Flow of $2.73 million is up from -$24.39 million in the previous quarter

- Net Revenue Retention Rate: 120%, in line with the previous quarter

- Gross Margin (GAAP): 57.8%, down from 69.3% in the same quarter last year

- Market Capitalization: $963.7 million

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

The Covid pandemic has made online ordering a necessity for restaurants and food retailers. But fully outsourcing online ordering to the popular food delivery apps drastically reduces a restaurant's margins, and building and maintaining your own online ordering system that can reliably handle peak loads is complicated and expensive.

Olo provides restaurant chains with software that can power their apps and websites, and makes it easy for them to offer online ordering directly to their customers. The platform provides the backend infrastructure and restaurants can still design their apps to look the way they want. Through the online dashboard managers can update menus, availability and pricing, and Olo integrates with delivery services, whether in-house or outsourced, so it can automate the whole food ordering process, from the purchase to delivery.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Olo competes with digital ordering platforms like Tillster, Onosys, and NovaDine; restaurant-focused POS platforms including NCR Corporation and Xenial; food-delivery companies such as Grubhub (NASDAQ:GRUB), DoorDash (NYSE:DASH), and UberEats.

Sales Growth

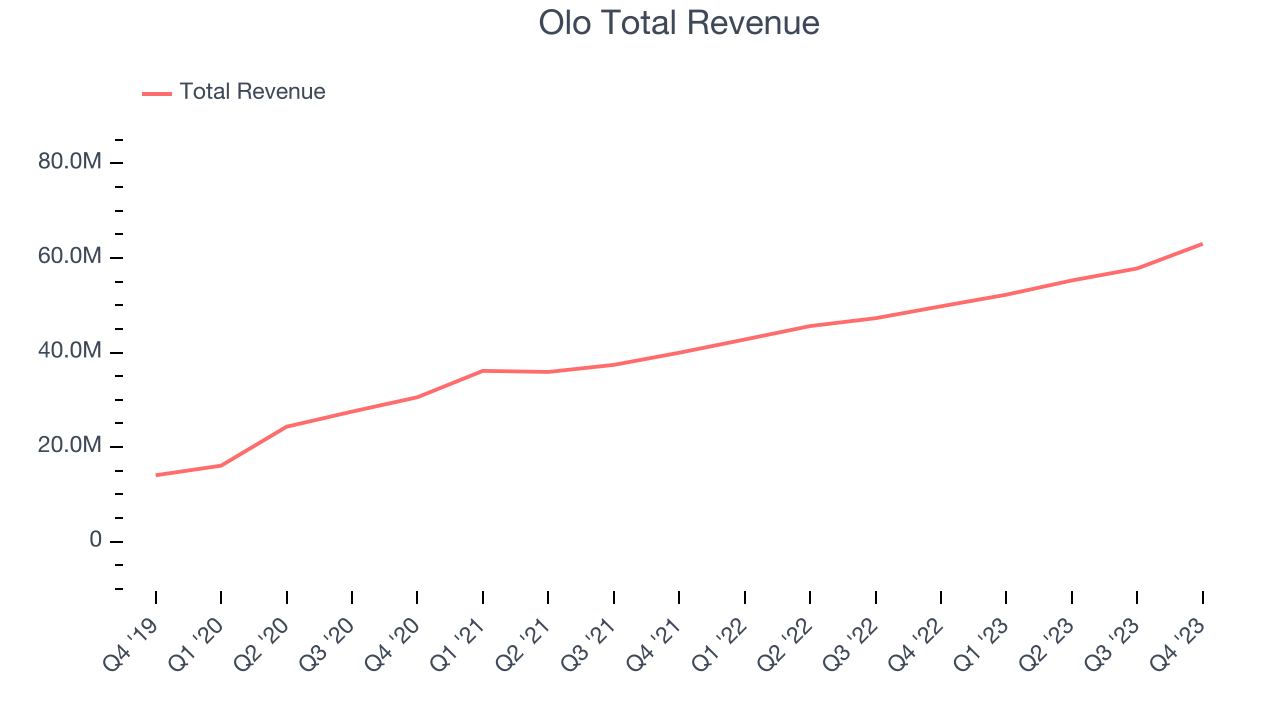

As you can see below, Olo's revenue growth has been strong over the last two years, growing from $39.96 million in Q4 FY2021 to $63 million this quarter.

