The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Oxford Industries (NYSE:OXM) and the rest of the apparel, accessories and luxury goods stocks fared in Q2.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 12.6% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Thankfully, apparel, accessories and luxury goods stocks have been resilient with share prices up 6.8% on average since the latest earnings results.

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

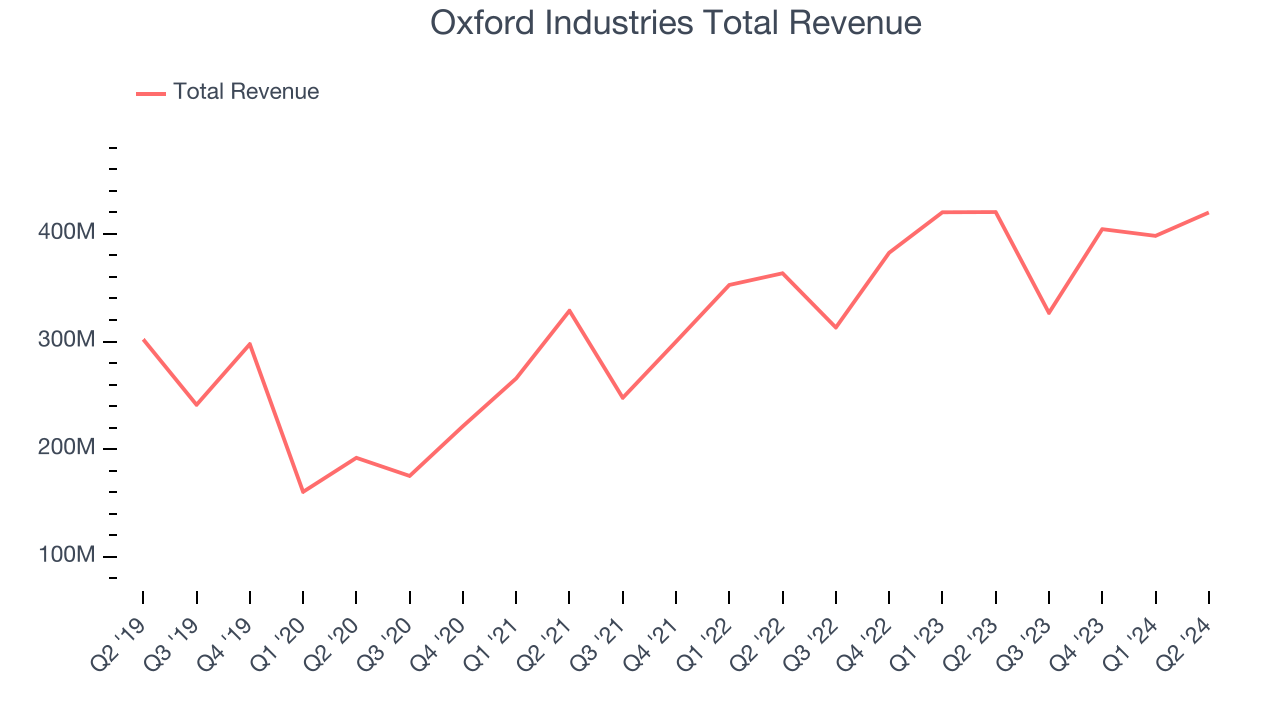

Oxford Industries reported revenues of $419.9 million, flat year on year. This print fell short of analysts’ expectations by 4.2%. Overall, it was a disappointing quarter for the company with revenue guidance for next quarter missing analysts’ expectations.

Tom Chubb, Chairman and CEO, commented, “Consumer sentiment in the second quarter continued to decline from levels earlier in the year reaching an eight month low in July. The decline led to market conditions that were weaker than expected with more consumers looking for deals and promotions as evidenced by increased sales in our outlet locations and during promotional events. Despite the challenging consumer environment, our teams continue to focus on our strategy of delivering new and compelling products and experiences for our customers. The current macroeconomic environment does not diminish our enthusiasm or commitment to our strategy to drive long-term shareholder value."

Interestingly, the stock is up 3.5% since reporting and currently trades at $86.44.

Read our full report on Oxford Industries here, it’s free.

