Fast-food company Restaurant Brands International (NYSE:QSR) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 9.4% year on year to $1.74 billion. It made a non-GAAP profit of $0.73 per share, down from its profit of $0.75 per share in the same quarter last year.

Restaurant Brands (QSR) Q1 CY2024 Highlights:

- Revenue: $1.74 billion vs analyst estimates of $1.70 billion (2.2% beat)

- EPS (non-GAAP): $0.73 vs analyst estimates of $0.72 (1.3% beat)

- Gross Margin (GAAP): 40%, down from 40.6% in the same quarter last year

- Free Cash Flow of $122 million, down 65.7% from the previous quarter

- Same-Store Sales were up 4.6% year on year

- Store Locations: 31,113 at quarter end, increasing by 1,157 over the last 12 months

- Market Capitalization: $23.36 billion

Formed through a strategic merger, Restaurant Brands International (NYSE:QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

The company was born in 2014 when Burger King (American fast-food) and Tim Hortons (Canadian coffee chain) merged to form Restaurant Brands International under the leadership of Brazilian private equity firm 3G Capital. This move brought together two iconic brands with complementary strengths, allowing Restaurant Brands International to leverage their combined resources and expertise. The company expanded further in 2017 when it acquired Popeyes (fried chicken), adding a new dimension of growth to its portfolio of brands.

Each fast-food chain brings different flavors to the table. Burger King, known for its Whopper and Chicken Fries, specializes in flame-grilled burgers. Tim Hortons has captured the hearts of Canadians and coffee lovers worldwide with its exceptional brews and delectable doughnuts. Popeyes, renowned for its flavorful Louisiana-style fried chicken, brings its distinctive Cajun-inspired seasonings and fried chicken sandwich (once impossible to get) to the global stage.

Much of Restaurant Brands International’s success can be attributed to its focus on customer convenience and digital advancements. It’s developed mobile apps to facilitate online ordering, customization, and loyalty rewards while partnering with leading delivery platforms to ensure that customers can indulge in their favorite meals wherever they may be.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Restaurant Brands International’s competitors include McDonald’s (NYSE:MCD), Shake Shack (NYSE:SHAK), Wendy’s (NASDAQ:WEN), and Taco Bell and KFC (owned by Yum! Brands, NYSE:YUM).Sales Growth

