Heading into the new earnings season, it’s time to take stock of this quarter's best and worst performers amongst the vertical software stocks in Q3, including Q2 Holdings (NYSE:QTWO) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 11 vertical software stocks we track reported a weaker Q3; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 2.32% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but vertical software stocks held their ground better than others, with the share prices up 17.5% since the previous earnings results, on average.

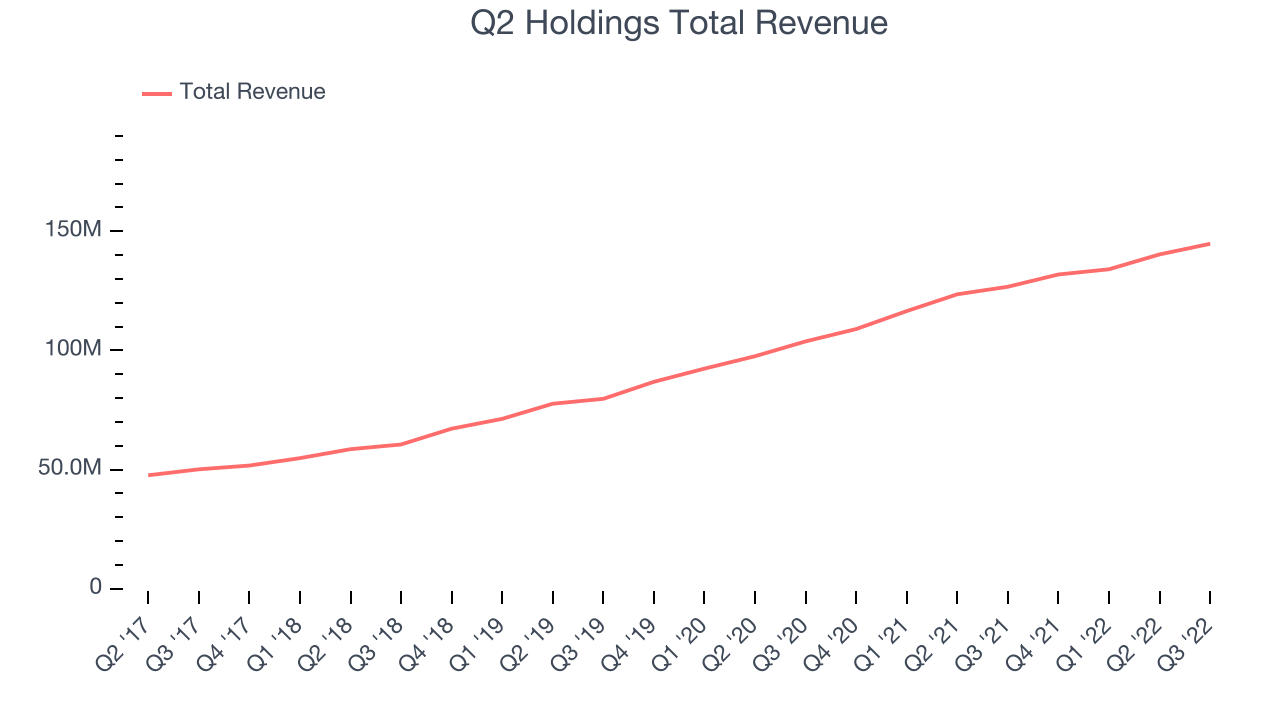

Q2 Holdings (NYSE:QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software as a service that enables small banks provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $144.7 million, up 14.2% year on year, missing analyst expectations by 1.37%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

“The third quarter represented our strongest bookings performance of the year,” said Q2 CEO Matt Flake.

Q2 Holdings delivered the weakest full year guidance update of the whole group. The stock is up 24.4% since the results and currently trades at $32.82.

Read our full report on Q2 Holdings here, it's free.

