Financial planning software company Anaplan (NYSE:PLAN) reported results ahead of analyst expectations in the Q1 FY2023 quarter, with revenue up 30.2% year on year to $169.1 million. Anaplan made a GAAP loss of $57.8 million, down on its loss of $51.4 million, in the same quarter last year.

Anaplan (PLAN) Q1 FY2023 Highlights:

- Revenue: $169.1 million (2.34% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.08

- Free cash flow of $9.86 million, up from negative free cash flow of $21.9 million in previous quarter

- Gross Margin (GAAP): 72.4%, down from 74.7% same quarter last year

- Due to pending acquisition by Thoma Bravo Anaplan will not be holding a conference call or live webcast to discuss first quarter of fiscal year 2023 financial results. In addition, the it will not be providing financial guidance for the second quarter of fiscal year 2023 and is suspending its financial guidance for the full fiscal year 2023.

Founded by Michael Gould in 2006 in a stone barn in Yorkshire, England, Anaplan (NYSE:PLAN) is a financial modelling software that helps large enterprises with complex decision-making around budgets and financial forecasts.

Financial modelling for large companies is unsurprisingly very complex and many organisations still use siloed legacy systems that do not automatically update, and struggle with version control. The Anaplan platform stores all the information in the cloud and enables thousands of concurrent users to access a centralized single source of truth for their data, for anything from modelling to managing supply chains, sales planning, financial reporting or a combination of those.

Anaplan has experienced a lot of success due to its robust integration with other software platforms such as Salesforce.com and its customers range from heavy industries like airlines or food manufacturers to other software companies.

For example, a global foods company was using a mix of hundreds of large spreadsheets and legacy tools to manage their supply chain process and financial planning, and even simple scenarios required up to six hours to run. Adjusting plans to react to demand changes took a full week of reworks and to save time they were using averages and approximations, which led to misalignment in the inventory management and as a result excess inventories and lost sales opportunities. With Anaplan, they are able to collect precise data from across the organization in real time and running a planning scenario now takes less than five minutes.

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

Anaplan faces competition from companies like Oracle (NYSE:ORCL), SAP (NYSE:SAP), IBM (NYSE:IBM), and Workday (NASDAQ:WDAY).

