Inclusive gym franchise company (NYSE:PLNT) announced better-than-expected results in Q4 FY2023, with revenue up 1.4% year on year to $285.1 million. It made a non-GAAP profit of $0.60 per share, improving from its profit of $0.53 per share in the same quarter last year.

Planet Fitness (PLNT) Q4 FY2023 Highlights:

- Revenue: $285.1 million vs analyst estimates of $282.2 million (1% beat)

- EPS (non-GAAP): $0.60 vs analyst estimates of $0.58 (3.5% beat)

- Free Cash Flow of $11.98 million, down 82.9% from the previous quarter

- Gross Margin (GAAP): 56.8%, up from 53.3% in the same quarter last year

- Same-Store Sales were up 7.7% year on year

- Market Capitalization: $5.63 billion

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

In 1992, Michael and Marc Grondahl took over a gym with an ambitious vision: transform the fitness landscape. They recognized the need for an environment where everyone, regardless of skill level, felt welcome. Thus, Planet Fitness was born with its guiding principle to eliminate the intimidation and elitism often found in traditional fitness centers.

Planet Fitness stands out by offering a plethora of exercise equipment, group classes, and personal training sessions in its "Judgment-Free Zone." This core philosophy ensures that individuals, whether novices or regulars, can focus on their health goals. By addressing this concern, Planet Fitness eradicates a significant barrier many face when considering gym memberships.

The company’s revenue is primarily derived from memberships and franchise fees. Its business model thrives on low membership fees, encouraging higher subscription rates. This approach particularly resonates with those new to fitness or partaking in a casual exercise routine.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors offering a traditional gym experience include Life Time (NYSE:LTH), LA Fitness, and Crunch Fitness while companies offering a more boutique, class-based approach include Xponential Fitness (NYSE:XPOF) and Orange Theory.Sales Growth

