Virtual events software company (NYSE:ONTF) announced better-than-expected results in Q2 CY2024, with revenue down 11.3% year on year to $37.35 million. The company expects next quarter's revenue to be around $35.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.03 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy ON24? Find out by accessing our full research report, it's free.

ON24 (ONTF) Q2 CY2024 Highlights:

- Revenue: $37.35 million vs analyst estimates of $36.2 million (3.2% beat)

- Adjusted Operating Income: -$344,000 vs analyst estimates of -$1.18 million (70.8% beat)

- EPS (non-GAAP): $0.03 vs analyst estimates of $0.01 ($0.02 beat)

- Revenue Guidance for Q3 CY2024 is $35.5 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly lifted its revenue guidance for the full year from $145 million to $146.4 million at the midpoint

- Gross Margin (GAAP): 74.5%, up from 73.3% in the same quarter last year

- Free Cash Flow of $898,000, down 18.4% from the previous quarter

- Billings: $30.24 million at quarter end, down 14.5% year on year

- Market Capitalization: $244.1 million

“I am pleased with our Q2 results, as we exceeded guidance on the top and bottom line and delivered positive free cash flow. I am encouraged by another quarter of improvement in gross retention, which is trending much better than the average rates we have seen for each of the past three years,” said Sharat Sharan, co-founder and CEO of ON24.

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

Virtual Events Software

Online marketing and sales are expanding at a rapid pace. Compared to the offline advertising market, which has been affected by the Covid pandemic and is challenging to measure and improve, more organizations are expected to adopt data-driven digital engagement platforms to better engage their customers online.

Sales Growth

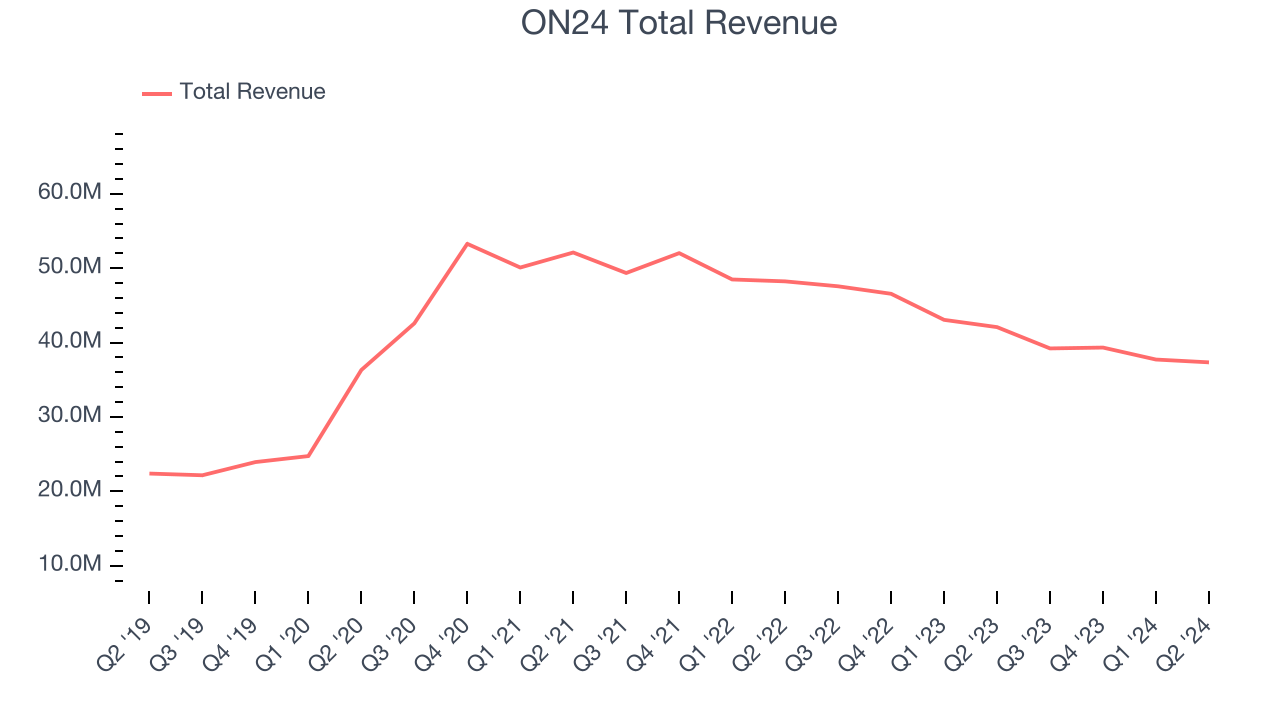

As you can see below, ON24's revenue has declined over the last three years, shrinking from $52.12 million in Q2 2021 to $37.35 million this quarter.

