IT incident response platform PagerDuty (NYSE:PD) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 10.1% year on year to $111.1 million. On the other hand, next quarter's revenue guidance of $111.5 million was less impressive, coming in 1.7% below analysts' estimates. It made a non-GAAP profit of $0.17 per share, improving from its loss of $0.25 per share in the same quarter last year.

PagerDuty (PD) Q4 FY2024 Highlights:

- Revenue: $111.1 million vs analyst estimates of $110.4 million (small beat)

- EPS (non-GAAP): $0.17 vs analyst estimates of $0.15 (12.6% beat)

- Revenue Guidance for Q1 2025 is $111.5 million at the midpoint, below analyst estimates of $113.4 million

- Management's revenue guidance for the upcoming financial year 2025 is $474 million at the midpoint, missing analyst estimates by 1.4% and implying 10.1% growth (vs 16.4% in FY2024)

- Gross Margin (GAAP): 81.7%, in line with the same quarter last year

- Free Cash Flow of $19.61 million, up 28.8% from the previous quarter

- Customers: 15,039, down from 15,049 in the previous quarter

- Market Capitalization: $2.15 billion

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

What started as a plan to build a bootstrapped software company, retire early and sip drinks on the beach has very quickly outgrown the wildest dreams of the three ex-Amazon founders.

The name PagerDuty comes from a software engineering practice which used to literally involve a pager on your belt that went off when the piece of the software you were responsible for broke and you were on-call to fix it, even in the middle of the night.

Today the methods of communication have changed but the principle stays the same. If a part of a website goes down, PagerDuty helps teams identify the source of the problem, alerts the engineers who are on-call to fix it, informs relevant stakeholders and provides collaborative space to work on the issue. This ensures that there is a clear accountability for incident response and that any issues are fixed fast.

The on-call incident response practice is something that pretty much every large engineering team has to establish and they either build the tools for it internally or use a third party tool like PagerDuty.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

As PagerDuty invests in gaining more market share, we expect it to come up against competition from Splunk (NASDAQ:SPLK), Dynatrace (NYSE:DT), Datadog (NASDAQ:DDOG) and Atlassian (NASDAQ:TEAM).

