Inclusive gym franchise company (NYSE:PLNT) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 11.6% year on year to $248 million. It made a non-GAAP profit of $0.53 per share, improving from its profit of $0.25 per share in the same quarter last year.

Planet Fitness (PLNT) Q1 CY2024 Highlights:

- Revenue: $248 million vs analyst estimates of $248.6 million (small miss)

- EPS (non-GAAP): $0.53 vs analyst estimates of $0.50 (5.2% beat)

- Lowers full year guidance for same-store sales and revenue growth

- Gross Margin (GAAP): 62.4%, up from 61.6% in the same quarter last year

- Free Cash Flow of $63.42 million, up from $11.98 million in the previous quarter

- Same-Store Sales were up 6.2% year on year (beat)

- Market Capitalization: $5.39 billion

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

In 1992, Michael and Marc Grondahl took over a gym with an ambitious vision: transform the fitness landscape. They recognized the need for an environment where everyone, regardless of skill level, felt welcome. Thus, Planet Fitness was born with its guiding principle to eliminate the intimidation and elitism often found in traditional fitness centers.

Planet Fitness stands out by offering a plethora of exercise equipment, group classes, and personal training sessions in its "Judgment-Free Zone." This core philosophy ensures that individuals, whether novices or regulars, can focus on their health goals. By addressing this concern, Planet Fitness eradicates a significant barrier many face when considering gym memberships.

The company’s revenue is primarily derived from memberships and franchise fees. Its business model thrives on low membership fees, encouraging higher subscription rates. This approach particularly resonates with those new to fitness or partaking in a casual exercise routine.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors offering a traditional gym experience include Life Time (NYSE:LTH), LA Fitness, and Crunch Fitness while companies offering a more boutique, class-based approach include Xponential Fitness (NYSE:XPOF) and Orange Theory.Sales Growth

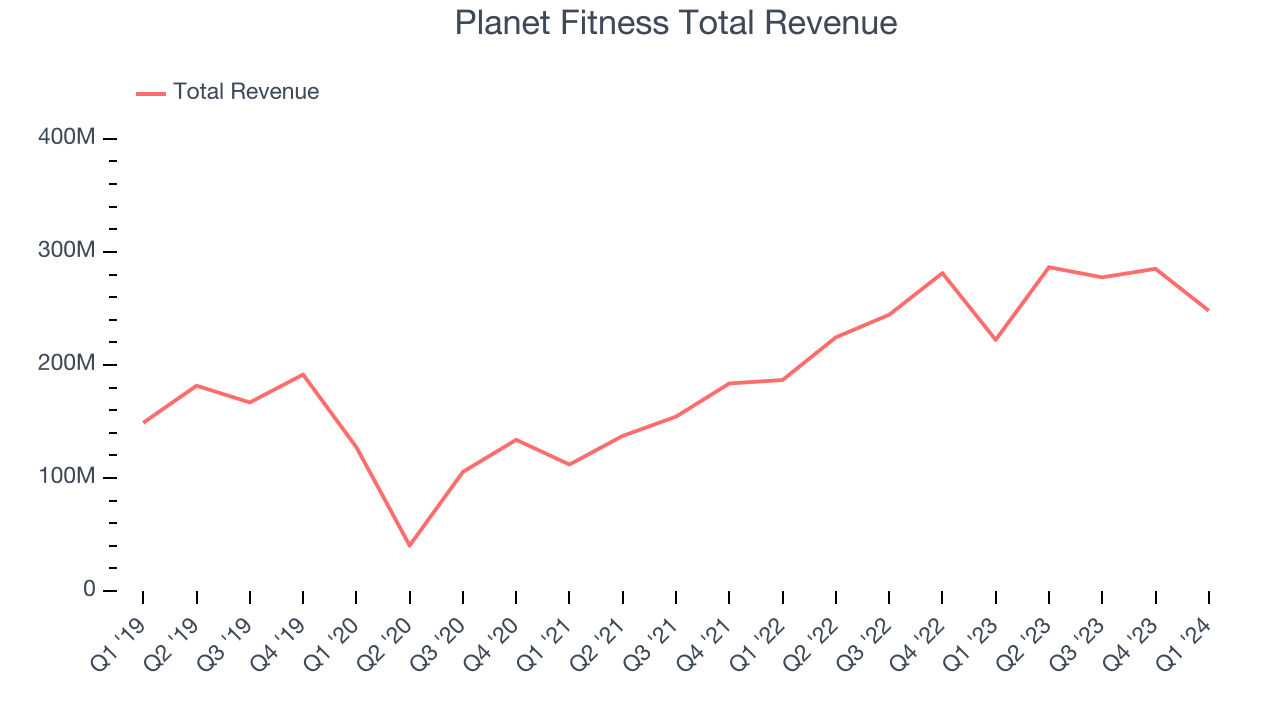

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Planet Fitness's annualized revenue growth rate of 12.8% over the last five years was mediocre for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Planet Fitness's annualized revenue growth of 28.8% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Planet Fitness's annualized revenue growth of 28.8% over the last two years is above its five-year trend, suggesting some bright spots.

