Fashion conglomerate PVH (NYSE:PVH) announced better-than-expected revenue in Q3 CY2024, but sales fell by 4.6% year on year to $2.26 billion. Its non-GAAP profit of $3.03 per share was 17% above analysts’ consensus estimates.

Is now the time to buy PVH? Find out by accessing our full research report, it’s free.

PVH (PVH) Q3 CY2024 Highlights:

- Revenue: $2.26 billion vs analyst estimates of $2.22 billion (4.6% year-on-year decline, 1.5% beat)

- Adjusted EPS: $3.03 vs analyst estimates of $2.59 (17% beat)

- Management reiterated its full-year Adjusted EPS guidance of $11.63 at the midpoint

- Operating Margin: 8.1%, down from 9.7% in the same quarter last year

- Constant Currency Revenue fell 5.9% year on year (0.7% in the same quarter last year)

- Market Capitalization: $6.23 billion

Stefan Larsson, Chief Executive Officer, commented, “We beat our top- and bottom-line guidance for the third quarter, fueled by our relentless execution of the PVH+ Plan. Throughout the quarter, we drove powerful consumer engagement for both Calvin Klein and TOMMY HILFIGER, and continued to build momentum in product, with significantly improved sell-throughs for the Fall 24 season across all regions and both our iconic brands, and we are coming into the holiday season with a fresh and strong inventory composition.”

Company Overview

Founded in 1881 by a husband and wife duo, PVH (NYSE:PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

