Wrapping up Q4 earnings, we look at the numbers and key takeaways for the leisure facilities stocks, including Planet Fitness (NYSE:PLNT) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 12 leisure facilities stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 3.2%, while next quarter's revenue guidance was 21.6% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, though the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and leisure facilities stocks have held roughly steady amidst all this, with share prices up 3% on average since the previous earnings results.

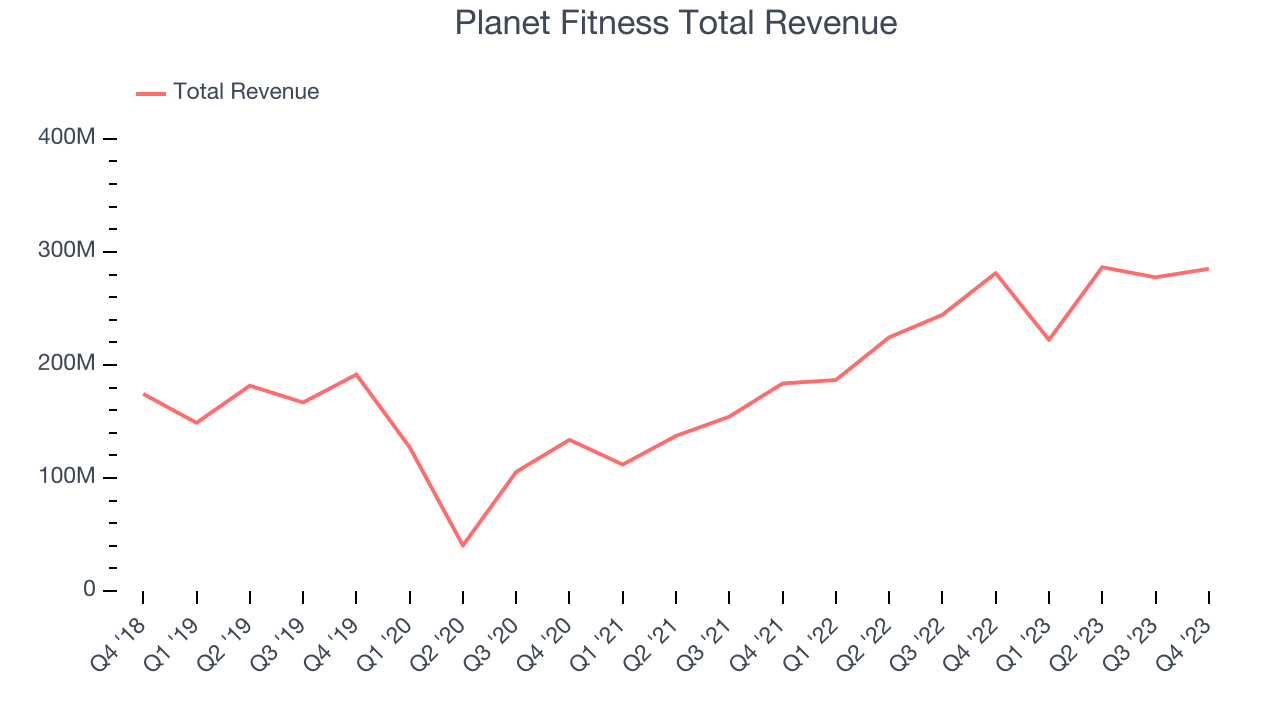

Planet Fitness (NYSE:PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $285.1 million, up 1.4% year on year, topping analyst expectations by 1%. It was a mixed quarter for the company, with a narrow beat of analysts' revenue estimates, driven by more new gym openings than expected (77 vs estimates of 69). That boost, however, was offset by underperformance in its same-store sales (7.7% growth vs estimates of 8.3% growth).

"In 2023, we proactively developed the New Growth Model to fuel long-term sustainable store growth and in recognition of the macro-economic environmental changes that have taken place since the pandemic. Focused on enhancing returns and reducing the capital requirements for opening and maintaining a Planet Fitness franchise location, the New Growth Model will provide our franchisees with additional flexibility to build their store portfolios for years to come," said Craig Benson, Interim Chief Executive Officer.

The stock is down 11.6% since the results and currently trades at $58.18.

Is now the time to buy Planet Fitness? Access our full analysis of the earnings results here, it's free.