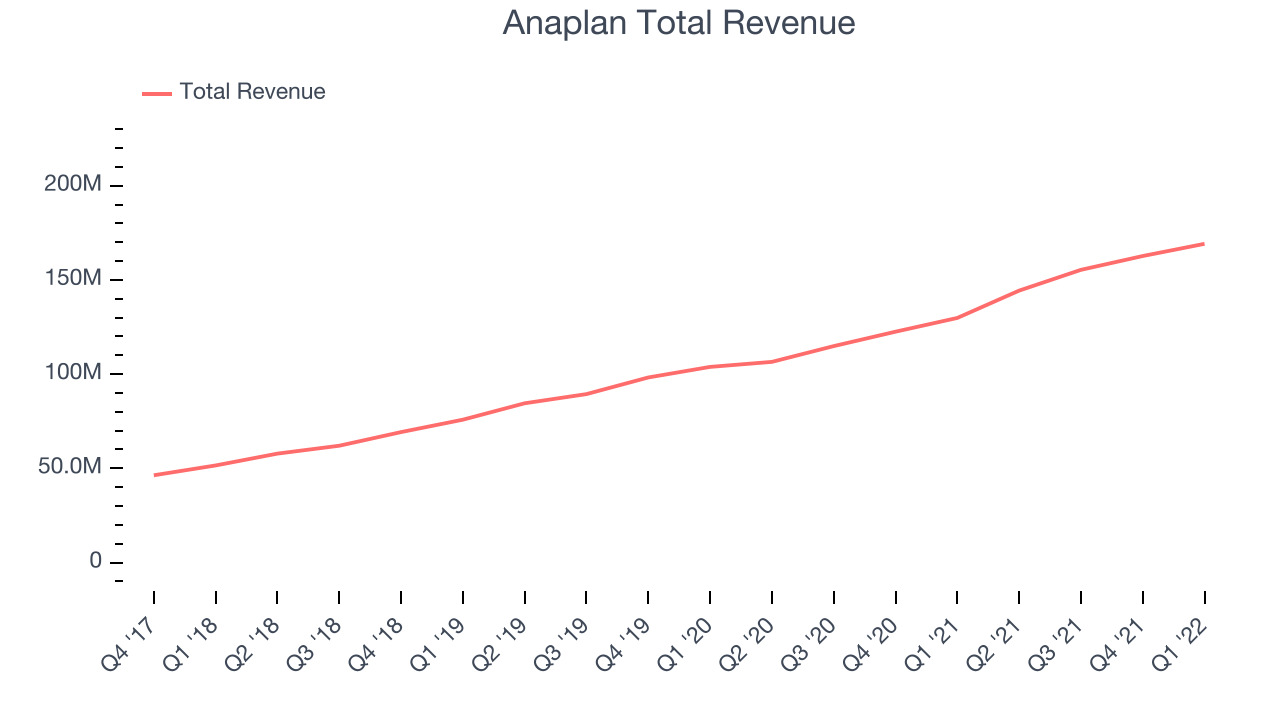

Sales Growth

As you can see below, Anaplan's revenue growth has been very strong over the last year, growing from quarterly revenue of $129.8 million, to $169.1 million.

And unsurprisingly, this was another great quarter for Anaplan with revenue up 30.2% year on year. But the growth did slow down a little compared to last quarter, as Anaplan increased revenue by $6.48 million in Q1, compared to $7.33 million revenue add in Q4 2022. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 24.9% over the next twelve months.

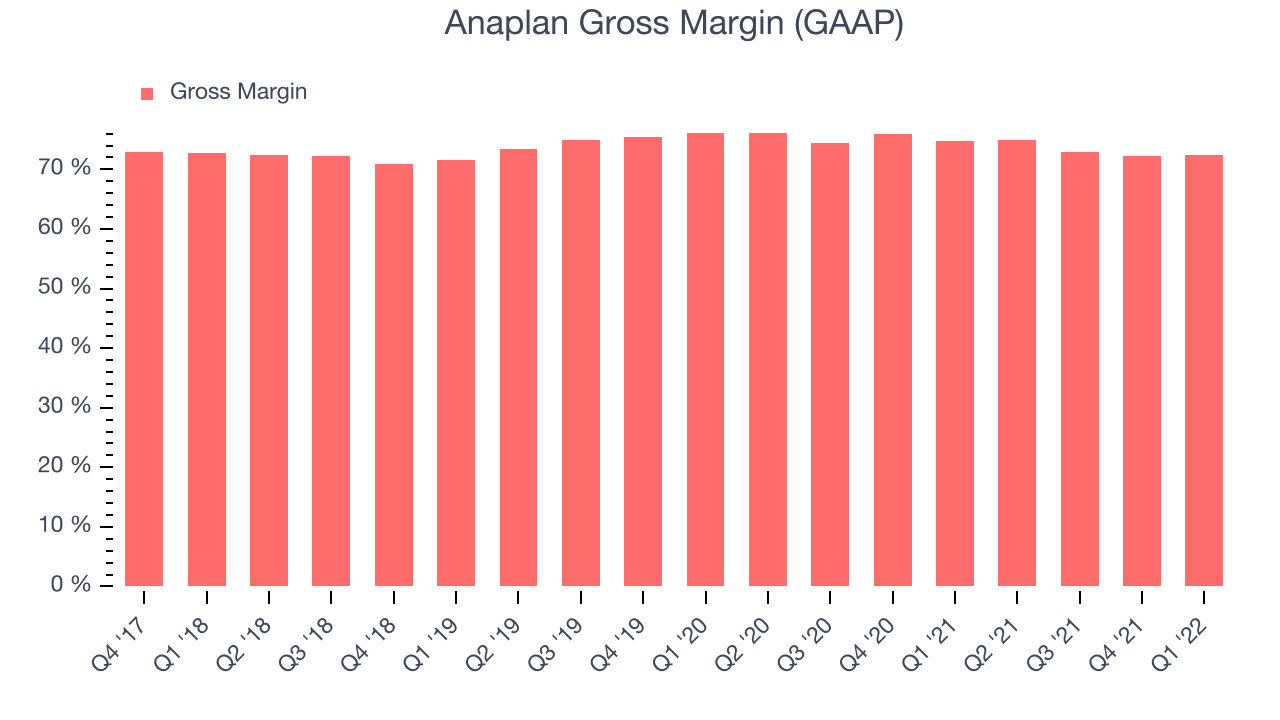

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Anaplan's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 72.4% in Q1.

That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, marketing & sales and the general administrative overhead. Despite it going down over the last year, this is still around the lower average of what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market so it is important to track.