Restaurant Brands is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

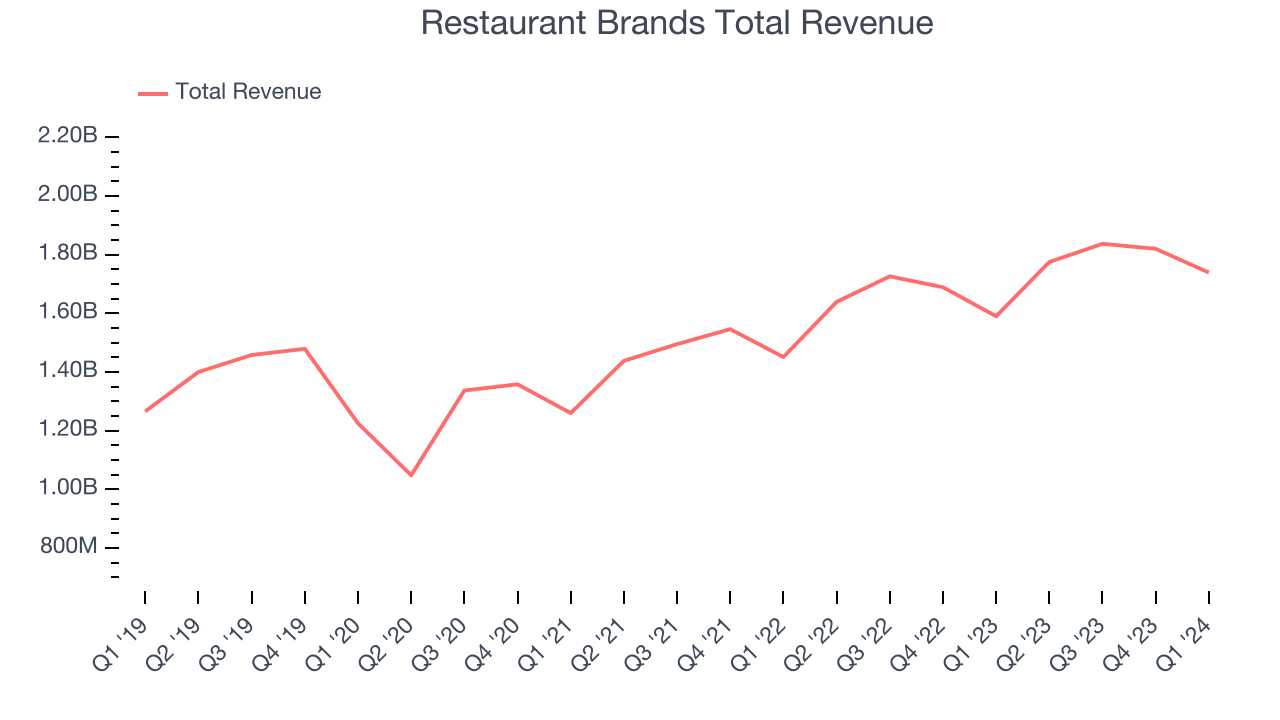

As you can see below, the company's annualized revenue growth rate of 6% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Restaurant Brands reported solid year-on-year revenue growth of 9.4%, and its $1.74 billion in revenue outperformed Wall Street's estimates by 2.2%. Looking ahead, Wall Street expects sales to grow 5% over the next 12 months, a deceleration from this quarter.

Same-Store Sales

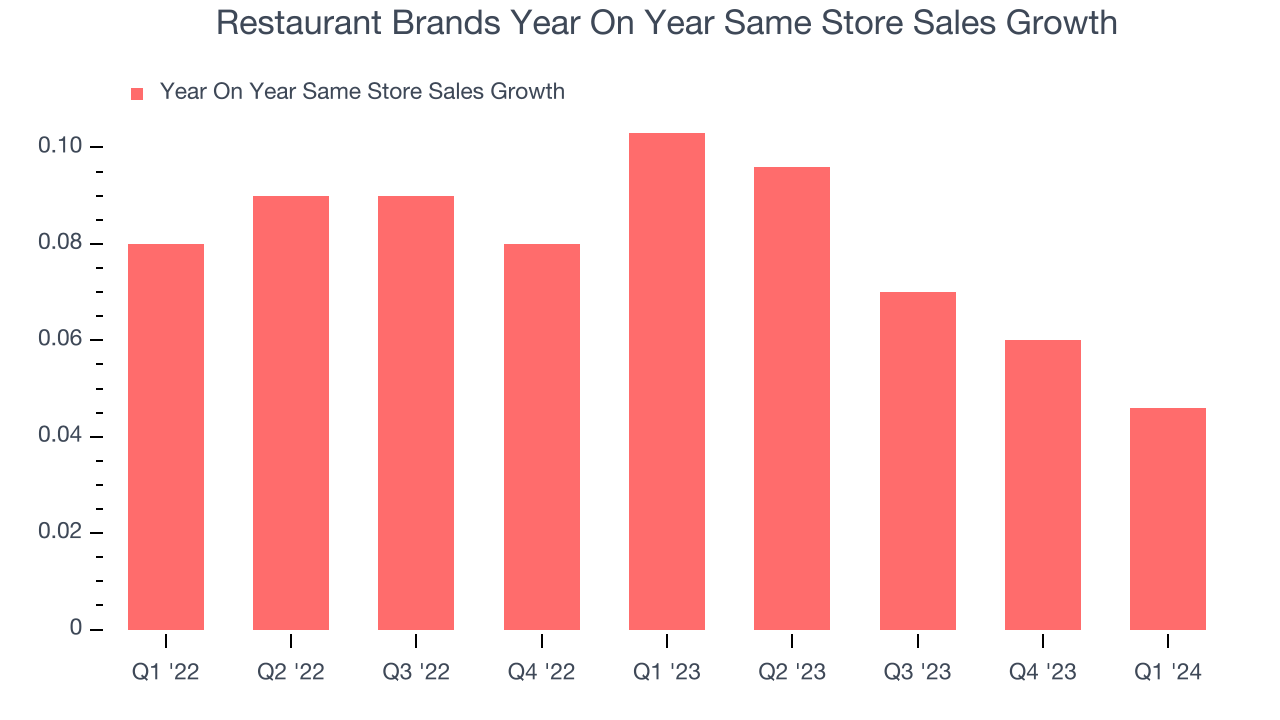

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Restaurant Brands's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 7.9% year on year. With positive same-store sales growth amid an increasing number of restaurants, Restaurant Brands is reaching more diners and growing sales.

