Social commerce platform Pinterest (NYSE: PINS) reported results ahead of analysts' expectations in Q3 FY2023, with revenue up 11.5% year on year to $763.2 million. Turning to EPS, Pinterest made a non-GAAP profit of $0.28 per share, improving from its profit of $0.11 per share in the same quarter last year.

Is now the time to buy Pinterest? Find out by accessing our full research report, it's free.

Pinterest (PINS) Q3 FY2023 Highlights:

- Revenue: $763.2 million vs analyst estimates of $743.3 million (2.67% beat)

- EPS (non-GAAP): $0.28 vs analyst estimates of $0.20 (40.4% beat)

- Free Cash Flow of $107.5 million, up 73.7% from the previous quarter

- Gross Margin (GAAP): 77.6%, up from 73.3% in the same quarter last year

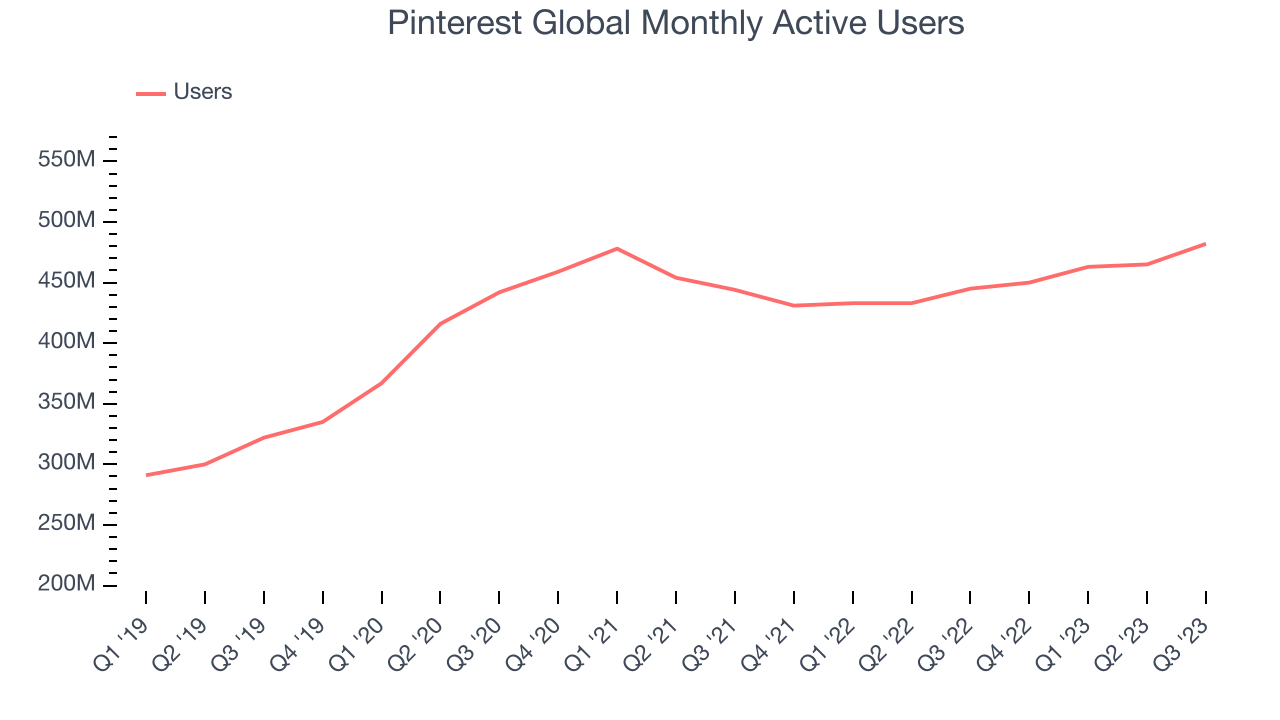

- Global Monthly Active Users: 482 million, up 37 million year on year

“We are driving strong revenue performance, robust global MAU growth, and substantial margin expansion. As we lean into Pinterest’s unique differentiators as a visual search, discovery, and shopping platform, we’re finding our best product market fit in years. Our users are engaging deeply and we’re delivering better results for advertisers through improved measurement and innovation across the full funnel. We’re making significant progress and are continuing to execute on the opportunity ahead,” said Bill Ready, CEO of Pinterest.