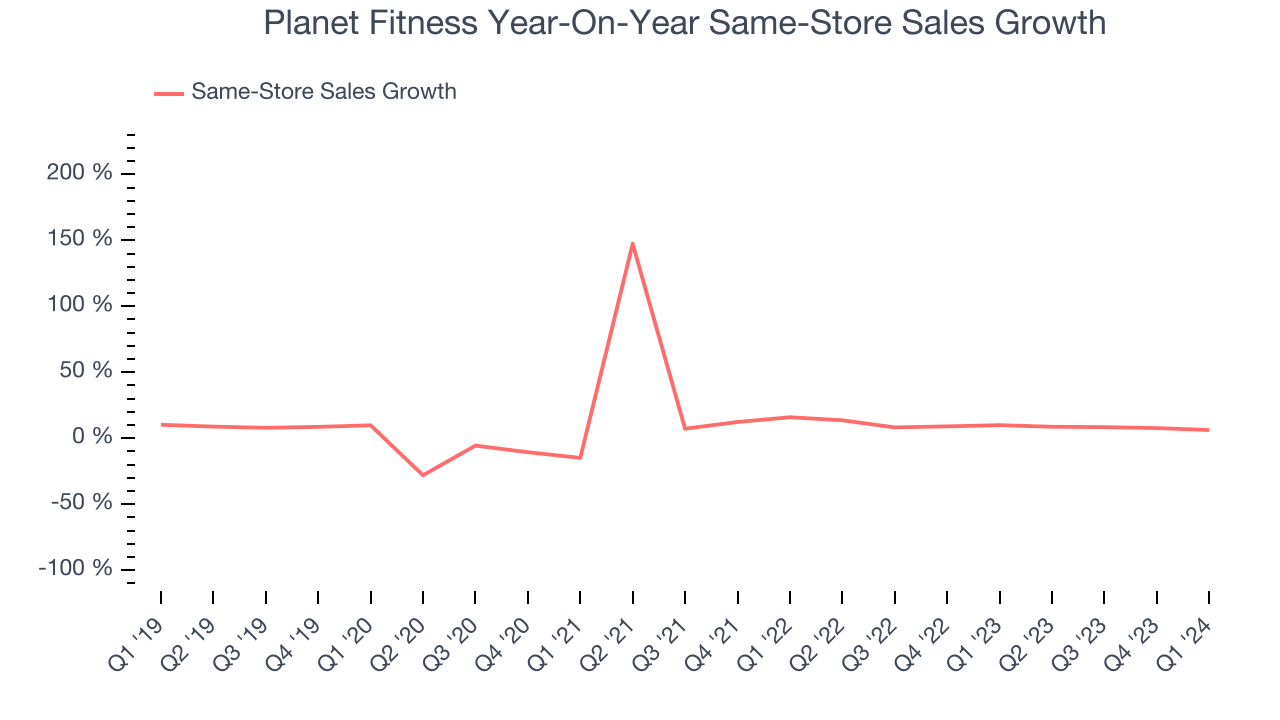

We can dig even further into the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Planet Fitness's same-store sales averaged 9% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Planet Fitness's year-on-year revenue growth clocked in at 11.6%, and its $248 million of revenue was line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7.8% over the next 12 months, a deceleration from this quarter.

