Off-Road and powersports vehicle corporation Polaris (NYSE:PII) fell short of analysts' expectations in Q1 CY2024, with revenue down 20.9% year on year to $1.74 billion. It made a GAAP profit of $0.07 per share, down from its profit of $1.95 per share in the same quarter last year.

Polaris (PII) Q1 CY2024 Highlights:

- Revenue: $1.74 billion vs analyst estimates of $1.75 billion (0.6% miss)

- EPS: $0.07 vs analyst expectations of $0.10 (29.5% miss)

- Full year guidance reiterated from previous

- Gross Margin (GAAP): 19%, down from 22.1% in the same quarter last year

- Free Cash Flow was -$177.5 million, down from $448.9 million in the previous quarter

- Market Capitalization: $4.98 billion

Founded in 1954, Polaris (NYSE:PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

Polaris was established to develop vehicles that could navigate the rugged landscapes of the Midwest. The company quickly made a name for itself with the introduction of the snowmobile, which opened up winter landscapes to new recreational possibilities.

Polaris stands at the forefront of the powersports industry, offering an extensive lineup of off-road vehicles, including ATVs, UTVs, and the Polaris RANGER®. Their motorcycles, under the Indian Motorcycle brand, and the Polaris Slingshot®, a three-wheeled roadster, complement the off-road range. While these vehicles are not for everyone, Polaris has identified its core market of adventurers and outdoor enthusiasts, who the company caters to with these unique and specialized products. These customers tend to be middle to higher income individuals who have extra disposable income to spend on a vehicle that is very unlikely to be their or their family's primary vehicle.

Polaris generates revenue through the sales of its vehicles, parts, garments, and accessories. It is supported by a network of dealerships and after-market services that not only make sales but serve a customer through the life of his/her vehicle, which deepens brand engagement. Those in search of a new Polaris vehicle or in need of services can find a dealership in many states across the US, spanning from the Northeast to the Southwest.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor sports industry include Vista Outdoor (NYSE:VSTO), Brunswick (NYSE:BC), and Malibu Boats (NASDAQ:MBUU).Sales Growth

