Technology real estate company Offerpad (NYSE:OPAD) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 53.2% year on year to $285.4 million. On the other hand, next quarter's revenue guidance of $275 million was less impressive, coming in 22% below analysts' estimates. It made a GAAP loss of $0.64 per share, improving from its loss of $2.51 per share in the same quarter last year.

Offerpad (OPAD) Q1 CY2024 Highlights:

- Revenue: $285.4 million vs analyst estimates of $270.2 million (5.6% beat)

- EPS: -$0.64 vs analyst expectations of -$0.46 (38.5% miss)

- Revenue Guidance for Q2 CY2024 is $275 million at the midpoint, below analyst estimates of $352.7 million

- Gross Margin (GAAP): 7.9%, up from 1.2% in the same quarter last year

- Free Cash Flow of $2.03 million is up from -$15.36 million in the previous quarter

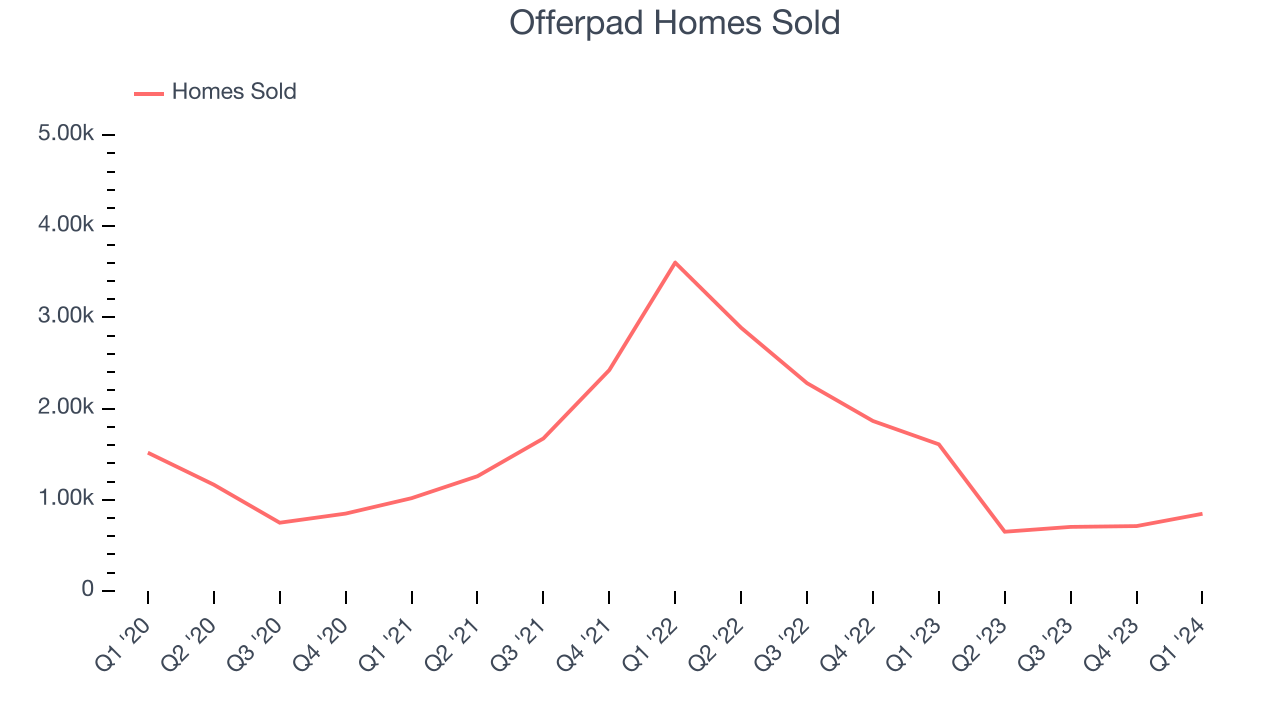

- Homes Sold: 847

- Market Capitalization: $202 million

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE:OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad's core service revolves around its home buying model, where homeowners looking to sell can receive an instant cash offer on their property through Offerpad's website. This approach streamlines the traditional home selling process, offering a quick alternative to the conventional real estate market. After purchasing homes, Offerpad renovates them for resale, revitalizing properties and providing quality homes for future buyers.

A key aspect of Offerpad's business model is its use of technology. The company utilizes algorithms and data analytics to assess property values accurately and make competitive offers. This tech-driven approach enables Offerpad to operate efficiently and scale its services across various markets.