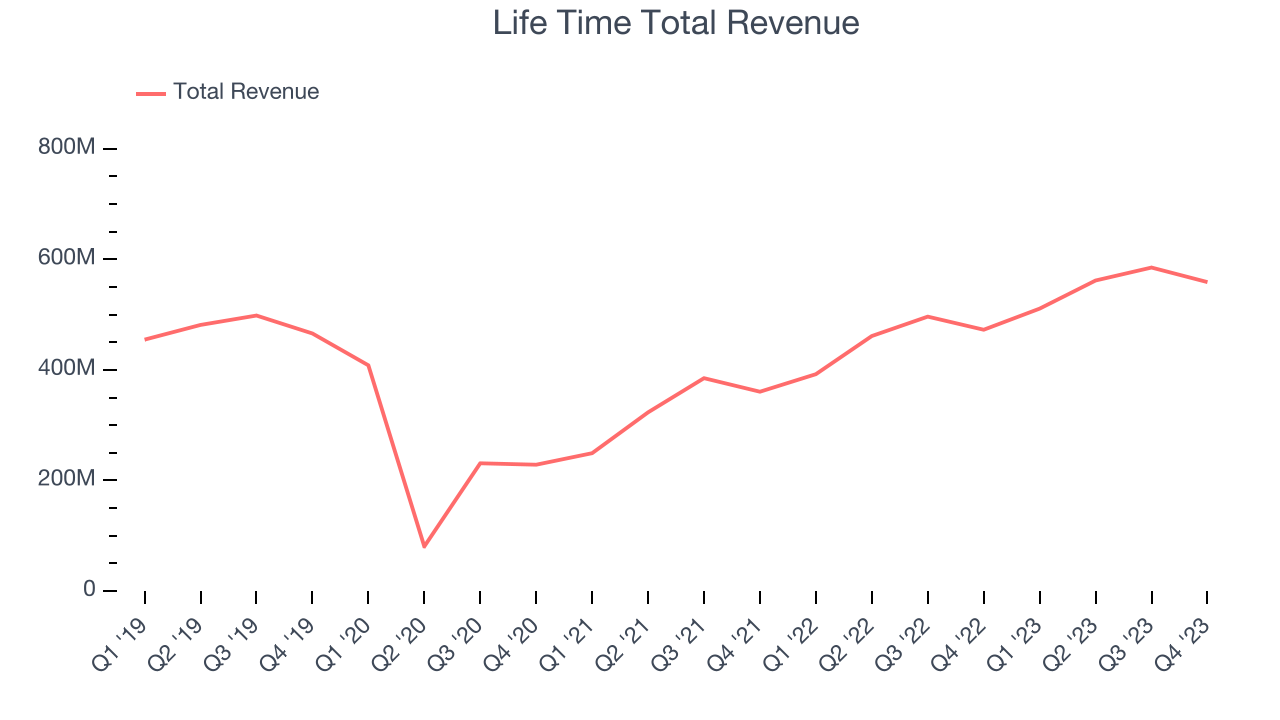

Best Q4: Life Time (NYSE:LTH)

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Life Time reported revenues of $558.8 million, up 18.2% year on year, in line with analyst expectations. It was a strong quarter for the company, with a solid beat of analysts' earnings estimates and revenue guidance for next quarter exceeding analysts' expectations.

Life Time pulled off the highest full-year guidance raise among its peers. The stock is up 12.8% since the results and currently trades at $14.01.

Is now the time to buy Life Time? Access our full analysis of the earnings results here, it's free.

Six Flags (NYSE:SIX)

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Six Flags reported revenues of $292.6 million, up 4.5% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' revenue, operating margin, and EPS estimates. On a side note, Six Flags merged with Cedar Fair (NYSE:FUN), another large regional theme park operator, on November 6th, 2023.

The stock is down 4% since the results and currently trades at $23.6.

Read our full analysis of Six Flags's results here.

Cedar Fair (NYSE:FUN)

Originally a lakeside resort, Cedar Fair (NYSE:FUN) operates amusement parks and resorts, delivering thrilling experiences and family entertainment across North America.

Cedar Fair reported revenues of $842 million, down 0.1% year on year, surpassing analyst expectations by 2.4%. It was a strong quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is up 3.7% since the results and currently trades at $39.04.

Read our full, actionable report on Cedar Fair here, it's free.

United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $389 million, down 0.4% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 6% since the results and currently trades at $51.74.

Read our full, actionable report on United Parks & Resorts here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.