Wrapping up Q2 earnings, we look at the numbers and key takeaways for the heavy transportation equipment stocks, including Oshkosh (NYSE:OSK) and its peers.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 15 heavy transportation equipment stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data, and heavy transportation equipment stocks have had a rough stretch. On average, share prices are down 11.1% since the latest earnings results.

Oshkosh (NYSE:OSK)

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

Oshkosh reported revenues of $2.85 billion, up 18% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ earnings estimates.

“We are pleased to report another quarter of strong performance highlighted by growth in revenue, adjusted operating income and adjusted earnings per share,” said John Pfeifer, president and chief executive officer of Oshkosh Corporation.

Oshkosh pulled off the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 14.7% since reporting and currently trades at $97.49.

Is now the time to buy Oshkosh? Access our full analysis of the earnings results here, it’s free.

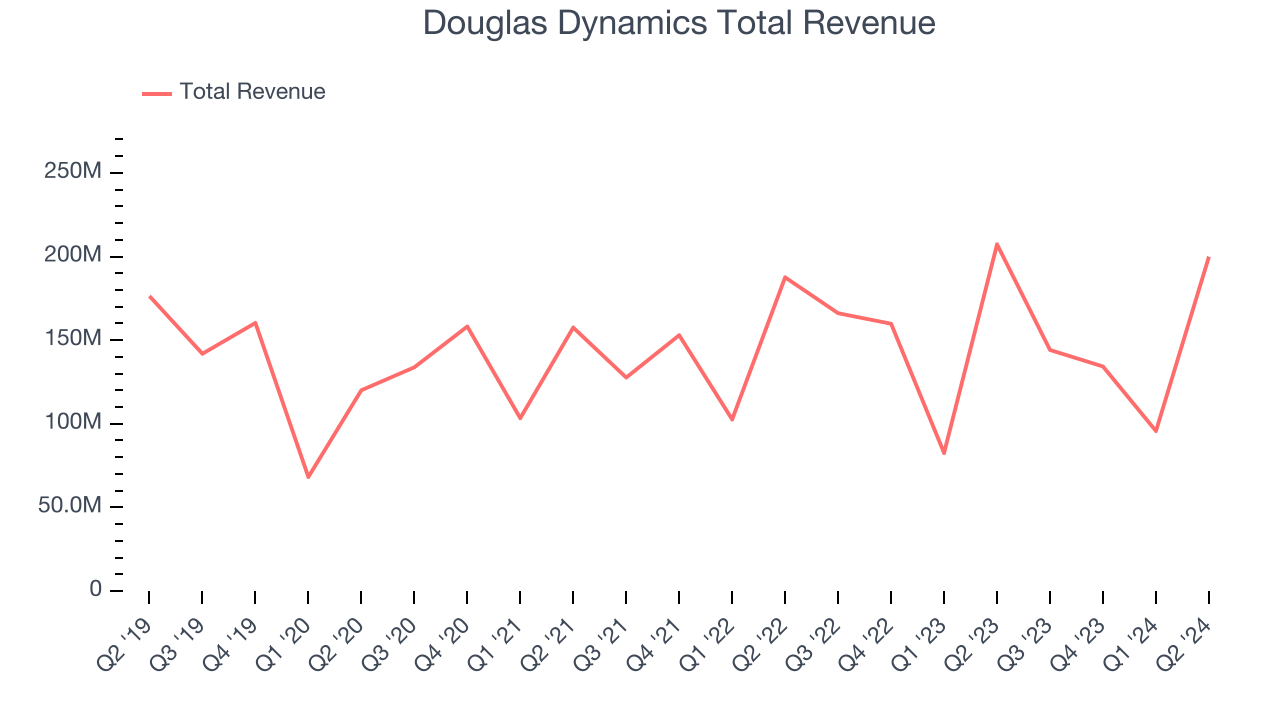

Best Q2: Douglas Dynamics (NYSE:PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE:PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $199.9 million, down 3.6% year on year, outperforming analysts’ expectations by 9.4%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $26.61.

Is now the time to buy Douglas Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Microvast (NASDAQ:MVST)

With over 25 patents, Microvast (NASDAQ:MVST) designs, develops, and manufactures lithium-ion batteries for electric vehicles and batteries for renewable energy storage.

Microvast reported revenues of $83.68 million, up 11.6% year on year, falling short of analysts’ expectations by 4.4%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 44.7% since the results and currently trades at $0.22.

Read our full analysis of Microvast’s results here.

Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $820.2 million, down 21% year on year. This result came in 10.9% below analysts' expectations. It was a slower quarter as it also recorded a miss of analysts’ earnings estimates.

Greenbrier had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 6.4% since reporting and currently trades at $45.45.

Read our full, actionable report on Greenbrier here, it’s free.

Blue Bird (NASDAQ:BLBD)

With around a century of experience, Blue Bird (NASDAQ:BLBD) is a manufacturer of school buses and complementary parts.

Blue Bird reported revenues of $333.4 million, up 13.3% year on year. This number beat analysts’ expectations by 2%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ earnings estimates.

The stock is down 5.7% since reporting and currently trades at $45.76.

Read our full, actionable report on Blue Bird here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.