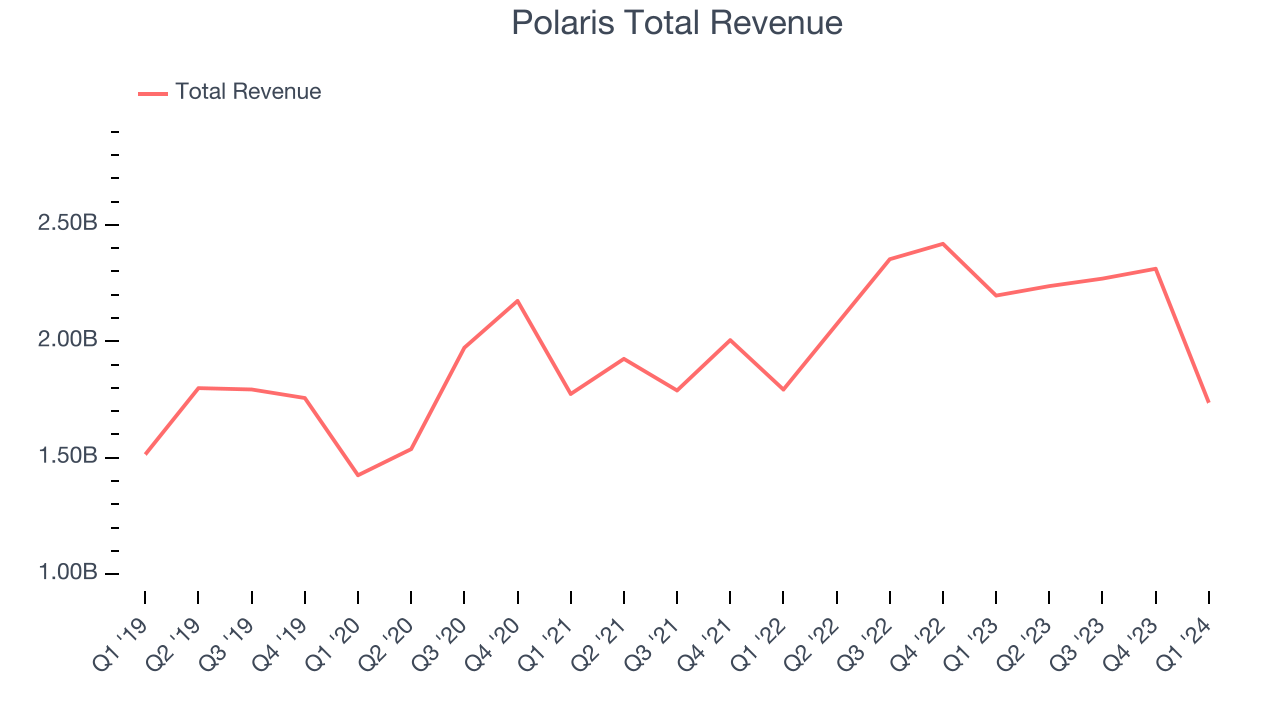

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Polaris's annualized revenue growth rate of 5.5% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Polaris's annualized revenue growth of 6.7% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Polaris missed Wall Street's estimates and reported a rather uninspiring 20.9% year-on-year revenue decline, generating $1.74 billion of revenue. Looking ahead, Wall Street expects revenue to decline 1% over the next 12 months.