Best Q2: Stitch Fix (NASDAQ:SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

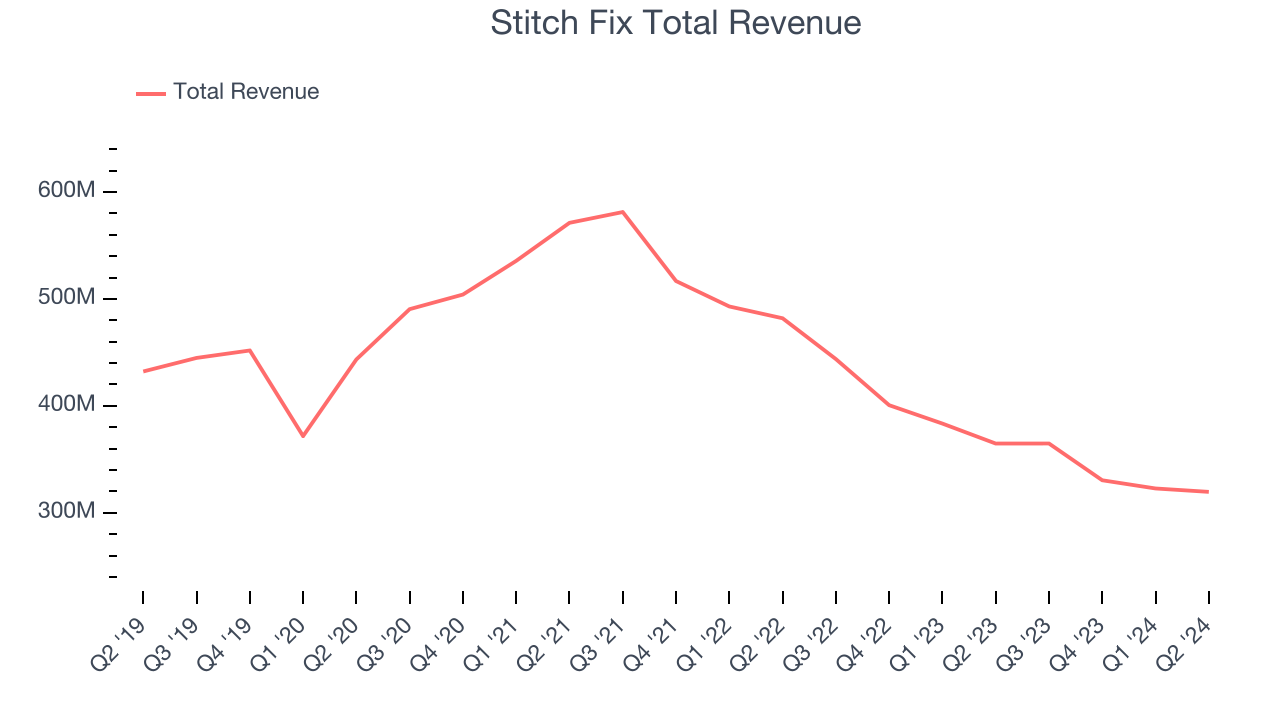

Stitch Fix reported revenues of $319.6 million, down 12.4% year on year, in line with analysts’ expectations. The business performed better than its peers, overall, it was a mixed quarter with revenue guidance for next quarter missing analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 24.3% since reporting. It currently trades at $2.83.

Is now the time to buy Stitch Fix? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.76 million, down 3.5% year on year, falling short of analysts’ expectations by 3.3%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations and a miss of analysts’ earnings estimates.

As expected, the stock is down 50.8% since the results and currently trades at $0.85.

Read our full analysis of ThredUp’s results here.

Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $144.2 million, up 4.4% year on year. This number beat analysts’ expectations by 1.4%. It was a very strong quarter as it also logged an impressive beat of analysts’ earnings estimates.

The stock is up 18.7% since reporting and currently trades at $6.78.

Read our full, actionable report on Figs here, it’s free.

Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $159.3 million, flat year on year. This result surpassed analysts’ expectations by 5.9%. However, it was a disappointing quarter as it recorded full-year revenue guidance missing analysts’ expectations.

Movado pulled off the biggest analyst estimates beat among its peers. The stock is down 15.8% since reporting and currently trades at $18.99.

Read our full, actionable report on Movado here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.