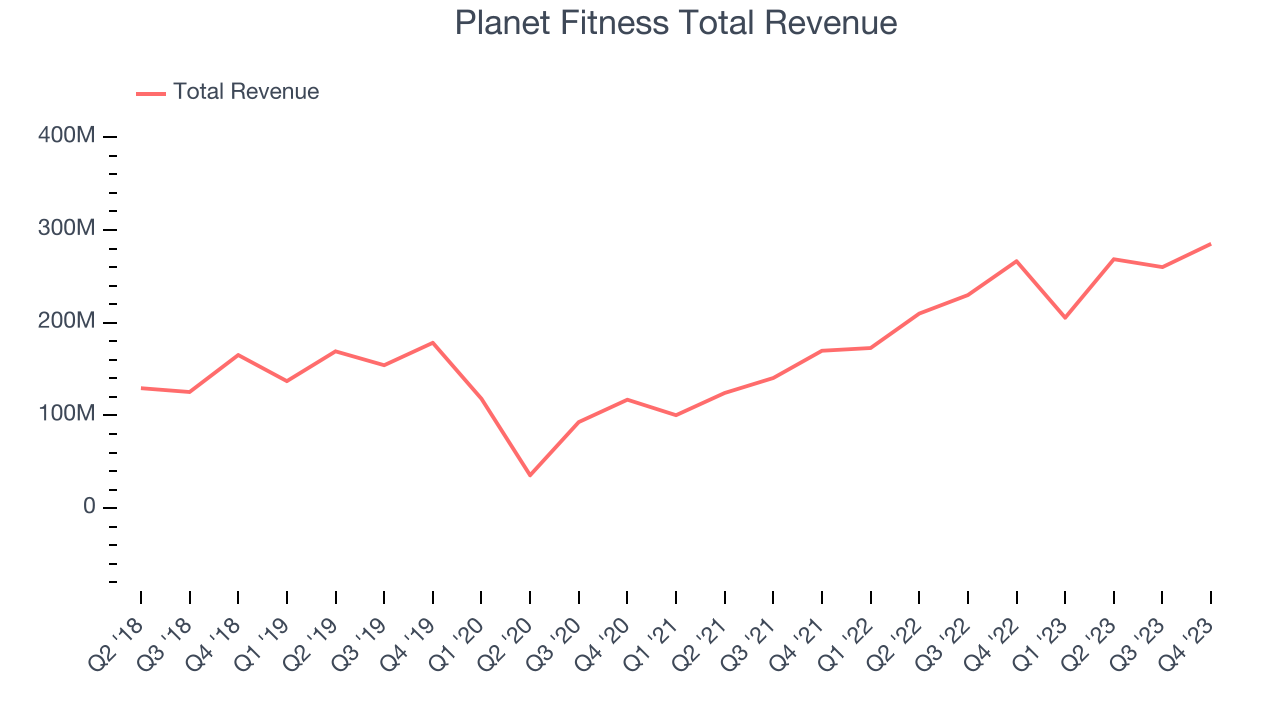

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Planet Fitness's annualized revenue growth rate of 13.3% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Planet Fitness's annualized revenue growth of 35.1% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Planet Fitness's annualized revenue growth of 35.1% over the last two years is above its five-year trend, suggesting some bright spots.

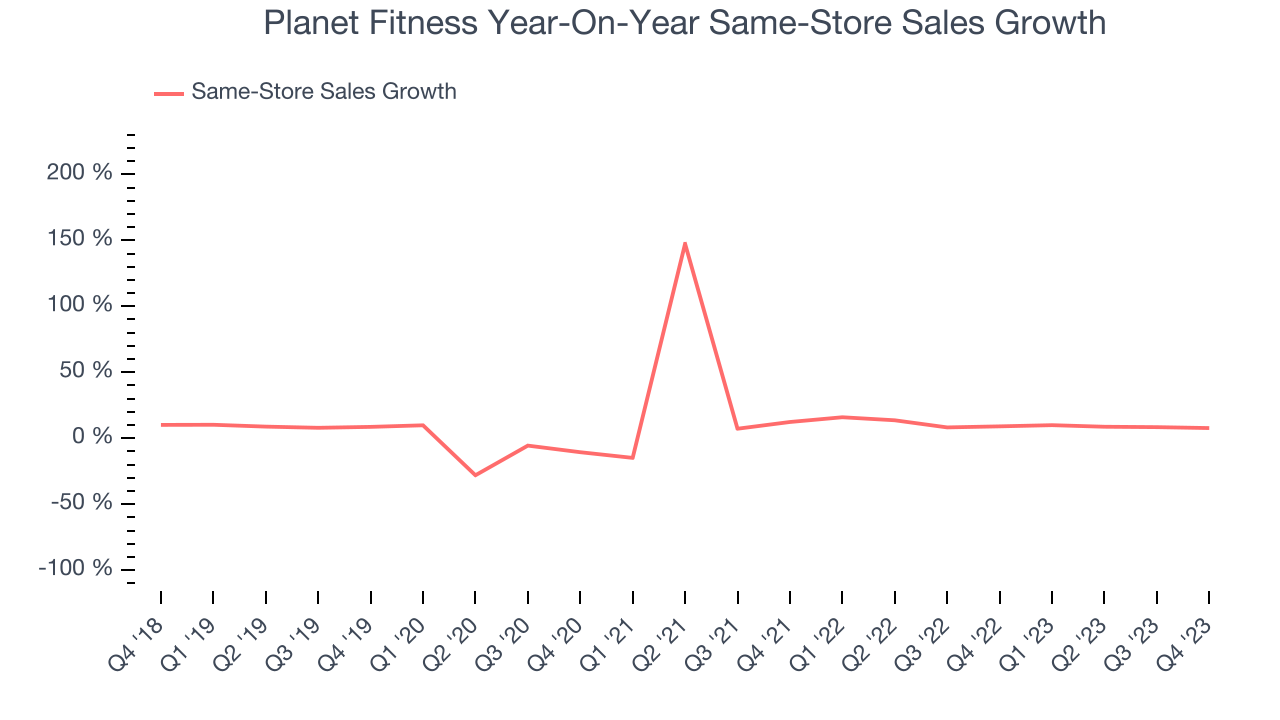

We can dig even further into the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Planet Fitness's same-store sales averaged 10.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the company's sales are benefitting from the opening of new locations.

