IT incident response platform PagerDuty (NYSE:PD) beat analyst expectations in Q1 FY2022 quarter, with revenue up 27.7% year on year to $63.5 million. PagerDuty made a GAAP loss of $22.5 million, down on its loss of $11.4 million, in the same quarter last year.

Is now the time to buy PagerDuty? Get early access to our full analysis of the earnings results here

PagerDuty (NYSE:PD) Q1 FY2022 Highlights:

- Revenue: $63.5 million vs analyst estimates of $61.9 million (2.62% beat)

- EPS (non-GAAP): -$0.08 vs analyst estimates of -$0.09

- Revenue guidance for Q2 2022 is $65.5 million at the midpoint, above analyst estimates of $63.6 million

- The company reconfirmed revenue guidance for the full year, at $269.5 million at the midpoint

- Free cash flow was negative -$350 thousand, down from positive free cash flow of $2.27 million in previous quarter

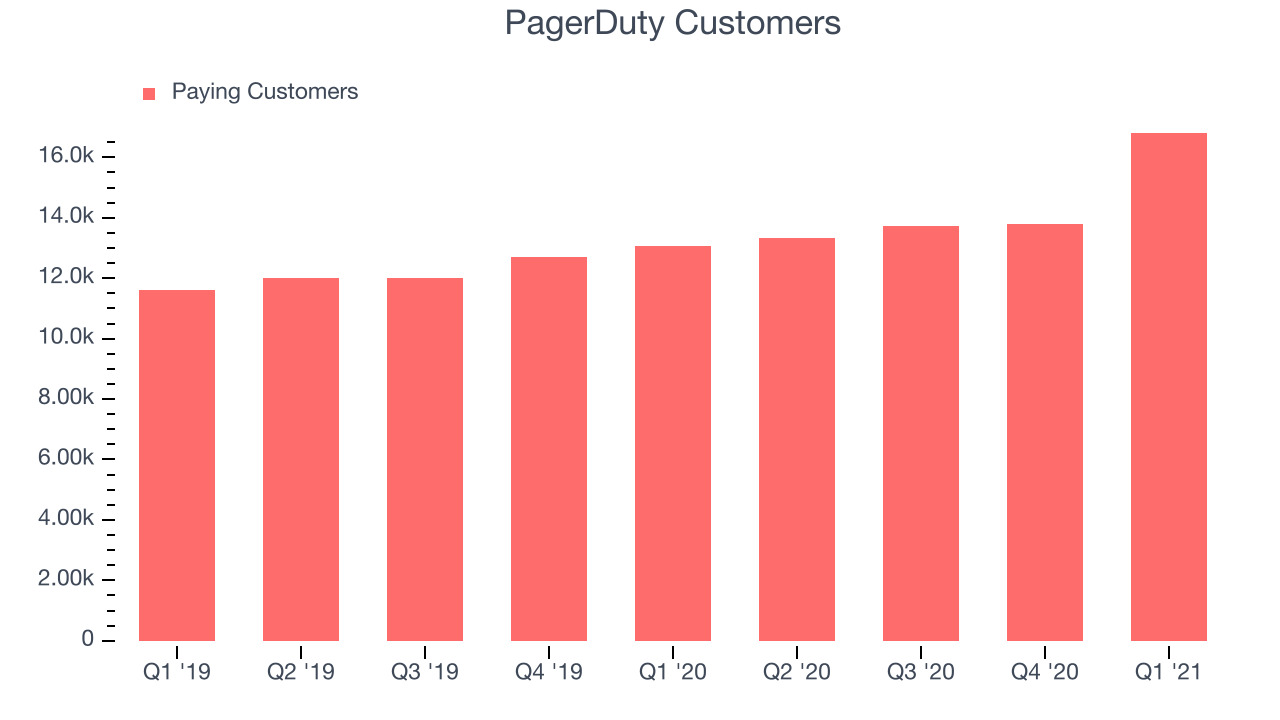

- Customers: 16,800, up from 13,800 in previous quarter

- Gross Margin (GAAP): 83.6%, in line with previous quarter

- Updated valuation: PagerDuty is down at $39.4 and accounting for the revenue added in Q1 it now trades at 14.8x price-to-sales (LTM), compared to 15.6x just before the results.

"PagerDuty's business is benefiting from recovery, as both the macro trends and market landscape continue to move in our favor. As communities, industries, and businesses move forward to a post-pandemic world, our platform is essential infrastructure for our customers. Building off a strong close to fiscal 2021, we beat both our top and bottom line guide,” said Jennifer Tejada, CEO at PagerDuty.

Who Is On Call?

What started in 2009 as a plan to build a bootstrapped software company, retire early and sip drinks on the beach has very quickly outgrown the wildest dreams of the three ex-Amazon founders. PagerDuty (NYSE:PD) is a software as a service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized. The name PagerDuty comes from a software engineering practice which used to literally involve a pager on your belt that went off when the piece of the software you were responsible for broke and you were on-call to fix it, even in the middle of the night.

