Cybersecurity provider Palo Alto Networks (NASDAQ:PANW) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 19.3% year on year to $1.98 billion. On the other hand, next quarter's revenue guidance of $1.97 billion was less impressive, coming in 3.7% below analysts' estimates. It made a non-GAAP profit of $1.46 per share, improving from its profit of $1.05 per share in the same quarter last year.

Palo Alto Networks (PANW) Q2 FY2024 Highlights:

- Revenue: $1.98 billion vs analyst estimates of $1.97 billion (small beat)

- EPS (non-GAAP): $1.46 vs analyst estimates of $1.30 (12.2% beat)

- Revenue Guidance for Q3 2024 is $1.97 billion at the midpoint, below analyst estimates of $2.04 billion (billings guidance for the period also missed expectations)

- The company dropped its revenue guidance for the full year from $8.18 billion to $7.98 billion at the midpoint, a 2.4% decrease (billings guidance for the period also missed expectations)

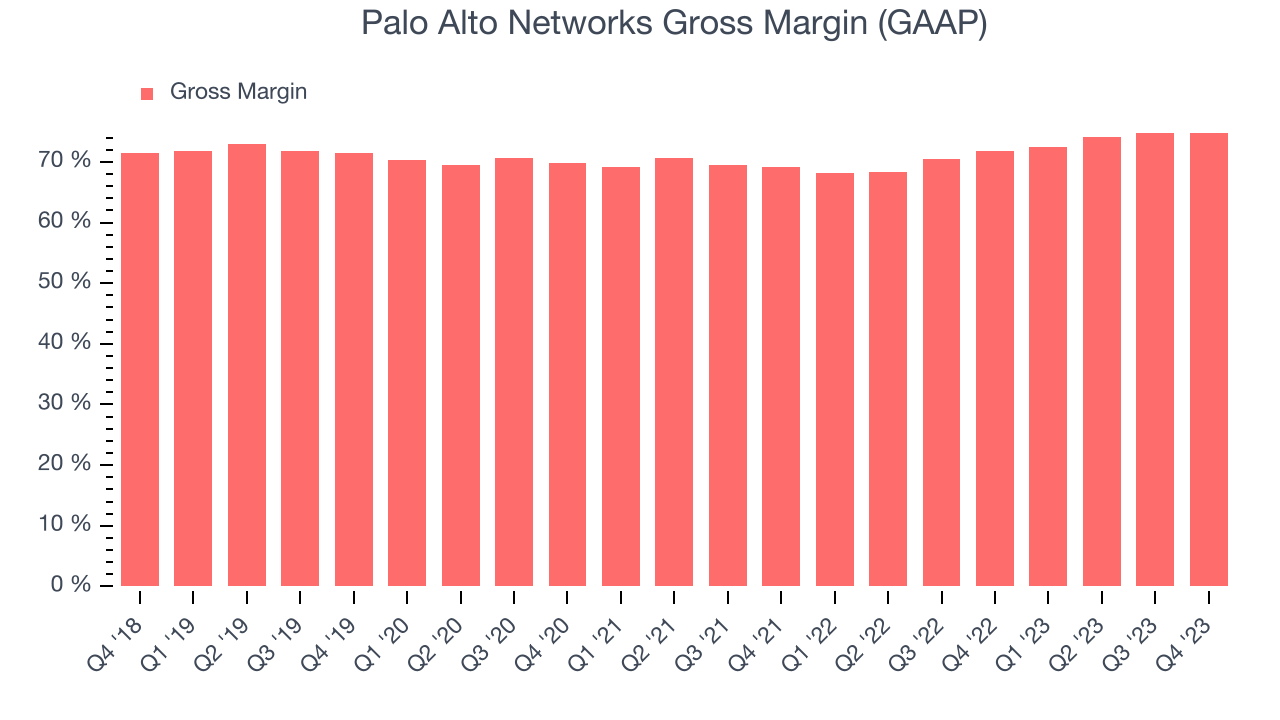

- Gross Margin (GAAP): 74.7%, up from 71.8% in the same quarter last year

- Market Capitalization: $115.5 billion

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

The company started by offering traditional on-premise hardware firewalls and while that is still a big part of their business, it has in the last couple of years been successfully transitioning into offering cloud-based software-as-a-service products.

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. While the majority of Palo Alto’s revenue these days comes from selling software, a significant part of their business is still manufacturing hardware firewalls, and that type of business has higher costs than pure software.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Palo Alto is a well known brand in the network security space which includes competitors such as Fortinet (NASDAQ:FTNT), Check Point Software (NASDAQ:CHKP), and Cisco (NASDAQ:CSCO).