This quarter, Planet Fitness reported reasonable year-on-year revenue growth of 1.4%, and its $285.1 million of revenue topped Wall Street's estimates by 1%. Looking ahead, Wall Street expects sales to grow 7.4% over the next 12 months, an acceleration from this quarter.

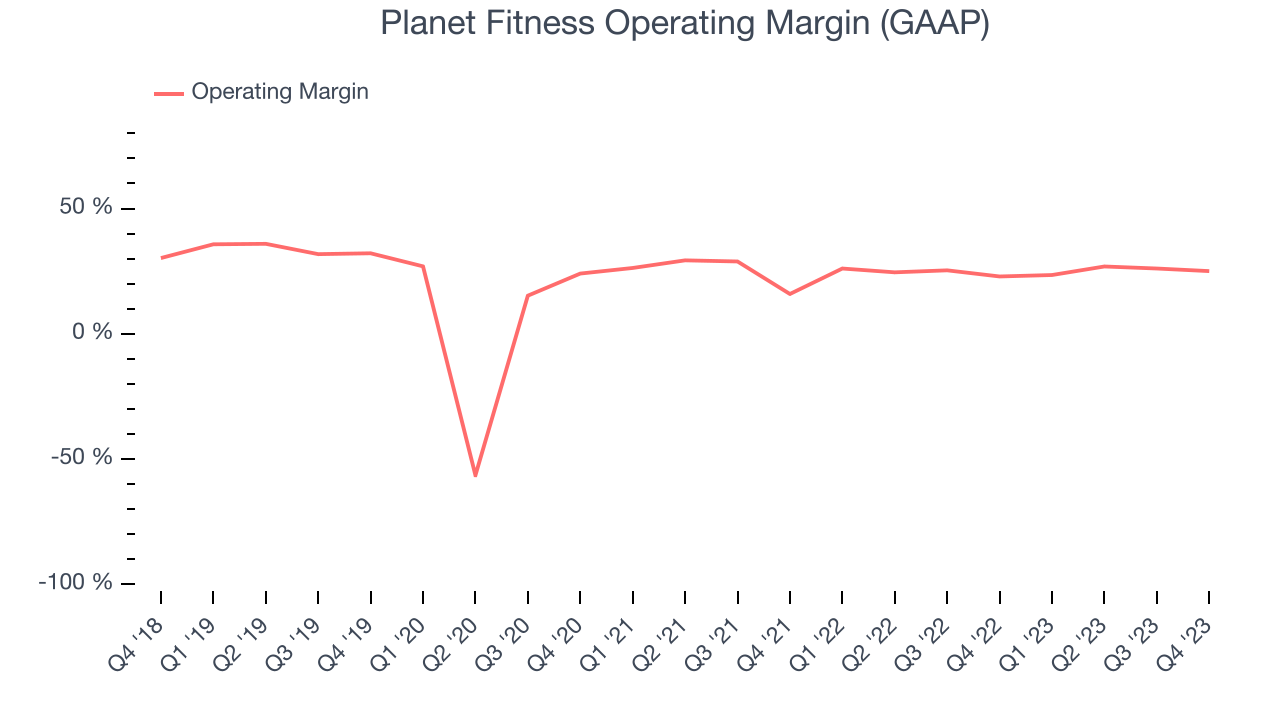

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Planet Fitness has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 25%.

In Q4, Planet Fitness generated an operating profit margin of 25%, up 2.1 percentage points year on year.

