As sales and marketing software stocks’ Q3 earnings season wraps, let's dig into this quarter's best and worst performers, including ON24 (NYSE:ONTF) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.53%, while on average next quarter revenue guidance was 2.56% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but sales and marketing software stocks held their ground better than others, with the share prices up 8.66% since the previous earnings results, on average.

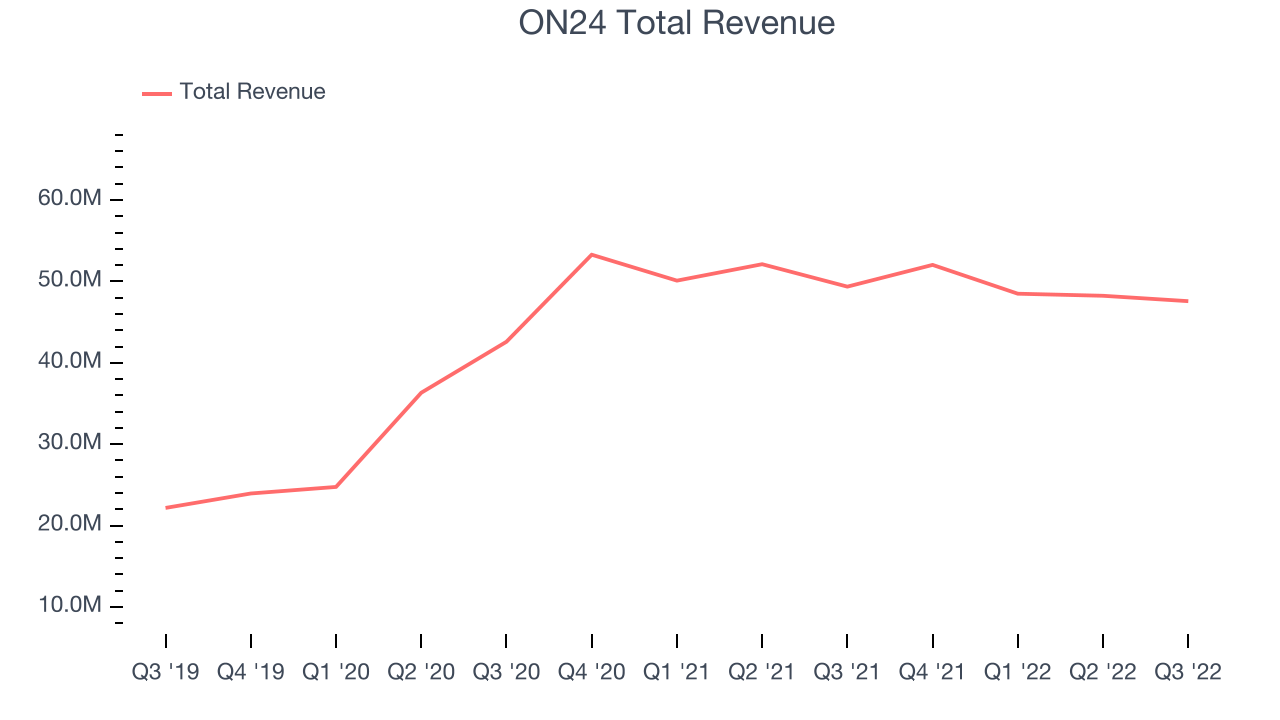

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $47.5 million, down 3.62% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining revenue and underwhelming guidance for the next quarter.

“In the third quarter, we saw exciting expansions with some of our customers, meaningfully improved our cost structure, and deepened our leadership bench with the appointment of two new go-to-market executives,” said Sharat Sharan, co-founder and CEO of ON24.

ON24 delivered the slowest revenue growth of the whole group. The stock is up 26.4% since the results and currently trades at $8.79.

Read our full report on ON24 here, it's free.

