Automation software company UiPath (NYSE:PATH) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 31.3% year on year to $405.3 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $332.5 million was less impressive, coming in 4.4% below expectations. It made a non-GAAP profit of $0.22 per share, improving from its profit of $0.15 per share in the same quarter last year.

Is now the time to buy UiPath? Find out by accessing our full research report, it's free.

UiPath (PATH) Q4 FY2023 Highlights:

- Revenue: $405.3 million vs analyst estimates of $383.7 million (5.6% beat)

- EPS (non-GAAP): $0.22 vs analyst estimates of $0.16 (40.5% beat)

- Revenue Guidance for Q1 2024 is $332.5 million at the midpoint, below analyst estimates of $347.9 million

- Management's revenue guidance for the upcoming financial year 2024 is $1.56 billion at the midpoint, beating analyst estimates by 1.8% and implying 19.1% growth (vs 23% in FY2023)

- Gross Margin (GAAP): 86.8%, up from 84.7% in the same quarter last year

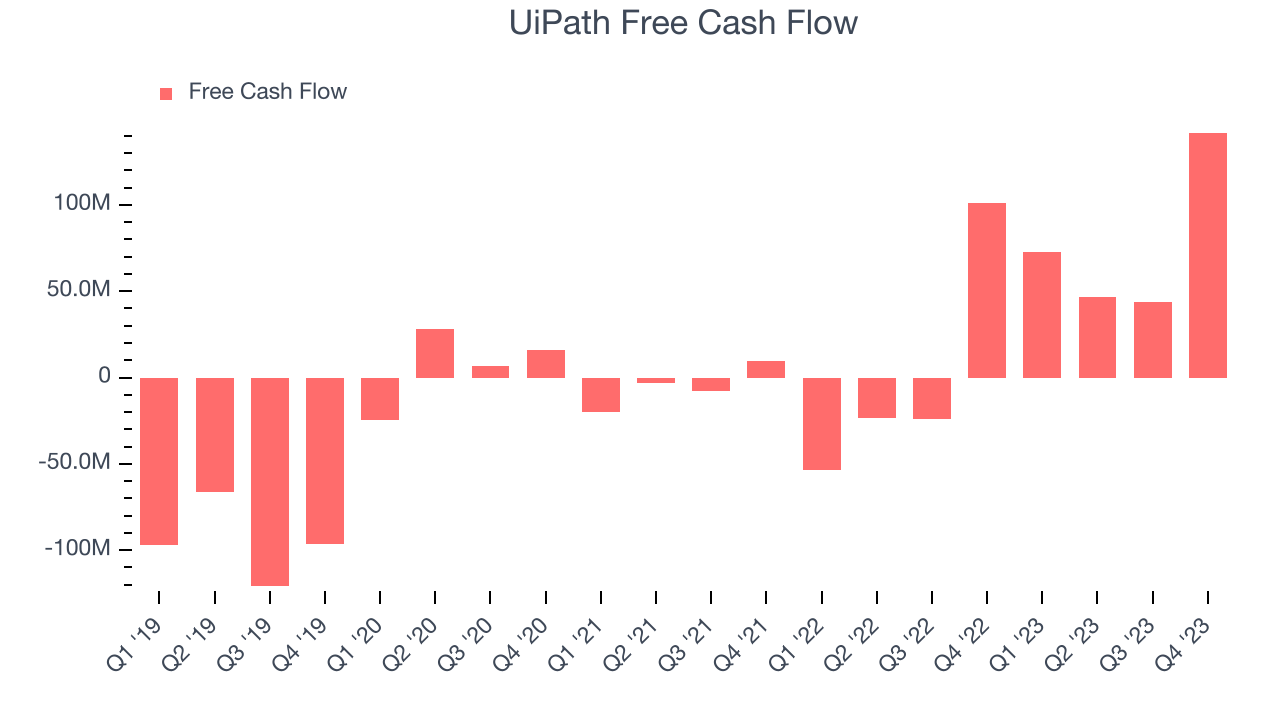

- Free Cash Flow of $141.8 million, up from $43.67 million in the previous quarter

- Annual Recurring Revenue (ARR): $1.46 billion at quarter end, up 21.6% year on year

- 2024 ARR Guidance: $1.73 billion

- Market Capitalization: $13.95 billion

“We delivered a strong close to the fiscal year with fourth quarter ARR growing 22 percent year-over-year to $1.464 billion, underscoring the meaningful outcomes our Business Automation Platform delivers for our customers,” said Rob Enslin, UiPath Chief Executive Officer.

