Social commerce platform Pinterest (NYSE: PINS) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 22.8% year on year to $740 million. Guidance for next quarter's revenue was also better than expected at $842.5 million at the midpoint, 1.9% above analysts' estimates. It made a non-GAAP profit of $0.20 per share, improving from its profit of $0.09 per share in the same quarter last year.

Is now the time to buy Pinterest? Find out by accessing our full research report, it's free.

Pinterest (PINS) Q1 CY2024 Highlights:

- Revenue: $740 million vs analyst estimates of $700.1 million (5.7% beat)

- EPS (non-GAAP): $0.20 vs analyst estimates of $0.13 (48.8% beat)

- Revenue Guidance for Q2 CY2024 is $842.5 million at the midpoint, above analyst estimates of $827.1 million (implied operating profit also well ahead of expectations)

- Gross Margin (GAAP): 75.5%, up from 71.6% in the same quarter last year

- Free Cash Flow of $344 million, up 35.4% from the previous quarter

- Monthly Active Users: 518 million, up 55 million year on year

- Market Capitalization: $23.06 billion

“Q1 was a milestone quarter for Pinterest as we reached new highs: surpassing half a billion monthly active users and reporting 23% revenue growth – our fastest user and revenue growth since 2021,” said Bill Ready, CEO of Pinterest.

