Advertising data platform LiveRamp (NYSE:RAMP) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue up 14.2% year on year to $176 million. The company expects next quarter's revenue to be around $176 million, in line with analysts' estimates. It made a non-GAAP profit of $0.35 per share, improving from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy LiveRamp? Find out by accessing our full research report, it's free.

LiveRamp (RAMP) Q2 CY2024 Highlights:

- Revenue: $176 million vs analyst estimates of $171.9 million (2.4% beat)

- EPS (non-GAAP): $0.35 vs analyst estimates of $0.31 (13% beat)

- Revenue Guidance for Q3 CY2024 is $176 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly lifted its revenue guidance for the full year from $720 million to $725 million at the midpoint

- Gross Margin (GAAP): 70.6%, in line with the same quarter last year

- Free Cash Flow was -$9.55 million, down from $25.85 million in the previous quarter

- Net Revenue Retention Rate: 105%, up from 103% in the previous quarter

- Customers: 900, similar to the previous quarter

- Market Capitalization: $1.80 billion

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

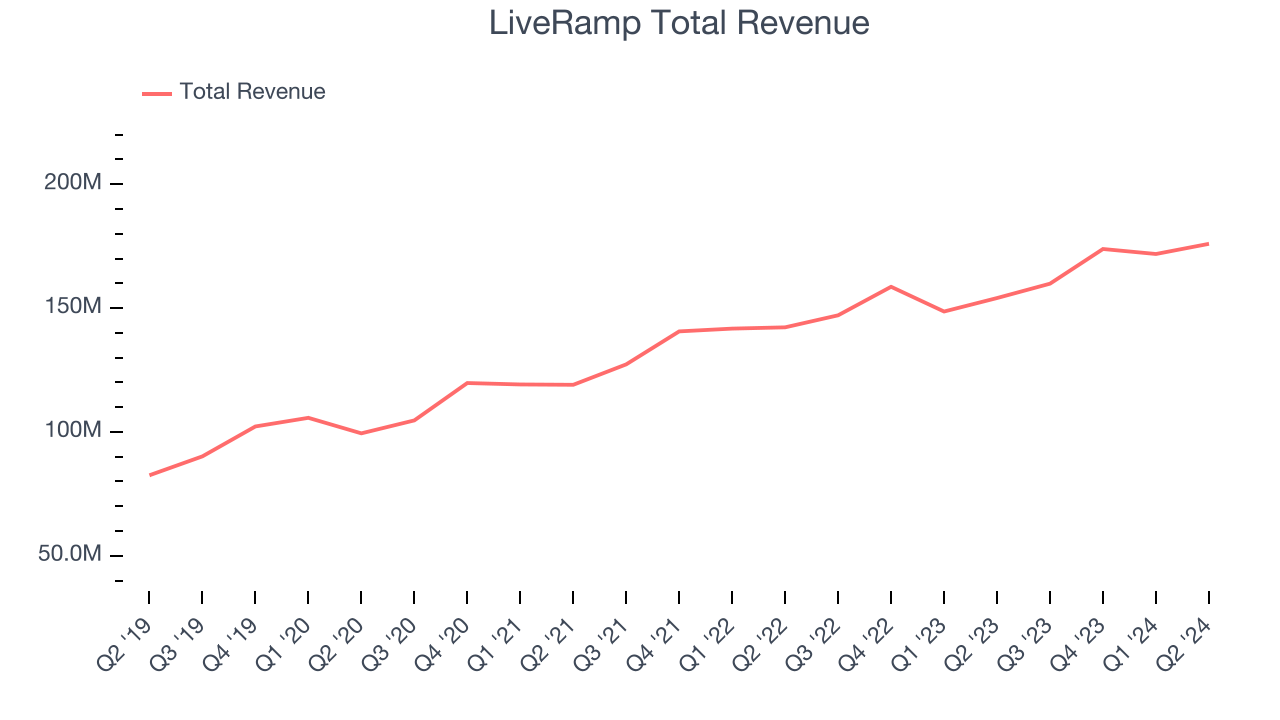

Sales Growth

As you can see below, LiveRamp's 13.8% annualized revenue growth over the last three years has been sluggish, and its sales came in at $176 million this quarter.

