Construction management software maker Procore Technologies (NYSE:PCOR) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 28.7% year on year to $260 million. Guidance for next quarter's revenue was also optimistic at $263 million at the midpoint, 2.2% above analysts' estimates. It made a non-GAAP profit of $0.17 per share, improving from its loss of $0.08 per share in the same quarter last year.

Is now the time to buy Procore Technologies? Find out by accessing our full research report, it's free.

Procore Technologies (PCOR) Q4 FY2023 Highlights:

- Revenue: $260 million vs analyst estimates of $248.3 million (4.7% beat)

- EPS (non-GAAP): $0.17 vs analyst estimates of $0.07 ($0.10 beat)

- Revenue Guidance for Q1 2024 is $263 million at the midpoint, above analyst estimates of $257.4 million (operating margin guidance for this period also beat expectations)

- Management's revenue guidance for the upcoming financial year 2024 is $1.14 billion at the midpoint, beating analyst estimates by 1.3% and implying 19.9% growth (vs 32.1% in FY2023) (operating margin guidance for this period also beat expectations)

- Free Cash Flow of $28.99 million, up 29.1% from the previous quarter

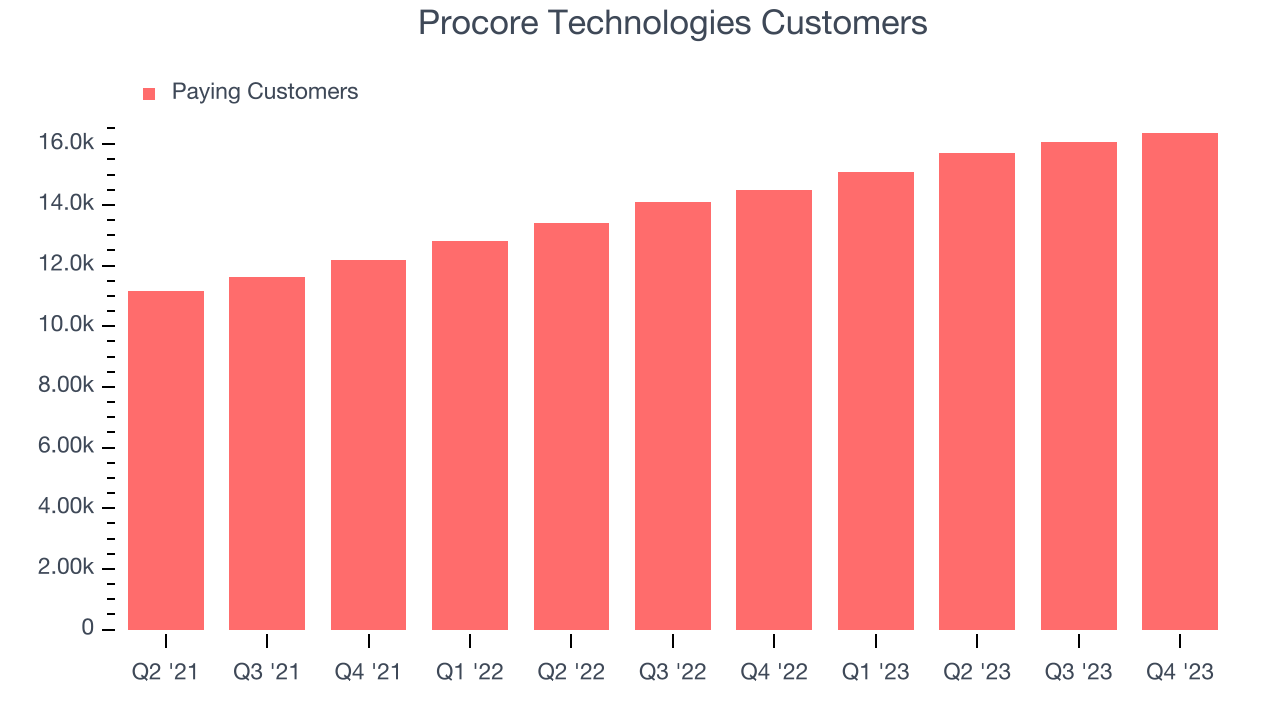

- Customers: 16,367, up from 16,067 in the previous quarter (miss vs. expectations of 16,418)