In the latest quarter, Restaurant Brands's same-store sales rose 4.6% year on year. By the company's standards, this growth was a meaningful deceleration from the 10.3% year-on-year increase it posted 12 months ago. We'll be watching Restaurant Brands closely to see if it can reaccelerate growth.

Number of Stores

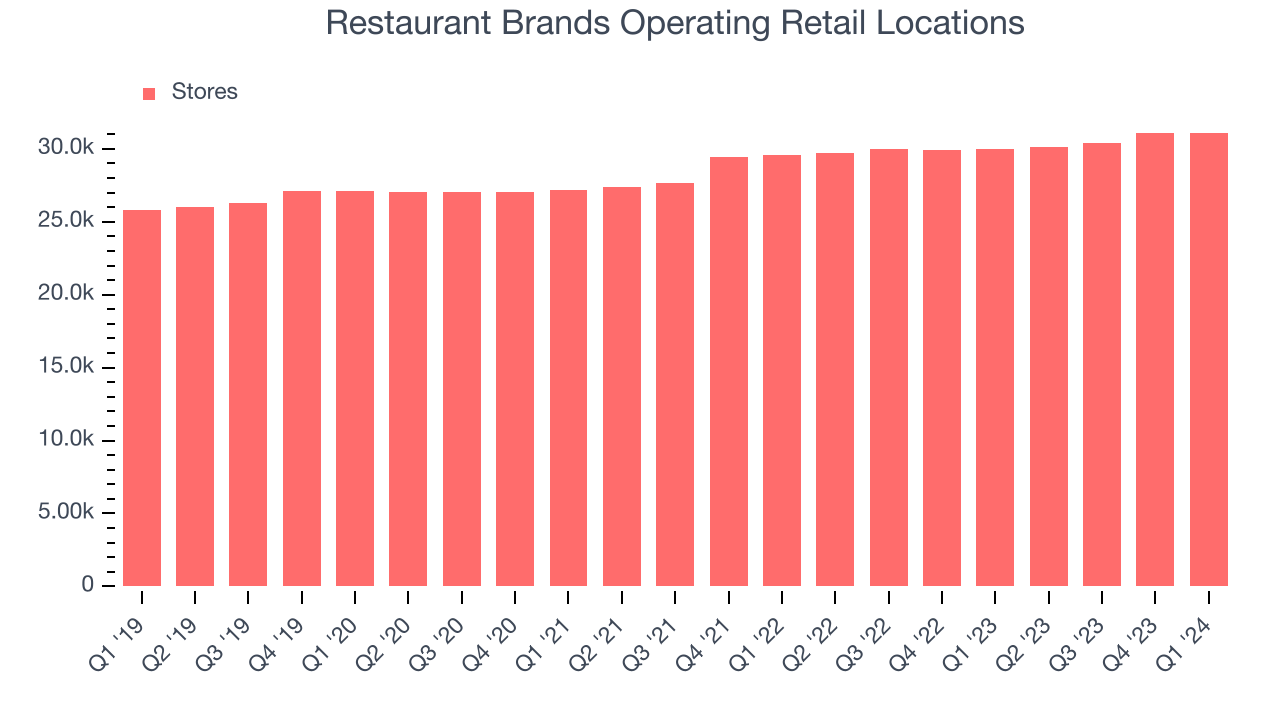

The number of dining locations a restaurant chain operates is a major determinant of how much it can sell and how quickly company-level sales can grow.

When a chain like Restaurant Brands is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Restaurant Brands's restaurant count increased by 1,157, or 3.9%, to 31,113 locations in the most recently reported quarter.