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

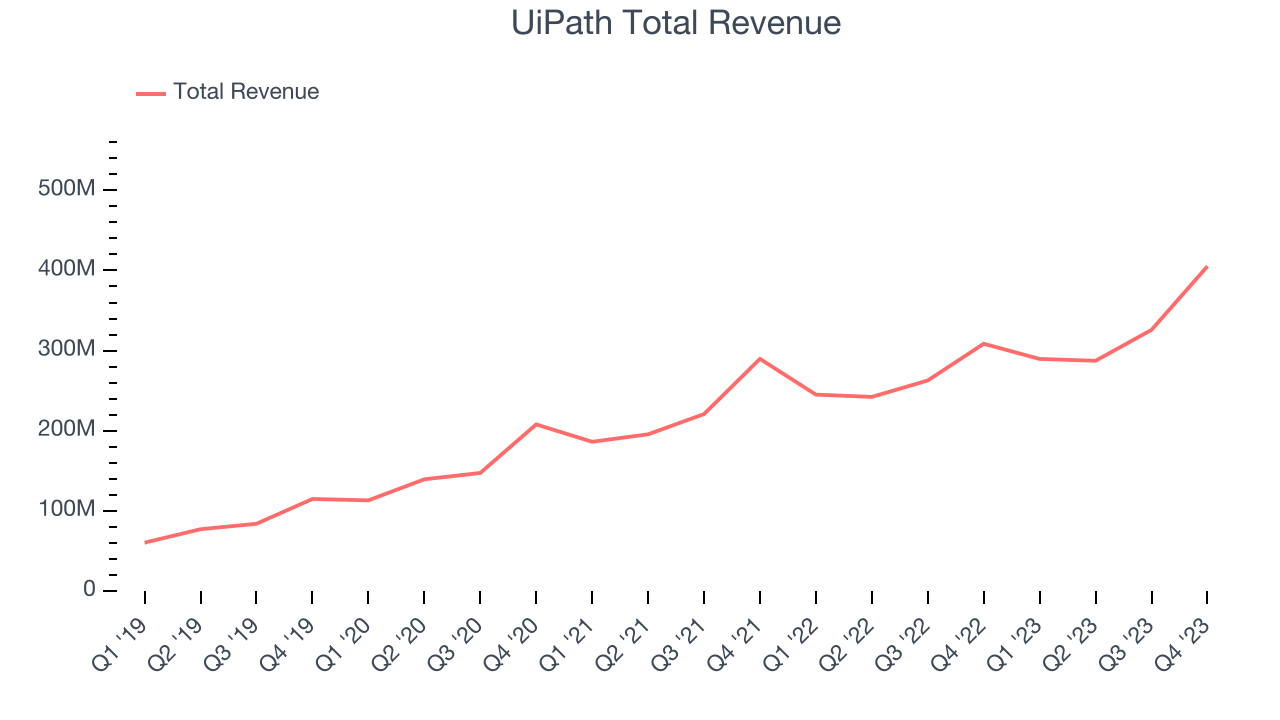

As you can see below, UiPath's revenue growth has been strong over the last three years, growing from $207.9 million in Q4 2021 to $405.3 million this quarter.

Unsurprisingly, this was another great quarter for UiPath with revenue up 31.3% year on year. On top of that, its revenue increased $79.33 million quarter on quarter, a very strong improvement from the $38.61 million increase in Q3 2024. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that UiPath is expecting revenue to grow 14.8% year on year to $332.5 million, slowing down from the 18.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.56 billion at the midpoint, growing 19.1% year on year compared to the 23.6% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. UiPath's free cash flow came in at $141.8 million in Q4, up 40.1% year on year.

UiPath has generated $304.8 million in free cash flow over the last 12 months, an impressive 23.3% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from UiPath's Q4 Results

This was an excellent beat-and-raise quarter for UiPath. It soared past analysts' estimates across all key metrics, including revenue, gross margin, EPS, and free cash flow. Its net retention rate and full-year 2024 ARR guidance of $1.73 billion also came in better than expected.

During the quarter, June Yang (former VP of Cloud AI and Industry Solutions at Google Cloud) joined the company's Board of Directors. Zooming out, we think this was a good quarter, showing that the company is staying on track. The stock is up 5% after reporting and currently trades at $25.65 per share.

So should you invest in UiPath right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.