Operating Margin

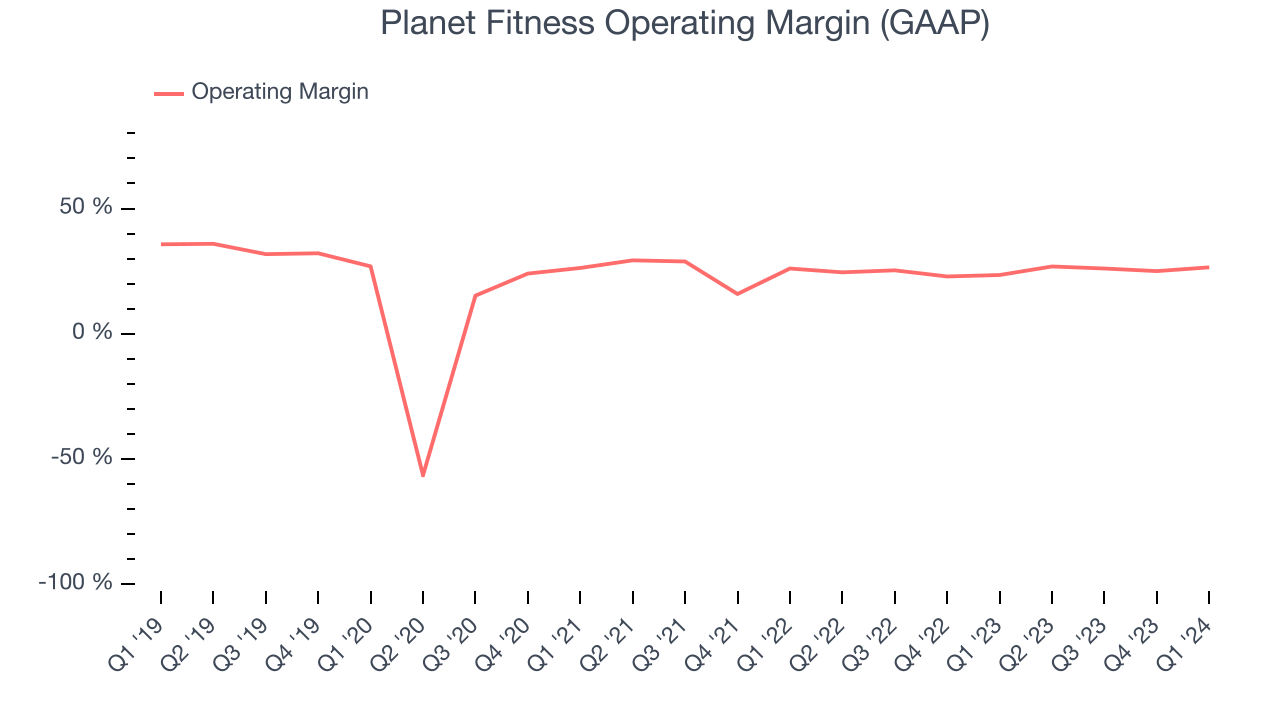

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Planet Fitness has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 25.1%.

This quarter, Planet Fitness generated an operating profit margin of 26.5%, up 3.1 percentage points year on year.

Over the next 12 months, Wall Street expects Planet Fitness to become more profitable. Analysts are expecting the company’s LTM operating margin of 26.1% to rise to 27.3%.EPS