Over the last two years, Restaurant Brands has rapidly opened new restaurants, averaging 3.8% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Restaurant Brands has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

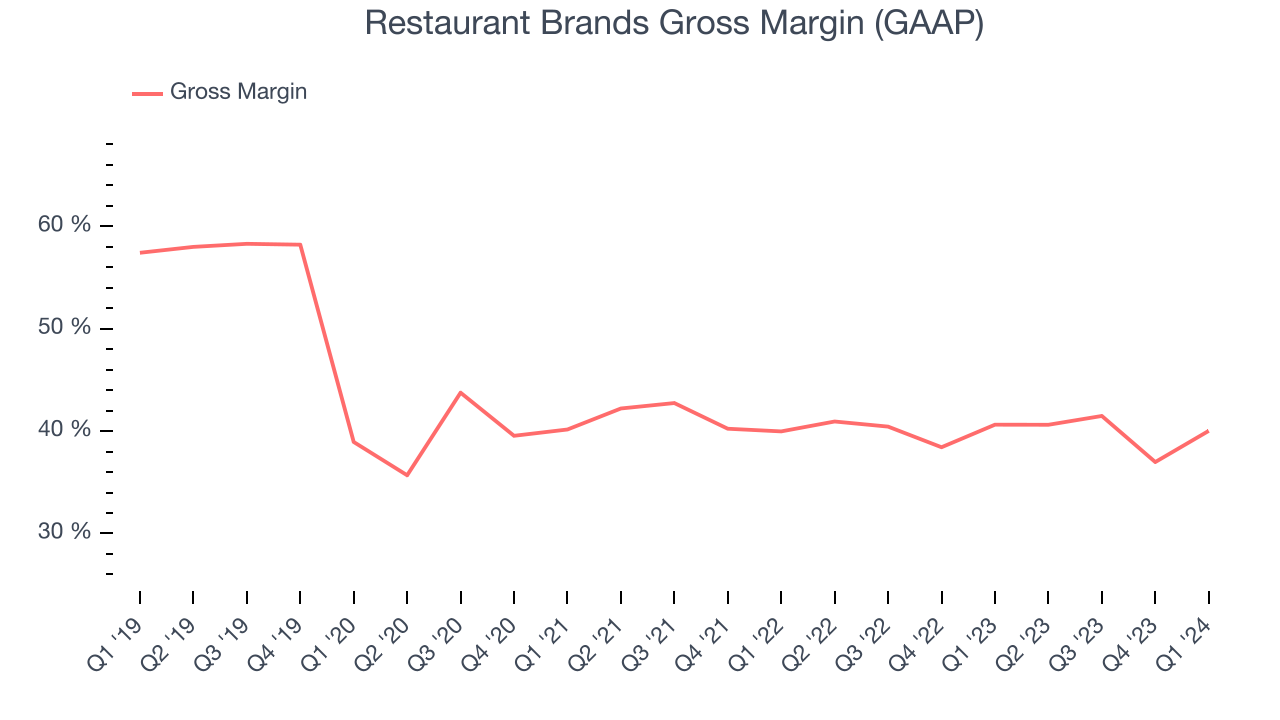

Gross profit margins are an important measure of a restaurant's pricing power and differentiation, whether it be the dining experience or quality and taste of food.

In Q1, Restaurant Brands's gross profit margin was 40%. in line with the same quarter last year. This means the company makes $0.40 for every $1 in revenue before accounting for its operating expenses.

Restaurant Brands has great unit economics for a restaurant company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 39.9% gross margin over the last eight quarters. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as ingredients and transportation expenses).