Offerpad's services extend beyond instant home buying. The company also provides traditional listing services for sellers who prefer to sell their homes on the open market. These services include home improvement advances, professional staging and listing, and a team of real estate experts to guide sellers through the process.

In addition to buying and selling homes, Offerpad has ventured into providing ancillary services related to real estate transactions. These include financing solutions through Offerpad Home Loans and other customer-centric services that aim to make the home buying and selling experience as seamless as possible.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Offerpad's primary competitors include Zillow (NASDAQ:ZG), Opendoor (NASDAQ:OPEN), Redfin (NASDAQ:RDFN), and eXp World (NASDAQ:EXPI).Sales Growth

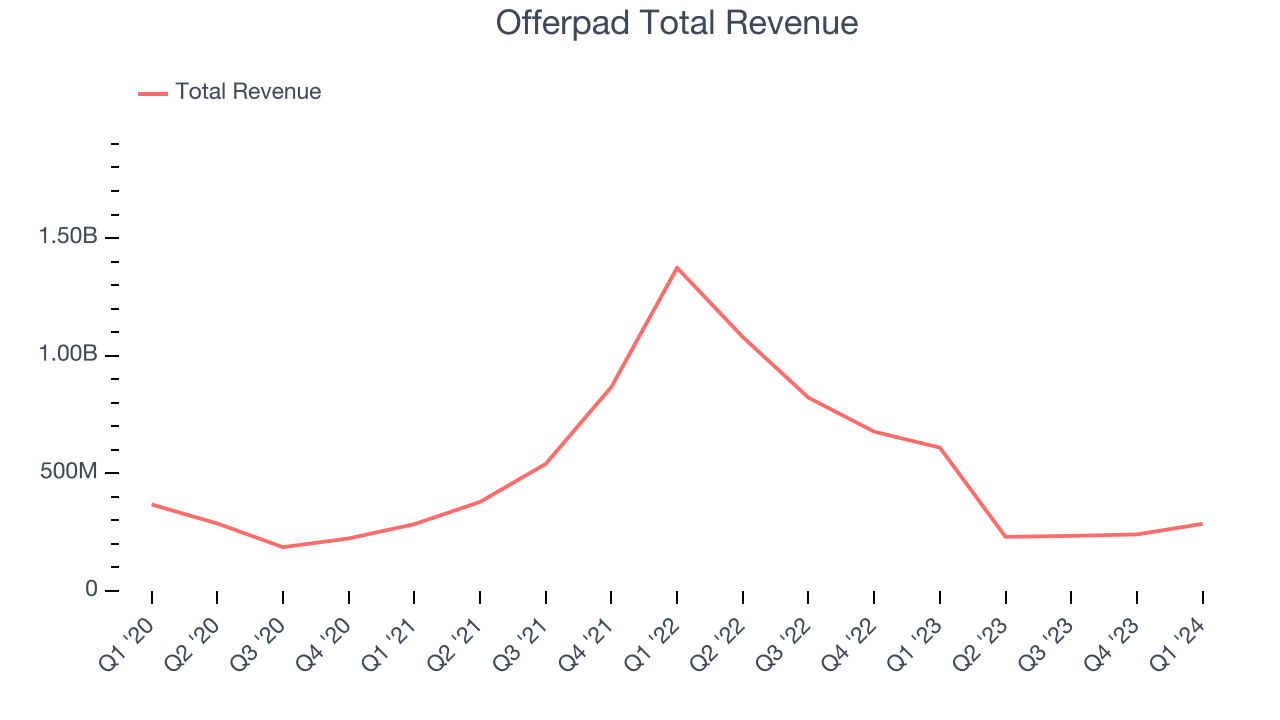

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Offerpad's revenue was flat over the last three years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Offerpad's recent history shows a reversal from its three-year trend as its revenue has shown annualized declines of 44% over the last two years.

We can better understand the company's revenue dynamics by analyzing its number of homes sold, which reached 847 in the latest quarter. Over the last two years, Offerpad's homes sold averaged 21.1% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, Offerpad's revenue fell 53.2% year on year to $285.4 million but beat Wall Street's estimates by 5.6%. The company is guiding for revenue to rise 19.5% year on year to $275 million next quarter, improving from the 78.7% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 50.4% over the next 12 months, an acceleration from this quarter.