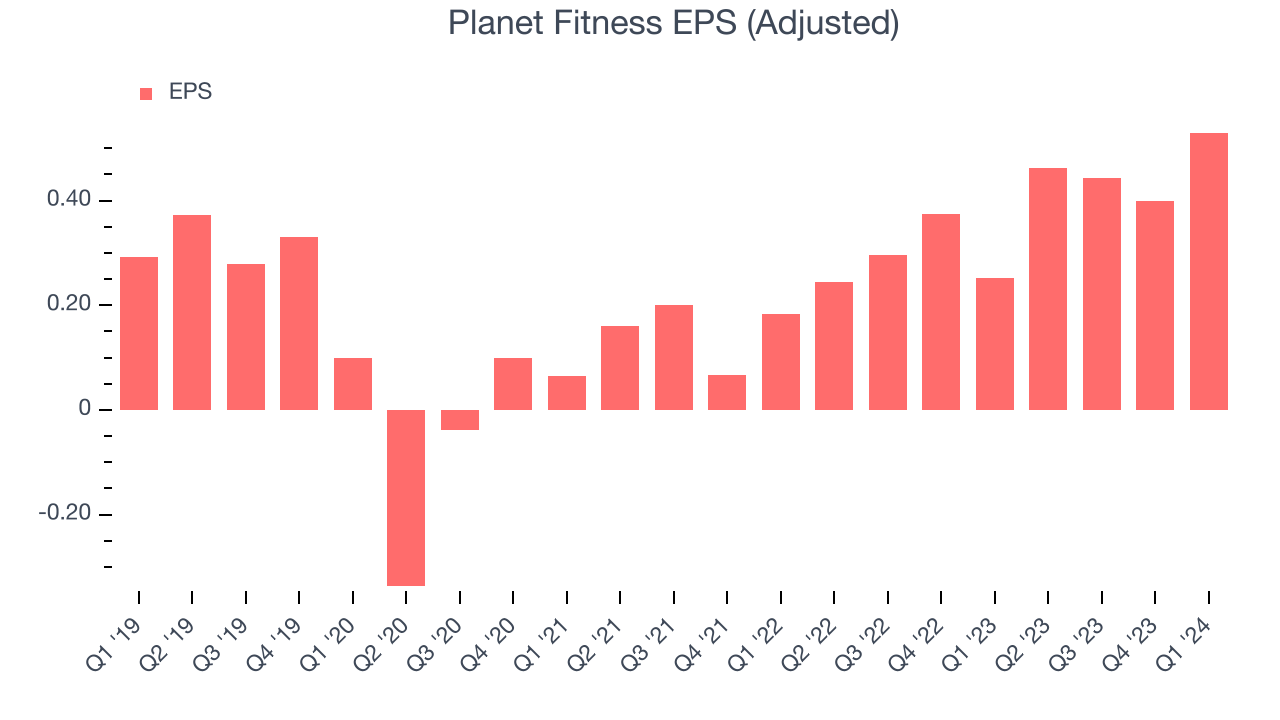

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Planet Fitness's EPS grew 85.1%, translating into a solid 13.1% compounded annual growth rate. This performance is in line with its 12.8% annualized revenue growth over the same period.

In Q1, Planet Fitness reported EPS at $0.53, up from $0.25 in the same quarter last year. This print beat analysts' estimates by 5.2%. Over the next 12 months, Wall Street expects Planet Fitness to grow its earnings. Analysts are projecting its LTM EPS of $1.83 to climb by 41% to $2.59.

Cash Is King

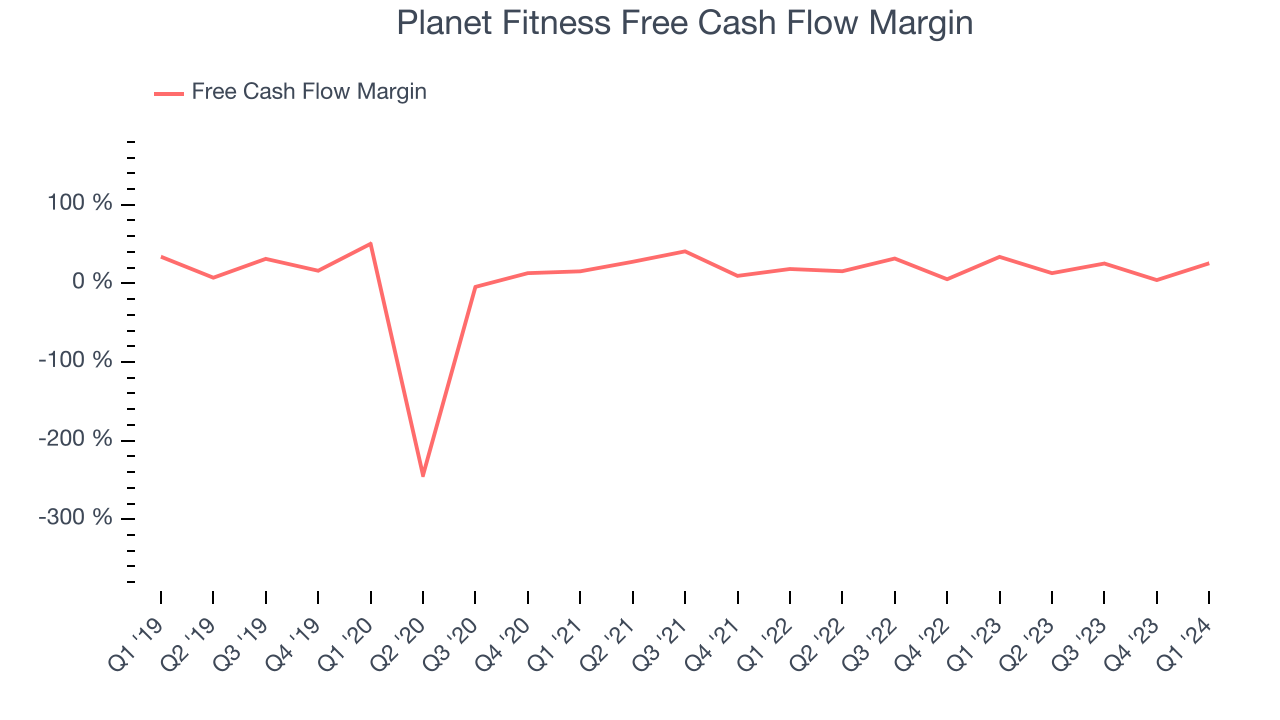

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Planet Fitness has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 18.6%, quite impressive for a consumer discretionary business.

