Data-mining and analytics company Palantir (NYSE:PLTR) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 19.6% year on year to $608.4 million. On the other hand, the company expects next quarter's revenue to be around $614 million, slightly below analysts' estimates. It made a non-GAAP profit of $0.08 per share, improving from its profit of $0.04 per share in the same quarter last year.

Palantir (PLTR) Q4 FY2023 Highlights:

- Revenue: $608.4 million vs analyst estimates of $602.8 million (0.9% beat, billings beat by a larger margin)

- EPS (non-GAAP): $0.08 vs analyst estimates of $0.08 (5.4% beat)

- Revenue Guidance for Q1 2024 is $614 million at the midpoint, below analyst estimates of $617.2 million

- Management's revenue guidance for the upcoming financial year 2024 is $2.66 billion at the midpoint, in line with analyst expectations and implying 19.5% growth (vs 16.7% in FY2023)

- Management's adjusted operating income guidance for the upcoming financial year 2024 is $842 million at the midpoint, well above analyst expectations of $738 million

- Free Cash Flow of $296.3 million, up 110% from the previous quarter

- Gross Margin (GAAP): 82.1%, up from 79.5% in the same quarter last year

- Market Capitalization: $37.04 billion

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir’s technology provides customers with capabilities to gather and ingest data from almost any source in almost any format and store it in the same type of interconnected architecture that Google uses. On top of the data platform then sits a range of data analysis and visualization tools, each with specific use cases from crime investigations, counterterrorism operation planning over to supply chain management and financial compliance.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

Other companies with similar data management capabilities include Snowflake, Alteryx and cloud service providers such as Google, Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT).