This quarter, Olo's quarterly revenue was once again up a very solid 26.6% year on year. On top of that, its revenue increased $5.21 million quarter on quarter, a very strong improvement from the $2.54 million increase in Q3 2023. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that Olo is expecting revenue to grow 23% year on year to $64.25 million, in line with the 22.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $270.5 million at the midpoint, growing 18.5% year on year compared to the 23.1% increase in FY2023.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

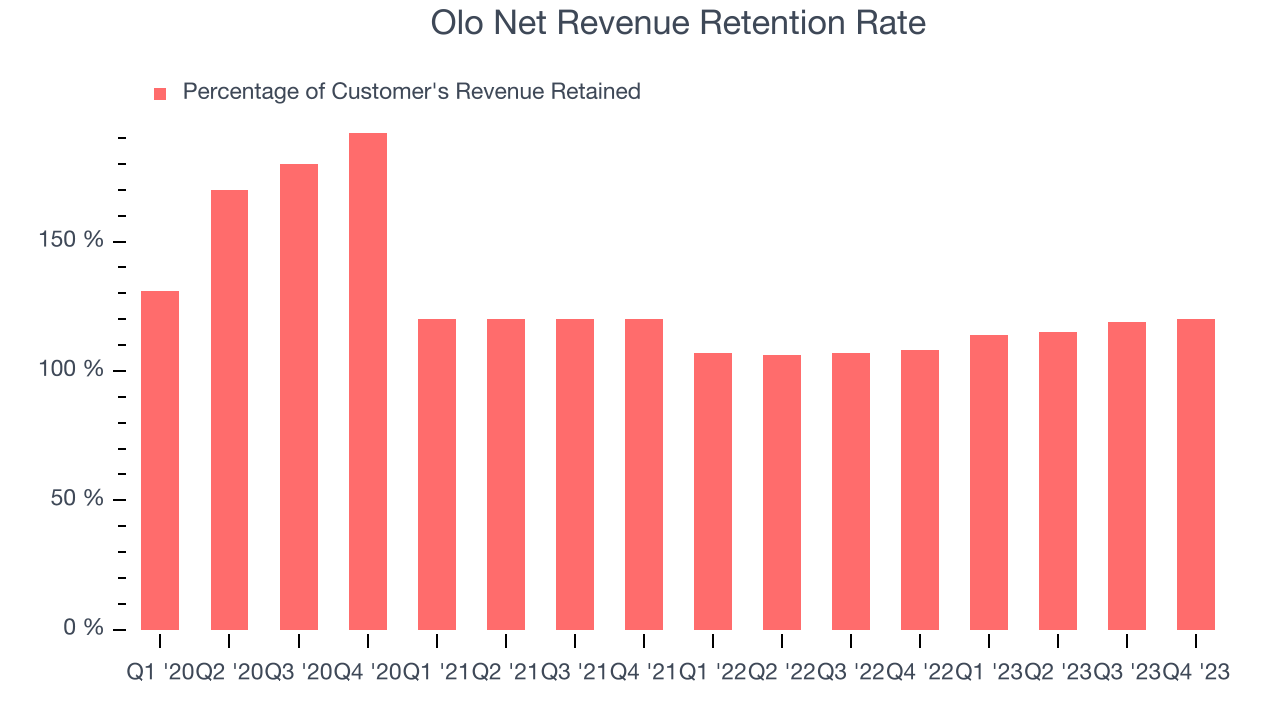

Olo's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 120% in Q4. This means that even if Olo didn't win any new customers over the last 12 months, it would've grown its revenue by 20%.