Operating Margin

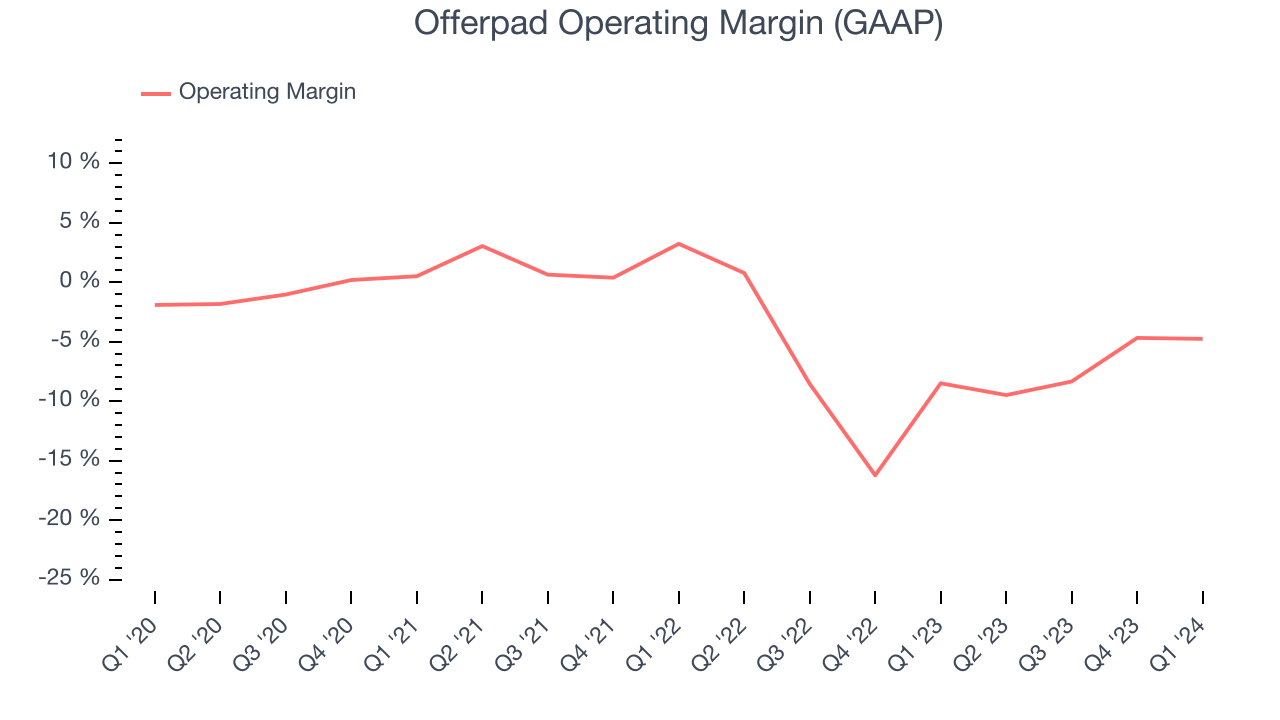

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Offerpad's high expenses have contributed to an average operating margin of negative 6.9%.

In Q1, Offerpad generated an operating profit margin of negative 4.8%, up 3.7 percentage points year on year.

Over the next 12 months, Wall Street expects Offerpad to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 6.7% to rise to negative 1.1%.EPS

