Theme park operator United Parks & Resorts (NYSE:SEAS) fell short of analysts' expectations in Q2 CY2024, with revenue flat year on year at $497.6 million. It made a GAAP profit of $1.46 per share, improving from its profit of $1.35 per share in the same quarter last year.

Is now the time to buy United Parks & Resorts? Find out by accessing our full research report, it's free.

United Parks & Resorts (PRKS) Q2 CY2024 Highlights:

- Revenue: $497.6 million vs analyst estimates of $501 million (small miss)

- EPS: $1.46 vs analyst expectations of $1.52 (3.7% miss)

- Gross Margin (GAAP): 54%, up from 52.8% in the same quarter last year

- EBITDA Margin: 43.9%, down from 45.2% in the same quarter last year

- Free Cash Flow of $93.7 million is up from -$15.84 million in the previous quarter

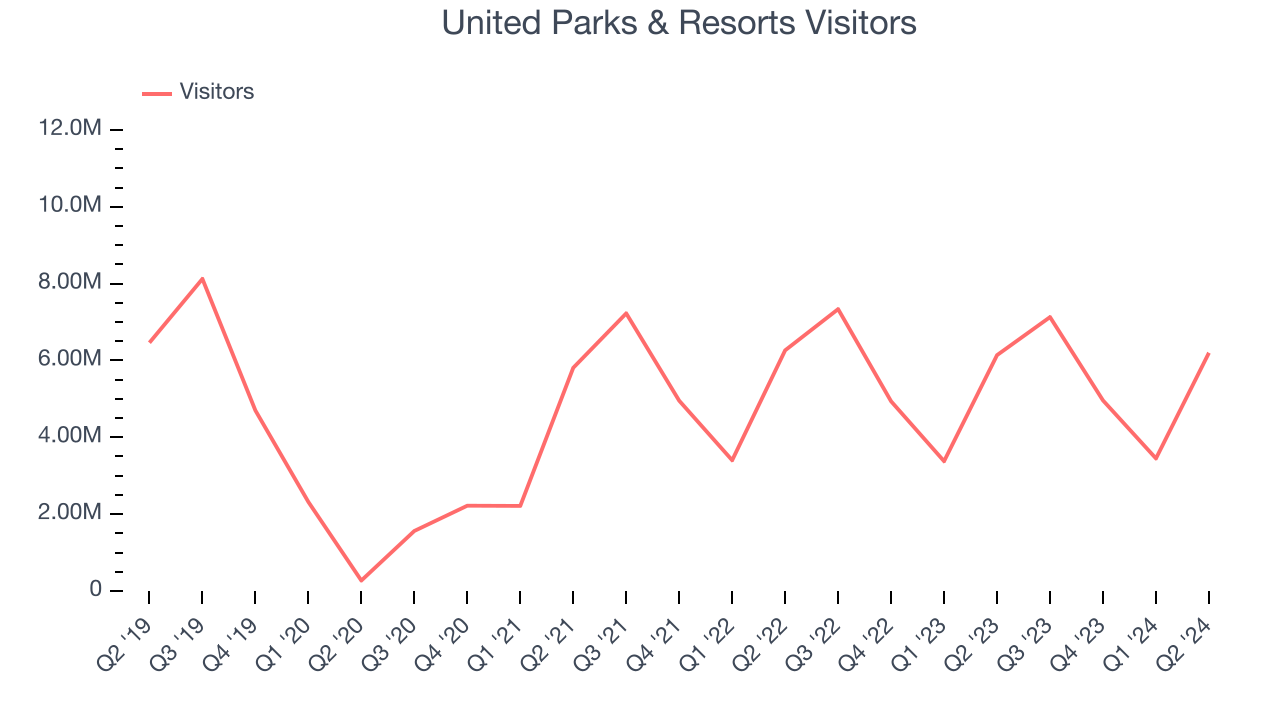

- Visitors: 6.2 million, in line with the same quarter last year

- Market Capitalization: $2.92 billion

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

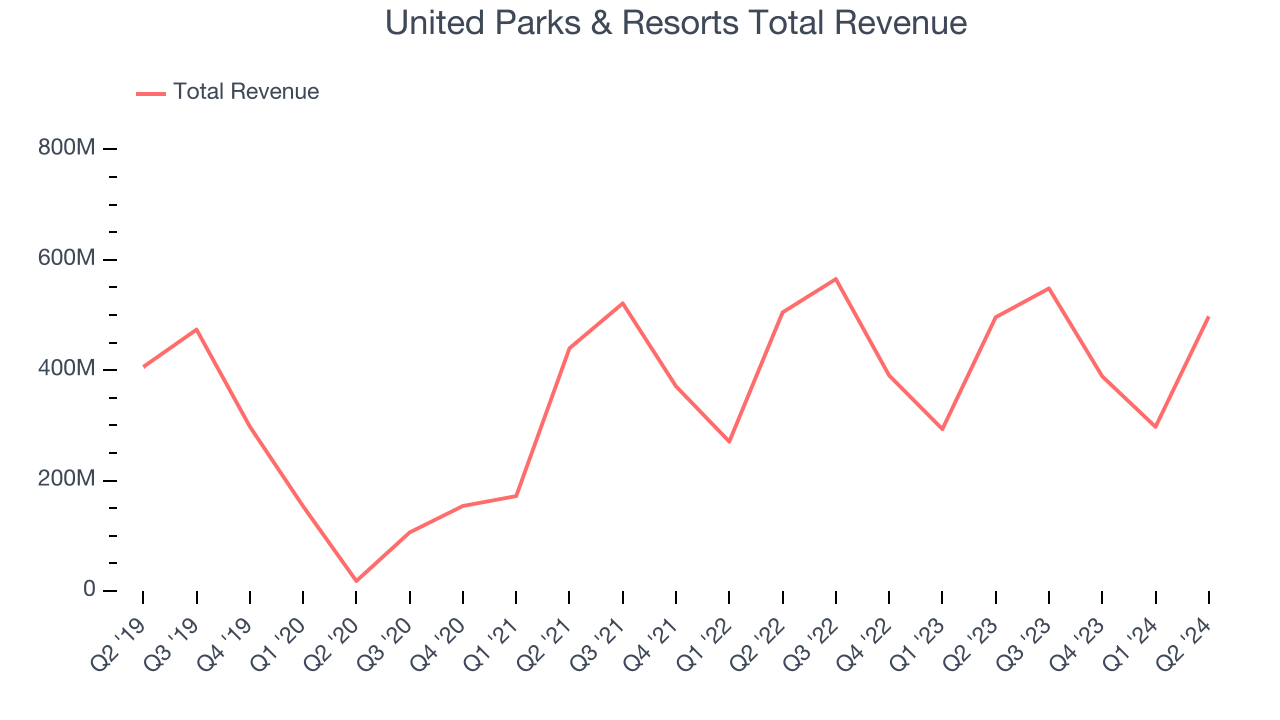

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Regrettably, United Parks & Resorts's sales grew at a weak 4.5% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. United Parks & Resorts's recent history shows its demand slowed as its annualized revenue growth of 1.9% over the last two years is below its five-year trend. Note that COVID hurt United Parks & Resorts's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

