Consumer products behemoth Proctor & Gamble (NYSE:PG) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 3.2% year on year to $21.44 billion. It made a non-GAAP profit of $1.84 per share, down from its profit of $5 per share in the same quarter last year.

Is now the time to buy Procter & Gamble? Find out by accessing our full research report, it's free.

Procter & Gamble (PG) Q2 FY2024 Highlights:

- Market Capitalization: $348.5 billion

- Revenue: $21.44 billion vs analyst estimates of $21.5 billion (small miss)

- EPS (non-GAAP): $1.84 vs analyst estimates of $1.70 (8.3% beat)

- EPS (non-GAAP) guidance: full year outlook raised to $6.40 per share, slightly above expectations

- Free Cash Flow of $4.28 billion, similar to the previous quarter

- Gross Margin (GAAP): 52.7%, up from 47.5% in the same quarter last year

- Organic Revenue was up 4% year on year (miss vs. expectations of up 4.9% year on year)

- Sales Volumes were down 1% year on year (miss vs. expectations of up 0.6% year on year)

“We delivered strong results in the second quarter, enabling us to raise our core EPS growth guidance and maintain our top-line outlook for the fiscal year,” said Jon Moeller, Chairman of the Board, President and Chief Executive Officer.

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE:PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Procter & Gamble is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

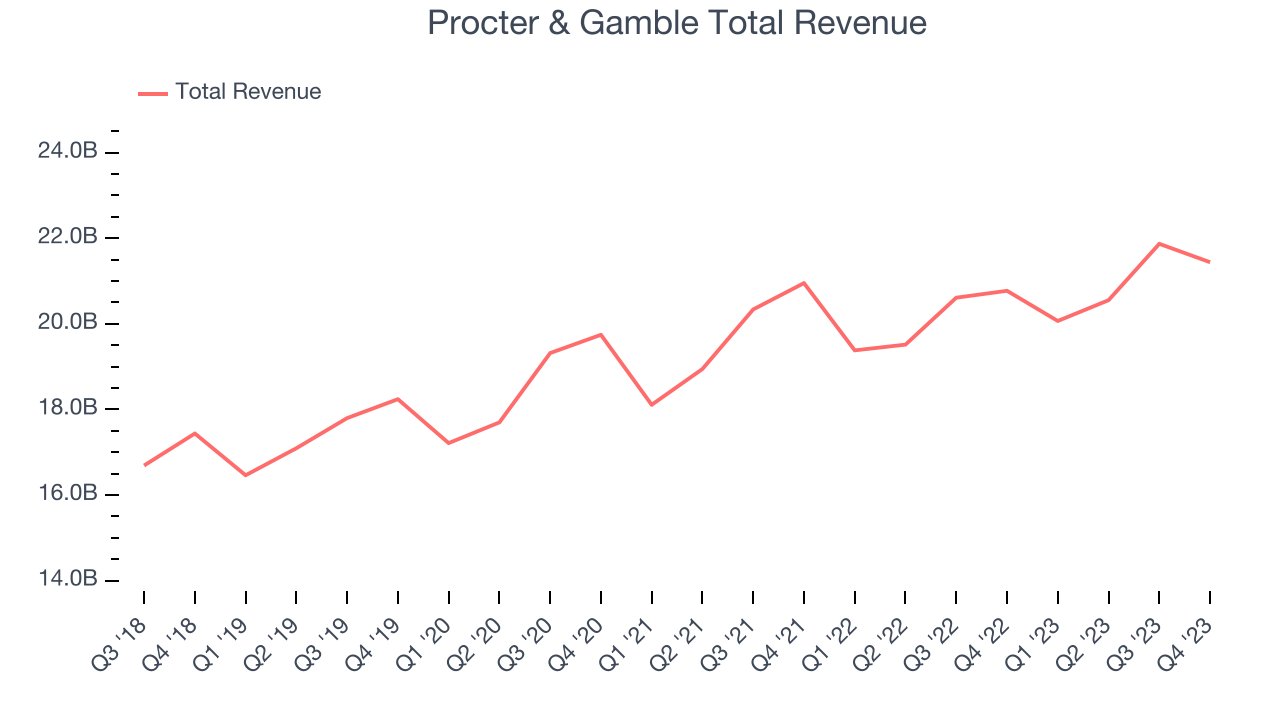

As you can see below, the company's annualized revenue growth rate of 4.3% over the last three years was mediocre as consumers bought less of its products. We'll explore what this means in the "Volume Growth" section.