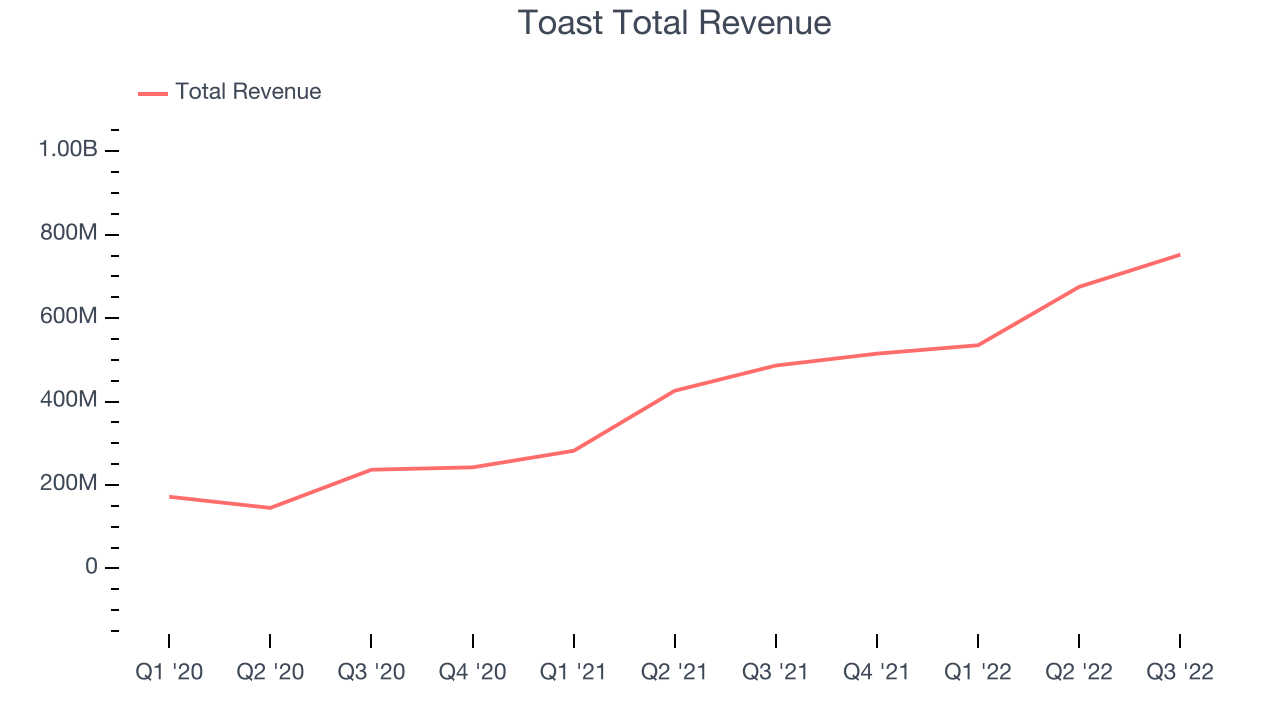

Best Q3: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $752 million, up 54.6% year on year, beating analyst expectations by 4.31%. It was a very strong quarter for the company, with a significant improvement in gross margin and exceptional revenue growth.

Toast delivered the fastest revenue growth among its peers. The stock is up 12.9% since the results and currently trades at $22.59.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $157.2 million, down 31.2% year on year, missing analyst expectations by 7.2%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

Upstart had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 3.46% since the results and currently trades at $18.4.

Read our full analysis of Upstart's results here.

nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $105.2 million, up 50.3% year on year, beating analyst expectations by 1.78%. It was a mixed quarter for the company, with exceptional revenue growth but underwhelming revenue guidance for the next quarter.

The stock is up 11% since the results and currently trades at $28.95.

Read our full, actionable report on nCino here, it's free.

Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading professional network for U.S. medical professionals.

Doximity reported revenues of $102.1 million, up 28.7% year on year, beating analyst expectations by 1.83%. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter.

The stock is up 32.5% since the results and currently trades at $34.91.

Read our full, actionable report on Doximity here, it's free.

The author has no position in any of the stocks mentioned