Operating Margin

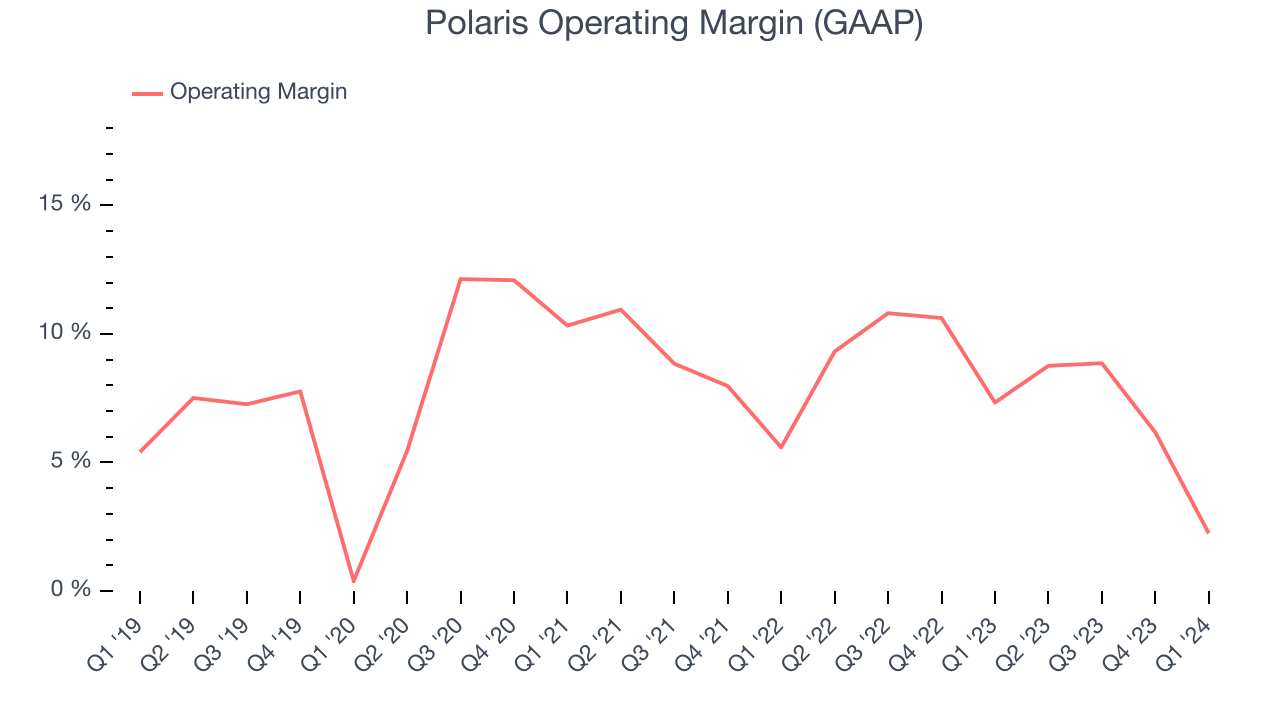

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Polaris was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8.2%.

In Q1, Polaris generated an operating profit margin of 2.2%, down 5.1 percentage points year on year.

Over the next 12 months, Wall Street expects Polaris to become more profitable. Analysts are expecting the company’s LTM operating margin of 6.8% to rise to 8.2%.EPS

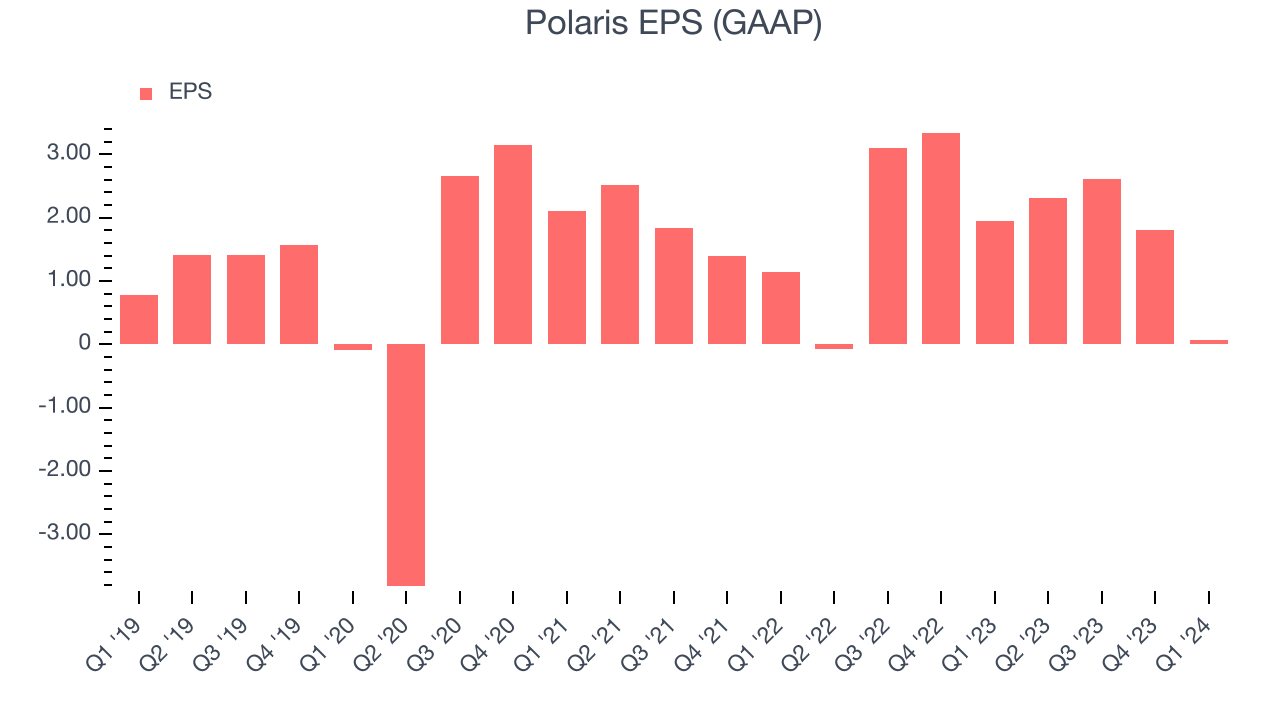

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Polaris's EPS grew 19.9%, translating into a weak 3.7% compounded annual growth rate. Furthermore, this performance is worse than its 5.5% annualized revenue growth over the same period. Let's dig into why.