This quarter, Procter & Gamble's revenue grew 3.2% year on year to $21.44 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.1% over the next 12 months, a deceleration from this quarter.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

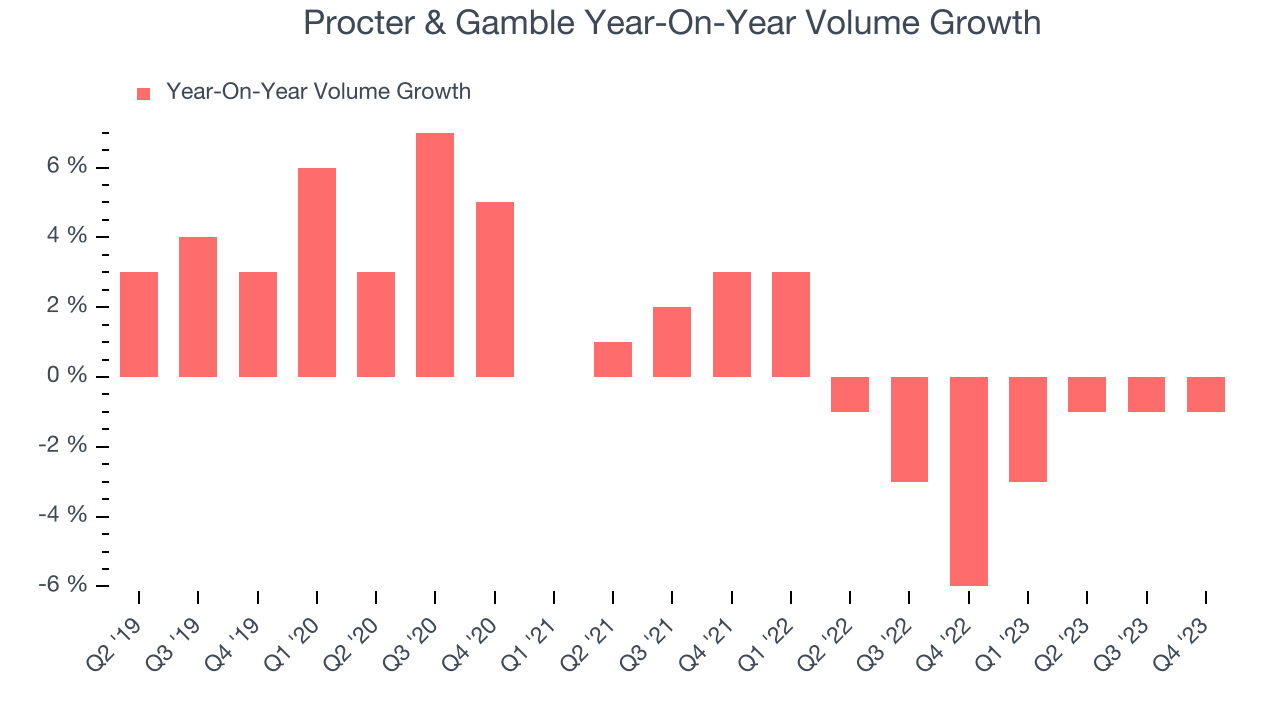

Procter & Gamble's average quarterly sales volumes have shrunk by 1.6% over the last two years. This decrease isn't ideal because the quantity demanded for consumer staples products is typically stable.

In Procter & Gamble's Q2 2024, year on year sales volumes were flat. This result was a well-appreciated turnaround from the 6% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

Key Takeaways from Procter & Gamble's Q2 Results

Volume and organic growth missed, leading to a slight revenue miss. However, EPS beat and full year guidance was raised and now stands above Consensus expectations. Overall, this was a mixed quarter for Procter & Gamble. The stock is flat after reporting and currently trades at $149.35 per share.

So should you invest in Procter & Gamble right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.