Inclusive gym franchise company (NYSE:PLNT) reported Q2 CY2024 results topping analysts' expectations, with revenue up 5.1% year on year to $300.9 million. It made a non-GAAP profit of $0.71 per share, improving from its profit of $0.46 per share in the same quarter last year.

Is now the time to buy Planet Fitness? Find out by accessing our full research report, it's free.

Planet Fitness (PLNT) Q2 CY2024 Highlights:

- $280 million Accelerated Share Repurchase in second quarter

- Revenue: $300.9 million vs analyst estimates of $290.7 million (3.5% beat)

- EPS (non-GAAP): $0.71 vs analyst estimates of $0.66 (7.7% beat)

- Gross Margin (GAAP): 59.4%, up from 58.7% in the same quarter last year

- Adjusted EBITDA Margin: 42.4%, in line with the same quarter last year

- Free Cash Flow of $40.18 million, down 36.6% from the previous quarter

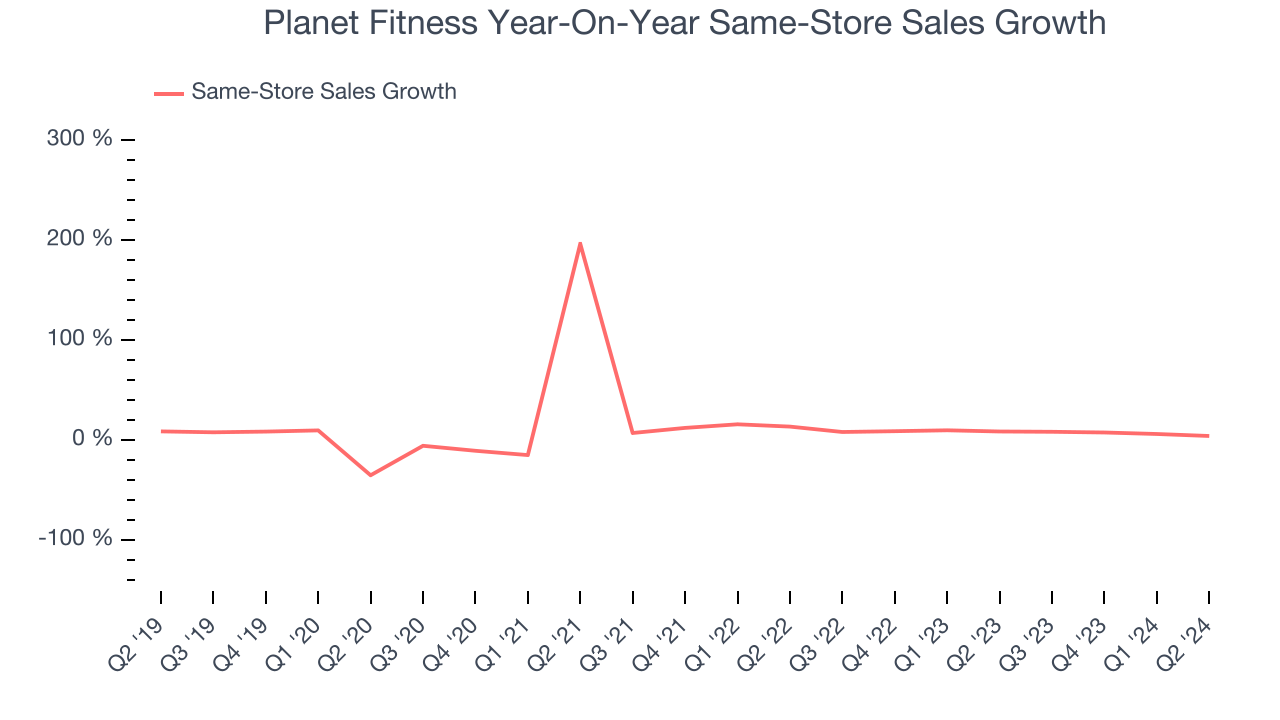

- Same-Store Sales rose 4.2% year on year (8.7% in the same quarter last year)

- Market Capitalization: $6.30 billion

"Since I stepped into the CEO role in June, I have become even more confident and excited about my decision to join such an iconic brand, supported by a strong foundation and team, a solid base of approximately 100 franchisees, and approximately 19.7 million members," said Colleen Keating, Chief Executive Officer.