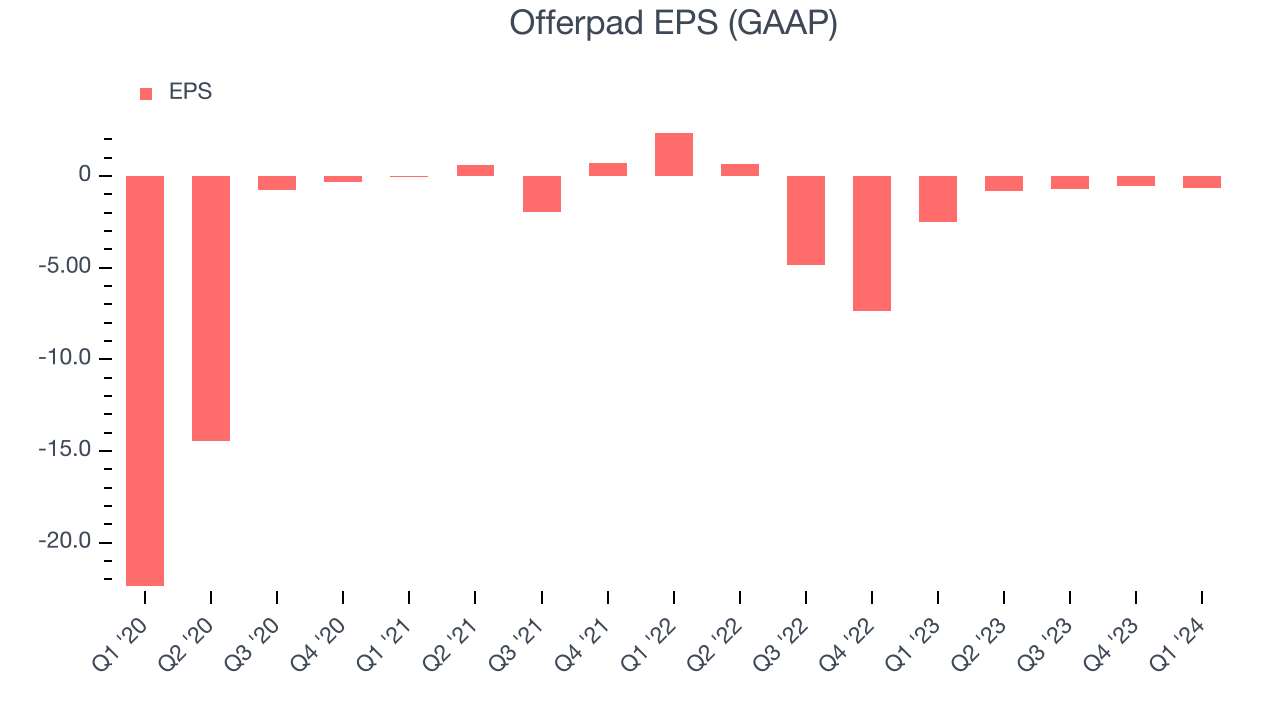

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last three years, Offerpad cut its earnings losses and improved its EPS by 43.9% each year.

In Q1, Offerpad reported EPS at negative $0.64, up from negative $2.51 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Offerpad to improve its earnings losses. Analysts are projecting its LTM EPS of negative $2.76 to advance to negative $1.36.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

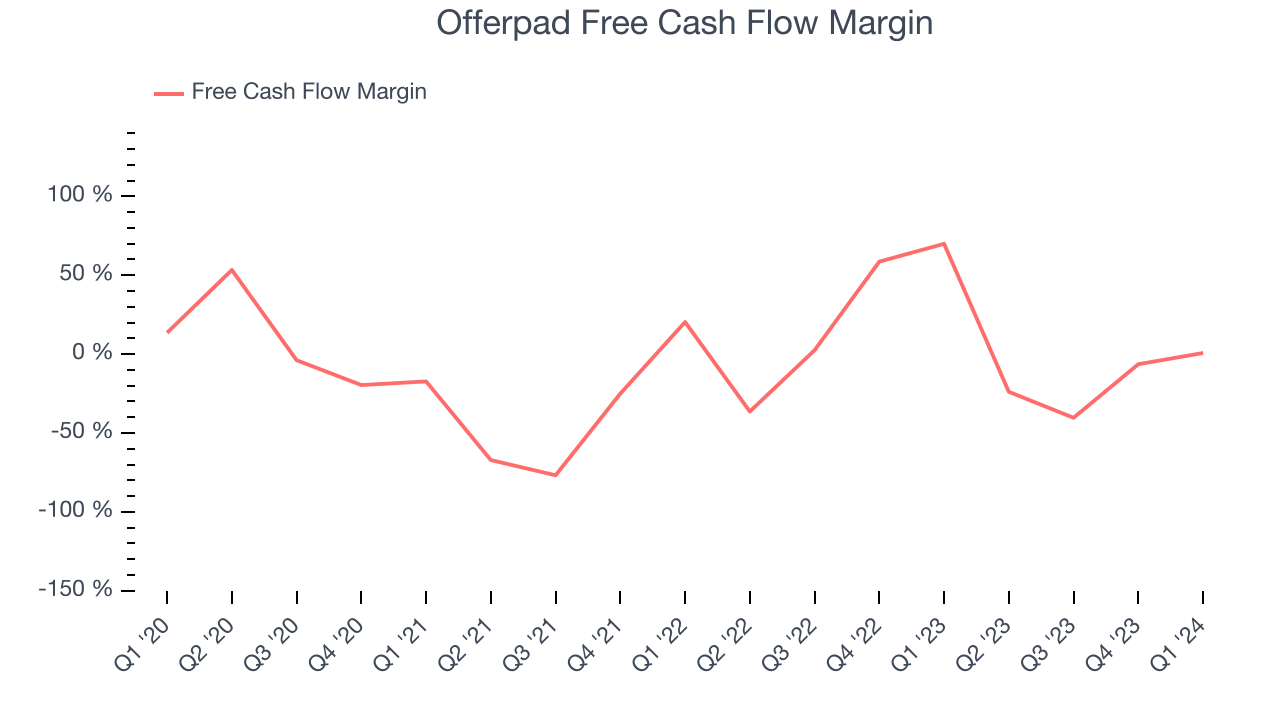

Over the last two years, Offerpad has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 6.9%, subpar for a consumer discretionary business.