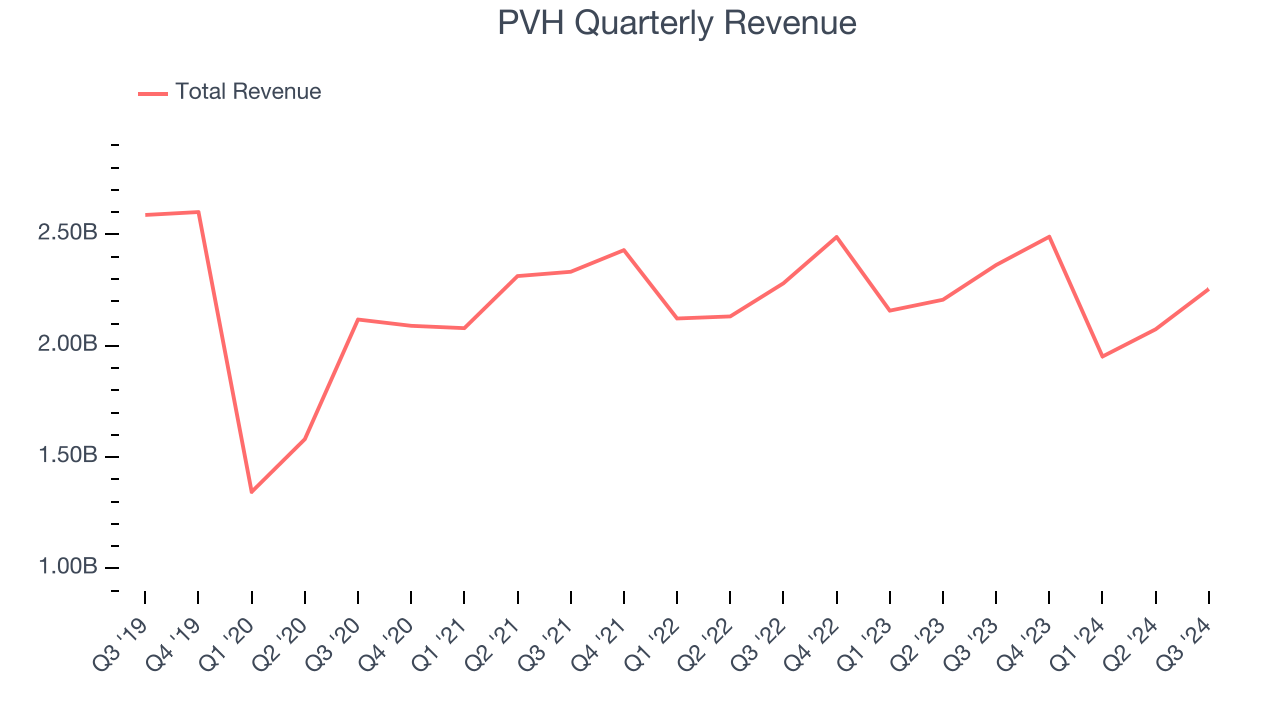

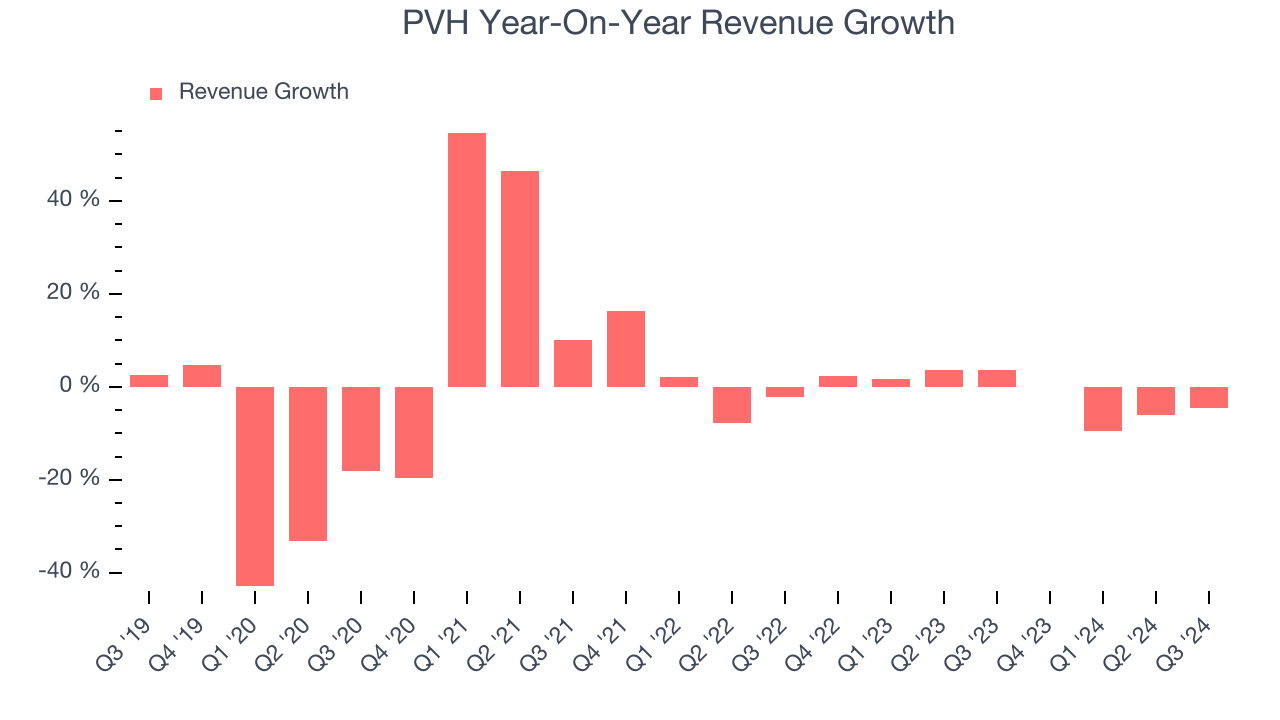

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. PVH’s demand was weak over the last five years as its sales fell at a 2.2% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. PVH’s annualized revenue declines of 1.1% over the last two years suggest its demand continued shrinking.

