Wrapping up Q4 earnings, we look at the numbers and key takeaways for the sales and marketing software stocks, including ON24 (NYSE:ONTF) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.76%, while on average next quarter revenue guidance was 1.09% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows, but sales and marketing software stocks held their ground better than others, with the share prices up 4.51% since the previous earnings results, on average.

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

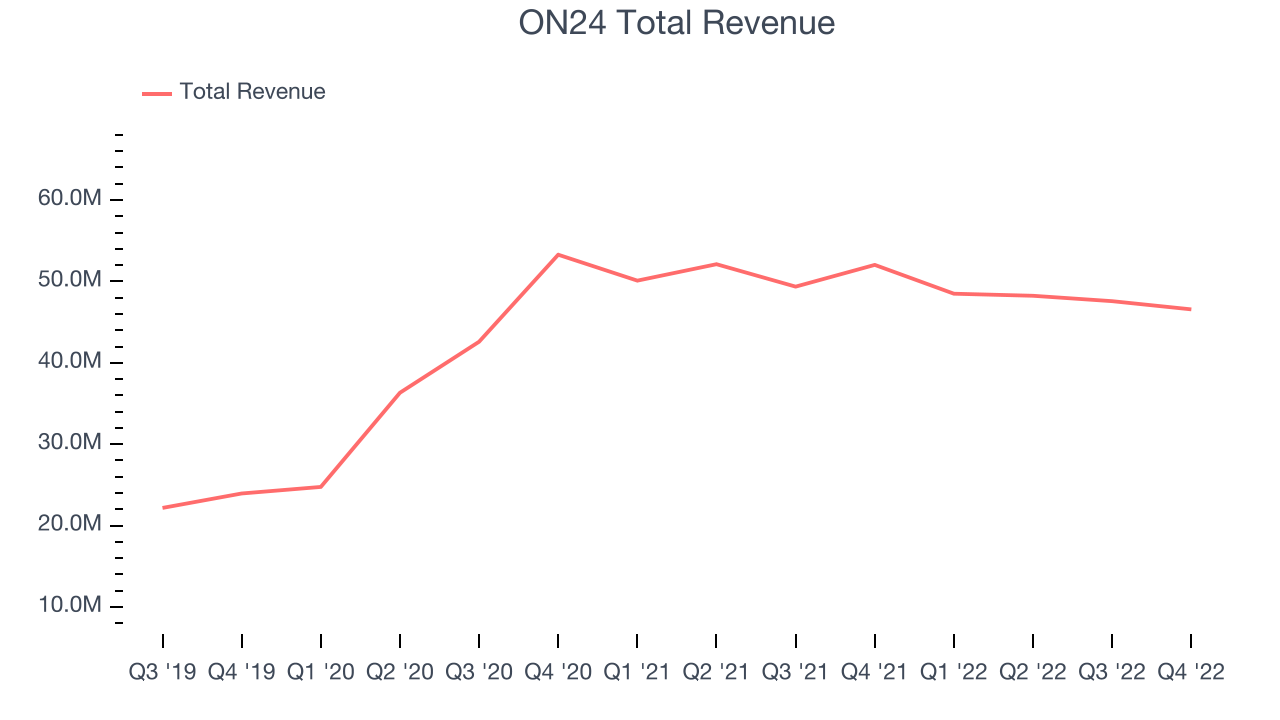

ON24 reported revenues of $46.6 million, down 10.5% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining revenue and full year guidance missing analysts' expectations.

“In Q4 we were pleased to deliver improvement in our Core Platform’s in-period gross dollar retention metrics and ARR growth in the life sciences and professional services verticals, however, we were impacted in the technology and manufacturing verticals given the current macroeconomic environment, which had a larger impact on our ARR results,” said Sharat Sharan, co-founder and CEO of ON24.

ON24 delivered the weakest full year guidance update of the whole group. The stock is down 9.95% since the results and currently trades at $8.69.

Read our full report on ON24 here, it's free.