Today the methods of communication have changed but the principle stays the same. If a part of a website goes down, PagerDuty helps teams identify the source of the problem, alerts the engineers who are on-call to fix it, informs relevant stakeholders and provides collaborative space to work on the issue. This ensures that there is a clear accountability for incident response and that any issues are fixed fast.

The on-call incident response practice is something that pretty much every large engineering team has to establish and they either build the tools for it internally or use a third party tool like PagerDuty.

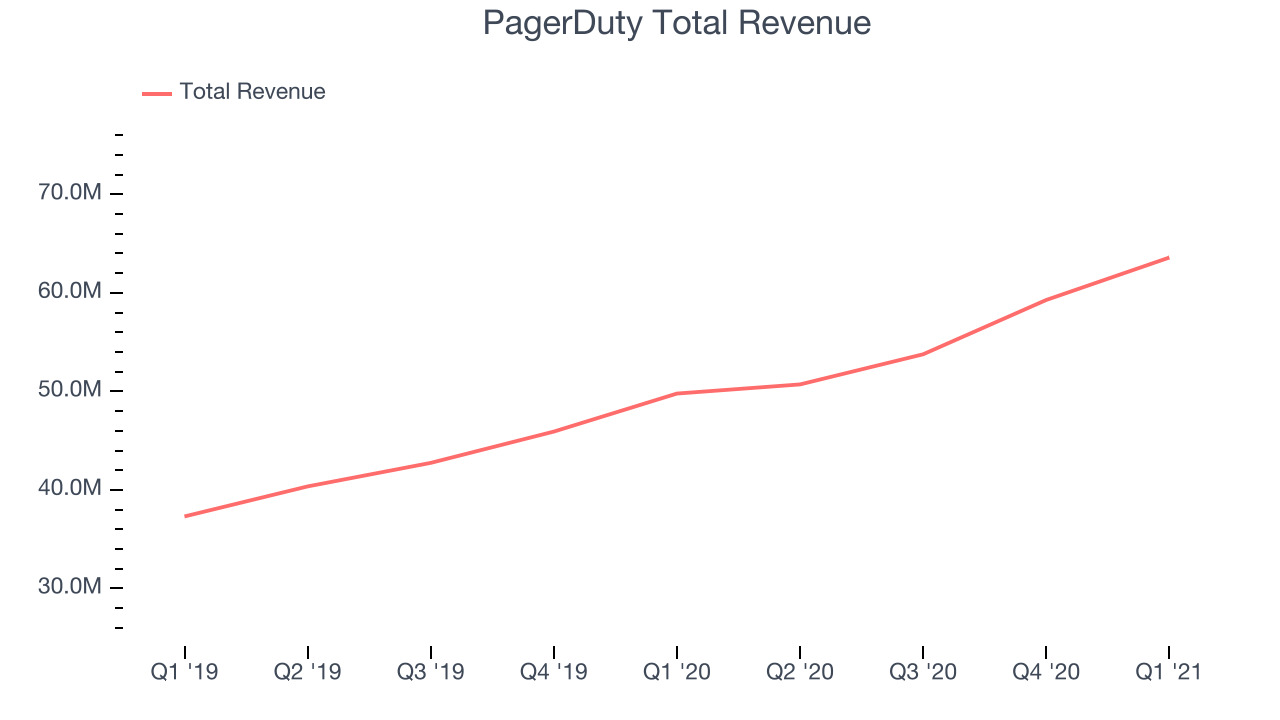

As you can see below, PagerDuty's revenue growth has been strong over the last twelve months, growing from $49.7 million to $63.5 million.

This quarter, PagerDuty's quarterly revenue was once again up a very solid 27.7% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $4.3 million in Q1, compared to $5.51 million in Q4 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

One of the reasons why the cloud based software as a service model is so powerful is because it makes possible to offer very sales-light and easy to try products. PagerDuty offers a self-service free plan that can be used by a small number of engineers on the team, allowing them to try the product and decide whether they like it without needing to talk to any sales people or go through any internal procurement process. This is an important part of the company's go-to-market strategy.You can see below that PagerDuty reported 16,800 customers at the end of the quarter, an increase of 3,000 on last quarter. That is quite a bit better customer growth than last quarter and quite a bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from PagerDuty's Q1 Results

With market capitalisation of $3.51 billion PagerDuty is among smaller companies, but its more than $556.9 million in cash and positive free cash flow over the last twelve months give us confidence that PagerDuty has the resources it needs to pursue a high growth business strategy.

We were very impressed by PagerDuty’s very strong acceleration in customer growth this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. Therefore, we think PagerDuty will become more attractive to investors, compared to before these results.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.