This quarter, LiveRamp's quarterly revenue was once again up 14.2% year on year. On top of that, its revenue increased $4.11 million quarter on quarter, a strong improvement from the $2.02 million decrease in Q1 CY2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that LiveRamp is expecting revenue to grow 10.1% year on year to $176 million, improving on the 8.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 8.1% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

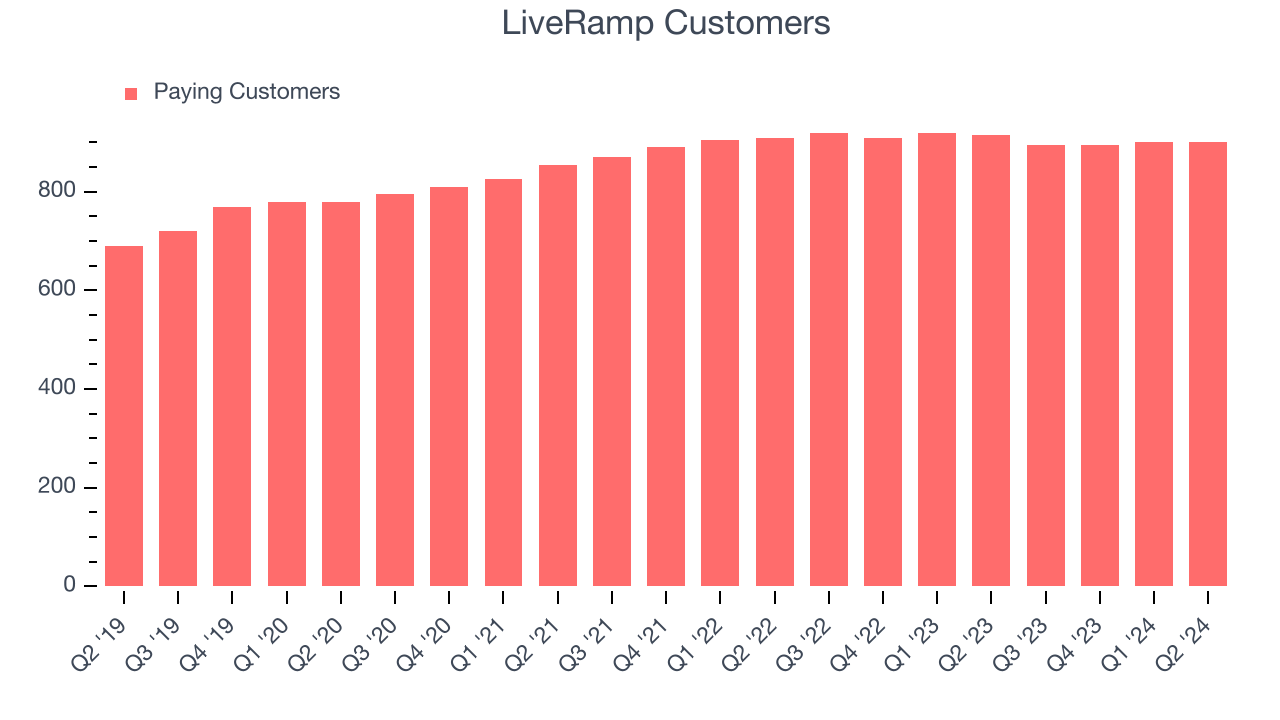

Customer Growth

LiveRamp reported 900 customers at the end of the quarter, flat versus the previous quarter. That's slower customer growth than last quarter but quite a bit above what we've typically observed over the last 12 months, suggesting that its sales momentum is healthy but softening after a tough comp quarter from last year.

Key Takeaways from LiveRamp's Q2 Results

It was great to see LiveRamp improve its net revenue retention and beat analysts' revenue and EPS expectations this quarter. We were also glad it raised its full-year revenue guidance, which outperformed Wall Street's estimates. Overall, this was a solid quarter for LiveRamp. The stock remained flat at $26.92 immediately following the results.

LiveRamp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.