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

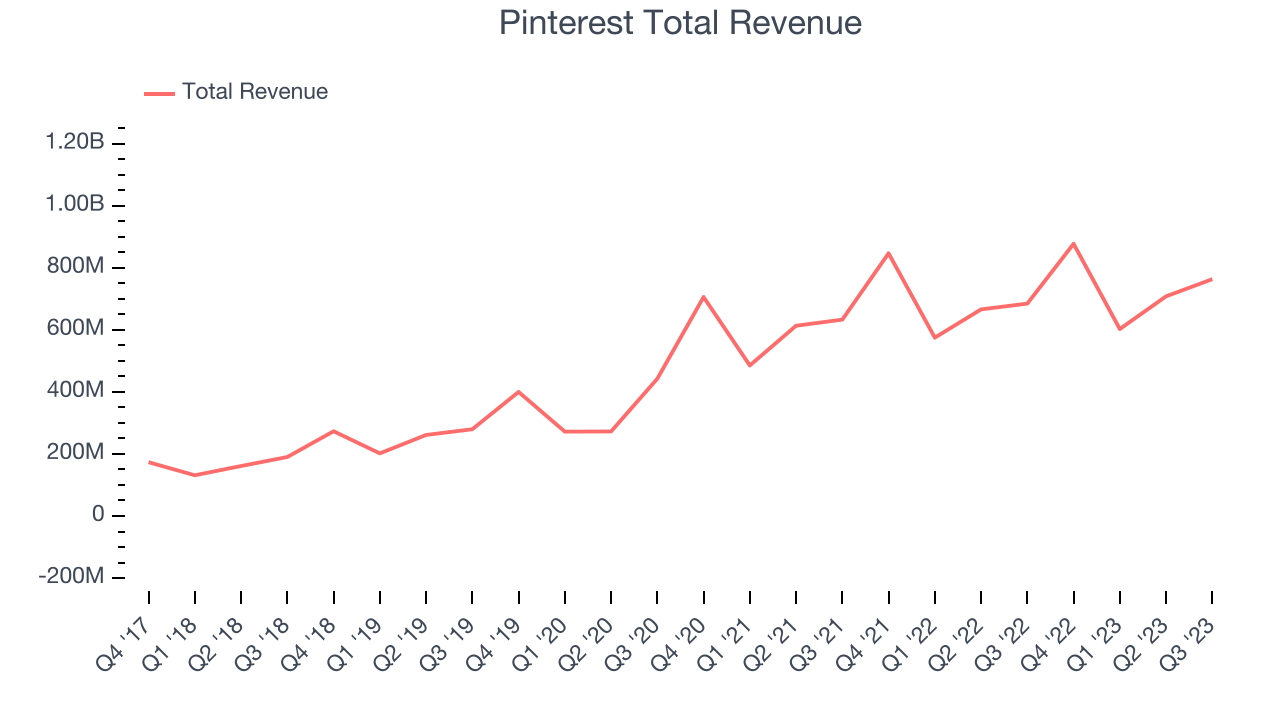

Sales Growth

Pinterest's revenue growth over the last three years has been very strong, averaging 33.7% annually. This quarter, Pinterest beat analysts' estimates but reported mediocre 11.5% year-on-year revenue growth.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 13.5% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Usage Growth

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Pinterest's monthly active users, a key performance metric for the company, grew 0.89% annually to 482 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q3, Pinterest added 37 million monthly active users, translating into 8.31% year-on-year growth.

Key Takeaways from Pinterest's Q3 Results

Sporting a market capitalization of $16.3 billion, more than $2.33 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Pinterest is attractively positioned to invest in growth.

It was great to see Pinterest beat analysts' revenue expectations this quarter, driven by better-than-expected growth in monthly active users. Its adjusted EBITDA and EPS also topped estimates. Zooming out, we think this was a good quarter, showing that the company is staying on track. The stock is up 7.78% after reporting and currently trades at $27.02 per share.

So should you invest in Pinterest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.