Financial planning software company Anaplan (NYSE:PLAN) beat analyst expectations in Q1 FY2022 quarter, with revenue up 25% year on year to $129.8 million. Anaplan made a GAAP loss of $51.4 million, down on its loss of $39.6 million, in the same quarter last year.

What do these results signal for the future of Anaplan? Get early access our full analysis here

Anaplan (NYSE:PLAN) Q1 FY2022 Highlights:

- Revenue: $129.8 million vs analyst estimates of $127 million (2.16% beat)

- EPS (non-GAAP): -$0.10 vs analyst estimates of -$0.09

- Revenue guidance for Q2 2022 is $134 million at the midpoint, above analyst estimates of $132.4 million

- The company reconfirmed revenue guidance for the full year, at $557.5 million at the midpoint

- Free cash flow of $7.61 million, roughly flat from previous quarter

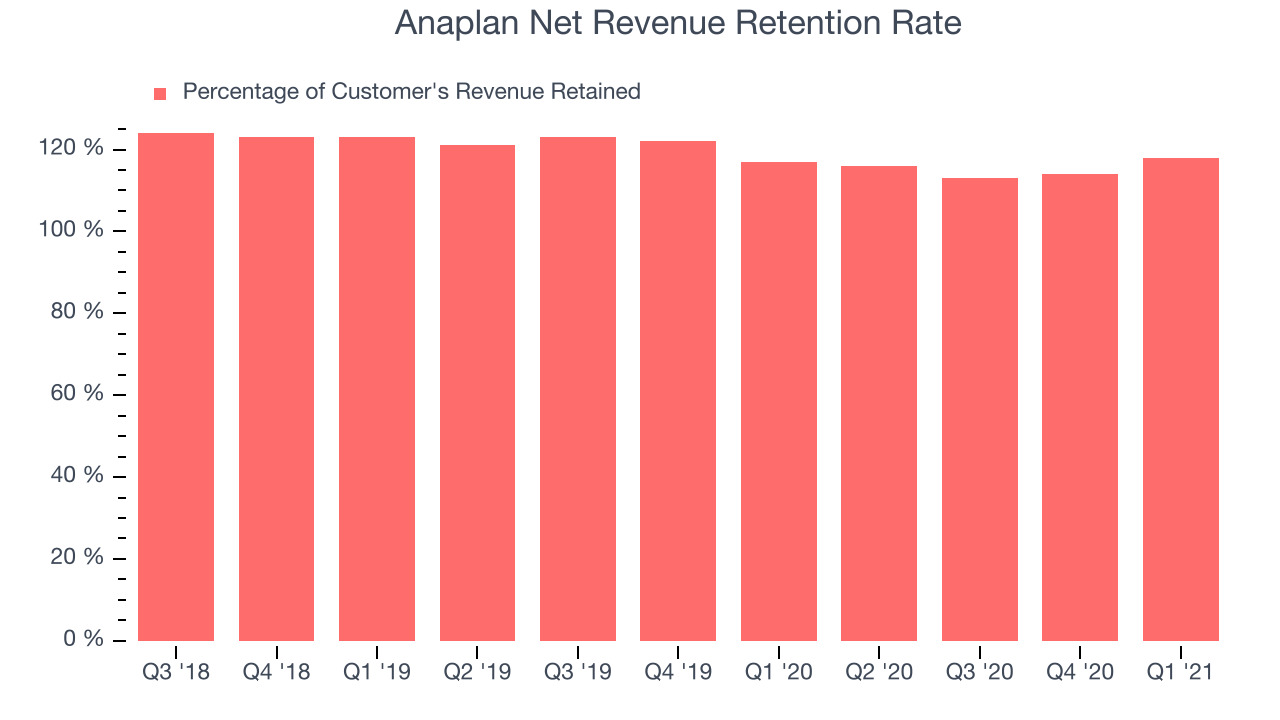

- Net Revenue Retention Rate: 118%, up from 114% previous quarter

- Gross Margin (GAAP): 74.7%, in line with previous quarter

- Updated valuation: Anaplan is down slightly at $56.25 and now trades at 17.4x price-to-sales (LTM), compared to 18.2x just before the results.

“We started our fiscal year with a solid first quarter as we are seeing the need for enterprise-wide planning increase globally,” said Frank Calderoni, chief executive officer of Anaplan.