Offerpad broke even from a free cash flow perspective in Q1. The company's margin regressed this quarter as it was 69.2 percentage points lower than in the same period last year.

Return on Invested Capital (ROIC)

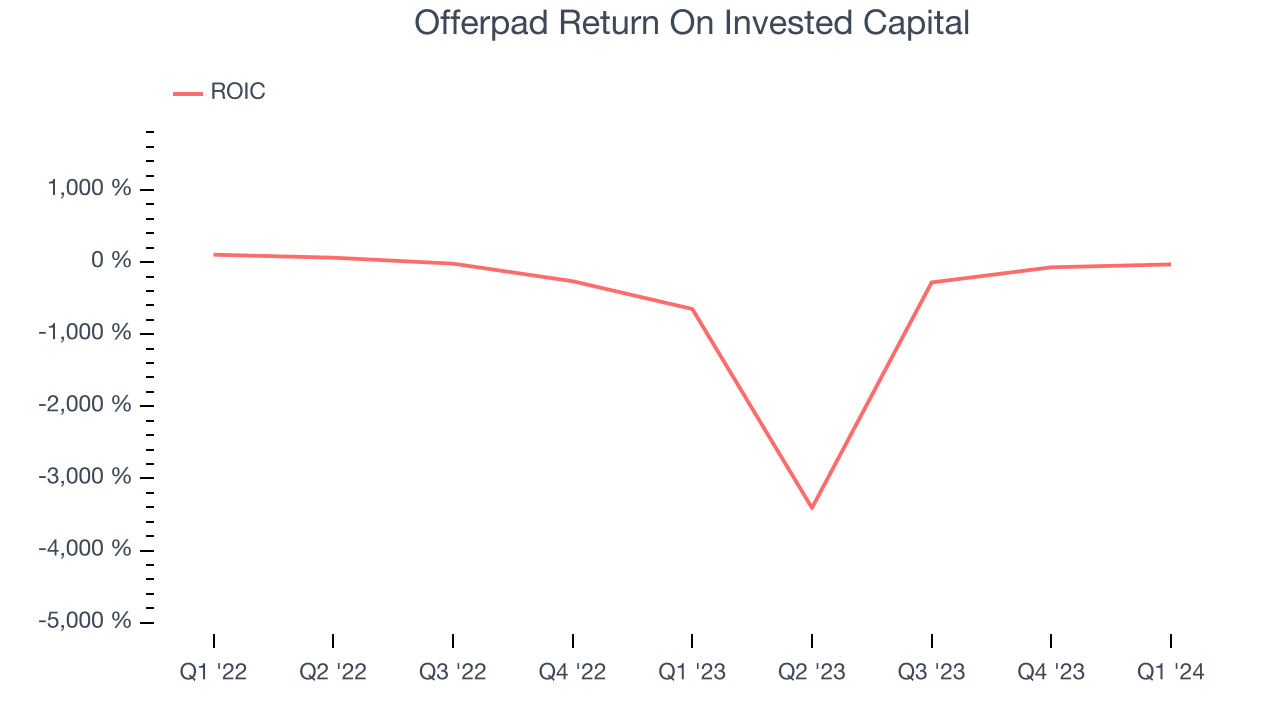

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Offerpad's five-year average return on invested capital was negative 31.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Offerpad, which has $68.55 million of cash and $254.6 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $44.74 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade Offerpad if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Offerpad can improve its profitability and remain cautious until then.

Key Takeaways from Offerpad's Q1 Results

We enjoyed seeing Offerpad exceed analysts' revenue expectations this quarter as it sold more homes than anticipated (847 vs estimates of 800). On the other hand, its operating margin and EPS missed while its revenue guidance for the next quarter fell significantly short of Wall Street's estimates. Overall, the results could have been better. The company is down 1.4% on the results and currently trades at $7.26 per share.

Is Now The Time?

Offerpad may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Offerpad, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its number of homes sold has been disappointing. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While we've no doubt one can find things to like about Offerpad, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $8.55 per share right before these results (compared to the current share price of $7.26).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.