Polaris's operating margin has declined 3.2 percentage points over the last five years, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS, but they don't tell us as much about a company's fundamentals.In Q1, Polaris reported EPS at $0.07, down from $1.95 in the same quarter last year. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Polaris to grow its earnings. Analysts are projecting its LTM EPS of $6.81 to climb by 22.9% to $8.37.

Cash Is King

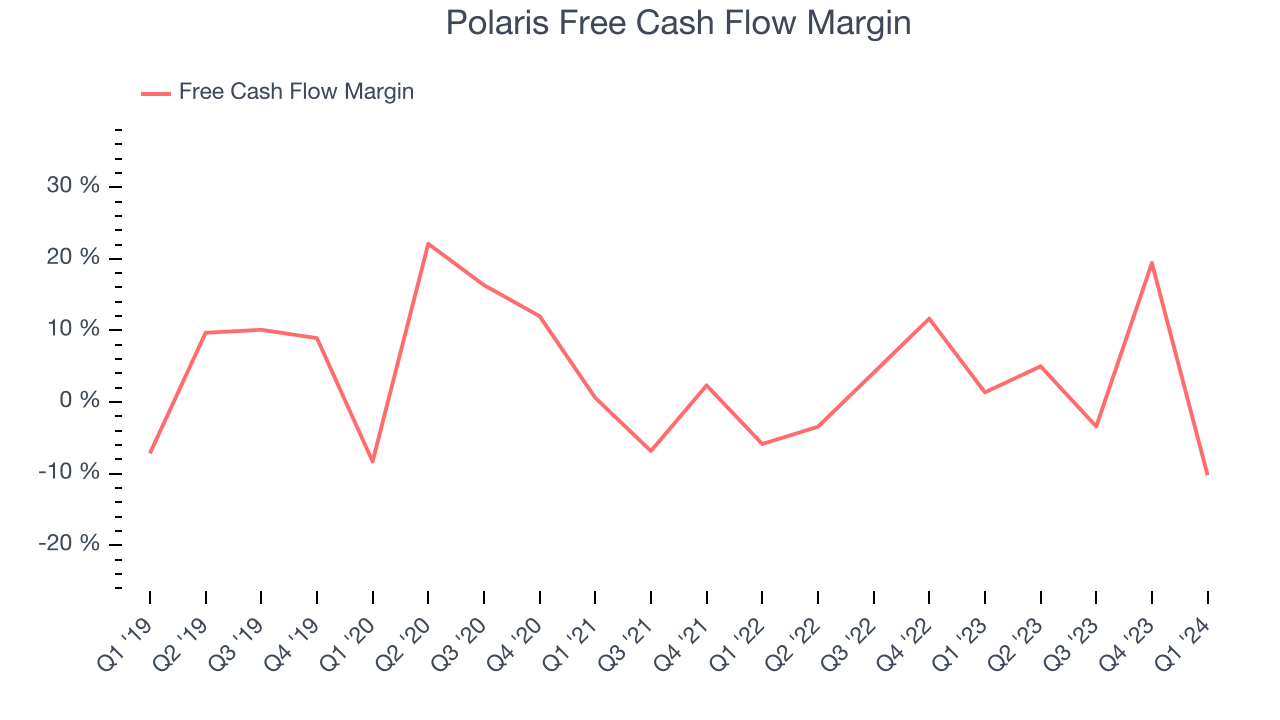

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Polaris has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.7%, subpar for a consumer discretionary business.