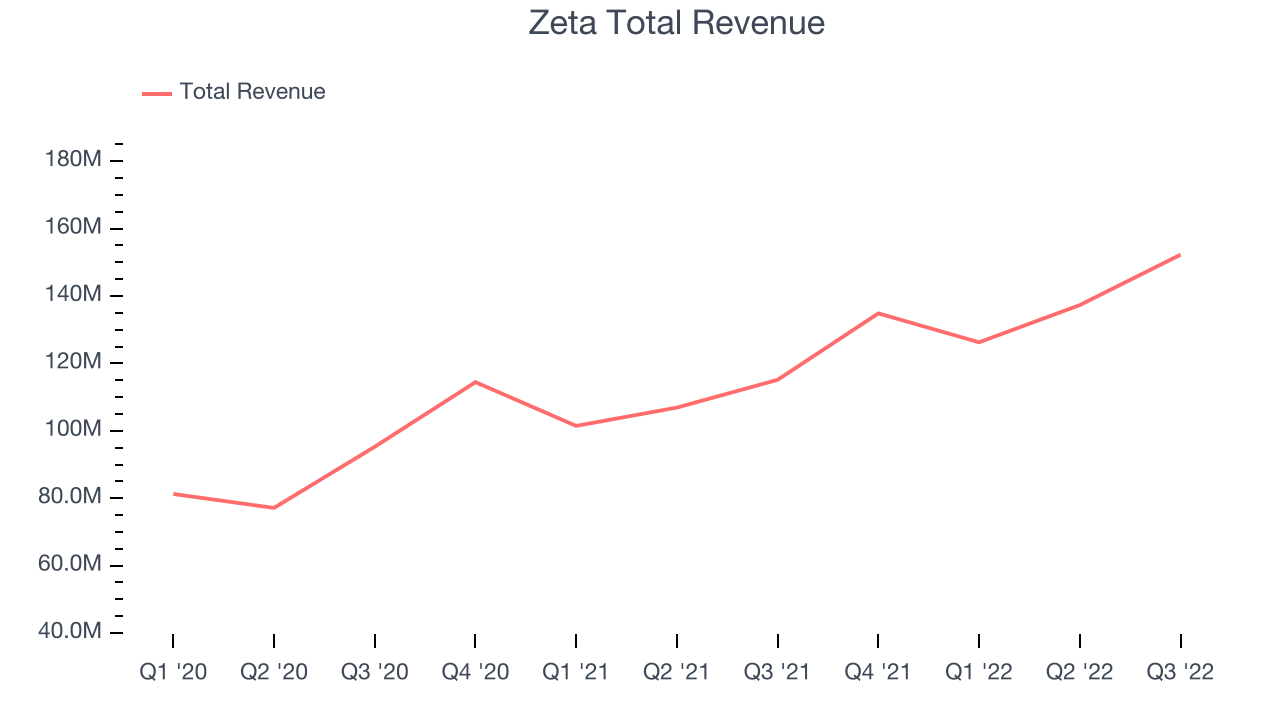

Best Q3: Zeta (NYSE:ZETA)

Co-Founded by former Apple CEO, John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $152.2 million, up 32.2% year on year, beating analyst expectations by 7.94%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and solid top line growth.

Zeta pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is up 3.09% since the results and currently trades at $8.65.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it's free.

AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

AppLovin reported revenues of $713 million, down 1.9% year on year, missing analyst expectations by 2.07%. It was a weak quarter for the company, with a decline in gross margin and full year guidance missing analysts' expectations.

The stock is down 20.8% since the results and currently trades at $10.87.

Read our full analysis of AppLovin's results here.

Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $99.2 million, flat year on year, missing analyst expectations by 0.34%. It was a weak quarter for the company, with slower customer growth and underwhelming revenue guidance for the next quarter.

The company added 30 customers to a total of 2,900. The stock is up 21.6% since the results and currently trades at $6.46.

Read our full, actionable report on Yext here, it's free.

WalkMe (NASDAQ:WKME)

Founded in Israel in 2011, WalkMe (NASDAQ:WKME) is software that teaches users how to get the most out of new applications.

WalkMe reported revenues of $63.3 million, up 25.2% year on year, in line with analyst expectations. It was a weaker quarter for the company, with revenue guidance for the next quarter and full year below analysts' estimates.

The stock is up 21.1% since the results and currently trades at $9.35.

Read our full, actionable report on WalkMe here, it's free.

The author has no position in any of the stocks mentioned