Trending up over the last year, Olo has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Profitability

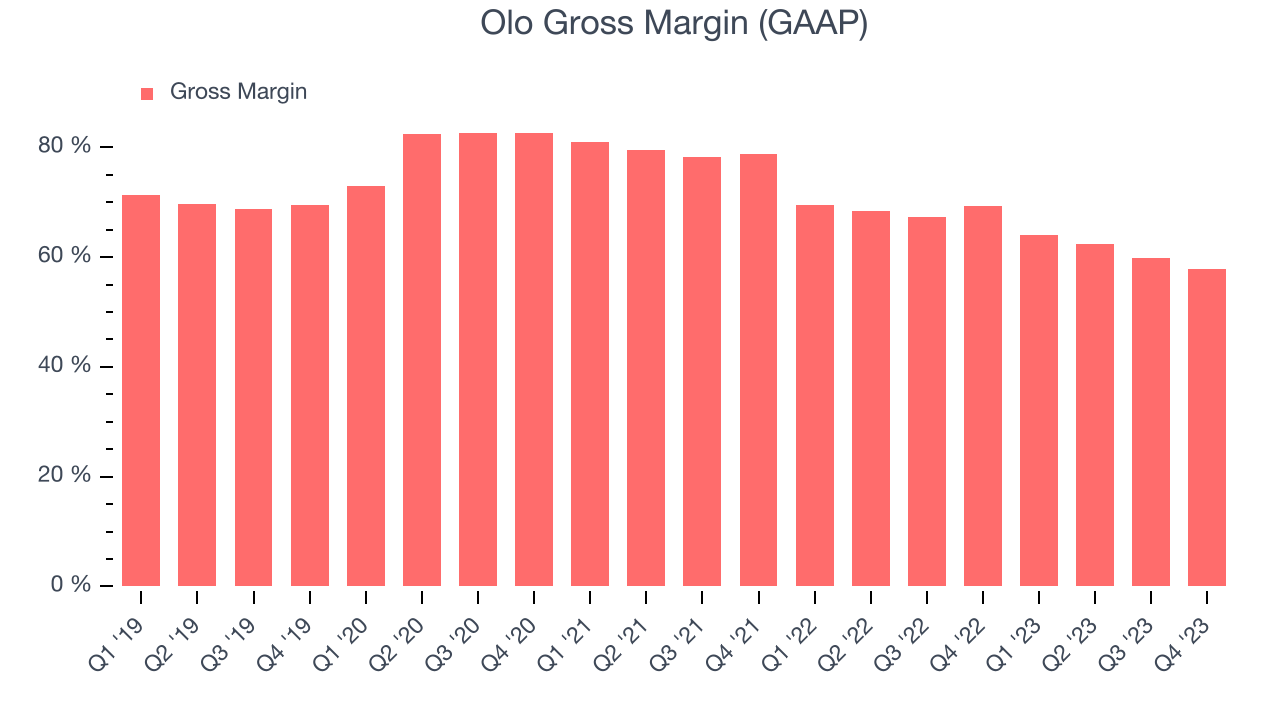

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Olo's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 57.8% in Q4.

That means that for every $1 in revenue the company had $0.58 left to spend on developing new products, sales and marketing, and general administrative overhead. Olo's gross margin is poor for a SaaS business and it's deteriorated even further over the last year. This is probably the opposite direction that shareholders would like to see it go.