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

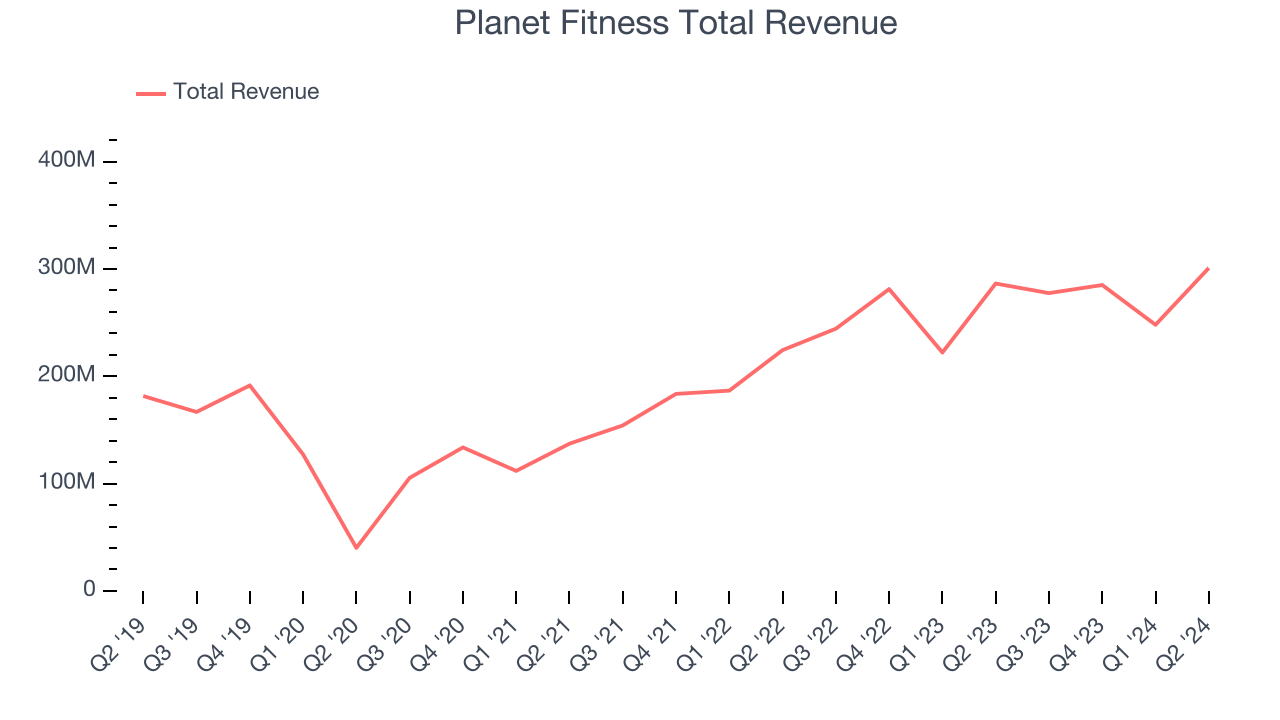

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Planet Fitness's 11.6% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Planet Fitness's annualized revenue growth of 21.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Planet Fitness's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Planet Fitness also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, Planet Fitness's same-store sales averaged 7.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Planet Fitness reported solid year-on-year revenue growth of 5.1%, and its $300.9 million of revenue outperformed Wall Street's estimates by 3.5%. Looking ahead, Wall Street expects sales to grow 8.3% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

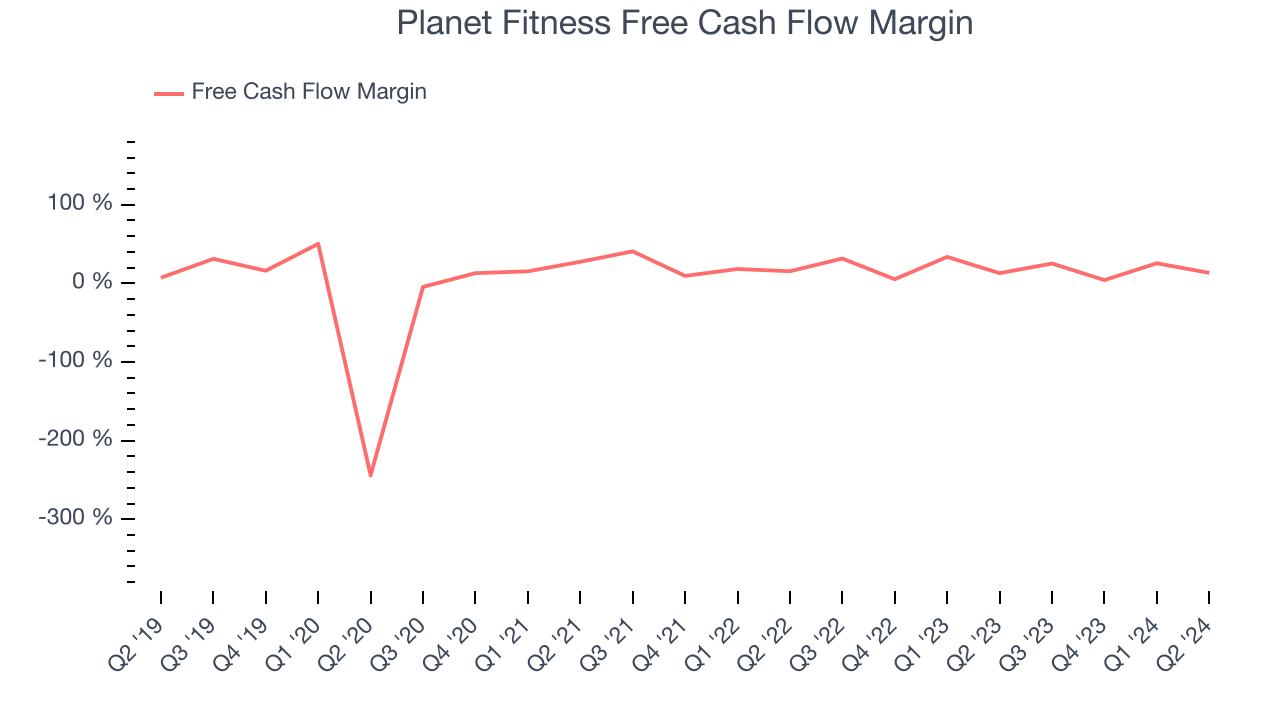

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Planet Fitness has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company's free cash flow margin averaged 18.2% over the last two years, quite impressive for a consumer discretionary business.

Planet Fitness's free cash flow clocked in at $40.18 million in Q2, equivalent to a 13.4% margin. This quarter's cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Planet Fitness's Q2 Results

It was good to see Planet Fitness beat analysts' revenue expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. An accelerated share repurchase announcement shows that it is generating a healthy amount of cash. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock traded up 11.1% to $80 immediately after reporting.

Planet Fitness may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.