Packaged foods company Post (NYSE:POST) announced better-than-expected revenue in Q3 CY2024, with sales up 3.3% year on year to $2.01 billion. Its non-GAAP profit of $1.53 per share was 25.2% above analysts’ consensus estimates.

Is now the time to buy Post? Find out by accessing our full research report, it’s free.

Post (POST) Q3 CY2024 Highlights:

- Revenue: $2.01 billion vs analyst estimates of $1.97 billion (2.2% beat)

- Adjusted EPS: $1.53 vs analyst estimates of $1.22 (25.2% beat)

- Adjusted EBITDA: $348.7 million vs analyst estimates of $327.5 million (6.5% beat)

- EBITDA guidance for the upcoming financial year 2025 is $1.44 billion at the midpoint, above analyst estimates of $1.42 billion

- Gross Margin (GAAP): 28.6%, in line with the same quarter last year

- Operating Margin: 9.5%, in line with the same quarter last year

- EBITDA Margin: 17.3%, in line with the same quarter last year

- Sales Volumes were flat year on year (-8.2% in the same quarter last year)

- Market Capitalization: $6.40 billion

Company Overview

Founded in 1895, Post (NYSE:POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Post is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions.

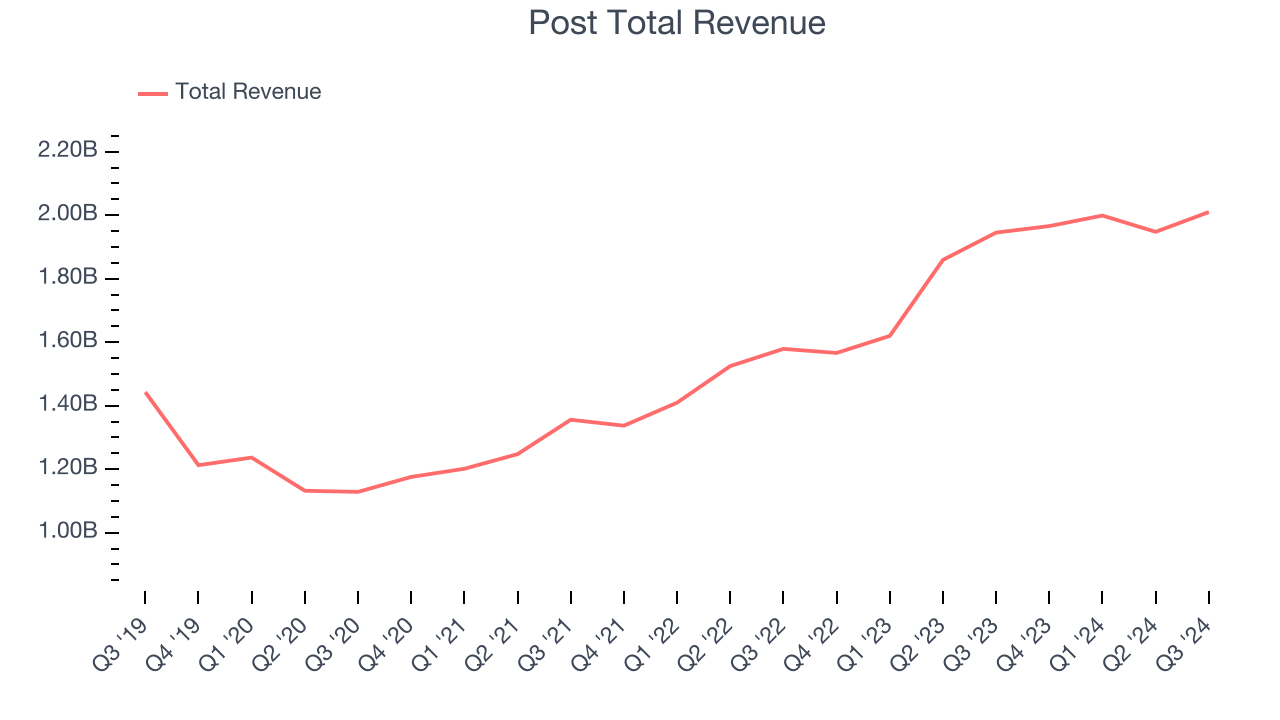

As you can see below, Post grew its sales at an impressive 16.7% compounded annual growth rate over the last three years despite consumers buying less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Post reported modest year-on-year revenue growth of 3.3% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