Best Q4: Shopify (NYSE:SHOP)

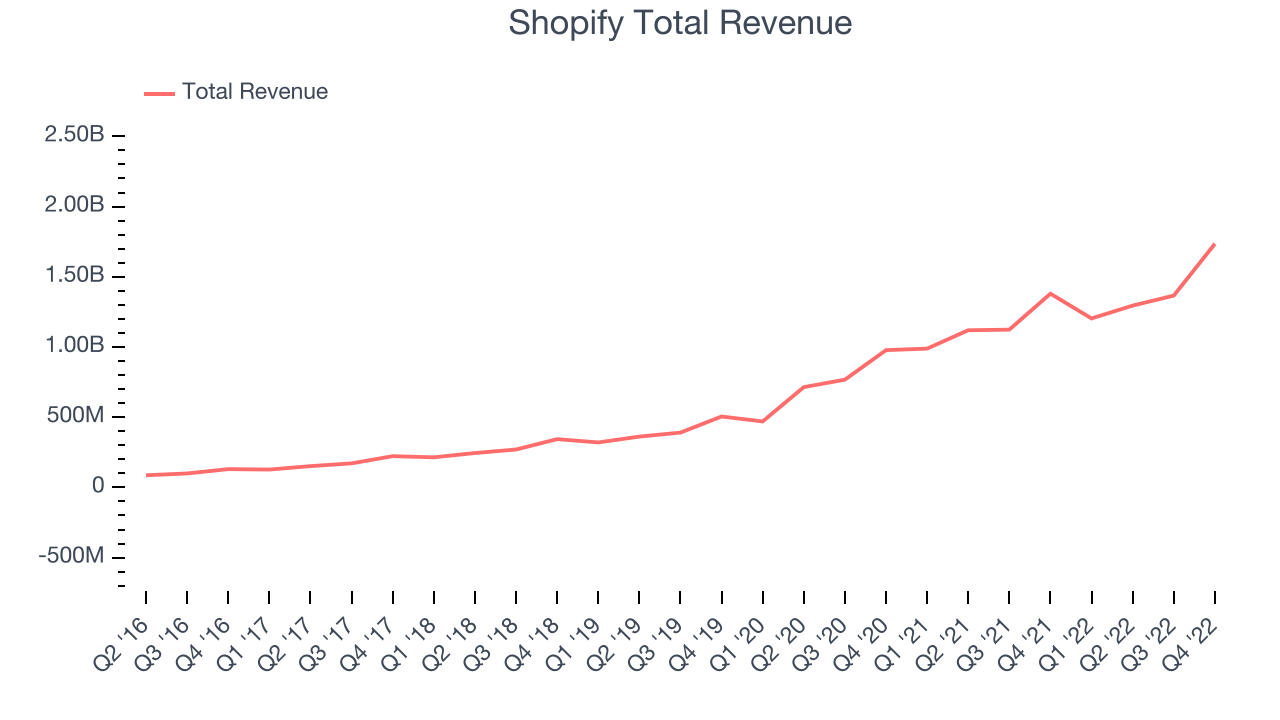

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.73 billion, up 25.7% year on year, beating analyst expectations by 5.11%. It was a strong quarter for the company, with a decent beat of analyst estimates and solid revenue growth.

The stock is down 9.05% since the results and currently trades at $48.55.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it's free.

Weakest Q4: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $72.4 million, up 11.6% year on year, missing analyst expectations by 1.24%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The stock is down 25% since the results and currently trades at $8.51.

Read our full analysis of BigCommerce's results here.

AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

AppLovin reported revenues of $702.3 million, down 11.5% year on year, beating analyst expectations by 1.71%. It was a weak quarter for the company, with declining revenue and gross margin.

AppLovin had the slowest revenue growth among the peers. The stock is up 30.7% since the results and currently trades at $16.6.

Read our full, actionable report on AppLovin here, it's free.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $355 million, up 8.13% year on year, in line with analyst expectations. It was a decent quarter for the company, with very strong guidance for the next year but slow revenue growth.

The stock is up 12.5% since the results and currently trades at $90.86.

Read our full, actionable report on Wix here, it's free.

The author has no position in any of the stocks mentioned