Planet Fitness's free cash flow came in at $63.42 million in Q1, equivalent to a 25.6% margin and down 15.3% year on year.

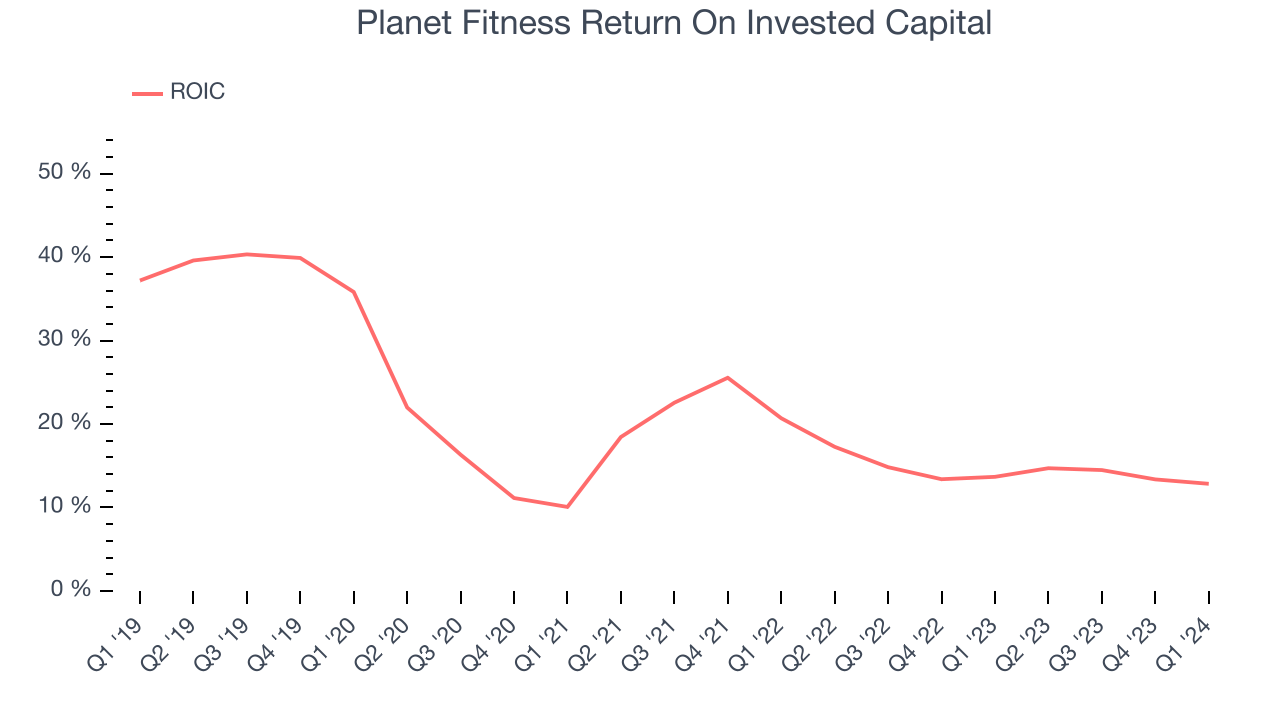

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Planet Fitness hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 18.6%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Planet Fitness's ROIC averaged 9.7 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Planet Fitness reported $395.1 million of cash and $2.37 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $451.5 million of EBITDA over the last 12 months, we view Planet Fitness's 4.4x net-debt-to-EBITDA ratio as safe. We also see its $33.61 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Planet Fitness's Q1 Results

The quarter itself was fine, but the company lowered its full year guidance for same store sales and revenue growth. As a result of that worse outlook, the stock is down 8.6% after reporting, trading at $56.56 per share.

Is Now The Time?

Planet Fitness may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Planet Fitness isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been mediocre over the last five years, and analysts expect growth to deteriorate from here. And while its impressive operating margins show it has a highly efficient business model, unfortunately, its same-store sales performance has been disappointing.

Planet Fitness's price-to-earnings ratio based on the next 12 months is 23.9x. We can find things to like about Planet Fitness and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $74.82 per share right before these results (compared to the current share price of $56.56).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.