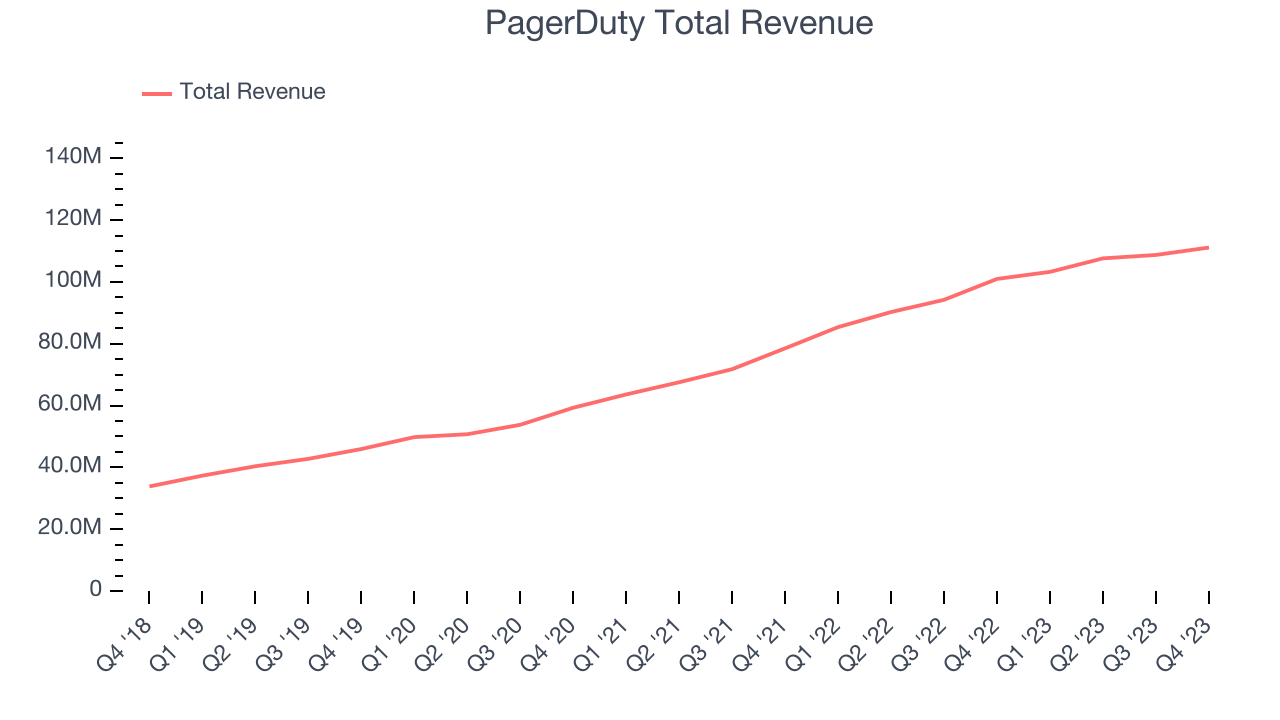

Sales Growth

As you can see below, PagerDuty's revenue growth has been strong over the last three years, growing from $59.28 million in Q4 2021 to $111.1 million this quarter.

This quarter, PagerDuty's quarterly revenue was once again up 10.1% year on year. We can see that PagerDuty's revenue increased by $2.40 million quarter on quarter, which is a solid improvement from the $1.10 million increase in Q3 2024. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that PagerDuty is expecting revenue to grow 8% year on year to $111.5 million, slowing down from the 20.9% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $474 million at the midpoint, growing 10.1% year on year compared to the 16.2% increase in FY2024.