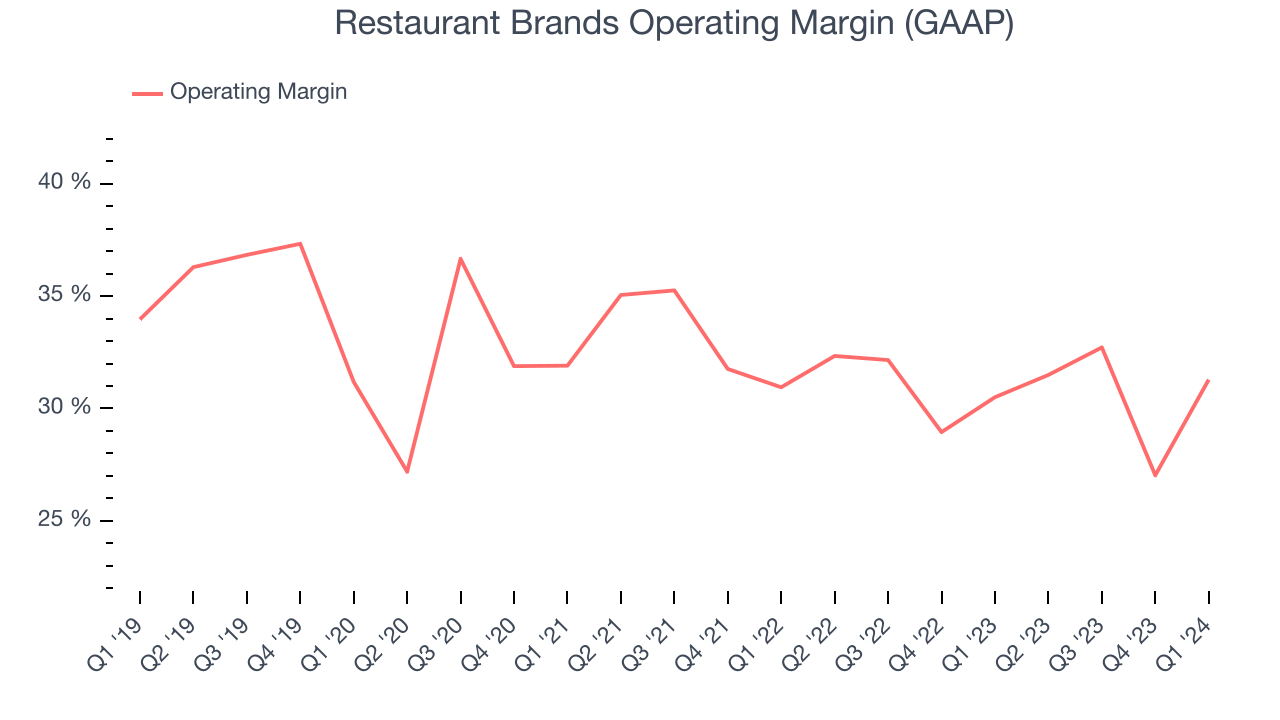

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Restaurant Brands generated an operating profit margin of 31.3%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Restaurant Brands has been a well-managed company over the last two years. It's demonstrated elite profitability for a restaurant business, boasting an average operating margin of 30.8%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Restaurant Brands has been a well-managed company over the last two years. It's demonstrated elite profitability for a restaurant business, boasting an average operating margin of 30.8%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