Over the next 12 months, Wall Street expects Planet Fitness to become more profitable. Analysts are expecting the company’s LTM operating margin of 25.5% to rise to 27.7%.EPS

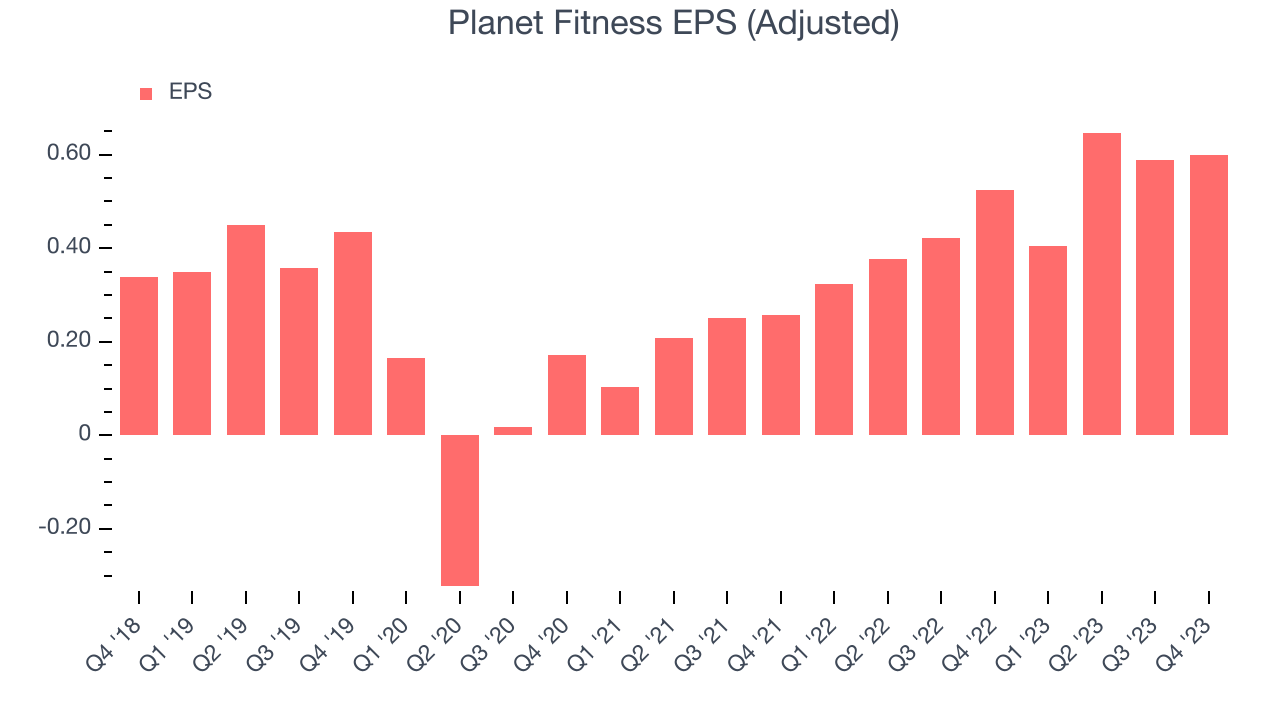

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Planet Fitness's EPS grew 83.5%, translating into a decent 12.9% compounded annual growth rate. This performance is in line with its 13.3% annualized revenue growth over the same period.

In Q4, Planet Fitness reported EPS at $0.60, up from $0.53 in the same quarter a year ago. This print beat analysts' estimates by 3.5%. Over the next 12 months, Wall Street expects Planet Fitness to grow its earnings. Analysts are projecting its LTM EPS of $2.24 to climb by 11.3% to $2.50.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