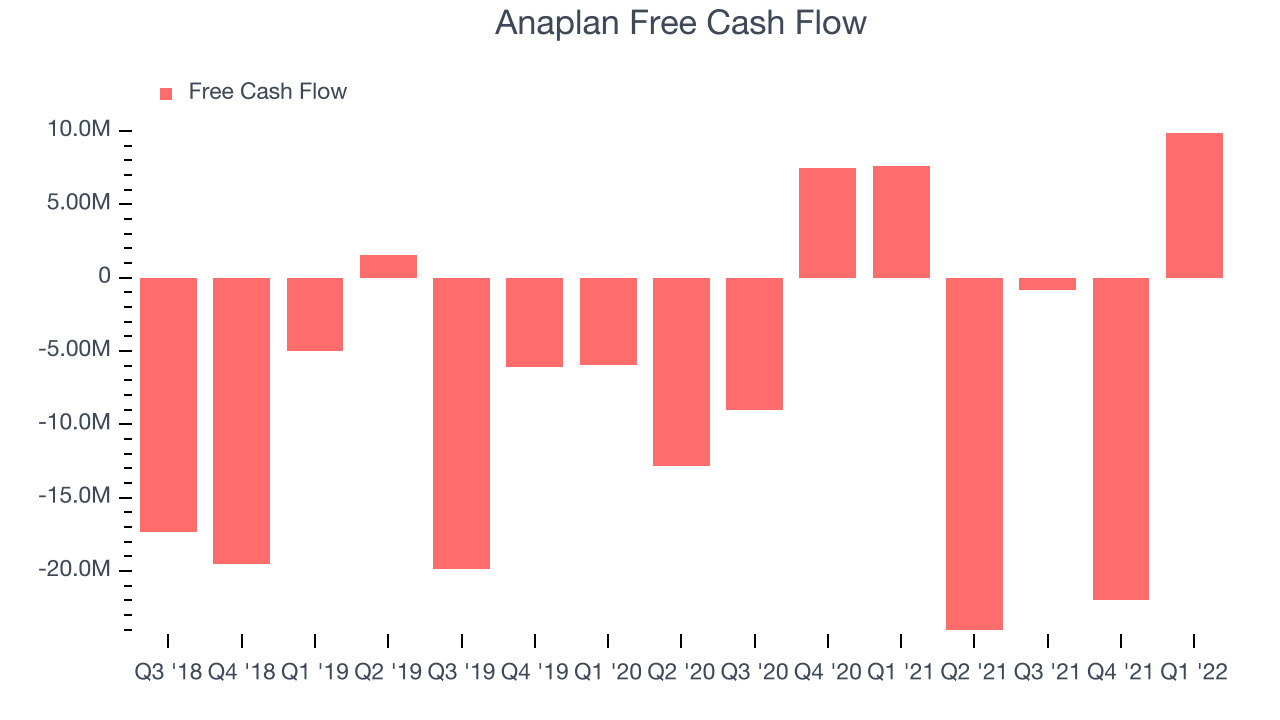

Cash Is King

If you follow StockStory for a while, you know that we put an emphasis on cash flow. Why, you ask? We believe that in the end cash is king, as you can't use accounting profits to pay the bills. Anaplan's free cash flow came in at $9.86 million in Q1, up 29.5% year on year.

Anaplan has burned through $36.9 million in cash over the last twelve months, resulting in a negative 5.85% free cash flow margin. This below average FCF margin is a result of Anaplan's need to invest in the business to continue penetrating its market.

Key Takeaways from Anaplan's Q1 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Anaplan’s balance sheet, but we note that with a market capitalization of $9.79 billion and more than $304 million in cash, the company has the capacity to continue to prioritise growth over profitability.

It was good to see Anaplan deliver strong revenue growth this quarter. And we were also excited to see that it outperformed analysts' revenue expectations. Overall, this quarter's results seemed pretty positive. The company is flat on the results due to the pending acquisition and currently trades at $65.54 per share.

Is Now The Time?

When considering Anaplan, investors should take into account its valuation and business qualities, as well as what happened in the latest quarter. Although Anaplan is not a bad business, it probably wouldn't be one of our picks. Its revenue growth has been strong. But while its customers are increasing their spending quite quickly, suggesting that they love the product, the downside is that its customer acquisition is less efficient than many comparable companies and its cash burn raises the question if it can sustainably maintain its growth.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds from the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.