Bearings manufacturer RBC Bearings (NYSE:RBC) fell short of the market’s revenue expectations in Q3 CY2024 as sales rose 3.2% year on year to $397.9 million. On the other hand, the company expects next quarter’s revenue to be around $395 million, close to analysts’ estimates. Its non-GAAP profit of $2.29 per share was in line with analysts’ consensus estimates.

Is now the time to buy RBC Bearings? Find out by accessing our full research report, it’s free.

RBC Bearings (RBC) Q3 CY2024 Highlights:

- Revenue: $397.9 million vs analyst estimates of $404.5 million (1.6% miss)

- Adjusted EPS: $2.29 vs analyst expectations of $2.30 (in line)

- EBITDA: $123.4 million vs analyst estimates of $123.7 million (small miss)

- Revenue Guidance for Q4 CY2024 is $395 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 43.7%, in line with the same quarter last year

- Operating Margin: 21.6%, down from 22.8% in the same quarter last year

- EBITDA Margin: 31%, in line with the same quarter last year

- Free Cash Flow Margin: 6.7%, down from 11.8% in the same quarter last year

- Market Capitalization: $8.72 billion

“RBC delivered another quarter of strong operational performance with total A&D sales up 12.5% year over year and Industrial sales down only 1.4% year over year,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer.

Company Overview

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE:RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

