Paycom has had an impressive run over the past six months as its shares have beaten the S&P 500 by 25%. The stock now trades at $230.17, marking a 38% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy PAYC? Find out in our full research report, it’s free.

Why Do Investors Watch Paycom?

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Three Things to Like:

1. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Paycom’s excellent gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 84.7% gross margin over the last year. Said differently, roughly $84.66 was left to spend on selling, marketing, and R&D for every $100 in revenue.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Paycom is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9.8 months this quarter. The company’s performance indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Paycom the freedom to invest in new product initiatives while maintaining optionality.

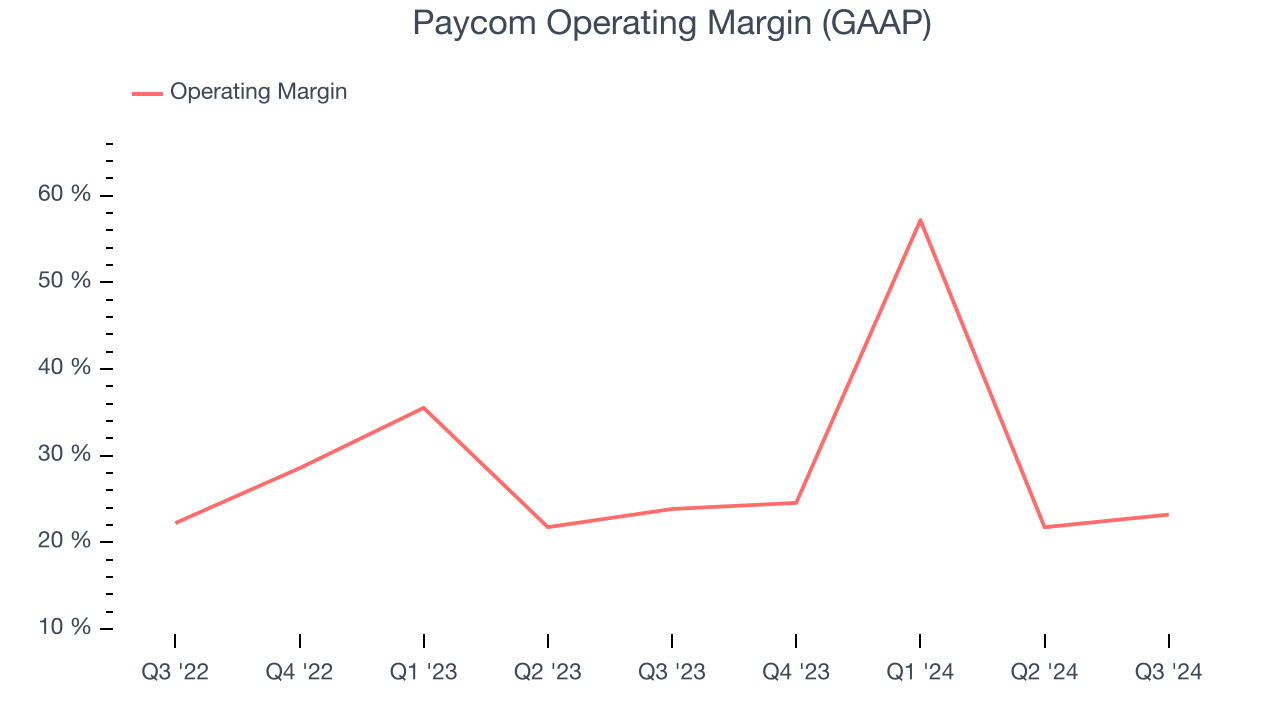

3. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Paycom has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 32.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Final Judgment

Paycom possesses several positive attributes, and with its shares topping the market in recent months, the stock trades at 6.5x forward price-to-sales (or $230.17 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Paycom

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.