Polaris burned through $177.5 million of cash in Q1, equivalent to a negative 10.2% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

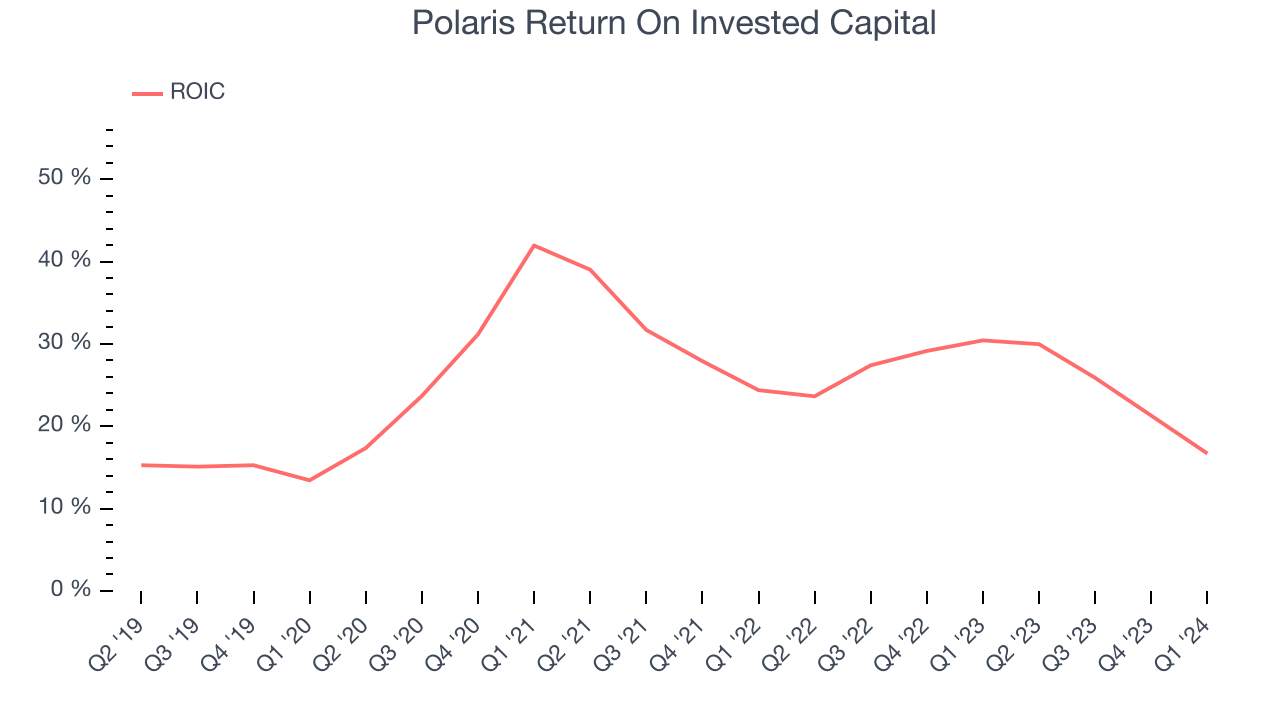

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Polaris hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 25.4%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Polaris's ROIC averaged 4.1 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Polaris's Q1 Results

Revenue and EPS missed this quarter. On a brighter note, the company reiterated its previous full year guidance. Management stated that the company "gained share in ORV, motorcycles and Marine, and the recent launches in our best-selling full-size RANGER and Indian Scout lineups reflect our strategic focus on Rider-Driven Innovation". Overall, the results could have been better. The company is down 2.3% on the results and currently trades at $86.21 per share.

Is Now The Time?

When considering an investment in Polaris, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Polaris, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years, and analysts expect growth to deteriorate from here. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its low free cash flow margins give it little breathing room. On top of that, its EPS growth over the last five years has been subpar.

Polaris's price-to-earnings ratio based on the next 12 months is 10.3x. While there are some things to like about Polaris and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $103.44 per share right before these results (compared to the current share price of $86.21).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.