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

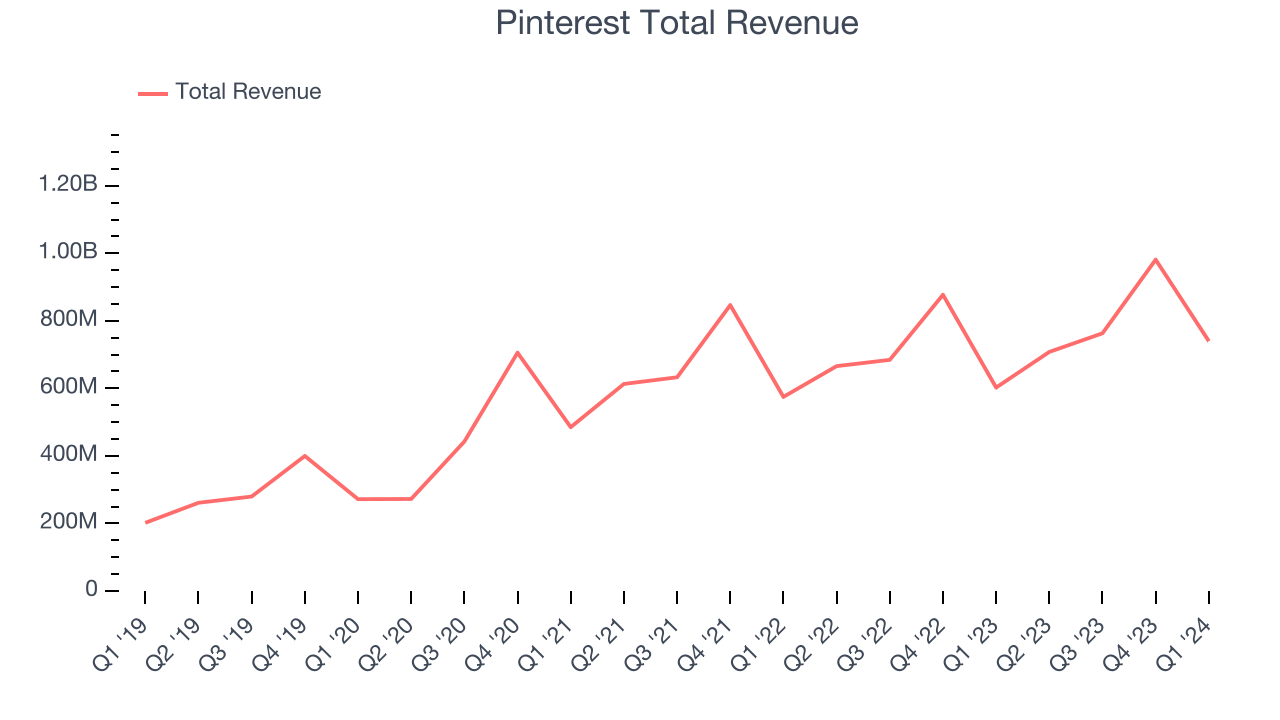

Sales Growth

Pinterest's revenue growth over the last three years has been strong, averaging 23.7% annually. This quarter, Pinterest beat analysts' estimates and reported decent 22.8% year-on-year revenue growth.

Guidance for the next quarter indicates Pinterest is expecting revenue to grow 19% year on year to $842.5 million, improving from the 6.3% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 15.7% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Usage Growth

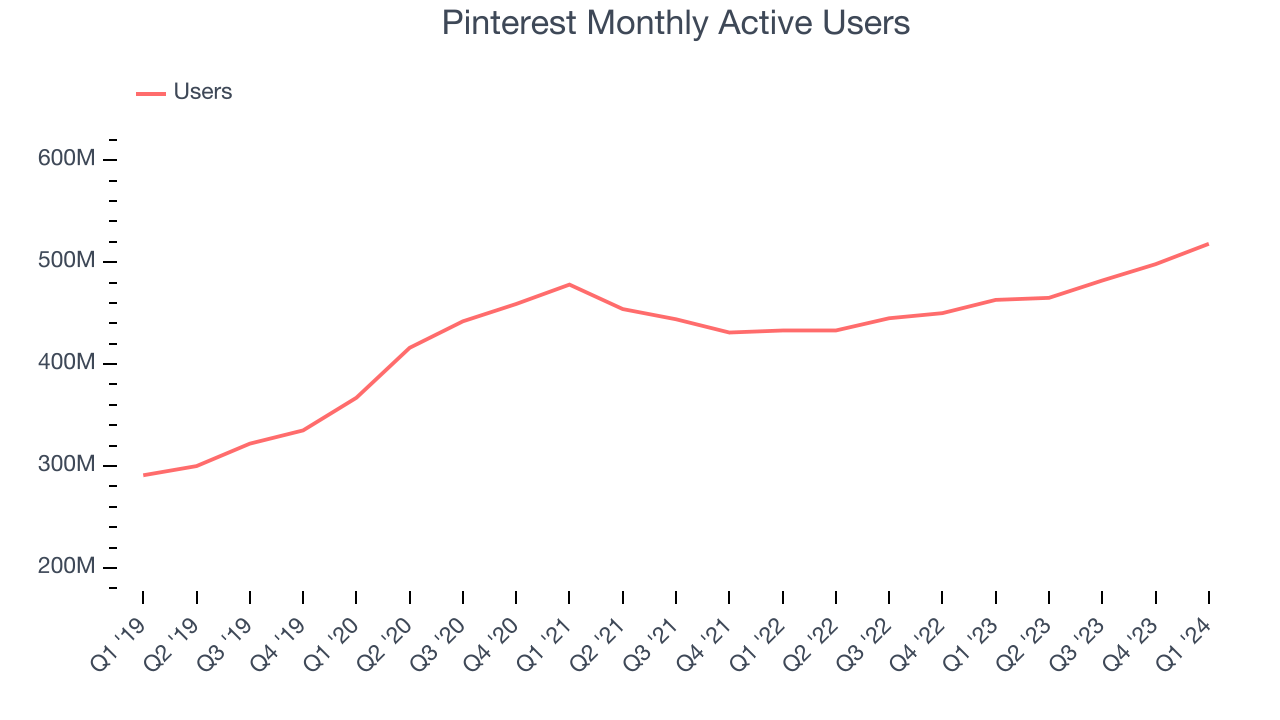

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Pinterest's monthly active users, a key performance metric for the company, grew 5.6% annually to 518 million. This is average growth for a consumer internet company.

