Advertising data platform LiveRamp (NYSE:RAMP) beat analyst expectations in Q4 FY2021 quarter, with revenue up 12.7% year on year to $119.1 million. LiveRamp made a GAAP loss of $32.8 million, down on its loss of $4.12 million, in the same quarter last year.

What do these results signal for the future of LiveRamp? Get early access our full analysis here

LiveRamp (NYSE:RAMP) Q4 FY2021 Highlights:

- Revenue: $119.1 million vs analyst estimates of $116.1 million (2.58% beat)

- EPS (non-GAAP): $0.04 vs analyst estimates of $0.03 ($0.01 beat)

- Revenue guidance for Q1 2022 is $112 million at the midpoint, below analyst estimates of $112.8 million

- Management's revenue guidance for upcoming financial year 2022 is $509 million at the midpoint, predicting 14.8% growth (vs 26.5% in FY2021)

- Free cash flow was negative -$18.27 million, down from positive free cash flow of $14 million in previous quarter

- Net Revenue Retention Rate: 104%, down from 110% previous quarter

- Customers: 825, up from 810 in previous quarter

- Gross Margin (GAAP): 68.4%, in line with previous quarter

- Updated valuation: LiveRamp is flat at $47 and now trades at 7.1x price-to-sales (LTM), compared to 7.2x just before the results.

“LiveRamp had an exceptional year amidst an unprecedented macro environment. I am proud of how our team showed up for our customers and each other in FY21,” said LiveRamp CEO Scott Howe.

Advertising Data Aggregator

LiveRamp (NYSE:RAMP) provides software as a service that helps companies better target their marketing by merging offline and online data about their customers. The advertising market is massive, growing and becoming more diverse, both in terms of audiences and media. This as a result drives a growing need to automate and optimize ad placements, which requires reliable data, and that is LiveRamp's market.

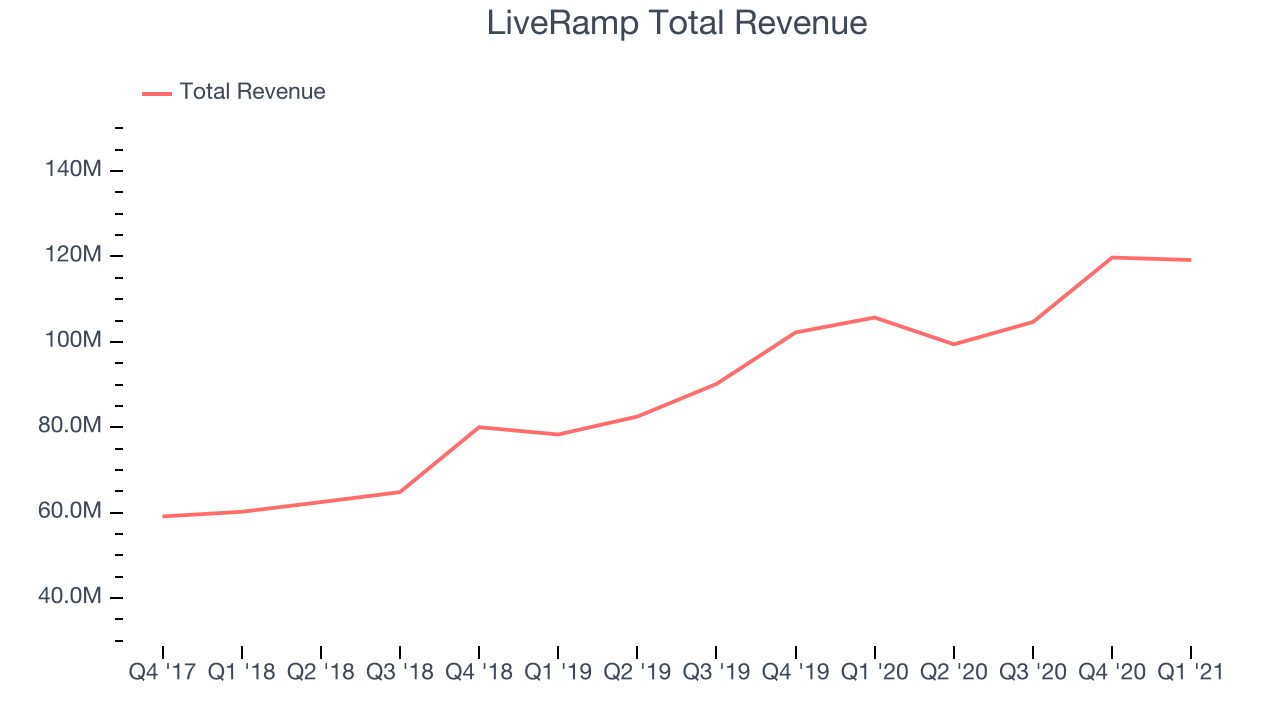

As you can see below, LiveRamp's revenue growth has been strong over the last twelve months, growing from $105.7 million to $119.1 million.