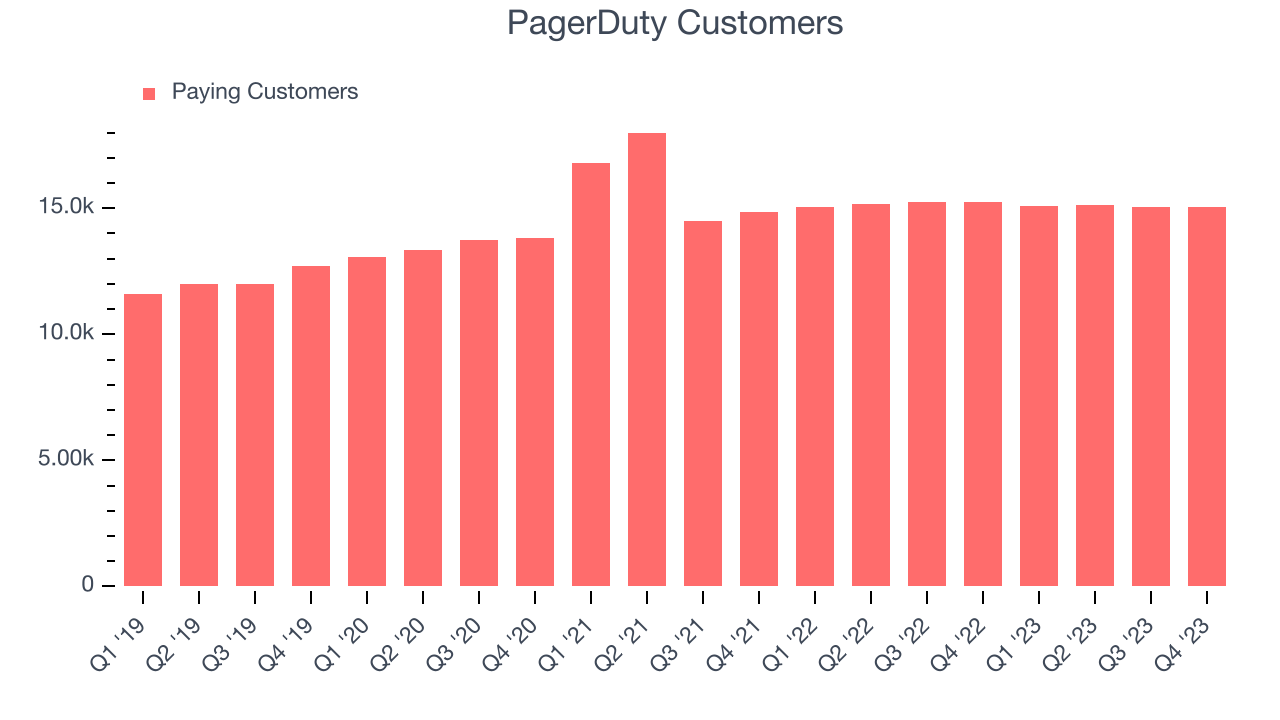

Customer Growth

PagerDuty reported 15,039 customers at the end of the quarter, a decrease of 10 from the previous quarter. That's better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that PagerDuty's go-to-market strategy is working very well.

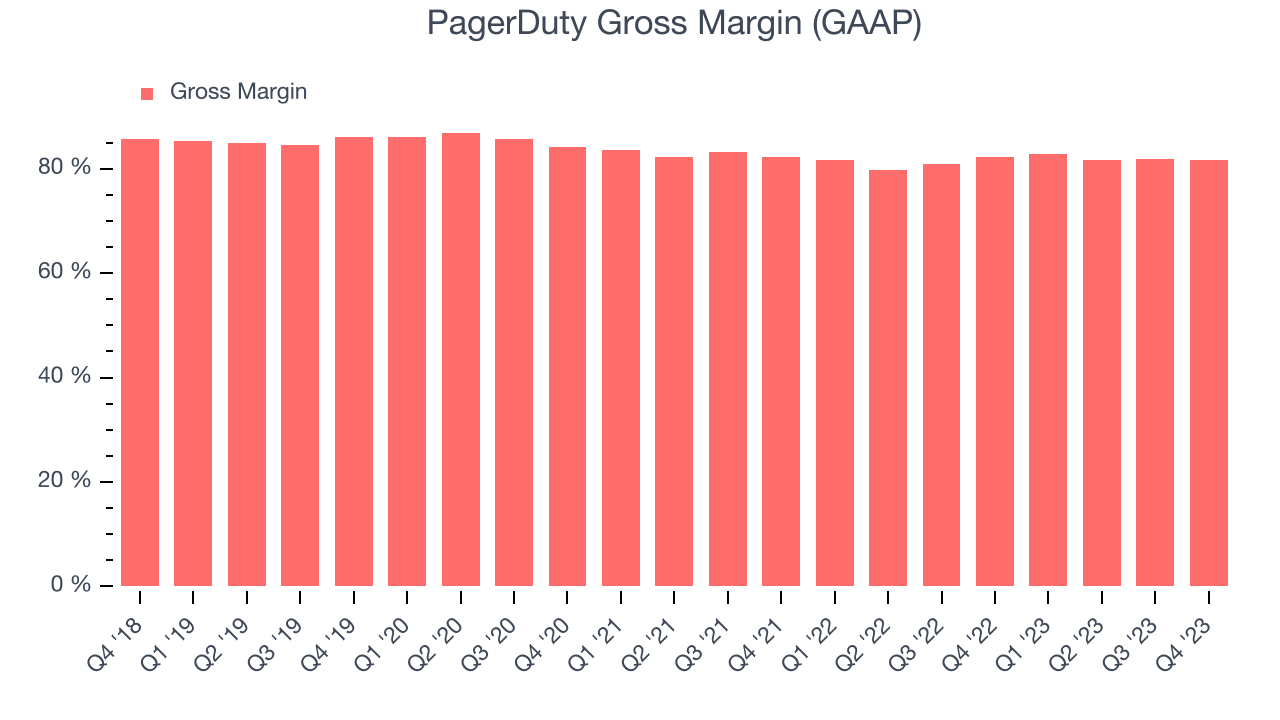

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. PagerDuty's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 81.7% in Q4.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. PagerDuty's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that PagerDuty is controlling its costs and not under pressure from its competitors to lower prices.