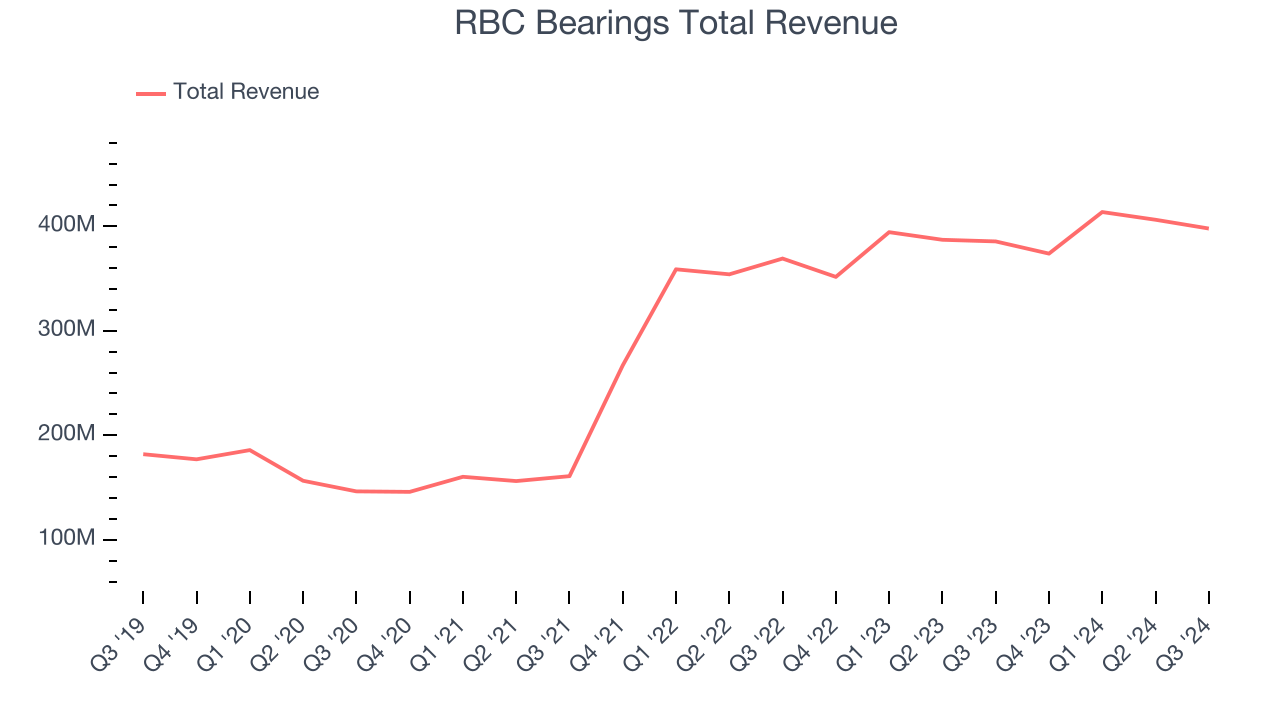

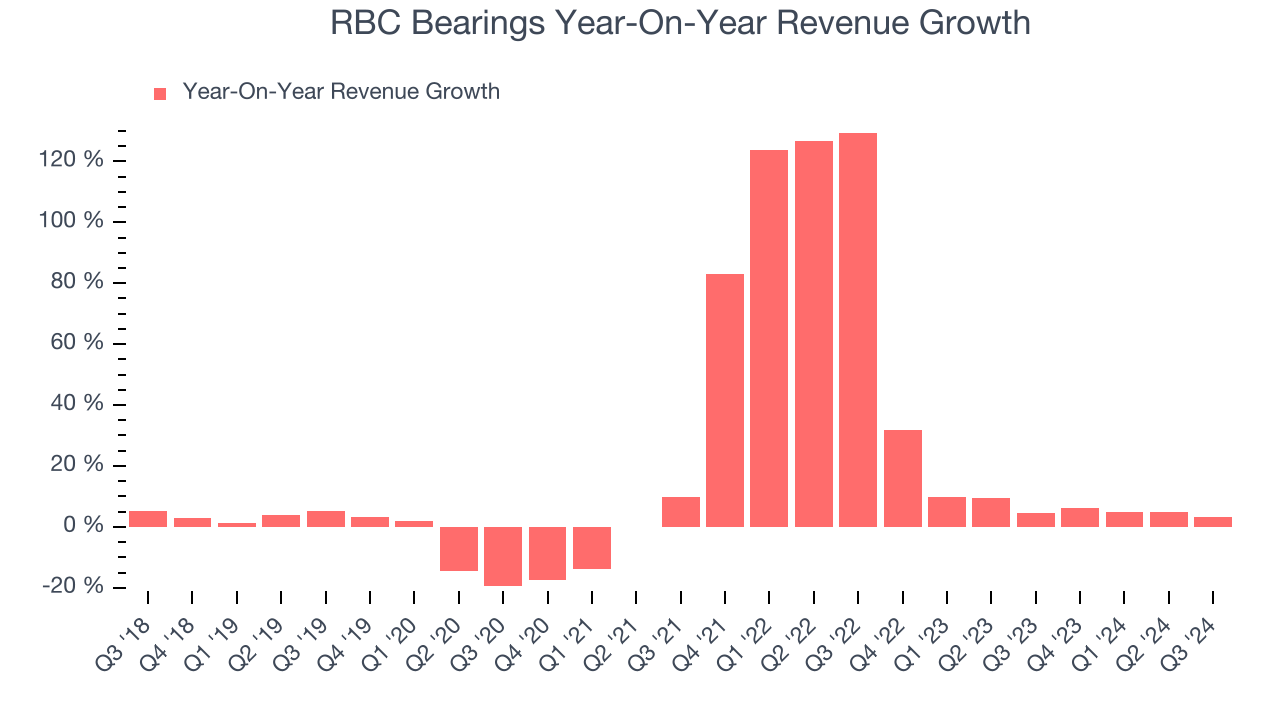

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, RBC Bearings grew its sales at an incredible 17.3% compounded annual growth rate. This is encouraging because it shows RBC Bearings’s offerings resonate with customers, a helpful starting point.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. RBC Bearings’s annualized revenue growth of 8.6% over the last two years is below its five-year trend, but we still think the results were respectable.

RBC Bearings also breaks out the revenue for its most important segments, Diversified Industrials and Aerospace and Defense, which are 36% and 64% of revenue. Over the last two years, RBC Bearings’s Diversified Industrials revenue (general industrial equipment) was flat while its Aerospace and Defense revenue (aircraft equipment, radar, missiles) averaged 29.6% year-on-year growth.

This quarter, RBC Bearings’s revenue grew 3.2% year on year to $397.9 million, falling short of Wall Street’s estimates. Management is currently guiding for a 5.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and shows the market believes its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