United Parks & Resorts also discloses its number of visitors, which reached 6.2 million in the latest quarter. Over the last two years, United Parks & Resorts's visitors were flat. Because this number is lower than its revenue growth during the same period, we can see the company's monetization has risen.

This quarter, United Parks & Resorts's $497.6 million of revenue was flat year on year, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

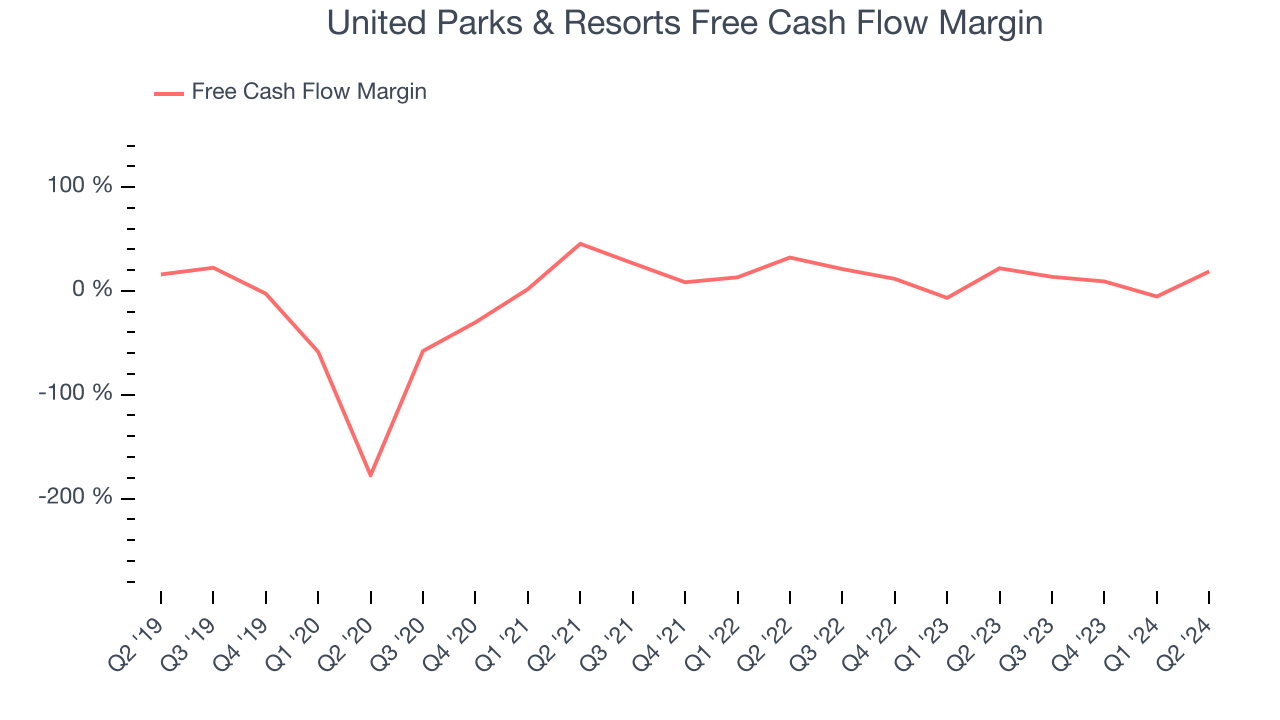

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

United Parks & Resorts has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company's free cash flow margin averaged 12.7% over the last two years, slightly better than the broader consumer discretionary sector.

United Parks & Resorts's free cash flow clocked in at $93.7 million in Q2, equivalent to a 18.8% margin. The company's cash profitability regressed as it was 3.1 percentage points lower than in the same quarter last year, but it's still above its two-year average. We wouldn't put too much weight on this quarter's decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from United Parks & Resorts's Q2 Results

We struggled to find many strong positives in these results. Its EPS missed and its revenue fell short of Wall Street's estimates. Overall, this quarter could have been better. The stock remained flat at $46.68 immediately after reporting.

So should you invest in United Parks & Resorts right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.