- Gross Margin (GAAP): 81.6%, up from 80% in the same quarter last year

- Market Capitalization: $10.55 billion

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

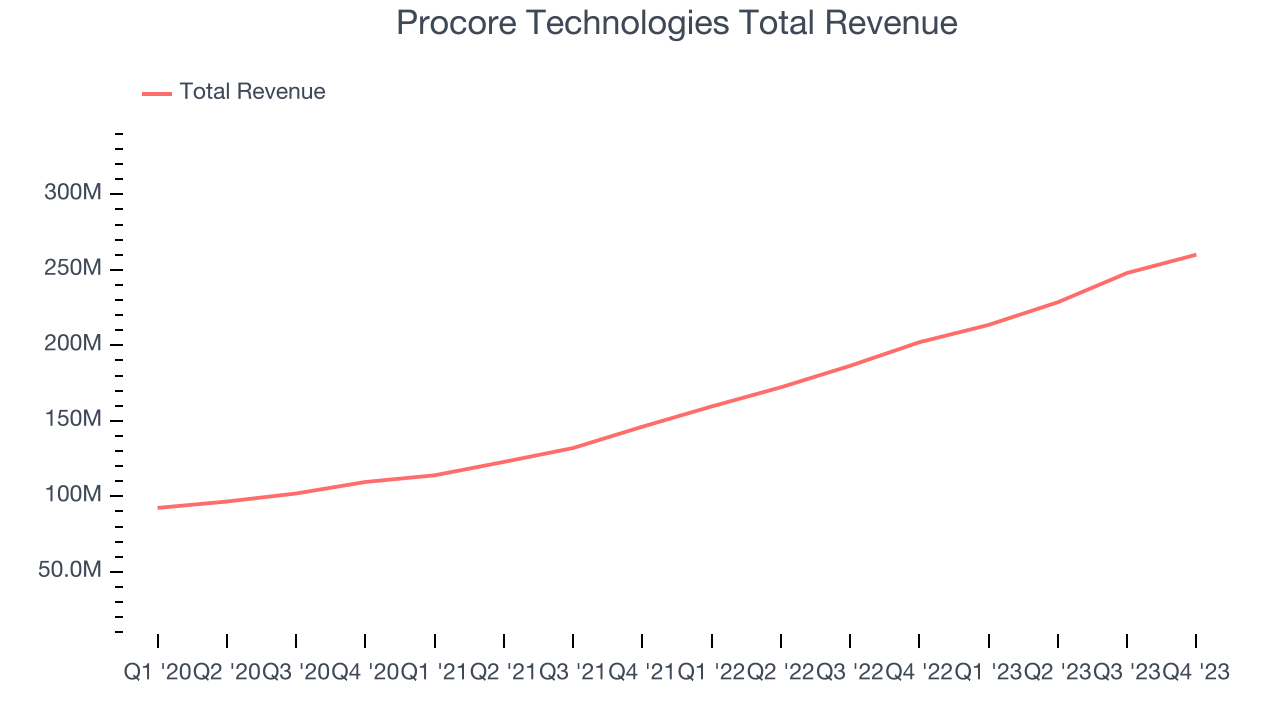

Sales Growth

As you can see below, Procore Technologies's revenue growth has been very strong over the last two years, growing from $146.1 million in Q4 FY2021 to $260 million this quarter.

This quarter, Procore Technologies's quarterly revenue was once again up a very solid 28.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $12.13 million in Q4 compared to $19.37 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Procore Technologies is expecting revenue to grow 23.2% year on year to $263 million, slowing down from the 33.9% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.14 billion at the midpoint, growing 19.9% year on year compared to the 31.9% increase in FY2023.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

Procore Technologies reported 16,367 customers at the end of the quarter, an increase of 300 from the previous quarter. That's a little slower customer growth than what we've observed in past quarters, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Procore Technologies's Q4 Results

This was a solid quarter. Revenue, profit, and EPS beat. Guidance for revenue and operating margin were ahead for next quarter and the full year as well. The stock is up 6.4% after reporting and currently trades at $79.32 per share.

Procore Technologies may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.