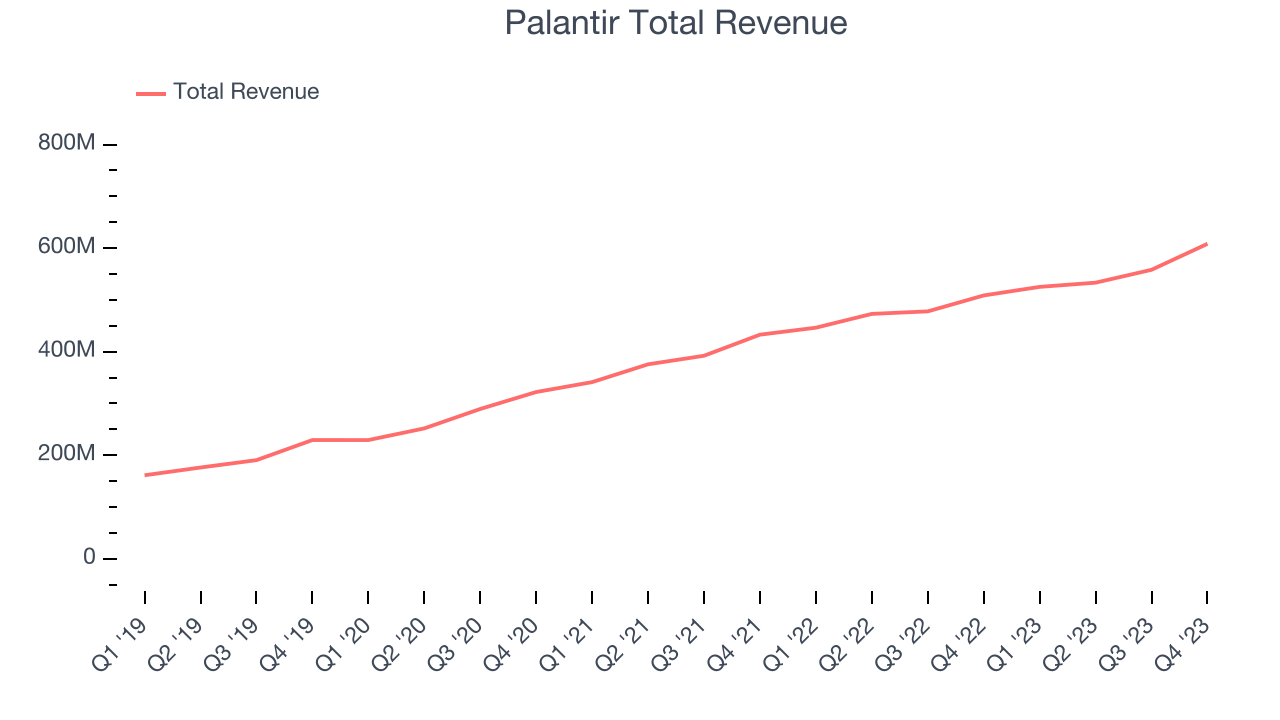

Sales Growth

As you can see below, Palantir's revenue growth has been strong over the last two years, growing from $432.9 million in Q4 FY2021 to $608.4 million this quarter.

This quarter, Palantir's quarterly revenue was once again up 19.6% year on year. We can see that Palantir's revenue increased by $50.19 million quarter on quarter, which is a solid improvement from the $24.84 million increase in Q3 2023. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that Palantir is expecting revenue to grow 16.9% year on year to $614 million, in line with the 17.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.66 billion at the midpoint, growing 19.5% year on year compared to the 16.7% increase in FY2023.

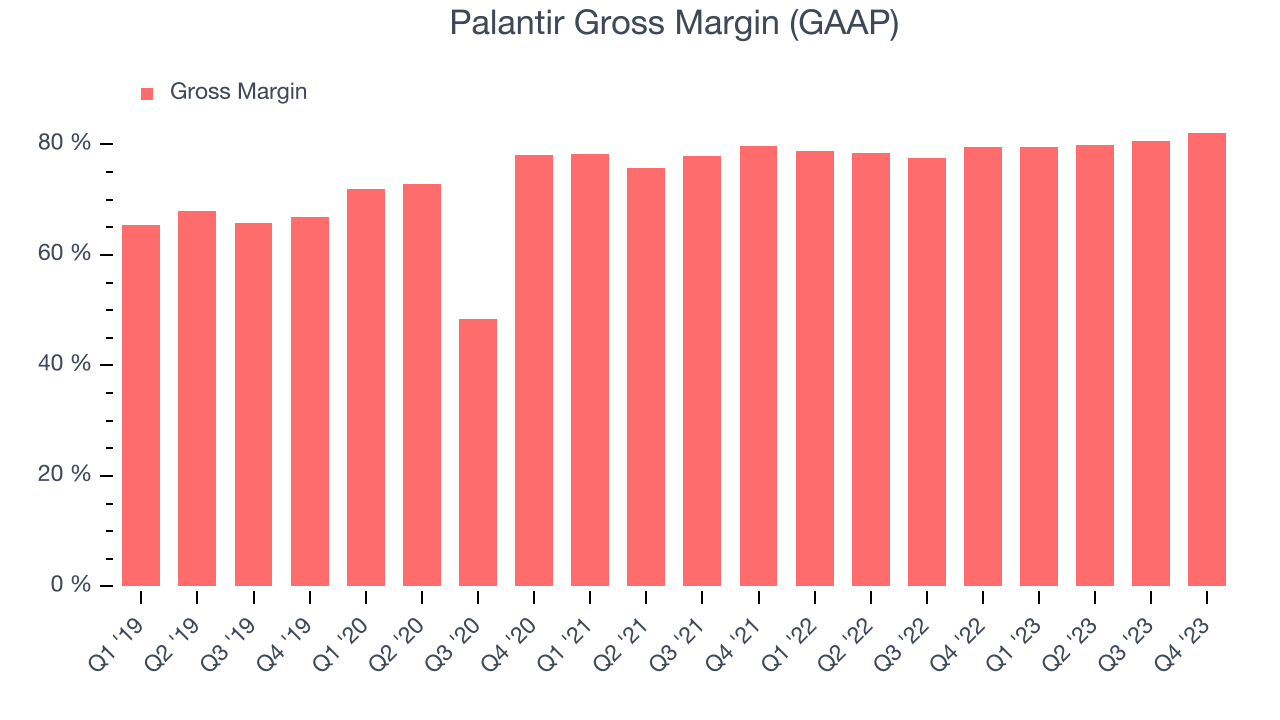

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Palantir's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 82.1% in Q4.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Palantir's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