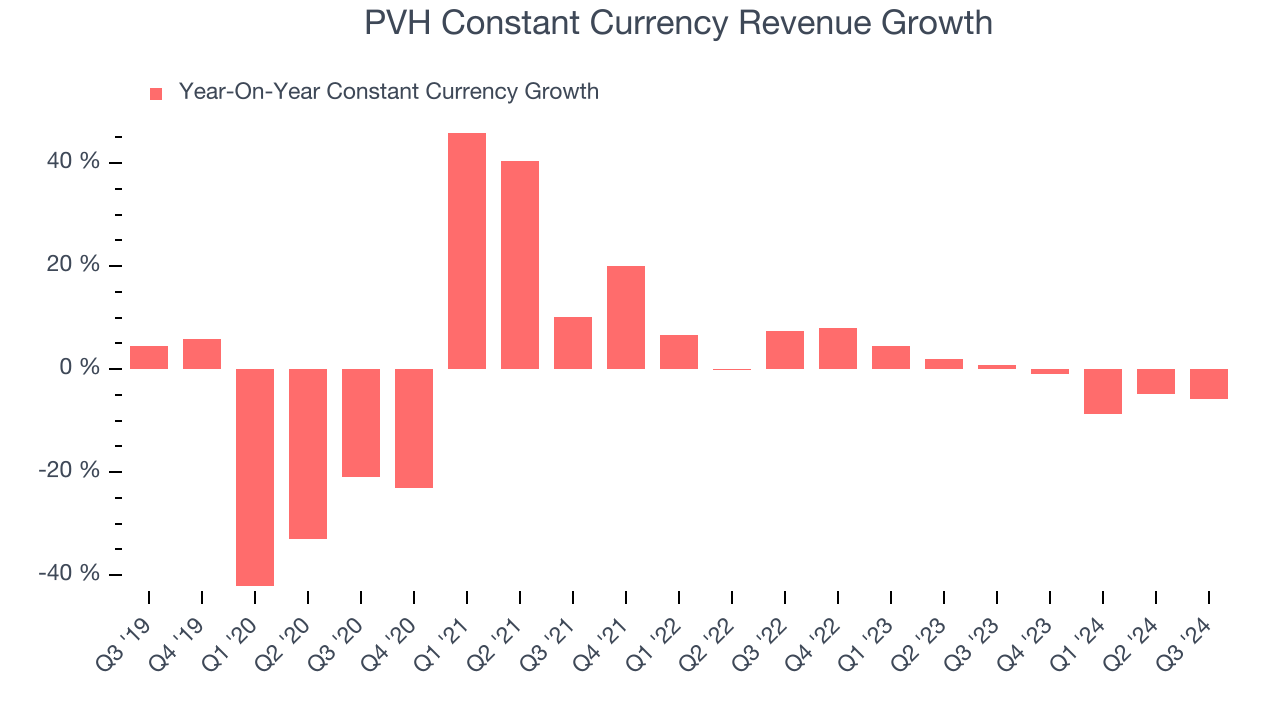

PVH also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number aligns with its normal revenue growth, we can see PVH’s foreign exchange rates have been steady.

This quarter, PVH’s revenue fell by 4.6% year on year to $2.26 billion but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

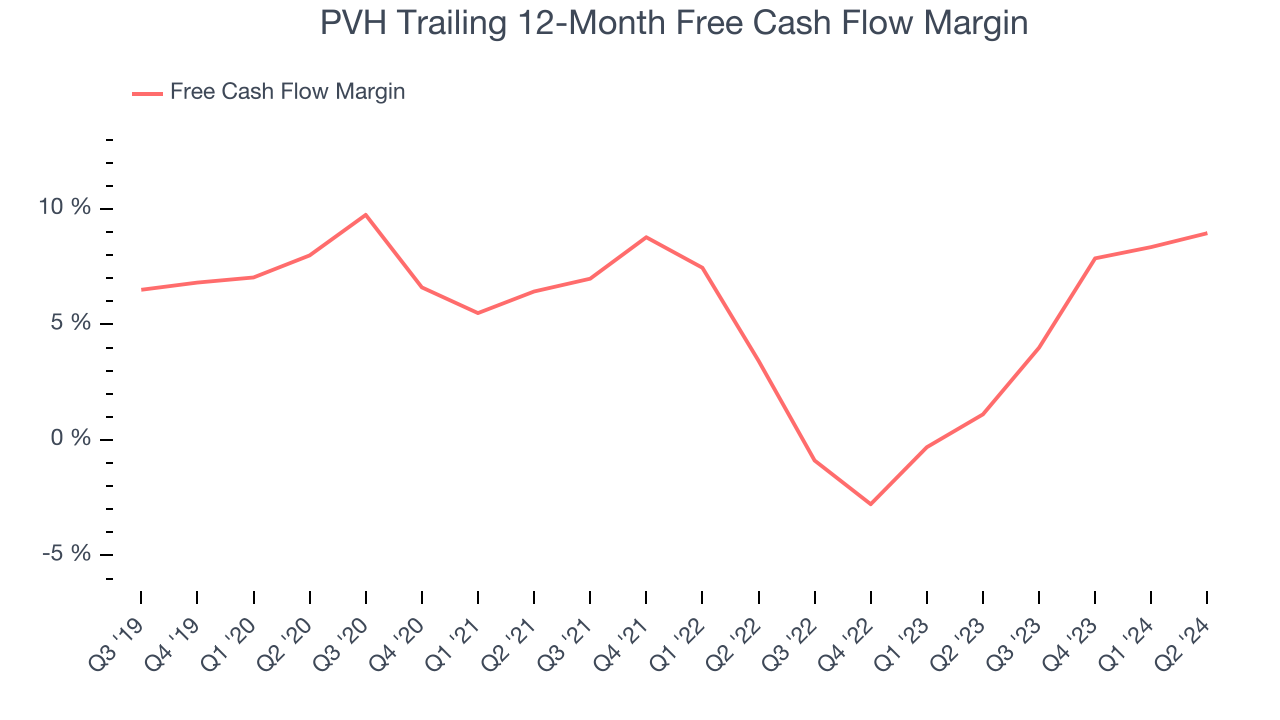

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

PVH has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7%, subpar for a consumer discretionary business.

Key Takeaways from PVH’s Q3 Results

We enjoyed seeing PVH exceed analysts’ EPS expectations this quarter. We were also happy its constant currency revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly. Overall, this was a weaker quarter. The stock traded down 6.7% to $105.26 immediately following the results.

Big picture, is PVH a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.