The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the consumer internet stocks have fared in Q3, starting with Pinterest (NYSE:PINS).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.41%, while on average next quarter revenue guidance was 3.9% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again, but consumer internet stocks held their ground better than others, with share prices down 3.25% since the previous earnings results, on average.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

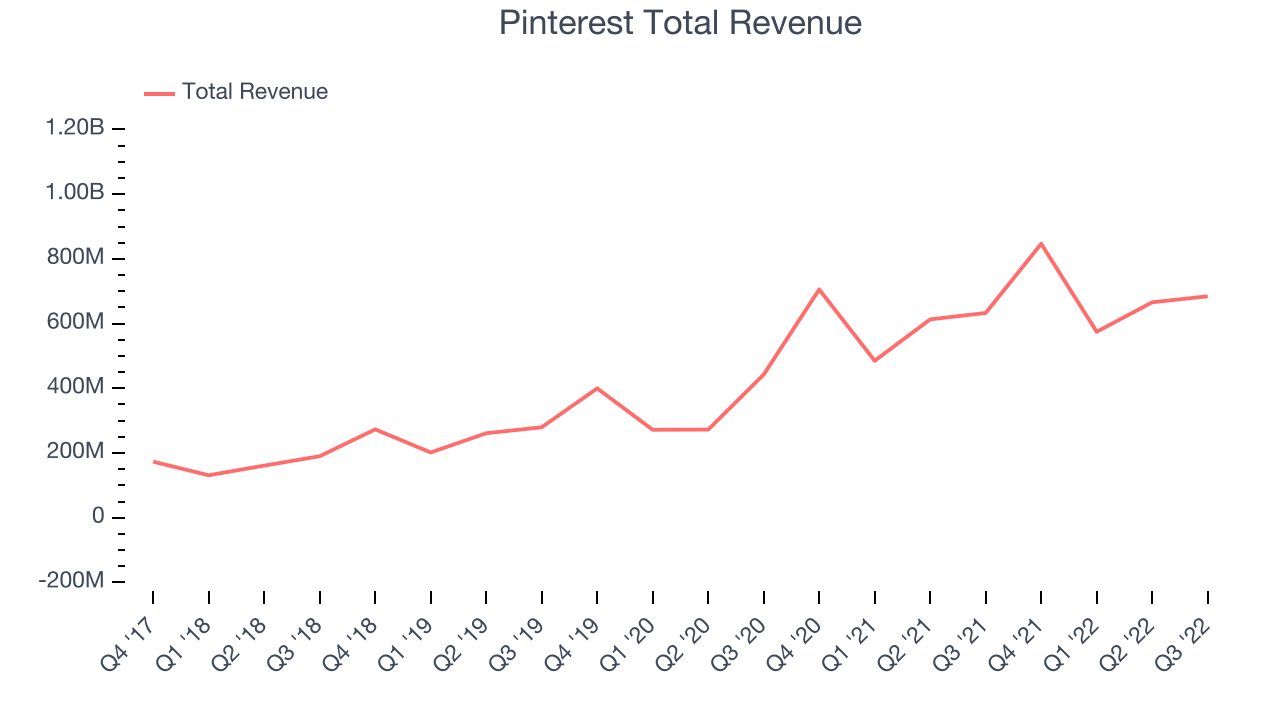

Pinterest reported revenues of $684.5 million, up 8.15% year on year, beating analyst expectations by 2.68%. It was a mixed quarter for the company, with a decent beat of analyst estimates but slow revenue growth.

“I’m proud of the solid results our team delivered in Q3, growing revenue 8% year over year, 10% on a constant currency basis, and returning to user growth,” said Bill Ready, CEO, Pinterest.

The company reported 445 million monthly active users, up 8.15% year on year. The stock is up 8.31% since the results and currently trades at $23.71.

Is now the time to buy Pinterest? Access our full analysis of the earnings results here, it's free.

