Wrapping up Q2 earnings, we look at the numbers and key takeaways for the advertising software stocks, including LiveRamp (NYSE:RAMP) and its peers.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.7% above.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Luckily, advertising software stocks have performed well with share prices up 17.2% on average since the latest earnings results.

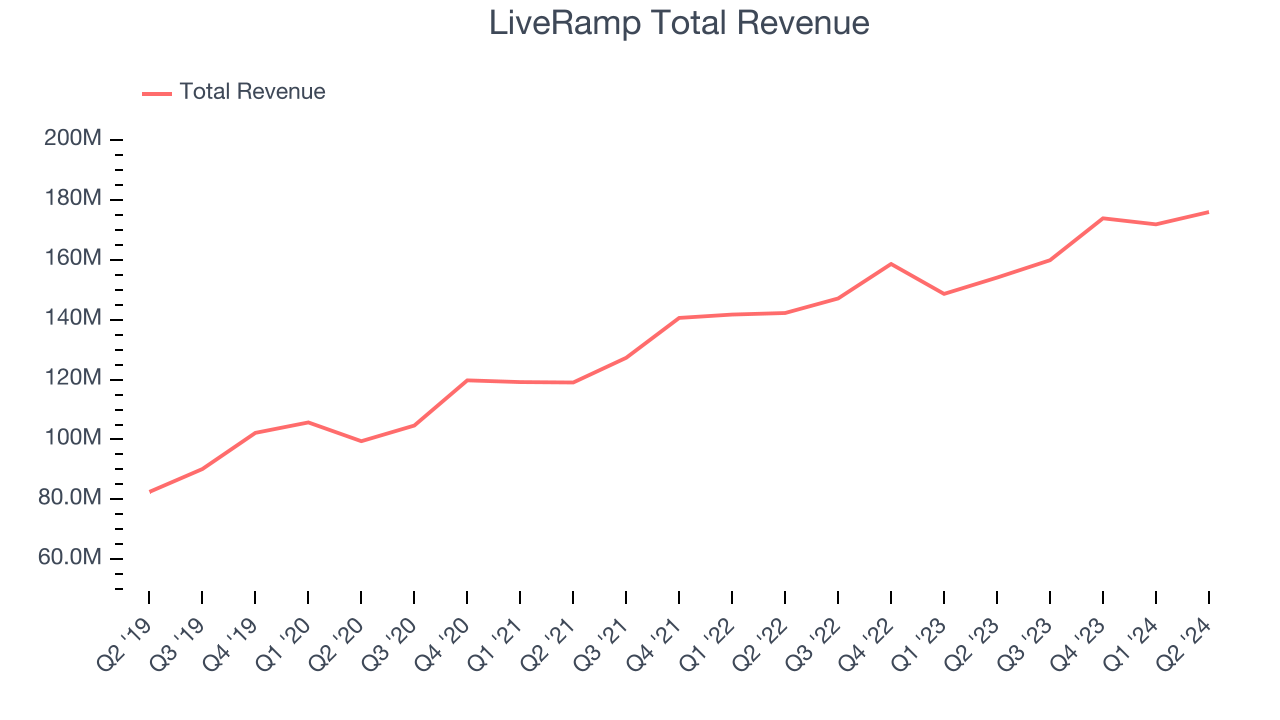

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $176 million, up 14.2% year on year. This print exceeded analysts’ expectations by 2.4%. Despite the top-line beat, it was still a slower quarter for the company with decelerating customer growth and a decline in its gross margin.

Unsurprisingly, the stock is down 8% since reporting and currently trades at $24.78.

Read our full report on LiveRamp here, it’s free.

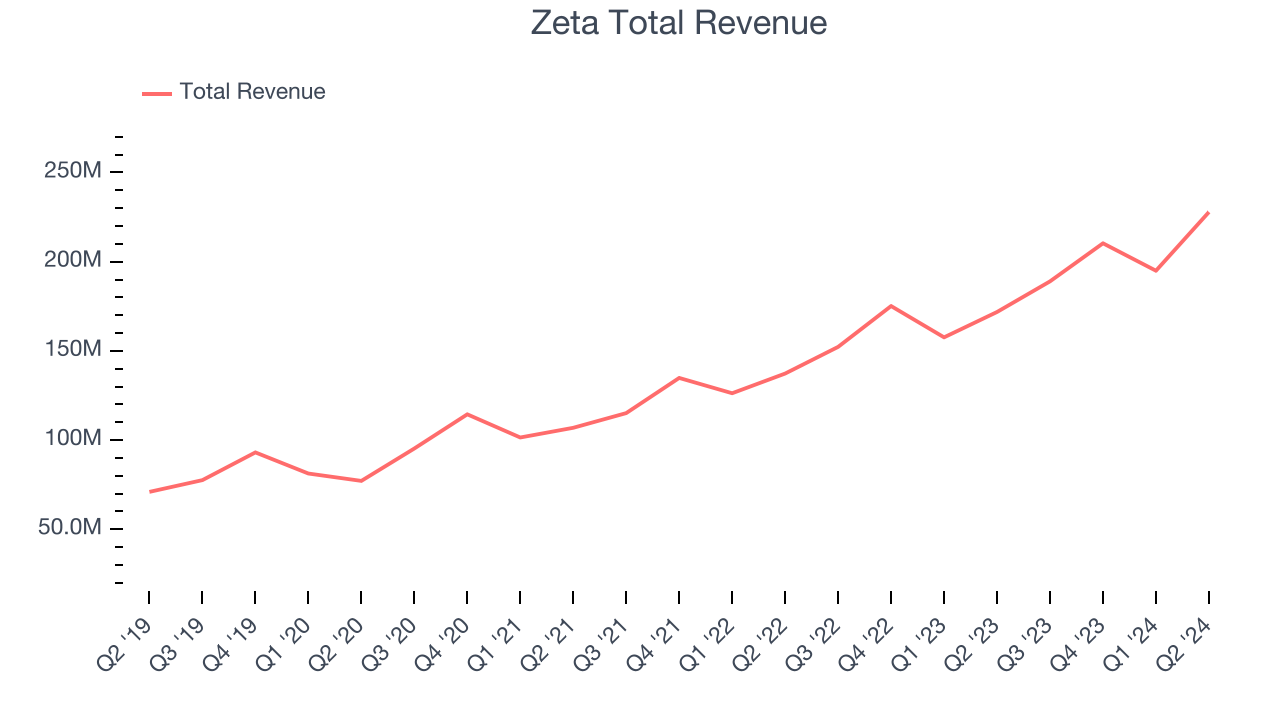

Best Q2: Zeta (NYSE:ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $227.8 million, up 32.6% year on year, outperforming analysts’ expectations by 7.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and optimistic revenue guidance for the next quarter.

Zeta achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 36.8% since reporting. It currently trades at $29.37.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $67.27 million, up 6.2% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter.

PubMatic delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 23.3% since the results and currently trades at $15.03.

Read our full analysis of PubMatic’s results here.

AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.08 billion, up 44% year on year. This result met analysts’ expectations. Zooming out, it was a slower quarter as it underperformed in other aspects of the business.

AppLovin achieved the fastest revenue growth among its peers. The stock is up 94.3% since reporting and currently trades at $130.54.

Read our full, actionable report on AppLovin here, it’s free.

DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE:DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $155.9 million, up 16.6% year on year. This number beat analysts’ expectations by 1.4%. It was a satisfactory quarter as it also recorded a meaningful improvement in its gross margin.

The stock is down 22% since reporting and currently trades at $16.84.

Read our full, actionable report on DoubleVerify here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.