Sales Growth

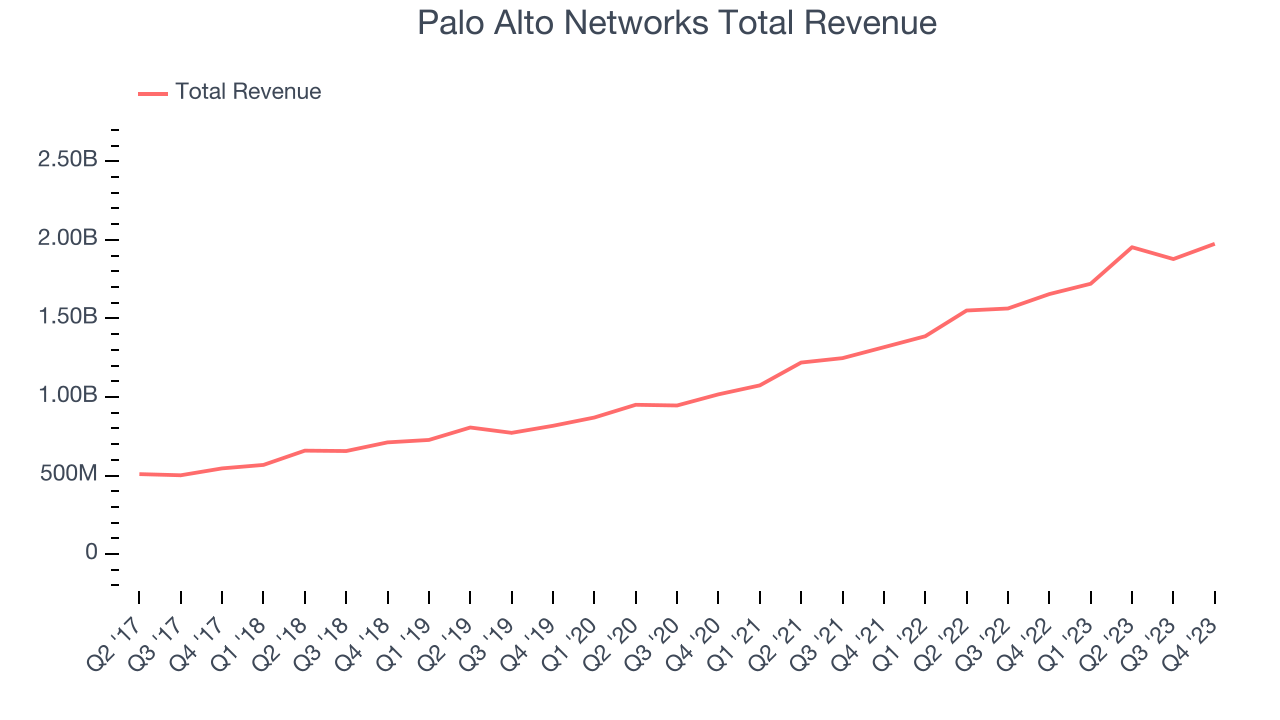

As you can see below, Palo Alto Networks's revenue growth has been strong over the last two years, growing from $1.32 billion in Q2 FY2022 to $1.98 billion this quarter.

This quarter, Palo Alto Networks's quarterly revenue was once again up 19.3% year on year. On top of that, its revenue increased $97 million quarter on quarter, a strong improvement from the $75.2 million decrease in Q1 2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Palo Alto Networks is expecting revenue to grow 14.2% year on year to $1.97 billion, slowing down from the 24.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 18% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Palo Alto Networks's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 74.7% in Q2.

That means that for every $1 in revenue the company had $0.75 left to spend on developing new products, sales and marketing, and general administrative overhead. Trending up over the last year, Palo Alto Networks's gross margin is around the average of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Key Takeaways from Palo Alto Networks's Q2 Results

The quarter itself was ok, with revenue beat by a bit and operating income beating by a more convincing amount. However, both full-year billings and full-year revenue guidance were below expectations. EPS guidance for that period was more in line. Furthermore, billings and revenue guidance for next quarter also missed Wall Street's estimates, with EPS below as well. Overall, this was an ok quarter for Palo Alto Networks with the poor guidance dragging shares down. The company is down 13% on the results and currently trades at $318.55 per share.

Is Now The Time?

Palo Alto Networks may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Palo Alto Networks is a great business. While we'd expect growth rates to moderate from here, its . Additionally, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its very efficient customer acquisition hints at the potential for strong profitability.

There's no doubt that the market is optimistic about Palo Alto Networks's growth prospects, as its price-to-sales ratio based on the next 12 months of 14.7x would suggest. And looking at the tech landscape today, Palo Alto Networks's qualities really stand out. We are big fans at this price, even more so considering the company is actually trading at a multiple .

Wall Street analysts covering the company had a one-year price target of $361.98 per share right before these results (compared to the current share price of $318.55), implying they saw upside in buying Palo Alto Networks in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.