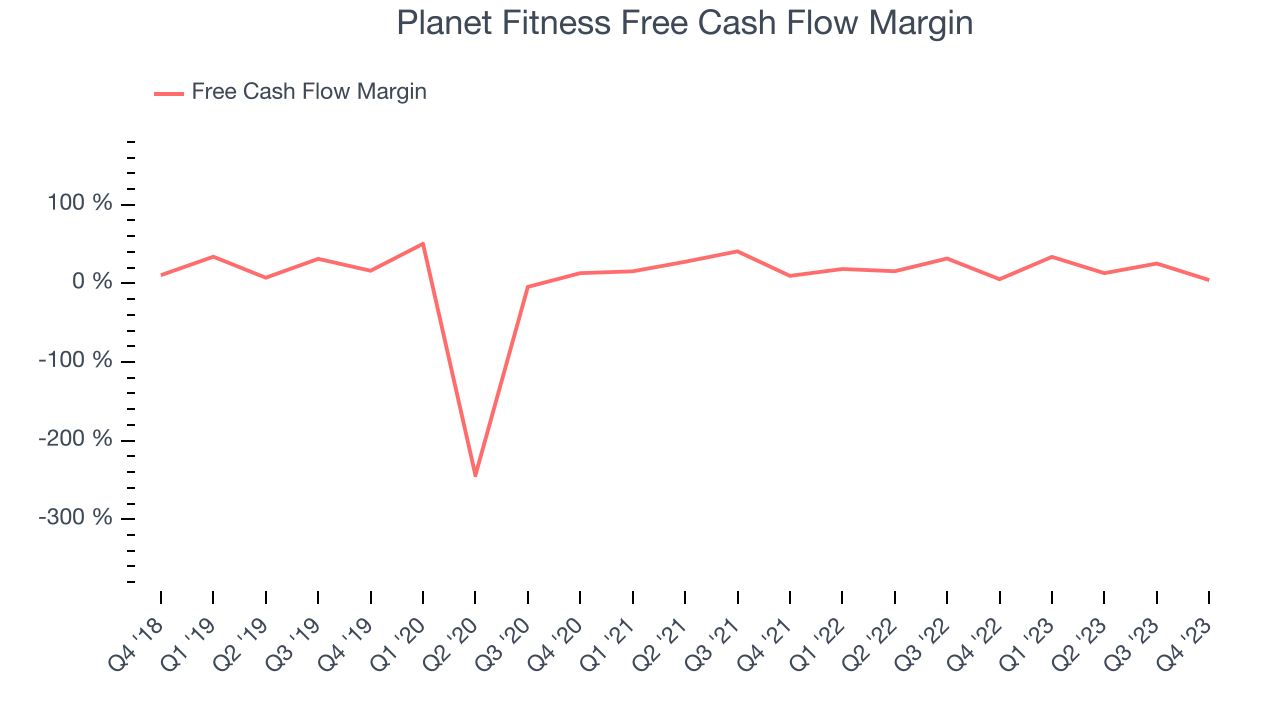

Over the last two years, Planet Fitness has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 17.7%, quite impressive for a consumer discretionary business.

Planet Fitness's free cash flow came in at $11.98 million in Q4, equivalent to a 4.2% margin and down 19.4% year on year. Over the next year, analysts predict Planet Fitness's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 18.1% will decrease to 16.9%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Planet Fitness hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 17.9%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Planet Fitness's ROIC over the last two years averaged 5.4 percentage point decreases each year. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Planet Fitness's Q4 Results

It was encouraging to see Planet Fitness narrowly top analysts' revenue expectations this quarter, driven by more new gym openings than expected (77 vs estimates of 69). That boost, however, was offset by underperformance in its same-store sales (7.7% growth vs estimates of 8.3% growth). In terms of profitability, we were glad its adjusted EBITDA and EPS beat Wall Street's forecasts.

Looking ahead, the company's full-year 2024 revenue and EPS guidance fell short as Planet Fitness focuses on rolling out its New Growth Model to franchisees. The company also increased its total store opportunity to 5,000 gyms in the U.S., up from the 4,000 it stated in its 2015 IPO.

Overall, this was a mixed quarter for Planet Fitness. The company is down 2.1% on the results and currently trades at $64.5 per share.

Is Now The Time?

When considering an investment in Planet Fitness, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Planet Fitness isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last five years, its same-store sales performance has been disappointing.

Planet Fitness's price-to-earnings ratio based on the next 12 months is 26.4x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Planet Fitness, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $78.71 per share right before these results (compared to the current share price of $66).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.