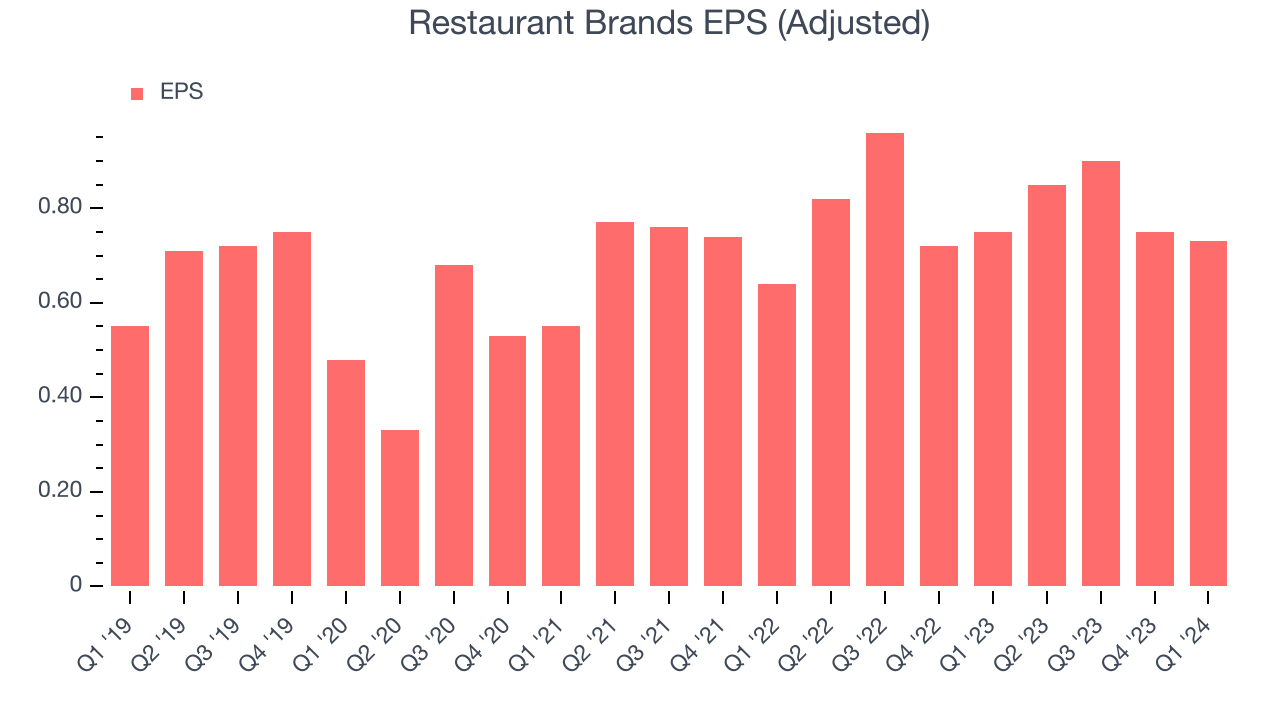

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Restaurant Brands reported EPS at $0.73, down from $0.75 in the same quarter a year ago. This print beat Wall Street's estimates by 1.3%.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 7.2% year-on-year increase in EPS.

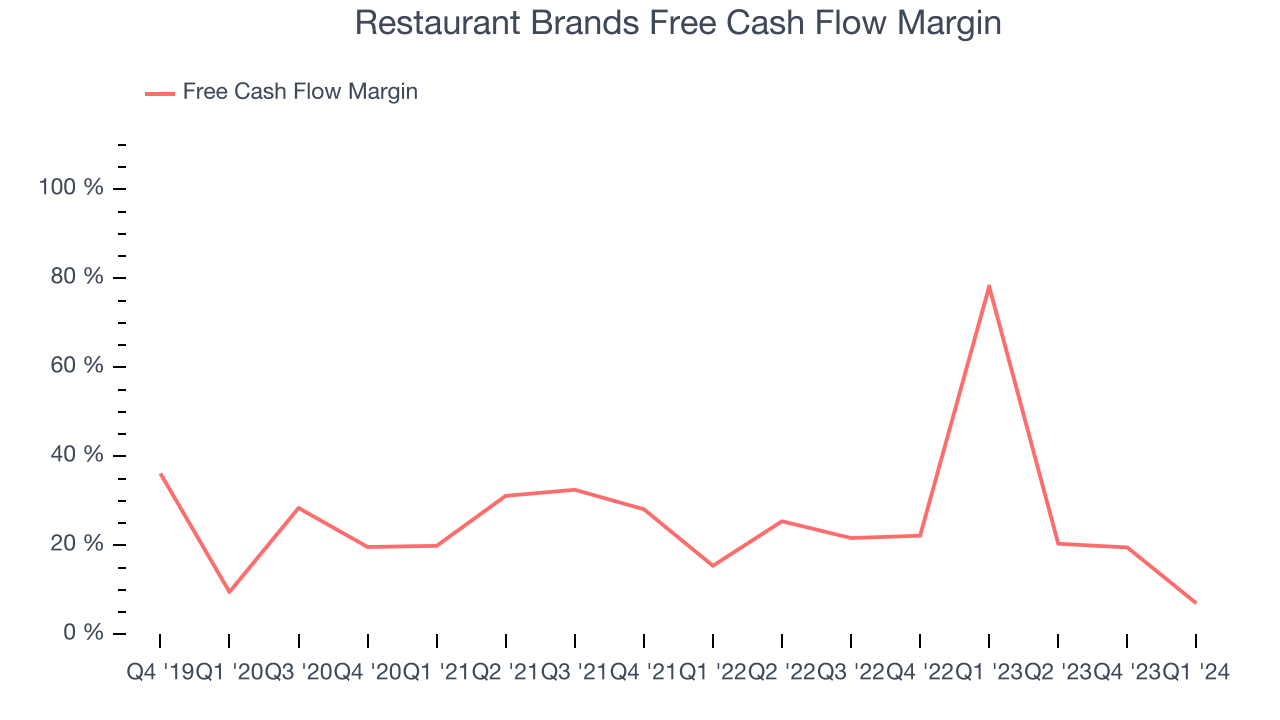

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Restaurant Brands's free cash flow came in at $122 million in Q1, down 90.2% year on year. This result represents a 7% margin.