Cash Is King

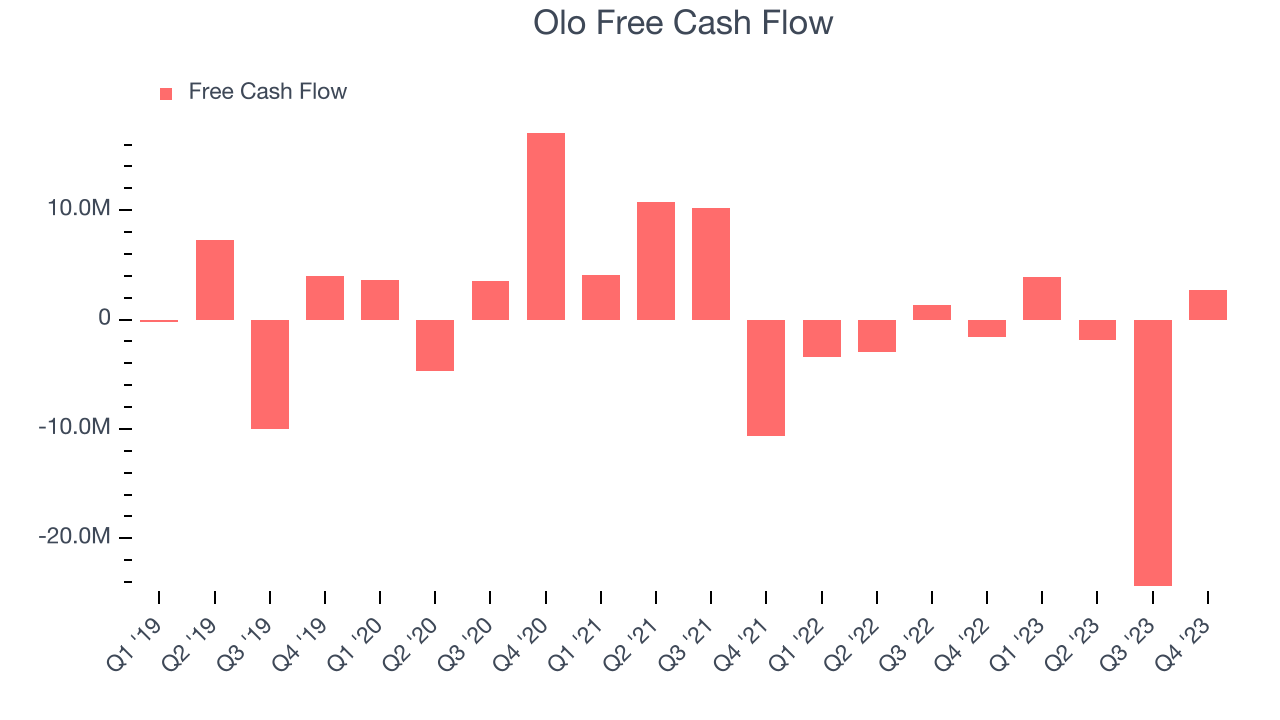

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Olo's free cash flow came in at $2.73 million in Q4, turning positive over the last year.

Olo has burned through $19.67 million of cash over the last 12 months, resulting in a negative 8.6% free cash flow margin. This low FCF margin stems from Olo's constant need to reinvest in its business to stay competitive.

Key Takeaways from Olo's Q4 Results

We were impressed by Olo's revenue guidance and rosy outlook, which blew past analysts' expectations. Revenue retention stayed solid and free cash flow turned positive. On the other hand, its gross margin declined. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 8.8% after reporting and currently trades at $6.29 per share.

Is Now The Time?

Olo may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for everyone who's making the lives of others easier through technology, but in case of Olo, we'll be cheering from the sidelines. Although its , Wall Street expects growth to deteriorate from here. And while its very efficient customer acquisition hints at the potential for strong profitability, the downside is its gross margins show its business model is much less lucrative than the best software businesses. On top of that, its growth is coming at a cost of significant cash burn.

Olo's price-to-sales ratio based on the next 12 months is 3.7x, suggesting that the market does have lower expectations of the business, relative to the high growth tech stocks. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $7.60 per share right before these results (compared to the current share price of $6.29).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.