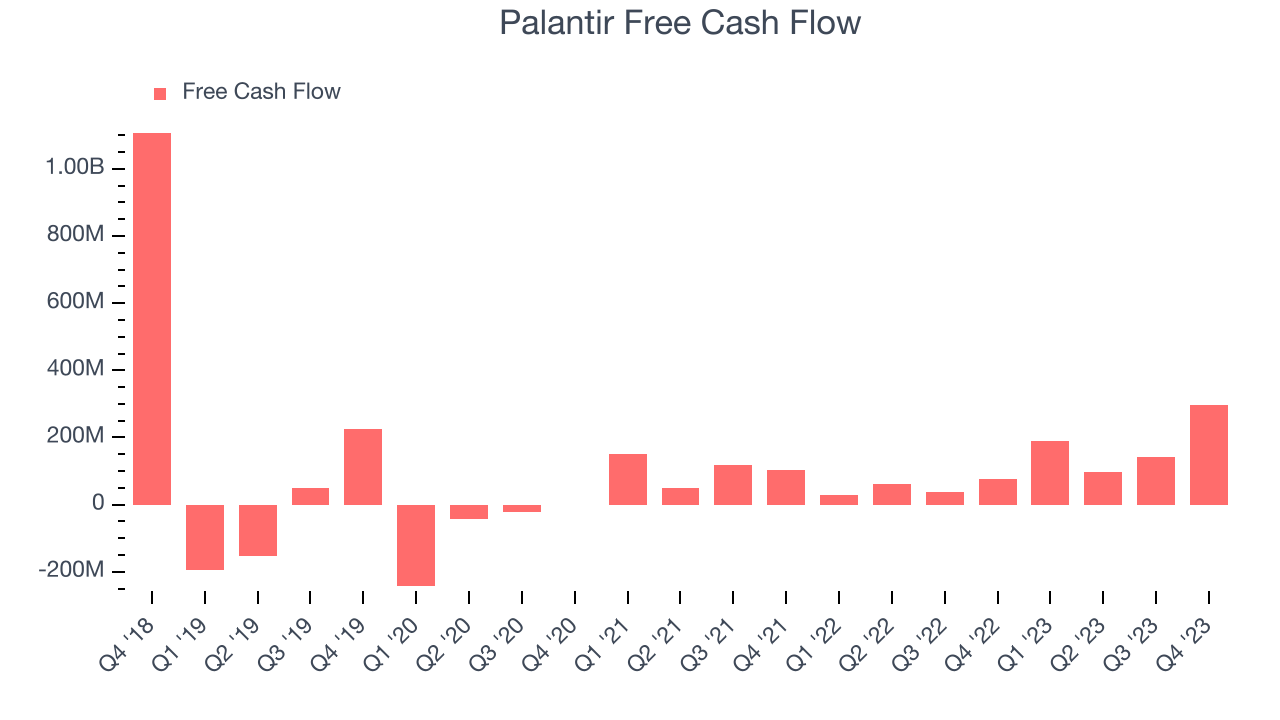

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Palantir's free cash flow came in at $296.3 million in Q4, up 291% year on year.

Palantir has generated $722.1 million in free cash flow over the last 12 months, an eye-popping 32% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Palantir's Q4 Results

It was great to see Palantir expecting revenue growth to accelerate next year. Icing on the cake is adjusted operating income well above expectations, showing that the company is not sacrificing profits for the higher topline growth. We were also glad its revenue in the quarter beat and its gross margin improved. A minor negative was that revenue guidance for next quarter missed analysts' expectations. Overall, this was a very solid quarter for Palantir. The stock is up 11.7% after reporting and currently trades at $18.68 per share.

Is Now The Time?

When considering an investment in Palantir, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think Palantir is a great business. First off, its revenue growth has been solid over the last two years. Additionally, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its impressive gross margins indicate excellent business economics.

Palantir's price-to-sales ratio based on the next 12 months of 14.9x indicates that the market is definitely optimistic about its growth prospects. But looking at the tech landscape today, Palantir's qualities stand out and we still like it at this price.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.