In Q1, Pinterest added 55 million monthly active users, translating into 11.9% year-on-year growth.

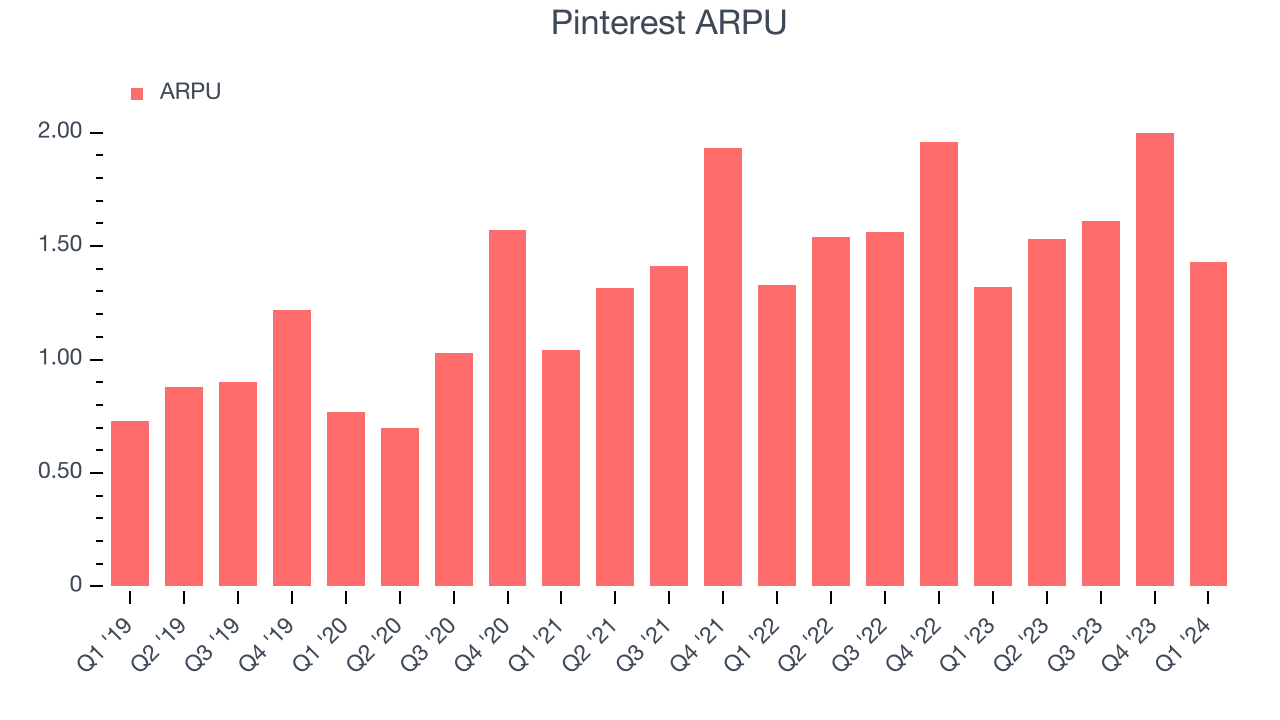

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Pinterest because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Pinterest's audience and its ad-targeting capabilities.

Pinterest's ARPU growth has been decent over the last two years, averaging 5.2%. The company's ability to increase prices while growing its monthly active users demonstrates the value of its platform. This quarter, ARPU grew 8.2% year on year to $1.43 per user.

Key Takeaways from Pinterest's Q1 Results

We enjoyed seeing Pinterest exceed analysts' revenue expectations this quarter on higher-than-expected MAUs (monthly active users). We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. The big bright spot was actually next quarter's implied operating profit guidance--while Wall Street was expecting a loss, the company guided to a nice profit instead. Overall, we think this was a really good quarter that should please shareholders. The stock is up 22.5% after reporting and currently trades at $40.99 per share.

Pinterest may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.