Over the last eight quarters, Restaurant Brands has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the restaurant sector, averaging 27.1%. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

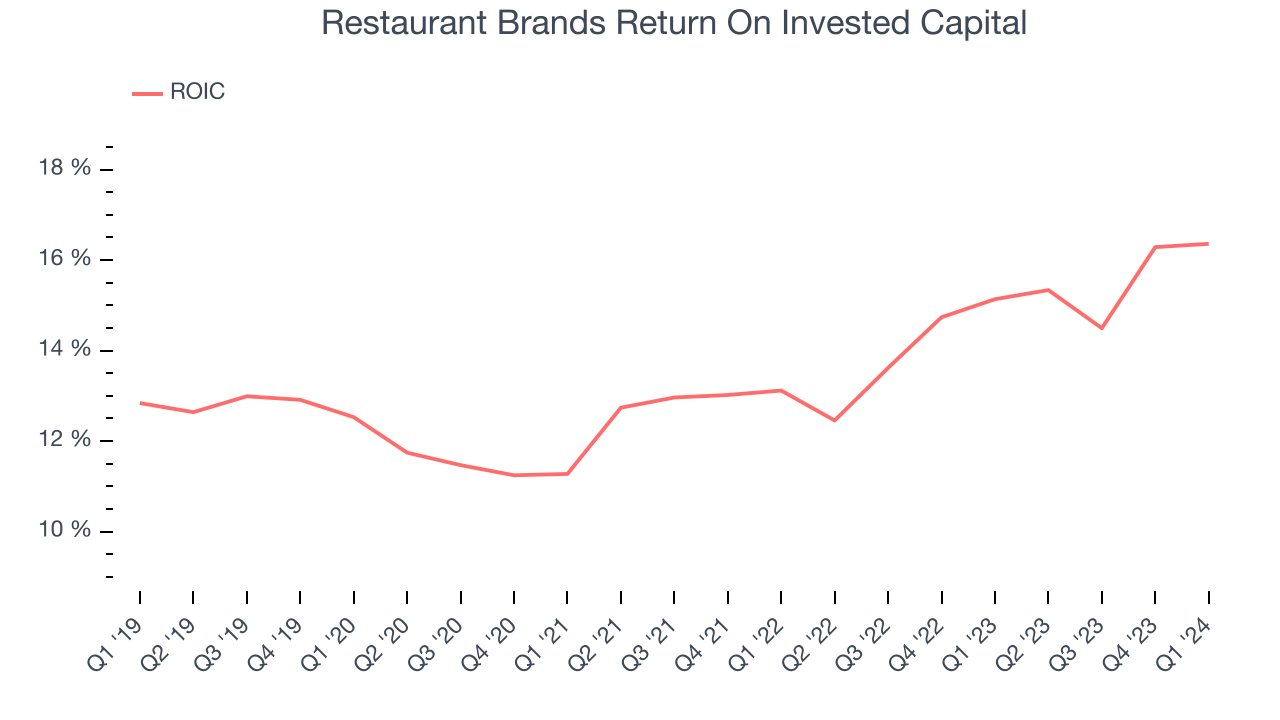

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Restaurant Brands's five-year average ROIC was 13.7%, higher than most restaurant companies. Just as you’d like your investment dollars to generate returns, Restaurant Brands's invested capital has produced solid profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Restaurant Brands's ROIC averaged 3.8 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Restaurant Brands reported $1.05 billion of cash and $12.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.59 billion of EBITDA over the last 12 months, we view Restaurant Brands's 4.6x net-debt-to-EBITDA ratio as safe. We also see its $292 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Restaurant Brands's Q1 Results

We were excited that Restaurant Brands exceeded expectations on the revenue and EPS lines. Zooming out, we think this was a solid quarter. The stock is flat after reporting and currently trades at $74.3 per share.

Is Now The Time?

Restaurant Brands may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Restaurant Brands isn't a bad business. Although its revenue growth has been a little slower over the last five years, its impressive operating margins show it has a highly efficient business model. Investors should still be cautious, however, as its projected EPS for the next year is lacking.

Restaurant Brands's price-to-earnings ratio based on the next 12 months is 21.3x. In the end, beauty is in the eye of the beholder. While Restaurant Brands wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $85.49 per share right before these results (compared to the current share price of $74.30).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.