Best Q3: Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

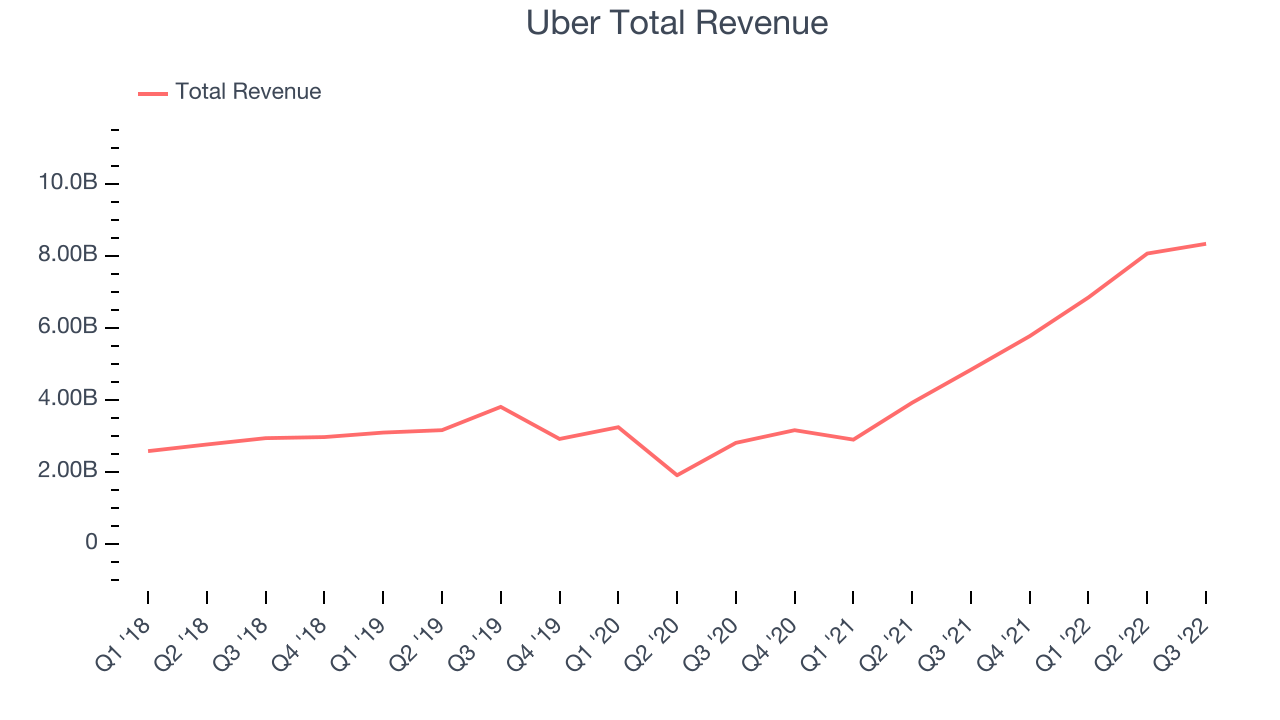

Uber reported revenues of $8.34 billion, up 72.1% year on year, beating analyst expectations by 3.52%. It was a very strong quarter for the company, with exceptional revenue growth and a decent beat of analyst estimates.

Uber delivered the fastest revenue growth among its peers. The company reported 124 million paying users, up 13.7% year on year. The stock is down 3.61% since the results and currently trades at $25.62.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $460.2 million, down 33.2% year on year, missing analyst expectations by 2.66%. It was a weak quarter for the company, with declining number of users and revenue.

Overstock had declining revenue in the group. The company reported 5.8 million active buyers, down 33.3% year on year. The stock is down 30% since the results and currently trades at $17.93.

Read our full analysis of Overstock's results here.

Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $498 million, up 7.9% year on year, missing analyst expectations by 0.66%. It was a weak quarter for the company, with declining number of users and a miss of the top line analyst estimates.

The company reported 7.78 million service requests, down 10.6% year on year. The stock is up 30% since the results and currently trades at $2.49.

Read our full, actionable report on Angi here, it's free.

Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $3.61 billion, up 22.1% year on year, in line with analyst expectations. Despite the stock dropping on the results, it was a solid quarter for the company, with growing number of users.

The company reported 93.2 million nights booked, up 19.7% year on year. The stock is up 6.15% since the results and currently trades at $93.01.

Read our full, actionable report on Expedia here, it's free.

The author has no position in any of the stocks mentioned