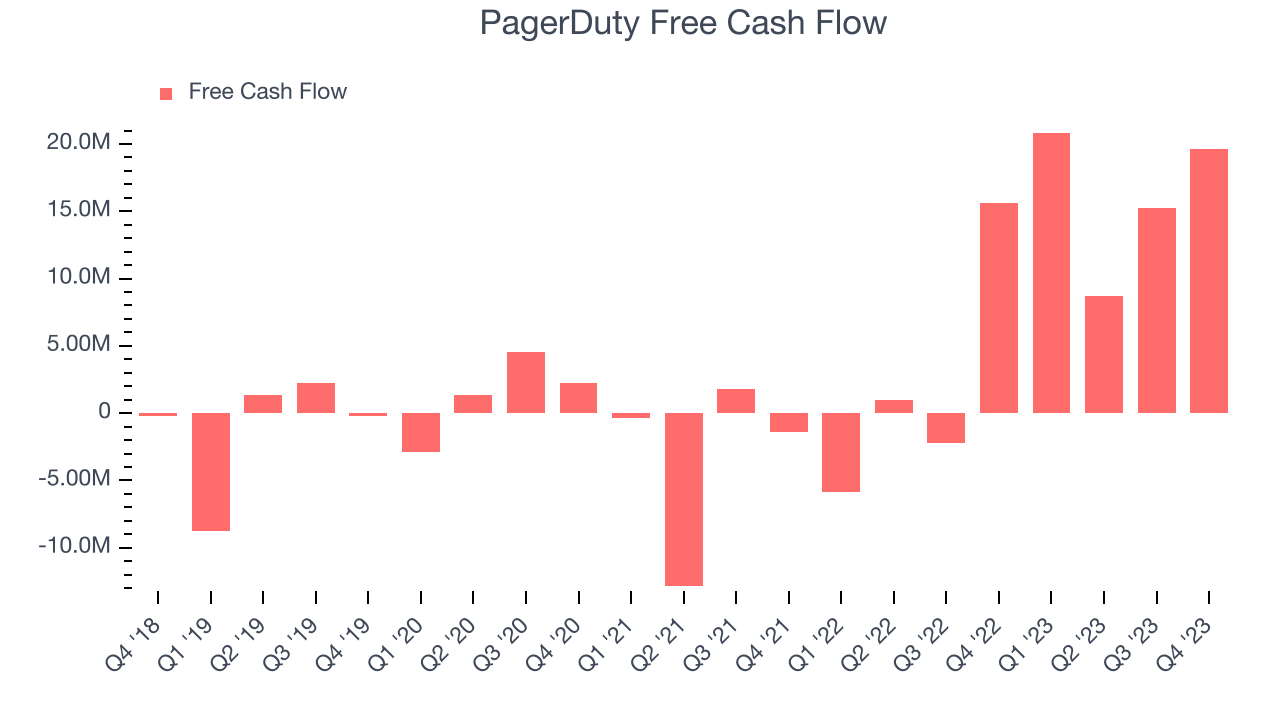

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. PagerDuty's free cash flow came in at $19.61 million in Q4, up 25.9% year on year.

PagerDuty has generated $64.43 million in free cash flow over the last 12 months, a decent 15% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from PagerDuty's Q4 Results

We were impressed by PagerDuty's strong growth in customers this quarter. On the other hand, its full-year revenue guidance was below expectations and and suggests a slowdown in demand. Overall, this was a mixed quarter for PagerDuty, with the guidance weighing on shares. The company is down 7.8% on the results and currently trades at $21.15 per share.

Is Now The Time?

When considering an investment in PagerDuty, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think PagerDuty is a solid business. We'd expect growth rates to moderate from here, but its revenue growth has been strong over the last three years. On top of that, its impressive gross margins indicate excellent business economics and its customers are increasing their spending quite quickly, suggesting they love the product.

PagerDuty's price-to-sales ratio based on the next 12 months is 4.4x, suggesting the market is expecting slower growth relative to the hottest software stocks. There are definitely things to like about PagerDuty, and there's no doubt it's a bit of a market darling, at least for some. But when comparing the company against the broader tech landscape, it seems there's a lot of good news already priced in.

Wall Street analysts covering the company had a one-year price target of $27.34 right before these results (compared to the current share price of $21.15).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.