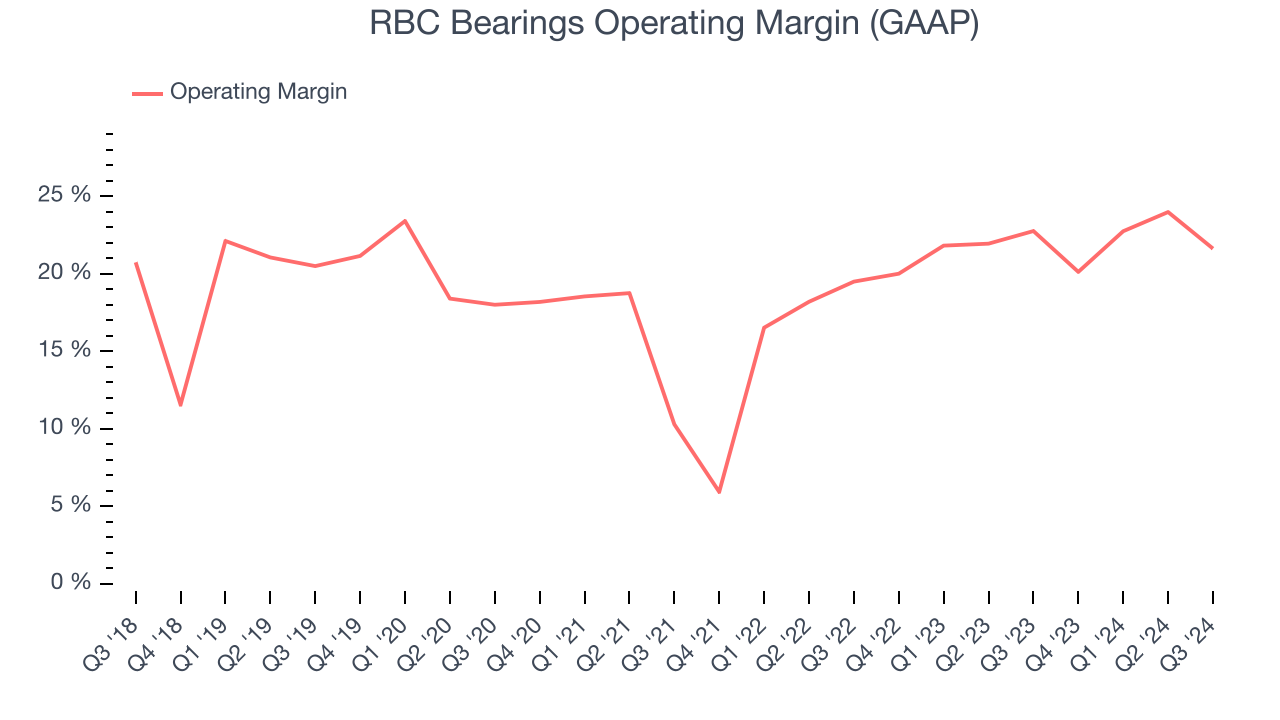

Operating Margin

RBC Bearings has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, RBC Bearings’s annual operating margin rose by 1.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, RBC Bearings generated an operating profit margin of 21.6%, down 1.1 percentage points year on year. Since RBC Bearings’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