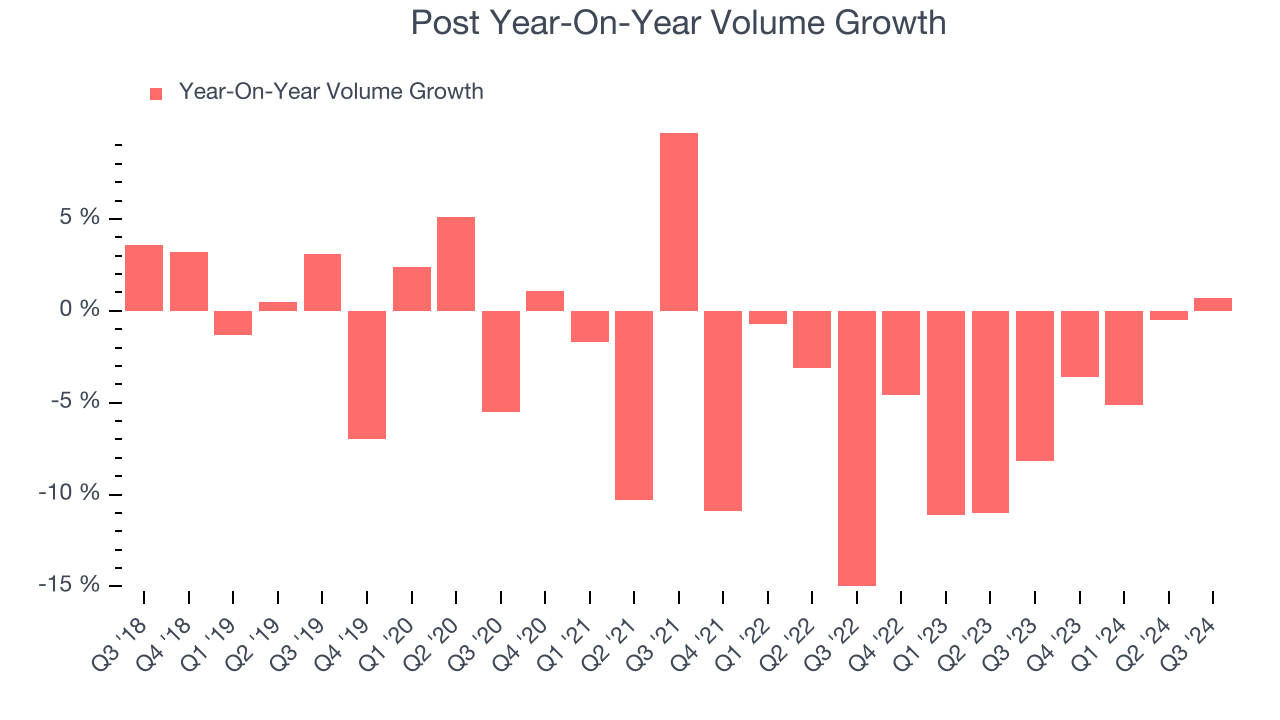

Post’s average quarterly sales volumes have shrunk by 5.4% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Post’s Q3 2024, year on year sales volumes were flat. This result was a well-appreciated turnaround from its historical levels, showing the company is heading in the right direction.

Key Takeaways from Post’s Q3 Results

We enjoyed seeing Post exceed analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2% to $110 immediately after reporting.

Sure, Post had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.