ON24's revenue was down again this quarter, falling 11.3% year on year.

Next quarter, ON24 is guiding for a 9.5% year-on-year revenue decline to $35.5 million, an improvement on the 17.6% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street was expecting revenue to decline 6.8% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

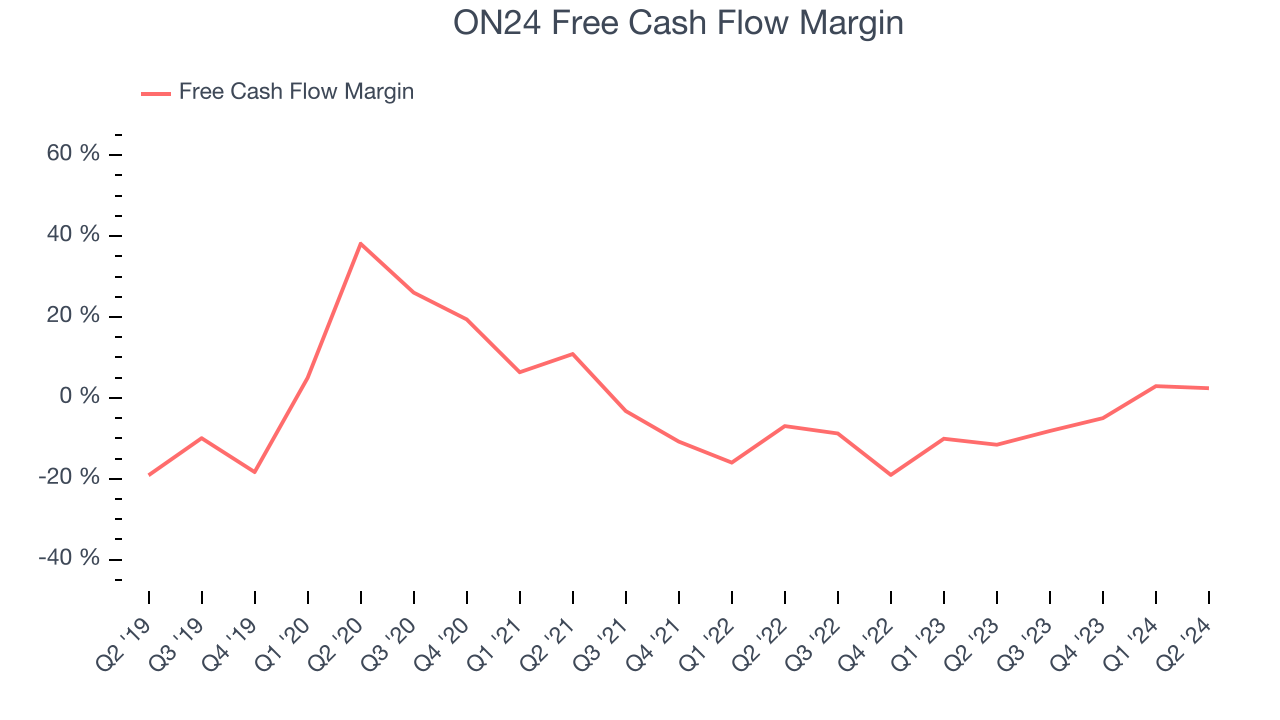

While ON24 posted positive free cash flow this quarter, the broader story hasn't been so clean. ON24's demanding reinvestments have consumed many resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2.1%, weak for a software business.

ON24's free cash flow clocked in at $898,000 in Q2, equivalent to a 2.4% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, but we wouldn't read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict ON24's cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 2.1% for the last 12 months will increase by 2.9 percentage points.

Key Takeaways from ON24's Q2 Results

It was good to see ON24 beat analysts' revenue, EPS, and adjusted operating income expectations this quarter. We were also glad it raised its full-year revenue guidance, which came in higher than Wall Street's estimates. Overall, this was a solid quarter for ON24. The stock traded up 3.6% to $6.04 immediately following the results.

So should you invest in ON24 right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.