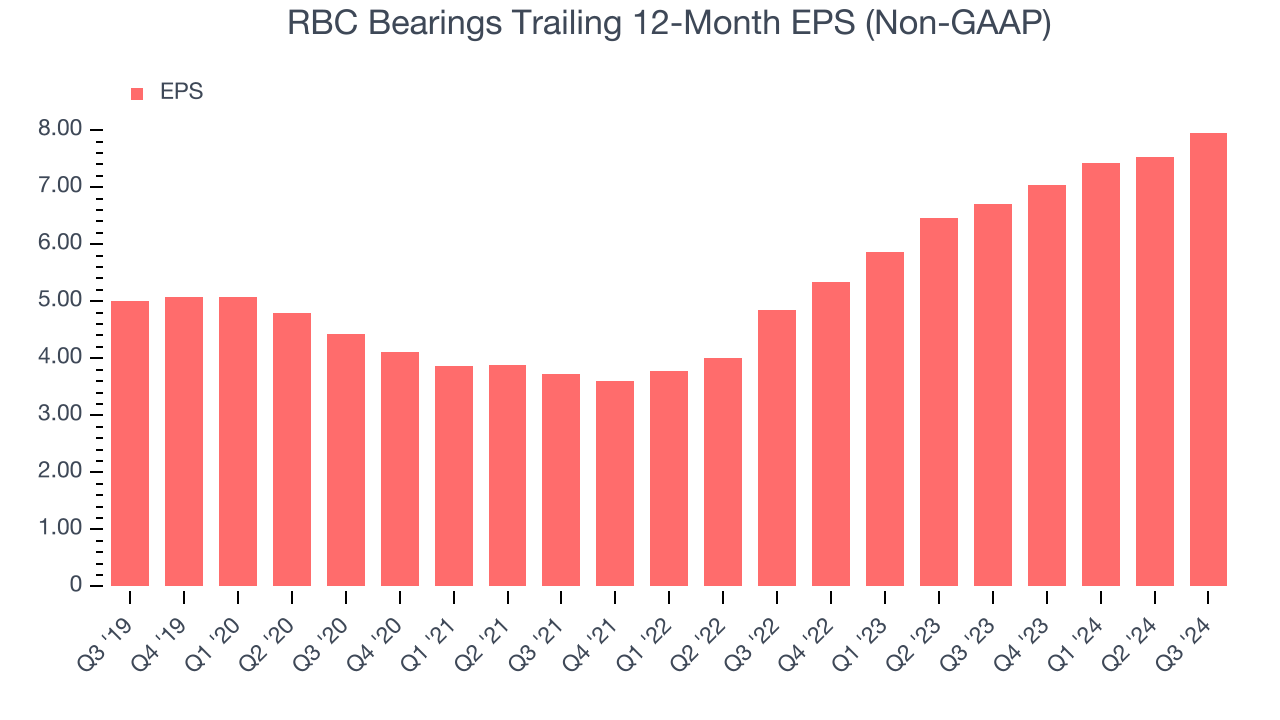

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

RBC Bearings’s EPS grew at a decent 9.7% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 17.3% annualized revenue growth. This tells us that non-fundamental factors affected its ultimate earnings.

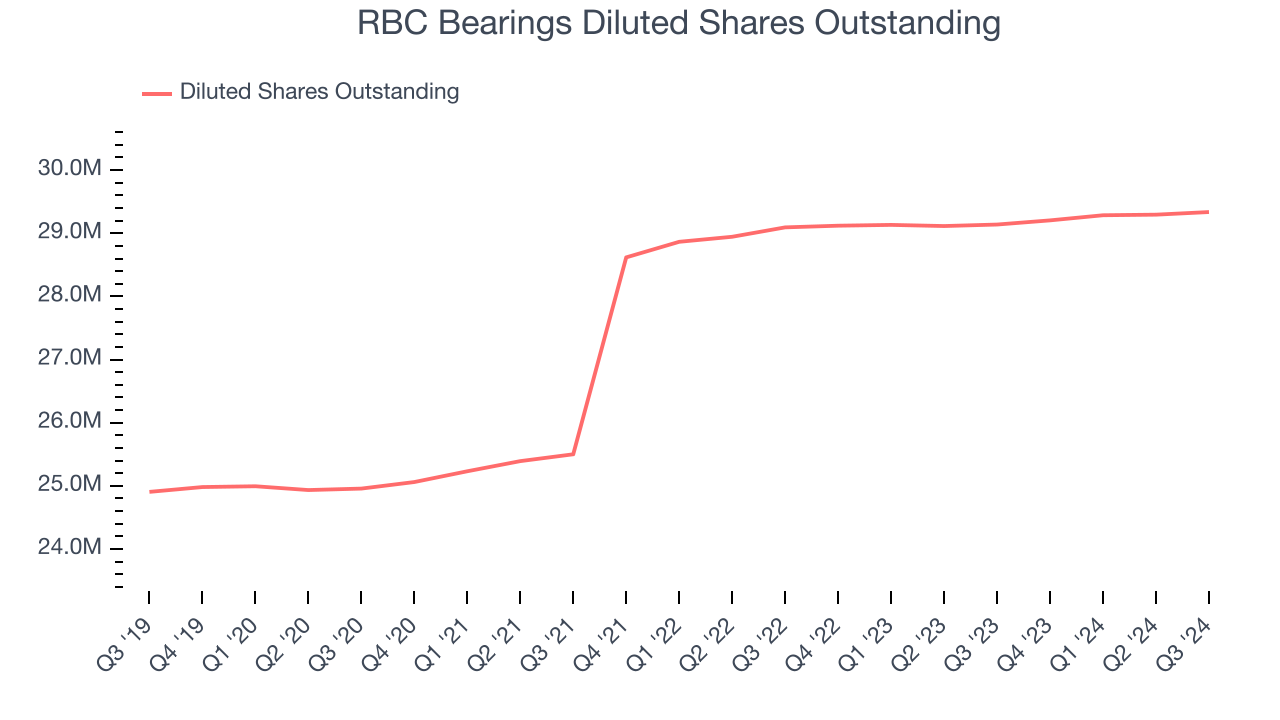

We can take a deeper look into RBC Bearings’s earnings quality to better understand the drivers of its performance. A five-year view shows RBC Bearings has diluted its shareholders, growing its share count by 17.8%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For RBC Bearings, its two-year annual EPS growth of 28.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, RBC Bearings reported EPS at $2.29, up from $1.87 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects RBC Bearings’s full-year EPS of $7.96 to grow by 27.4%.

Key Takeaways from RBC Bearings’s Q3 Results

We struggled to find many strong positives in these results. Overall, this quarter could have been better. The stock remained flat at $280.35 immediately following the results.

RBC Bearings’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.