The Plan Is to Have a Plan

Anaplan's (NYSE:PLAN) software helps large enterprises with complex decision-making around budgets, financial forecasts, managing supply chains, sales planning, financial reporting or a combination of those and its customers range from heavy industry like airlines to other innovative software companies. While it has plenty of competition, there is a growing market for centralised finance reporting and planning capabilities, as many organisations still use siloed legacy systems that don't automatically update. The Anaplan platform stores all the information in the cloud and enables thousands of concurrent users to access a centralized single source of truth for their data.

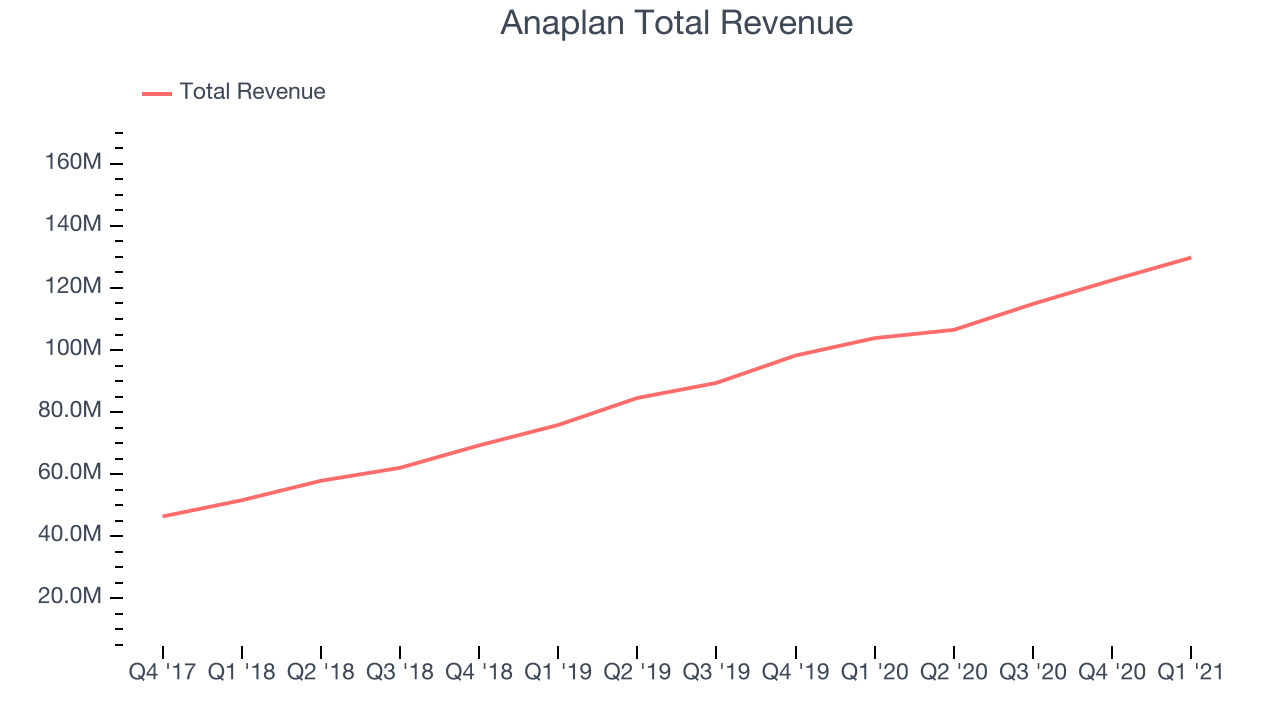

As you can see below, Anaplan's revenue growth has been very strong over the last twelve months, growing from $103.8 million to $129.8 million.

This quarter, Anaplan's quarterly revenue was once again up a very solid 25% year on year. Quarter on quarter the revenue increased by $7.3 million in Q1, which was in line with Q4 2021. This steady quarter-on-quarter growth shows the company is able to maintain its steady growth trajectory.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Land and Expand

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Anaplan focuses on a “land and expand” go-to-market strategy and often starts with a line of business or corporate function, then expands. Once a cloud product like Anaplan gets adopted by a company and becomes part of their processes it is hard go back to Excel or some other legacy on-premise competitor.

Anaplan's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 118% in Q1. That means even if they didn't win any new customers, Anaplan would have grown its revenue 18% year on year. Significantly up from the last quarter, this a good retention rate and a proof that Anaplan's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Anaplan's Q1 Results

With market capitalisation of $8.23 billion Anaplan is among smaller companies, but its more than $327.5 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We enjoyed seeing Anaplan’s improve their revenue retention rate materially this quarter. And we were also excited to see it that it outperformed analysts' revenue expectations. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think Anaplan will look more attractive to growth investors after these results.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.