This quarter, LiveRamp's quarterly revenue was once again up 12.7% year on year. We can see that revenue decreased by $578 thousand in Q4, down from the increase of $15 million in Q3 2021. Having said that, we wouldn't be too concerned about the slowdown in a single quarter, because LiveRamp's revenue seems to be more seasonal and bumpy compared to other SaaS companies.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Customers

LiveRamp's customers are marketing agencies and enterprises big enough to have a full-scale marketing operation.

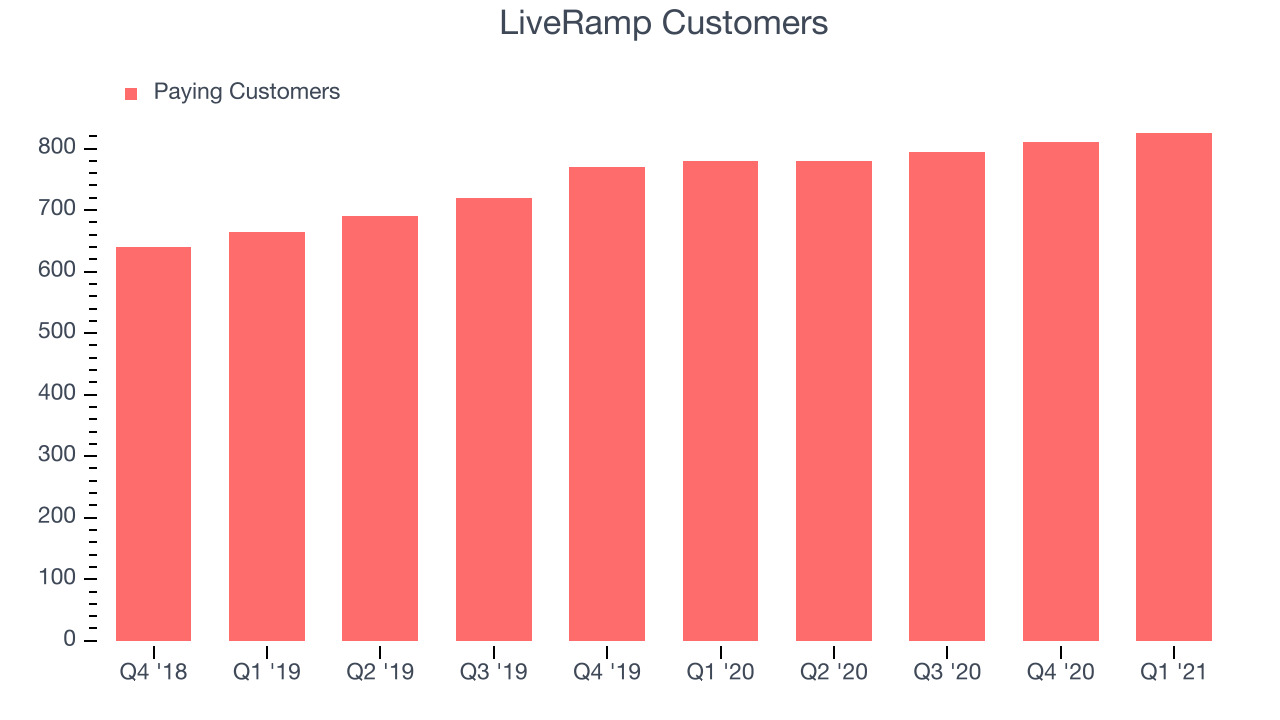

You can see below that LiveRamp reported 825 customers at the end of the quarter, an increase of 15 on last quarter. That's about the same customer growth as what we seen last quarter, confirming the company is sustaining a good pace of sales.

Key Takeaways from LiveRamp's Q4 Results

With market capitalisation of $3.17 billion LiveRamp is among smaller companies, but its more than $572.7 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

It was good to see LiveRamp outperform Wall St’s revenue expectations this quarter. That feature of these results really stood out as a positive. On the other hand, the revenue guidance for next year indicates a slowdown. Overall, this quarter's results were not the best we've seen from LiveRamp. LiveRamp isn't necessarily our first pick when looking for the best growth stocks, and nothing we have seen today has changed that.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.